Thesis

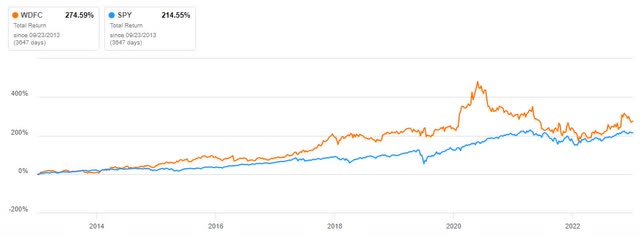

WD-40 Company (NASDAQ:WDFC) is a quality company with a strong brand that has generated market-beating returns over the past 10 years. However, I believe that over the next 5 to 10 years, the probability of WD-40 delivering only single-digit returns is quite high due to its current extremely high valuation.

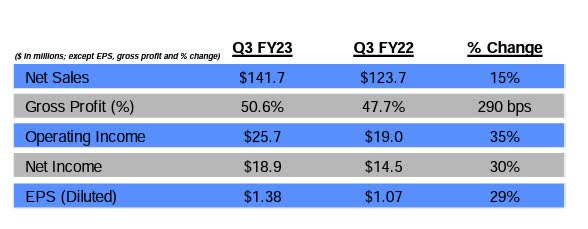

WD-40’s Q3 2023 Results

Q3 Earnings Report

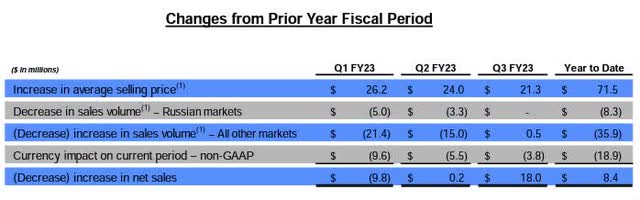

After two not-so-good quarters, Q3 was better, with net sales up 15% year-over-year and net income up 30%. However, sales volumes were down 1.5 million in the Americas, down 3.5 million in EMEA, and up 5.5 million in Asia Pacific, which saved the quarter.

Q3 Earnings Report

Sales volumes generally increased for the first time this fiscal year due to strong growth in Asia Pacific after last year’s supply chain issues due to COVID. Americas and EMEA, which have been experiencing lower demand for a number of quarters, are currently able to offset this with price increases. However, the question remains how long this will be possible?

Yes, WD-40 has one of the strongest brands in the Western world, but there comes a point when price increases become too much. But right now they have pricing power. But will they have pricing power in China and India, which are likely to be the biggest growth drivers over the next 10 years?

Q3 Earnings Report

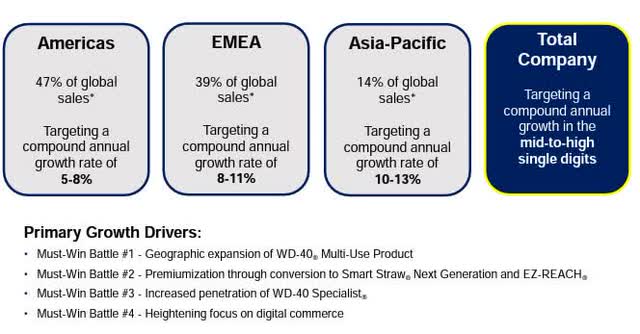

Americas, which is now their largest market, is growing the slowest and also has the worst gross margins, currently at 48.2%. EMEA, with a gross margin of 52%, is expected to grow at a high single-digit or low double-digit rate. But I think depending on the situation in Ukraine and when it ends or how it evolves, that target could be in jeopardy. The decline in sales volume from 3.5 million is definitely something to keep an eye on.

And Asia, particularly India, Indonesia, and China, are the markets where they see future growth. Right now, this market has a strong gross margin of 56.3%, despite being the fastest-growing market. However, I am somewhat skeptical of companies that are so dependent on China for future growth. Especially when there are political risks on top of the normal business risks.

WDFC Growth Opportunities

WDFC sees Premiumization as a growth driver that could also lead to higher margins. Furthermore, China, India, and Indonesia will be the main growth drivers outside the U.S. and will most likely determine whether or not this company will be in a better position in 5 to 10 years. But I am not sure if their strong brand name is enough to capture the market in China. Everyone in the U.S. and most of Europe knows WD-40, and the brand name is really strong, but the key question is always whether the moat is shrinking or widening.

If WD-40 were to succeed in China, it would mean that their moat is widening, and future returns to shareholders would likely be strong. But what happens if they do not succeed? WDFC is richly valued at the moment and mistakes could lead to a hard time for existing shareholders.

WDFCs Balance Sheets

TTM net income is $64.2 million and cash and equivalents are $38.4 million. That compares to $144.3 million in total debt, so debt/net income is less than 3x, so I don’t see a lot of risk in the balance sheet. Furthermore, the cash position together with the free cash flow, or FCF, which is consistently between $30 and $60 million, is enough to cover further dividend increases and buybacks.

WD-40’s Valuation

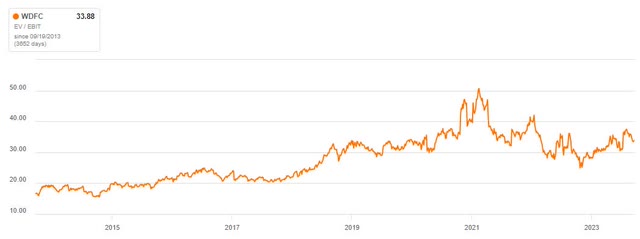

Seeking Alpha Charting Tab

The higher the multiple, the greater the risk to shareholders. And WD-40’s multiple is in the low 30s, even though it’s not a high-growth stock. I think their brand name justifies a valuation premium, but I would say a fair valuation would be more in the low 20s. Remember that Warren Buffett most of the time buys companies that have an EV / EBIT lower than ~14. So a 33x multiple is very expensive. Therefore, let’s take a look at a reverse discounted cash flow (“DCF”) to see how WD-40 needs to grow to justify its current stock price.

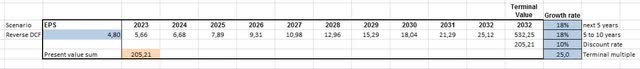

Reverse DCF for WD-40

Author

The basis for the reverse DCF is the FY23 diluted EPS guidance of $4.80 to $5.00. So, in order to justify the share price and earn a 10% annual return, which is my hurdle rate, EPS needs to grow 18% per year. This is a tough task for most companies over a 10-year period, and most will not achieve it. Moreover, the historical 10-year CAGR for TTM diluted EPS is only 6.22%. Well below the 18% which leads me to conclude that the stock is overvalued.

The CAGR for leveraged FCF over the last 10 years is also only 0.15%, which further tells me that this company is not that attractive if you are looking for a 15%+ CAGR over the next 10 years.

Capital Allocation

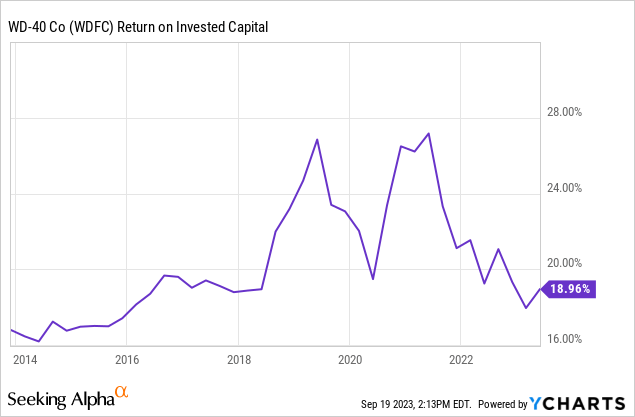

ROIC is still strong at 18.96%, leading to a strong ROIC-WACC spread of around 8%. WDFC is clearly creating value with its investments. And the fact that they paid down debt in the last few quarters and only bought back 10,000 shares tells me that they are trying to allocate capital intelligently. The number of shares outstanding has steadily declined in recent years, while the dividend has increased by approximately 10% per year over the past 10 years. This has resulted in WDFC beating the total return of the S&P 500 (SP500) over this period.

Seeking Alpha Charting Tab

But the starting point 10 years ago was an EV / EBIT of about 20x, so most likely the returns over the next 10 years will be lower than the recent 33x multiple. Valuation matters.

Conclusion

WD-40 has a brand that probably no Western company can replicate, but will that be enough to capture the Asian market? Volumes are declining, and only pricing power is helping them grow sales right now. But for a company at 33x EV / EBIT, we need more growth to justify this valuation. If you want to invest and your goal is to beat the S&P 500, I do not think this is a good bet at the current price. In my opinion, the returns over the next 10 years will most likely be lower than the index, as the starting point combined with the low growth does not have the risk/reward ratio I prefer.

WD-40 Company has no room for big multiple expansions, sales growth is likely to be lower than in the past, and FCF does not offer much room to return massive amounts of cash to shareholders. Therefore, I would think that for investors who are looking for market-beating returns, this is not the right stock at this price.

Read the full article here