Note: This article was written by Climent Molins, with inputs from J Mintzmyer. Both Climent and J are long NVGS.

Introduction

Navigator Holdings (NYSE:NVGS) is a shipowner focused on the ownership of liquified petroleum gas carriers. Furthermore, they also own a 50% stake in an ethylene export terminal based at Morgan Point, Texas (which is a Joint Venture with Enterprise Products Partners (EPD), one of the best operators in midstream space).

The company is well managed, and has two anchor shareholders, namely Naviera Ultranav Dos Limitada (which owns 28.4% of the shares outstanding) as well as BW Group, with a 29.7% stake. BW Group is a heavyweight in the shipping industry, and is a major shareholder in companies such as BW LPG, DHT, Hafnia, Cadeler and BW Energy (among others). They have historically been very good operators and fair to minority interests.

Despite being a well-managed operator with a very professional management team, the company is trading at an extreme discount to NAV. Although rates in the small and mid-sized LPG sector have lagged their larger counterparts, they have lately shown some promise, with NVGS reporting very strong utilization and TCE rates for Q2 as well as Q3 guidance (which tend to be the weaker periods of the year). Navigator also has further growth potential via the emerging ammonia markets as well as via carbon capture initiatives. Overall, I believe NVGS offers an enticing risk-reward proposition at current pricing with meaningful upside over the next 12-18 months.

Fleet & Market Commentary

Pro forma for recent acquisitions and the disposal of the “Navigator Orion”, a 2000-built ethylene carrier, NVGS owns a fleet of 56 vessels, spanning from a 2002-built 3,770 cbm vessel to larger and more modern vessels, such as the “Navigator Jorf”, built in 2017 with a 38k cbm capacity.

NVGS employs its fleet on a mixture of spot and medium-term contracts; the smaller vessels tend to trade in the spot market, whereas the larger assets have higher fixed TC-cover. The maturity of the contracts on their vessels are staggered over the next few years, although some of them will not be coming off-contract before 2025-2026.

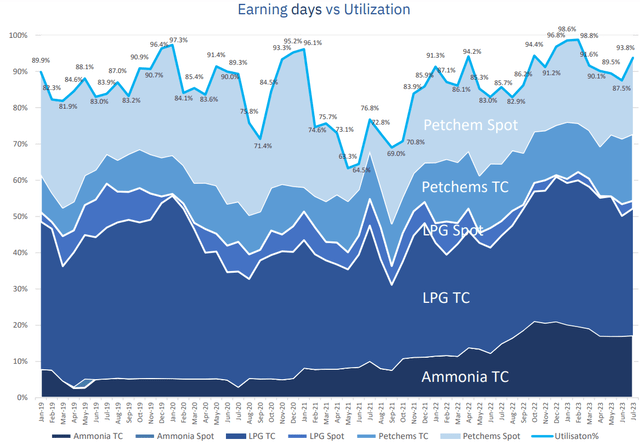

The image below, illustrates the mix between spot and TC exposure (as well as a partial breakdown of the cargoes). The ammonia share increased materially since the start of the war in Ukraine on the back of the production capacity curtailment in Europe due to high gas prices, forcing the region to source a significant portion of its volumes from overseas.

NVGS’s Q2 earnings presentation, slide 15.

Earnings and utilization tend to be lowest throughout the summer season, but as can be seen in the image above, the utilization floor for this year has been markedly higher than in previous years, whereas July utilization was simply outstanding (especially considering usual seasonal patterns). It remains to be seen how performance will fare over the next few months, but if seasonality is to be of any indication, we should expect an even tighter market towards the end of the year.

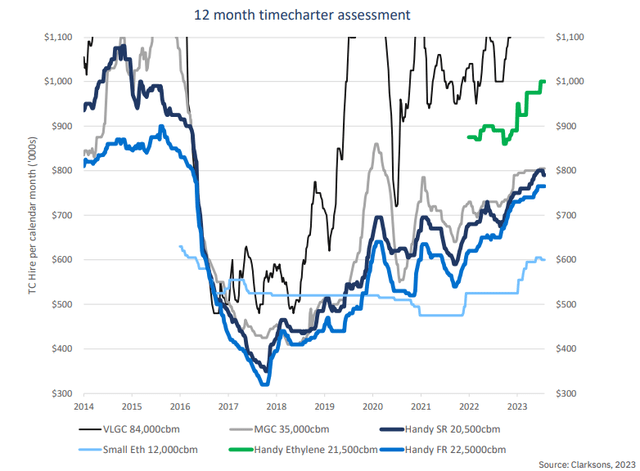

As can be seen in the image below, TC rates have been on a consistent uptrend over the past few months, but they remain well below the levels attained in previous bull markets. VLGC rates are currently at the “top of the cycle”, but small and mid-sized vessels have been far weaker on a relative basis over the past few years.

NVGS’s Q2 earnings presentation, slide 16.

The supply side is very attractive for small vessels, with the orderbook in the low single digits, whereas the orderbook for mid-sized vessels is higher (assessed at around 20%). For example, Avance Gas, which has traditionally been a VLGC owner, recently ordered two MGCs (and exercised options for two more) with deliveries ranging from Q4-25 to Q4-26. Management touted their ability to transport ammonia and transit the old Panama locks as key differentiators (on top of the improved efficiency).

The demand outlook is a bit more difficult to discern for small and mid-sized LPG carriers, but the market should continue to grow as India and other developing nations ramp up demand (coupled with strong Chinese demand as PDH capacity continues to increase). Furthermore, the ammonia trade is also forecasted to increase markedly, although that is partly contingent on green and blue ammonia projects coming to fruition.

NVGS owns a diversified fleet across the LPG trade, spanning from small to mid-sized vessels. Rates in those sub-segments have improved over the past year but remain at around mid-cycle levels (or slightly above). The orderbook is at low levels for the smaller sizes, but higher for mid-sized assets (although that should be manageable given the expectations for strong growth in the ammonia and overall LPG trade).

The Ethylene Export Terminal

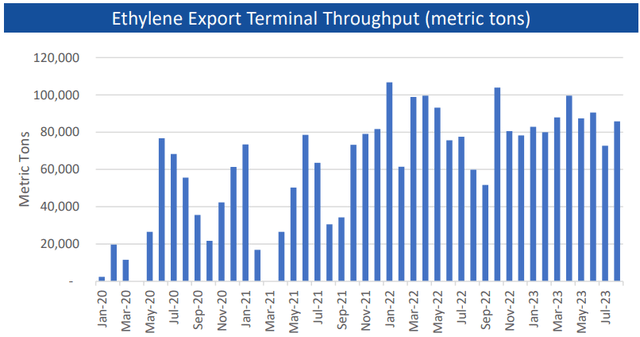

NVGS’s key differentiator versus typically shipping companies is their 50% stake in an ethylene export terminal based in Morgan Point, Texas. The operation is managed by Enterprise Products Partners, and currently has a nameplate capacity of 1M tons per annum. Throughout 2022, the Terminal exported 987.5k tons of ethylene, generating $25.8M in net income before taxes (for NVGS’ 50% stake).

NVGS’s Q2 earnings presentation, slide 20.

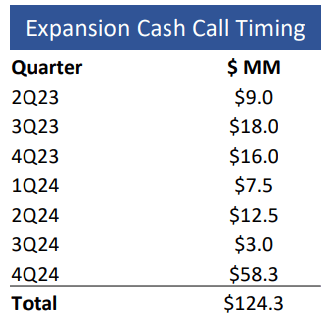

However, in November 2022, NVGS unveiled a much-awaited plan to increase the Terminal’s throughput to “at least approximately 1.55 million tons and up to 3.2 million tons per year”. The total capex outlay net to NVGS for the terminal’s expansion is forecasted to amount to $120M-$130M, resulting in mediocre returns at the low-end of the range and exceptional earnings at the higher-end. Notably, the $120-$130M capex spend covers the entire range of growth potential, so NVGS is paying large up front for enormous expansion optionality in the mid-2020s.

NVGS has been clear there are some logistical challenges that must be overcome to be able to unlock the high-end of the range but given the current state of the global energy market, I believe there are enough tailwinds to believe throughput will come in well above the low-end of 1.55M tons per annum by 2025. When the Terminal was initially built, both NVGS and EPD agreed to secure long-term offtake commitments for a whopping 94% of the nameplate capacity. When looking at the expansion, management reiterated they are looking to secure offtake commitments for a large portion of nameplate capacity (although I believe they will most likely strive to retain a slightly larger spot exposure).

The expansion’s construction is forecasted to be completed throughout H2-24, and the expected cash outflows (and associated timings) can be seen in the image below. While the expansion is constructed, exiting infrastructure will continue to operate normally, generating substantial FCF in the meantime.

NVGS’s Q2 earnings presentation, slide 20.

An interesting tidbit of NVGS exposure to the ethylene export terminal (on top of the diversification benefits and the substantial FCF generation) is that it helps create demand for NVGS’ own fleet; if the throughput is ultimately expanded to 3M tons, the additional demand will be significant relative to the overall market and could drive global utilization towards 100%.

The war in Ukraine underpinned the world’s need for US energy, and NVGS was well positioned to help supply European and Asian markets with ethylene. Although it has been more than 18 months since the onset of the war, the US continues to be flush with energy, granting the region’s petrochemical industry a “competitive advantage” given their cheaper access to reliable and cheap feedstock. Going forward, I would not be surprised to see NVGS pursue more infrastructure projects, potentially other export terminals.

Financial Position & Additional Growth Levers

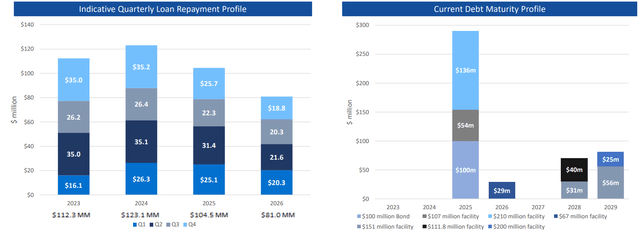

NVGS finished the quarter with $180.4M in cash and cash equivalents, which is more than enough to cover the company’s near-term commitments. As can be seen in the image below, Navigator has an attractive repayment profile. They have several debt balloons maturing in 2025, but most of those will most likely be refinanced prior to the maturity.

NVGS’s Q2 earnings presentation, slide 8.

Even when including the $115.3M in remaining capex for the expansion of the ethylene export terminal, which is expected to be made from “cash on hand until new financing agreements are completed in early 2024”, NVGS has ample financial capacity to pursue other capital allocation endeavors.

For example, during Q2 NVGS formed “Bluestreak CO2”, a joint venture with Bumi Armada (a Malaysia-based international offshore energy facilities and services provider) to “enable UK stranded emitters the ability to ship and store CO2”. Management had previously also mentioned they would look into CO2 shipping, but it seems they want to take an infrastructure-like approach, with long-term commitments on any potential projects, since on the latest quarterly conference call, management acknowledged they “don’t think that the risk of building that on speculation, [but] right now it’s worthwhile”.

Earlier this year, NVGS completed the acquisition of five vessels through a joint venture with Greater Bay Gas Company. This was a very interesting transaction, since NVGS managed to acquire modern assets that they knew well at attractive pricing (NVGS was the operator of the vessels via the Luna Pool); I believe NVGS would like to acquire additional modern tonnage, but it seems management is very focused on returns (and asset pricing has increased over the past few years, whereas there isn’t much liquidity among modern tonnage).

Finally, NVGS may also embark on additional infrastructure projects like the ethylene export terminal, but that would almost assuredly be alongside a midstream operator, reducing both execution risk and the overall capex commitment. Going forward, the company has several levers to pull to grow, providing a lot of optionality.

Shareholder Returns

Over the past few years, NVGS did not have much excess cash to reward shareholders, but that started to change throughout 2022. In mid-October 2022, NVGS announced that its Board had agreed to institute a $50M share repurchase authorization, which was completed throughout the second quarter (they ended up buying back 3.8M shares at $13.12/sh).

Alongside Q1 earnings, NVGS also instituted a new return of capital policy “that will pay a fixed quarterly cash dividend of $0.05/sh, with additional return of capital to equal at least 25% of net income”. Based on the new returns policy, NVGS declared a $0.05/sh distribution on Q2 earnings while also committing to repurchase a minimum of $3M worth of shares before quarter-end.

At current pricing, I believe share repurchases should be heavily prioritized given the large discount shares trade at (we currently assess NAV at $21.86/sh). The $50M share repurchase program accreted substantial value (on a per share basis), and it was positive to see management allocate the excess returns on top of the $0.05/sh dividend to share repurchases.

NVGS is very well managed and has BW Group as a backer, which I view positively considering the shareholder returns policies they have instituted in the other companies they participate in. I would personally like to see management allocate additional funds towards share repurchases at current pricing, but that must be balanced with capex spending and deleveraging (which explains the current payout).

Conclusion

NVGS is a well operated firm trading at a sizable discount to NAV. Rates are slightly above mid-cycle but remain a far cry (even on a relative basis) from current VLGC rates. The LPG trade is expected to continue to grow for the foreseeable future, and although the drivers for smaller classes revolve more around the coastal inter-refinery trade, that market should also fare well given the extremely low orderbook.

The ethylene export terminal is a key differentiator relative to the usual shipping company, providing stability and strong returns (especially if they manage to market all the capacity associated with the expansion of the terminal). Although capex associated with the expansion is significant (around $125M), NVGS can easily fund it with a combination from existing cash balances and OCF generation.

Investing in the terminal was a very interesting decision, not only due to the associated returns, but also since it creates demand for NVGS’s own vessels. It remains to be seen whether they will pursue additional infrastructure projects, but that would be a welcome development (obviously contingent on the concrete economies of the projects).

Navigator recently instituted a new shareholder returns program, with the company committing to the payout of 25% of earnings with a combination of dividends and share buybacks (at current pricing they clearly favor repurchases). The payout may seem low, but the company is expanding its terminal (and is admittedly looking at other growth projects, with the creation of the recent Bluestreak CO2 JV as one example).

Overall, I believe NVGS offers a compelling risk-reward at current pricing. The terminal JV is a very interesting addition to NVGS’ asset mix, whereas there are several potential growth avenues where the company can allocate excess cash. On the other hand, share repurchases remain very attractive at current pricing given the prevailing discount to NAV, and I expect management to allocate excess cash towards those.

Read the full article here