Introduction

The London-based Endeavour Mining plc (TSX:EDV:CA), (OTCQX:EDVMF)(LSE:EDV) is one of the largest gold producers in West Africa. The Company has four operating assets consisting of the Houndé and Mana mines in Burkina Faso, the Ity mine in Côte d’Ivoire, the Sabodala-Massawa mine in Senegal, two greenfield development projects (Lafigué and Kalana) in Côte d’Ivoire and Mali and a strong portfolio of exploration assets on the highly prospective Birimian Greenstone Belt across Burkina Faso, Côte d’Ivoire, Mali, Senegal, and Guinea.

EDVMF Map Assets West Africa (EDVMF Press Release)

Endeavour Mining released its second-quarter 2023 results on August 2, 2023.

Important note: This article is an update of my May 8, 2023 article. I have been following EDVMF on Seeking Alpha since 2021.

1 – 2Q23 Results Snapshot

On August 2, 2023, Endeavour Mining announced that gold production for the second quarter of 2023 was 267,619 Au ounces and sold 268,684 Au ounces at an AISC of approximately $1,000/oz.

Note: On March 10 2022, the Company completed the sale of its Karma mine in Burkina Faso, and on October 17 2022, the Company launched the construction of the Lafigué project, with the first gold production scheduled for 3Q24. Also, on June 30, 2023, the Company sold its 90% interest in the Boungou and Wahgnion non-core mines in Burkina Faso.

CEO Sebastien de Montessus said in the conference call:

The quality of our portfolio is set to further increase as our 2 growth projects the Sabodala-Massawa BIOX project in Senegal and the Lafigue project in Cote d’Ivoire are progressing well. Both are on budget, are on schedule to commence production in Q2 and Q3 ’24, respectively.

Revenues for 2Q23 were $524.1 million, with a net loss of $109.3 million. Adjusted earnings were $53.7 million or $0.22 per share. The company said it was on track to achieve FY23 Guidance. BIOX (Sabodala-Massawa) and Lafigué Projects are on budget and schedule.

EDVMF H1 2023 Highlights (EDVMF Presentation)

Finally, Endeavour Mining is paying a semi-annual dividend of $0.40 per share or a dividend yield of 3.95%. The company also has a share buyback program. The company repurchased $9.2 million or 0.4 million shares in 2Q23 and $20.0 million or 0.8 million shares in H1-2023.

Sabodala-Massawa and Lafigué greenfield project update 2Q23:

-

Sabodala-Massawa expansion

EDVMF Sabodala-Massawa Expansion (EDVMF Presentation)

- The Lafigué Greenfield project

EDVMF Lafigue Project (EDVMF Presentation)

The two projects are on budget, with 75% and 59% of the initial capital committed, respectively, and on schedule for 2Q24 and 3Q24, respectively.

CEO Sebastien De Montessus said in the conference call:

2023 is an exciting year for Endeavour, and we are pleased to be delivering against our key objectives. Driven by last year’s strong operational performance, we began the year with financial strength, which provides the flexibility to deliver against this year’s capital allocation priority, which is to maintain an attractive shareholder returns program, while unlocking our growth potential. Given that the Sabodala-Massawa expansion and the Lafigue greenfield builds are expected to both increase the Group’s production and lower our cost base, they will further enhance our capability to reward our shareholders.

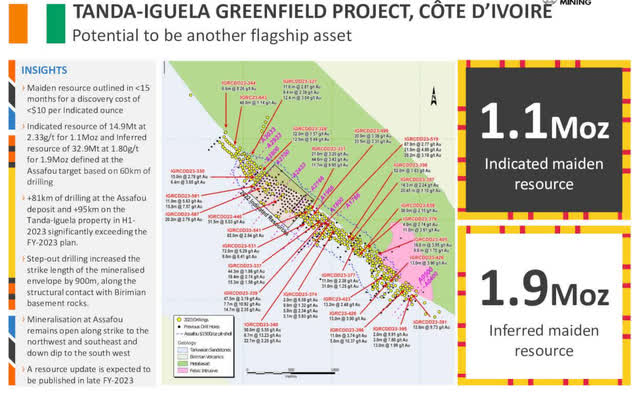

Also, one interesting thing to mention here is the greenfield project in Côte d’Ivoire called the Tanda-Iguela, which can potentially be another flagship asset containing about 1.1 Moz in maiden resources.

EDVMF Tanda Iguela Project (EDVMF Presentation)

2 – Investment Thesis

Endeavour Mining plc has an excellent financial profile despite mining in West Africa, which is not considered a safe jurisdiction compared to North America. The political instability in the region has been increasing in the past few months, adding to the risk attached to an investment based exclusively in West Africa.

However, 2021 saw a significant rise in military takeovers, with coups and attempted coups taking place in Chad, Guinea, Sudan and Niger. In 2022, there were five coup attempts, with two proving successful in Burkina Faso. The implications of these coups extend beyond the borders of the affected countries, sending shockwaves across the entire continent, and causing concern about the fragility of democratic governance in Africa in the face of several existential threats.

Thus, investing cautiously in “African” miners who present a riskier business environment is crucial.

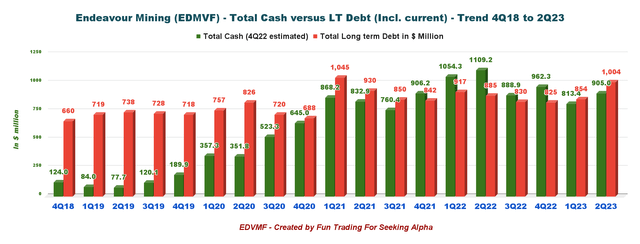

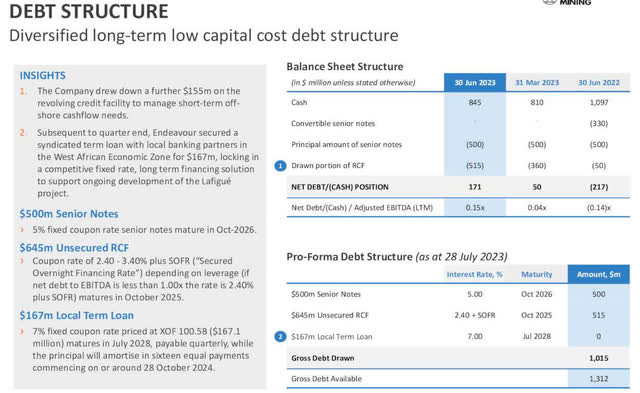

However, on the positive side, the balance sheet looks solid. Endeavour has little net debt and a total cash of $905 million. Moreover, the company is financing internally new projects (brownfield and greenfield) that will be produced in 2024, as shown earlier.

Finally, Endeavour Mining is paying a semi-annual dividend of $0.40 per share in 2023 and has an ongoing buyback program with $99 million worth of shares bought in 2022.

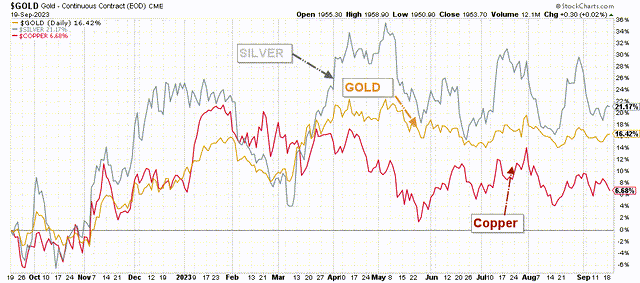

For investors who want to invest in Endeavour Mining, the main component that should always be carefully analyzed before deciding to place your bet is the price of gold.

The FED is expected to pause this week but could indicate a further rate increase in December to fight against stubborn inflation. The recent rise in oil prices could negatively affect the gold price, which may force the FED to turn hawkish again. The current CPI number went up to 3.7%, and with oil prices well above $90 per barrel, we may see sub-4% soon.

Gold is now up 16% year over year.

EDVMF 1-Year Chart Gold, Silver, Copper (Fun Trading StockCharts)

Thus, the best way to profit from such a volatile market is to trade short-term LIFO of 40% of your total position and use your short-term gain to increase your core long-term position for a much higher target.

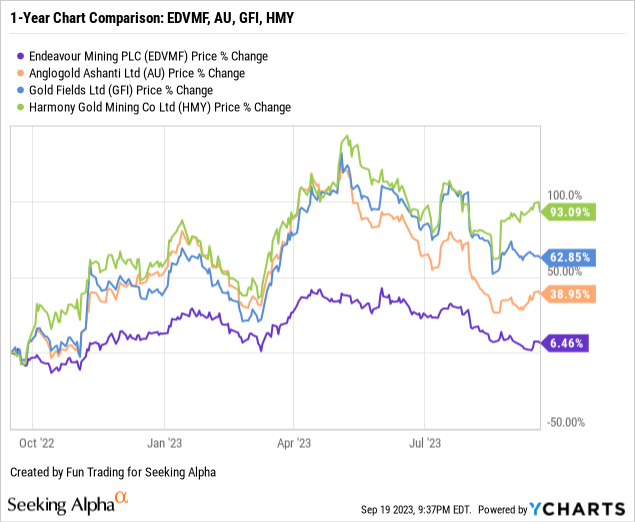

3 – Stock Performance

EDVMF is up 6.5% on a one-year basis, underperforming the group as shown below:

Endeavour Mining – 2Q23 Balance Sheet And Trend – The Raw Numbers

| Endeavour Mining | 2Q22 | 3Q22 | 4Q22 | 1Q23 | 2Q23 |

| Total Revenues in $ Million | 629.6 | 567.6 | 624.7 | 590.6 | 524.1 |

| Net income attributable to shareholders in $ Million | 189.4 | 57.6 | -262.1 | 3.8 | -109.3 |

| EBITDA $ Million | 414.6 | 299.2 | -107.3 | 203.5 | 271.0 |

| EPS diluted in $/share | 0.76 | 0.23 | -1.06 | 0.02 | -0.44 |

| Operating Cash Flow in $ Million | 253.20 | 153.7 | 310.8 | 205.6 | 159.3 |

| Capital Expenditure in $ Million | 140.30 | 121.4 | 171.4 | 198.5 | 183.8 |

| Free Cash Flow in $ Million | 112.90 | 32.3 | 139.4 | 7.1 | -24.5 |

| Total Cash $ Million | 1,109.8 | 888.9 | 962.3 | 813.4 | 905.0 |

| Total Long-term Debt in $ Million | 885.10 | 829.9 | 824.7 | 854.0 | 1,004.2 |

| Shares outstanding (diluted) in Million | 249.06 | 248.31 | 247.55 | 247.16 | 247.41 |

| Production Au Oz | 2Q22 | 3Q22 | 4Q22 | 1Q23 | 2Q23 |

| Total Production Gold | 345.1 | 342.7 | 355.2 | 300.8 | 267.6 |

| AISC (co-product) from continuing operations | 954 | 960 | 954 | 1,022 | 1,000 |

| Gold Price realized | 1,832 | 1,737 | 1,758 | 1,886 | 1,947 |

Source: Company releases M&A. Fun Trading files.

Analysis: Revenues, Free Cash Flow, Debt, And Gold Production

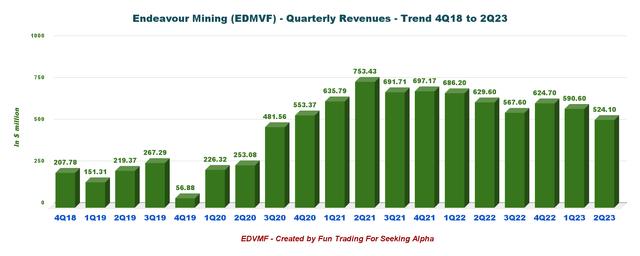

1 – Quarterly Revenues for the Second Quarter of 2023

EDVMF Quarterly Revenue History (Fun Trading) Revenues were $524.1 million in the second quarter of 2023, down 1.5% from a year ago and down 11.3% sequentially. The decrease sequentially was due to primarily lower sales volumes amounting to 20,803 ounces, an impact of $38.6 million, partly offset by higher realized gold prices amounting to $30.8 million. The net loss attributable to shareholders was $109.3 million or $0.44 per diluted share in 2Q23, compared to an income of $189.4 million or $0.76 per diluted share in 2Q22. The net loss from discontinued operations in 2Q23 was due to the earnings from Boungou and Wahgnion, which have been reclassified as discontinued operations following the sale to Lilium and include a loss on disposal of $177.8 million.

Tax expense amounted to $54.2 million in Q2-2023 are higher compared to the $36.4 million in Q1-2023 and $60.5 million in Q2-2022. The increase in current income tax expense compared to Q1-2023 is primarily due to the higher taxable earnings from Sabodala-Massawa and Houndé as well as higher withholding tax expense recognized in excess of the Q4-2022 deferred tax accrual. (Press release, emphasis added.)

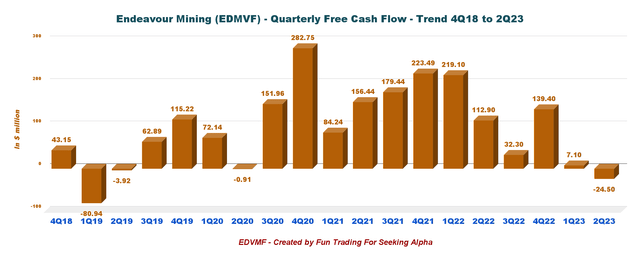

2 – Quarterly Free Cash Flow History

EDVMF Quarterly Free Cash Flow History (Fun Trading)

Note: Free cash flow is the Cash from operations minus CapEx.

The company’s free cash flow for the second quarter was negative $24.5 million, and the trailing 12-month free cash flow was $154.3 million.

3 – Debt Situation in 2Q23

EDVMF Quarterly Cash versus Debt History (Fun Trading)

EDVMF Balance Sheet Net Debt (EDVMF Presentation)

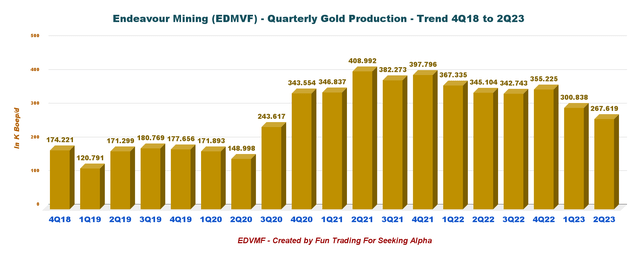

4 – Quarterly Gold Production Analysis

4.1 – Gold Production

EDVMF Quarterly Gold Production History (Fun Trading)

2Q23 gold production from continuing operations was 267,619 Au ounces, significantly down from 2Q22. Production was also down 11% sequentially.

Sebastien de Montessus said in the conference call:

we expect to add proceeds of more than $300 million from both assets comprised of upfront and deferred payments in addition to NSRs, which also allows us to retain further upside. These proceeds will allow us to complete our ongoing construction with a healthy balance sheet, accelerating our ability to increase our shareholder returns program. Following the divestment of Boungou and Wahgnion, we have updated our production guidance to around 1.1 million ounces at an all-in sustaining cost of below $950 per ounce.

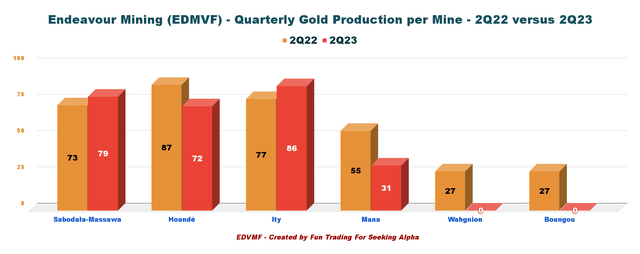

4.2 – Gold production per mine. Comparison between 2Q22 and 2Q23

Production for 2Q23 decreased significantly compared with 2Q22. Production went from 6 producing mines in 2Q22 to four in 2Q23. Ity and Sabadola mines performed well, but Hounde and Mana production was significantly lower, as shown in the graph below.

EDVMF Quarterly Gold Production Comp 2Q22 versus 2Q23 (Fun Trading)

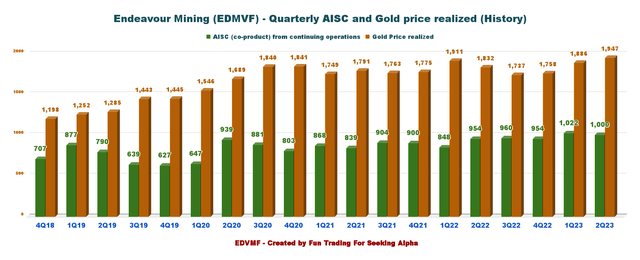

4.3 – Quarterly Gold price realized and AISC

AISC for all operations increased slightly this quarter to $1,000 per ounce, which is still excellent.

EDVMF Quarterly Gold Price and AISC History (Fun Trading)

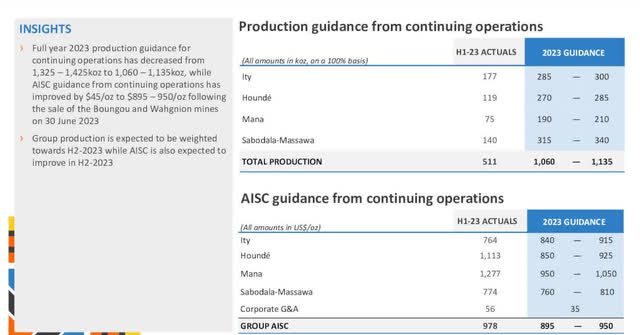

5 – 2023 Guidance – 1.060-1.135 Moz with AISC of $895-$950 per ounce. Revised after divestitures.

EDVMF 2023 Guidance (EDVMF Presentation)

Commentary And Technical Analysis

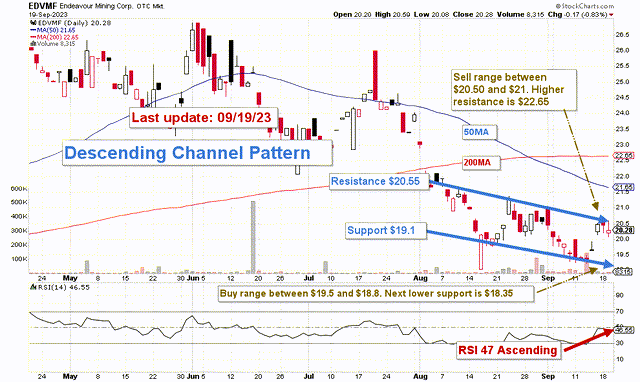

EDVMF TA Chart medium term (Fun Trading StockCharts)

Note: The chart is adjusted for dividends.

Descending channel patterns are short-term bearish in that a stock moves lower within a descending channel, but they often form within longer-term uptrends as continuation patterns. The descending channel pattern is often followed by higher prices, but only after an upside penetration of the upper trend line.

The trading strategy I suggest is to gradually sell about 50% of your EDVMF position between $20.5 and $21.0 with possible higher resistance at $22.65 and accumulate between $19.5 and $18.8 with potential lower support at $18.35.

The gold price is an important component here. The imminent FED decision on interest rates will indicate what to expect in this sector for the next few weeks. I am cautiously optimistic.

Thus, the best-adapted approach is to sell short-term LIFO while keeping a core long-term position for a much higher final target.

Watch the gold price like a hawk.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here