My analysis suggests that investors should hold shares of F.N.B. Corporation (NYSE:FNB).

I have been a bit bullish in my recent analyses of regional banks. Every company can’t be a buy, and it seems apparent that some banks do indeed warrant sell and hold ratings.

With respect to FNB’s recent history, the firm completed a merger with Howard Bancorp and UB Bancorp in 2022. This growth through M&A has been a common trend amongst regional banks, and FNB has been a beneficiary of accretive M&A activity in the past. However, much remains unclear in terms of whether or not FNB can weather the many storms that regional banks have faced throughout 2023.

Catalysts

There are a few key factors that will impact FNB’s prospects in the near term:

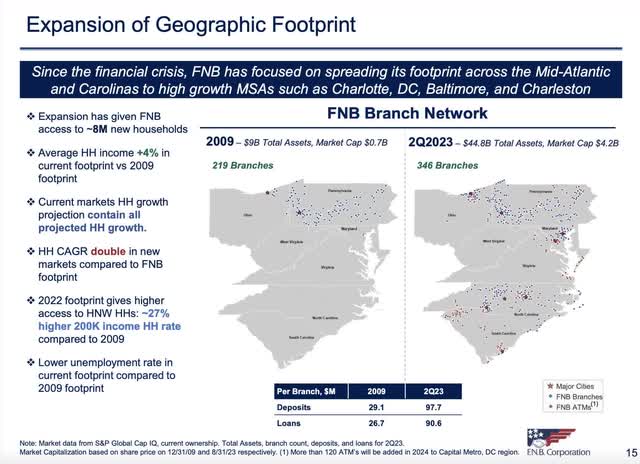

1. Rising Market Share

Since the 2008 Global Financial Crisis, FNB leaders have focused on geographic growth through physical branches. This strategy has been effective at growing the firm’s deposit base in addition to its loan portfolio. It is impressive that the firm has found success penetrating new markets in Maryland and the Carolinas given the fierce competition from existing banks in these areas. In addition, it is likely that this expansion saved FNB from being a takeover target in the shadow of 2008’s financial turmoil. The firm must continue seeking out new strategic opportunities, and be mindful of nurturing its existing customer bases.

F.N.B. Corp Q3 2023 Investor Presentation

2. Assets

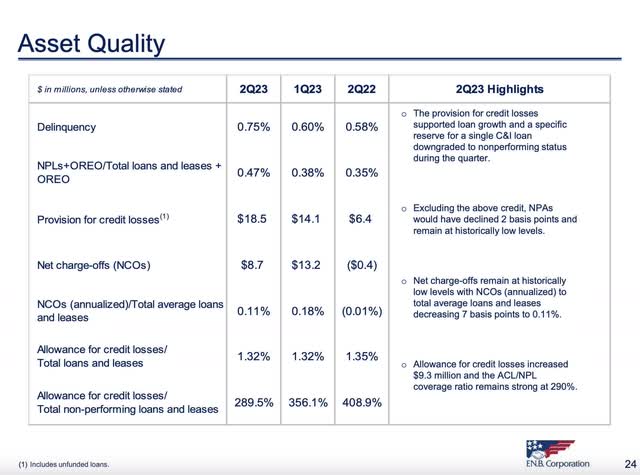

The dynamic nature of the present interest rate environment has been stressful for the financial managers at many banks. Given the rise in borrowing costs over the past year, it is reasonable to assume a rise in delinquencies. FNB has experienced this trend, but the bank’s delinquencies are still quite low. In addition, FNB has wisely increased its provision for credit losses from $6.4 million in 2Q22 to $18.5 million in 2Q23. This has been in response to rising delinquencies and rising net charge-offs. FNB’s asset pool is currently strong, but prospective investors must carefully monitor continued disclosures regarding charge-offs and delinquencies.

F.N.B. Corp Q3 2023 Investor Presentation

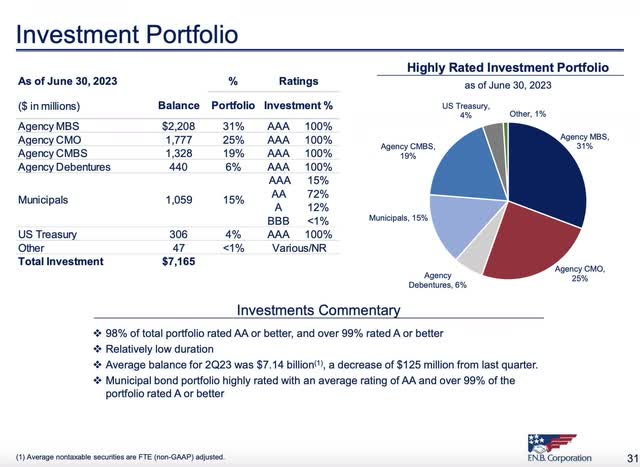

3. Investment Portfolio

FNB relies on various fixed income securities to generate additional revenue. These securities are theoretically low-risk, but rising interest rates have impacted the valuation of the firm’s investments. If FNB’s financial managers plan to hold these securities to maturity, then things could get a little bit interesting. Any forced liquidation could cause large realized losses, and impact the firm’s capitalization. In addition, FNB has done a reasonable job protecting against this risk by keeping duration and prepayment risk to a minimum.

F.N.B. Corp Q3 2023 Investor Presentation

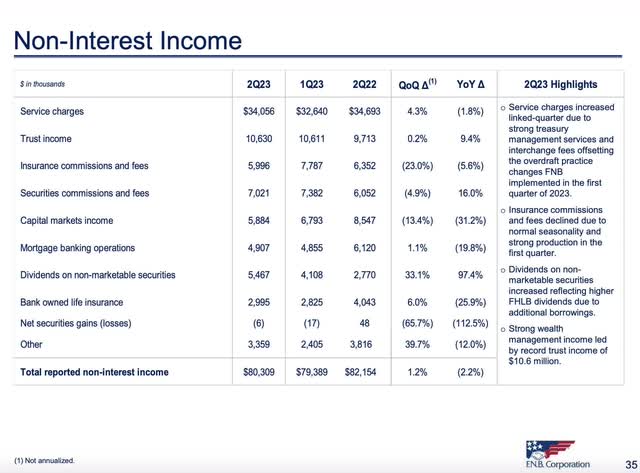

4. Non-Interest Income

Interest is the life-blood of many banks. However, finding additional ways to generate income helps to improve long-term profitability. Service charges have historically been the largest source of non-interest income for FNB. These have declined year-over-year, and it is likely that consumers will continue adopting overdraft protection and other offerings that help them avoid unnecessary service charges. Moreover, FNB’s capital markets income has fallen as part of a larger global slump in deal markets. The firm has fortunately leaned on its trust solutions practice within its wealth management segment to make up for lost capital markets income. Finally, the firm has experienced headwinds in its mortgage banking operations that are expected given the current interest rate environment. The biggest “plug” in preventing large overall losses in non-interest income has been dividends received on non-marketable securities. This is certainly non-recurring, and investors must pay attention to the broader trend of a dramatic fall in non-interest income.

F.N.B. Corp Q3 2023 Investor Presentation

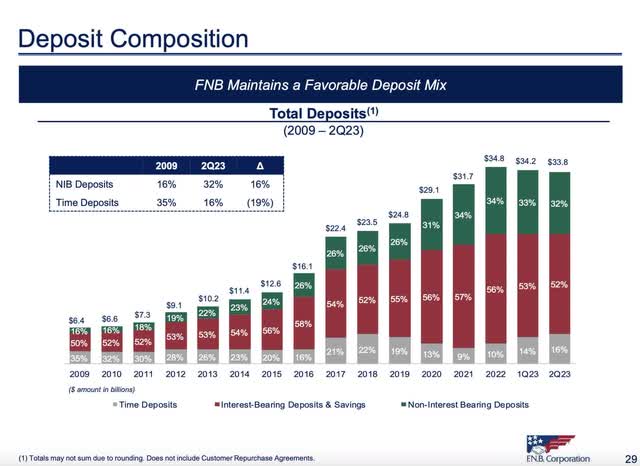

5. Deposit Growth

Since 2009, FNB has dramatically grown its deposit base. This growth cycle has flattened out since 2022, and it is likely that changes in interest rates have impacted this trend. I believe that FNB’s management must employ additional strategic initiatives to maintain new deposit levels.

F.N.B. Corp Q3 2023 Investor Presentation

Valuation

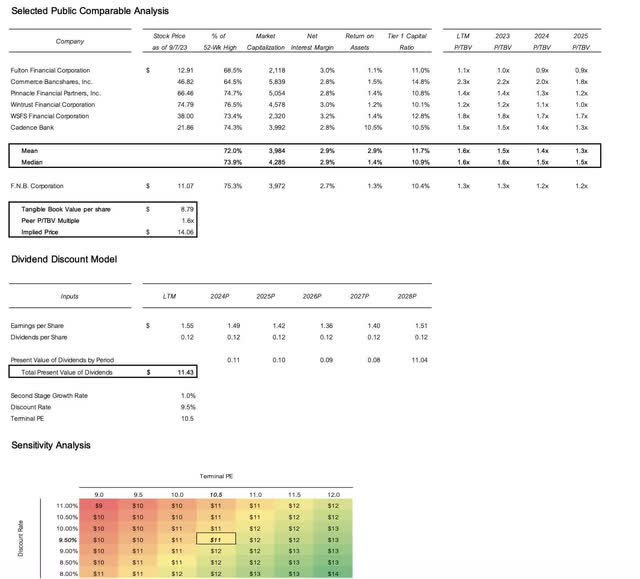

The first step towards pricing FNB was the creation of a peer group of comparable public companies. When selecting FNB’s peer group, multiple criteria were used:

- Market capitalization

- Ratio analysis (net interest margin, return on assets, tier 1 capital ratio)

- Business segments

There are a multitude of small-cap regional banks with similar characteristics to FNB. However, following a thorough analysis of potential comparable companies, a peer group of Fulton Financial Corporation (FULT), Commerce Banchsares, Inc. (CBSH), Pinnacle Financial Partners, Inc. (PNFP), Wintrust Financial Corporation (WTFC), WSFS Financial Corporation (WSFS), and Cadence Bank (CADE) was created.

Credit is given to S&P Global’s (SPGI) Capital IQ database, which provided details surrounding each firm’s net interest margin, return on assets, tier 1 capital, and tangible book value. The key multiple used for valuation, price to tangible book value, is an effective metric for banks for a few reasons. First, mark-to-market accounting rules under U.S. Generally Accepted Accounting Principles allow firms to carry many of their investment securities at prices similar to their fair market values. Since most of a bank’s assets are able to be carried on each firm’s balance sheet at their market values, book value is viewed as an appropriate proxy for each firm’s assets. Finally, tangible book value is effective because it strips out various intangible assets such as goodwill. While there is certainly merit in goodwill stemming from M&A activity and takeovers, it is hard to value and subject to imprecise estimates.

To price FNB, the averages and medians of historical and forward-looking P/TBV multiples were calculated. Using a forward-looking multiple of 1.6 times, FNB was valued at $14 per equity share.

Multiples valuation provides an extrinsic valuation of a firm. However, it is also important to value a firm intrinsically. This was accomplished using a dividend discount model because FNB has a history of distributing cash flows to shareholders via dividend payments. The inspiration for using a DDM was taken from David B. Moore, a CFA with Marathon Capital Holdings in San Diego, California. Mr. Moore published a guide on valuing community banks whereby he argues the merits of using a DDM to price bank stocks.

Based on my assessment of the firm’s future discounted dividends, I calculated an intrinsic value of $11 per share. This can be further amended to a target range of $9 to $14 per share, which implies major upside and minor downside. With respect to assumptions included in the base-case model, a 9.5% discount rate was used in addition to earnings and dividends estimates taken from CapIQ. Moreover, a second stage growth rate of 1% was used along with a terminal price to earnings ratio of 10.5. Please remember that these are estimates and are meant to illustrate a reasonable base case that does not consider a significantly positive or negative event.

Author’s Model

Investment Conclusion

Seeking value is a difficult prospect in the modern Information Age. However, small-cap regional banks provide a unique area where investors can apply traditional investment criteria to a relatively competitive market. FNB has an illustrious history, but is likely not the best pick for investors yearning for an undervalued and beaten-down stock. The firm has relied upon the growth through M&A trend that has engulfed the industry, and truly organic growth seems to be hard to find for many traditional regional banks. If the firm’s management can find a way to reinvigorate the firm’s traditional strategy in order to capture new market segments, FNB could have a bright future.

Read the full article here