Introduction

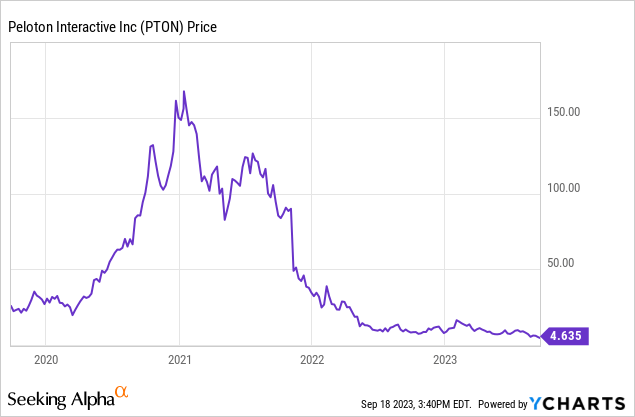

Peloton Interactive’s (NASDAQ:PTON) meteoric rise in the fitness industry during the pandemic has collided with the winds of change in a post-pandemic world. Once celebrated as a symbol of the at-home fitness revolution, Peloton achieved a peak market cap of nearly $50 billion. However, as the world reopened and people returned to gyms, the shares have fallen over 95% from their peak.

Combined with the general economic environment, with rising interest rates and high inflation, Peloton continues to experience headwinds and even after its dramatic drop in share price, it still appears overvalued. In this article, I hope to explore the headwinds facing Peloton, what Peloton is trying to do to become profitable, and why I believe its shares remain a sell.

Company Overview

Peloton Interactive, founded in 2012 and headquartered in New York, is a fitness firm operating in the connected fitness realm. The company’s main products are internet-connected stationary bikes and treadmills and on-demand fitness classes that are available through a subscription service, with the aim of allowing users to have an immersive workout at home.

The Turnaround Plan

Following investor disquiet over the share price drop, in late 2022, John Foley, the CEO, was replaced by Barry McCarthy. McCarthy’s plan to turn around the company has been to re-orientate from a capital-intensive hardware manufacturer to a provider of ‘Fitness-as-a-service”.

The result is Peloton outsourced production and fulfillment of its hardware products to a third party, now sells used bikes, and relies on third-party sellers. This shift aims to reduce the company’s focus on low-margin, unprofitable hardware and instead focus on its higher-margin software sales.

The plan also aimed to significantly reduce operating expenses at the company, with the employee count reduced by 50% to around 3,500 employees in its latest quarter. Management’s plan and execution successfully reduced operating expenses from $2,223 million in the 2022 financial year to $1,661 million in the 2023 Financial year to June.

Overall, the new CEO appears to have placed Peloton on a firmer footing than the previous CEO and has started tackling the problems the business is facing with a clear plan to turn around the company. The real question is, has he done enough? Although losses have reduced, a full year of profits appears elusive. Despite the focus on subscription sales, they seem to have reached a plateau of around 3 million customers. Latest analyst estimates suggest the company will actually see a fall in revenue in the 2024 financial year.

Share Dilutions

A concern I have for Peloton investors is the ongoing issue of shareholder dilutions. In the past several years, the company has consistently issued new shares, which have led to a dilution of existing shareholders’ ownership stakes. In the past year alone, the share count has jumped from 338 million at the end of Q4 2022 to 356 million at the end of the company’s financial year 2023; a 5.46% increase in share count.

The dilution has occurred primarily through stock-based compensation programs, including employee stock options and grants to executives. While such programs are common in the tech and start-up world to attract and retain talent, their unchecked expansion can have significant consequences, of reducing existing shareholders’ ownership percentage. While share dilution via employee stock options can be a useful tool for incentivizing employees and executives, striking the right balance is crucial.

The Debt

Another concern I have is the size of the debt. Peloton has $2.36 billion debt with only $831 million cash. With cash flow currently negative and showing no signs of turning positive, cash levels are only going to decrease.

In the rising interest rate environment, Peloton’s interest costs have increased drastically from $43 million in the year to June 2022 to $97.1 million in the year to June 2023. This can be partly attributed to the company’s term loan, where they pay a premium to the prevailing SOFR interest rate.

Another issue is a $1 billion convertible note with 0% interest, which is due to mature in 2026. This type of note can be converted to equity at a price of $239 a share, but given Peloton’s shares trade far below this amount, investors in the note are highly unlikely to take up this option and instead take the par value of the note from Peloton. When this note comes due, Peloton may need to issue an additional note to refinance and cover repaying the note. However, the interest rate on any refinancing will likely be far higher than the 0% coupon currently paid on the convertible note, which could push up Peloton’s interest costs significantly.

Q4 Results

Peloton’s most recent quarterly result, announced on the 23rd of August, was nothing short of a disaster. Even though revenue was in line at $642.1 million, a 5.4% fall year-on-year, loss per share was $0.68, a miss of $0.28 against expectations. The earnings miss was not the biggest surprise, though.

Management provided estimates for the coming quarter’s revenue of $580 million to $600 million, versus a consensus estimate of $654.2 million. This points towards another quarter of declining revenue for the company.

In fact, despite its efforts to transition to a more subscription-focused company, in the quarter the number of Connected Fitness subscriptions fell by 29,000 indicating lagging demand for its product. This is despite the corresponding quarter in the previous year posting an increase of 4000, indicating this is not purely seasonality-related.

Downside Catalysts

There are two further downside catalysts I find particularly noteworthy for Peloton, in addition to those explained above.

Firstly, changing consumer behaviour. Peloton’s success during the pandemic was partially due to a shift to home workouts as gyms were closed and travelling outside of cities to cycle was prevented. As economies have reopened, consumer preferences have shifted away from using Peloton. It is entirely possible that Peloton has passed the growth stage and is now a mature company, which would result in a lower valuation multiple if it does ever turn a profit.

Secondly, the macroeconomic background looks weaker with rising interest rates, and some economic indicators showing a slowdown in activity. Given that Peloton’s products are an entirely discretionary spend, it’s likely its sales could fall further, especially if consumers become more cautious about their discretionary expenditure in an environment of economic uncertainty.

Valuation

It is hard to place a valuation on Peloton given most traditional metrics such as price to earnings, EBITDA to EV, and Free Cash Flow Yield are unable to be calculated due to the unprofitability of the company and its negative free cash flow. Based on what I have uncovered and presented in the article, I still believe Peloton’s shares remain a strong sell, even after the over 95% fall in share price.

Risks to the Thesis

Even though the outlook looks bleak for Peloton, there is still hope for the company, and I could be wrong. If the turnaround plan works, Peloton will have changed from a company focusing on low-margin hardware products to focusing on higher-margin fitness subscriptions. The key to making this happen is that the number of subscriptions needs to rise, which currently does not look the case.

If Peloton does manage to grow the subscriptions substantially, they will also benefit from economies of scale. Many expenses are fixed in cost, such as paying for fitness instructors, and development of the software for subscriptions. If subscriber numbers increase, these costs as a percentage of revenue will decrease, leading to margin improvement in the subscription business, and bringing them closer to profitability.

Conclusion

In conclusion, Peloton finds itself navigating challenging terrain as it grapples with a series of setbacks and downside catalysts. With rising debt and interest costs, continued dilution of shareholders, and a turnaround that is yet to make significant progress to improve growth prospects, Peloton’s prospects look bleak. As such, I give Peloton a strong sell rating.

Read the full article here