Intro

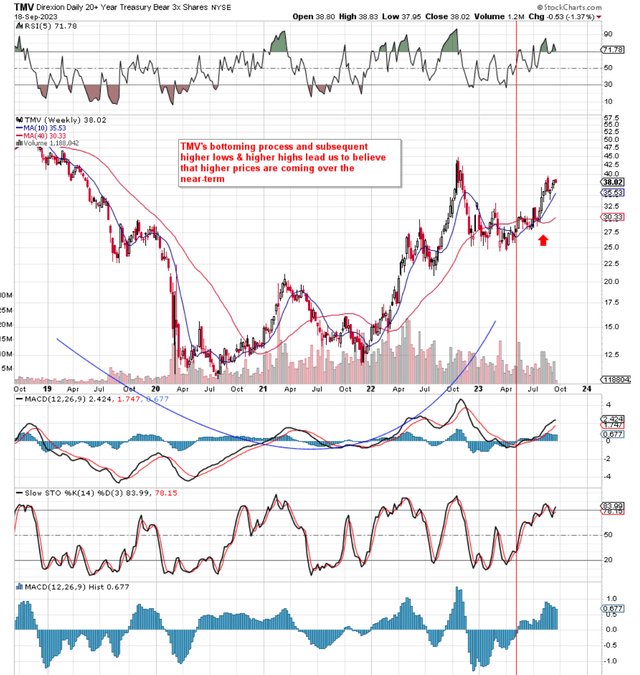

Our most recent articles on Direxion Daily 20+ Year Treasury Bear 3X Shares (NYSEARCA:TMV) were in August of last year (BUY rating initiated) and March of this year (HOLD rating initiated). The reason for the later ‘Hold rating was that shares of the fund were dropping down to a short-term low at the time. Not knowing how long the downswing would last, the right call was NOT to add to existing long positions at the time despite the fact that we continue to believe that this ETF should be bought aggressively on tradeable bottoms. To give an idea of the returns TMV has been delivering, the fund is up almost 51% since August of last year & almost 36% since our previous commentary in March of this year. We continue to recommend buying TMV on tradeable short-term bottoms as we learn below.

Leveraged ETF Risk

So why the caution in March with that temporary Hold rating? Well, this goes back to how the TMV fund is made up as a trading instrument. Given that the aim of the fund is to deliver three times the inverse of the standard 20-year US Treasury bond, short-term derivative strategies & future contracts must be entered into, to essentially deliver this leverage. When one is correct on the short-term trend, many times TMV will actually deliver more than the stated 300% but the risk is seriously elevated here for the following reasons.

In fact, the two worst enemies of holding a fund such as TMV are ‘Time’ and ‘Direction’. Suffice it to say, holding a leveraged fund such as TMV for a sustainable period of time when one is wrong on direction is ALWAYS the WRONG decision for the fund holder. This goes back to how short-term option contracts & futures are used in the fund to gain leverage. Derivative contracts for example many times however can expire worthless which means those losses must be attributed to the fund holder. In fact, given that there are so many moving parts to TMV in terms of risk, below is how the ETF’s sponsor (Direxion) views risk in the fund.

Direxion Shares Risks — An investment in TMV involves risk, including the possible loss of principal. Each Fund is non-diversified and includes risks associated with the Funds’ concentrating their investments in a particular industry, sector, or geographic region which can result in increased volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. Risks of each Fund include Effects of Compounding and Market Volatility Risk, Leverage Risk, Market Risk, Aggressive Investment Techniques Risk, Counterparty Risk, Intra-Day Investment Risk, Other Investment Companies (including ETFs) Risk, Cash Transaction Risk, Tax Risk, and risks specific to U.S. Government Securities. Additional risks include, for the Direxion Daily 20+ Year Bull 3X Shares, Daily Index Correlation Risk, and for the Direxion Daily 20+ Year Treasury Bear 3X Shares, Daily Inverse Index Correlation Risk, and risks related to Shorting. A security backed by the U.S. Treasury or the full faith and credit of the United States is guaranteed only as to the timely payment of interest and principal when held to maturity. The market prices for such securities are not guaranteed and will fluctuate.

Inflation Not Going Away

Although bond bulls will state that the stated US inflation rate has come down considerably since mid-2022 (when it was well above 8%), we believe investors should be looking beyond stated CPI inflation rates when thinking about investing in US bond markets. Many bond bulls would now state that the inflation war has been beaten and all that is needed now is for the much higher 5%+ interest rates to make their impact on the US economy over time. Not so fast.

Stated CPI inflation in August in the US came in at 3.7% which was the first sequential increase since June of last year. The rising prices of energy were the principal culprit for the jump and here is where bond bulls need to be careful.

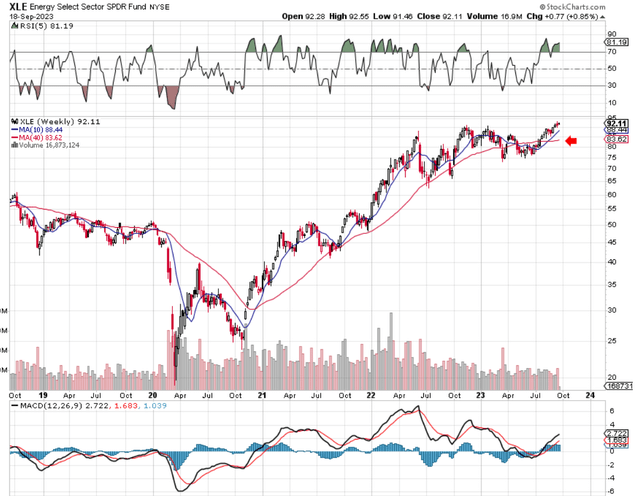

If we pull up an Energy Select Sector SPDR Fund (XLE) we see that shares just recently delivered an intermediate golden cross (bullish crossover of the commodity’s 10-week moving average above its 40-week counterpart). Furthermore, the bullish crossover facilitated the fund to break out to all-time highs which means that it is probable that the energy sector will enjoy blue skies for some time to come.

XLE Intermediate Chart (Stockcharts.com)

Rising oil prices will cause more inflation where food products in particular will cost more due to higher transportation costs. What comes as a consequence? We only can see more government spending whether it is having to pay more interest costs on its debt on the front end through higher interest rates or more entitlement programs on the back end to help underprivileged groups. The end game is the same. The US government & the Fed have been playing catch-up for some time now and rising oil prices are only going to add to their woes. In fact, Bill Ackman weighed in on this with a similar conclusion where he most likely knew the US debt recently got downgraded.

In fact, as we see on TMV’s intermediate 5-year chart, none of the Fed’s actions concerning how the reported CPI inflation numbers have come down has impacted this market. The Chart clearly shows a bottoming formation over a two-year horizon which subsequently has resulted in higher lows & higher highs for the leveraged inverse fund. Furthermore, the recent intermediate golden cross reflects how rising oil prices will continue to put pressure on bond prices over time.

TMV Intermediate Chart (Stockcharts.com)

Conclusion

To sum up, rising inflation in the US buoyed by higher oil prices points to more tightening by the Fed over time which will continue to pressurize bond prices. Traders can use the intermediate histogram or the triple moving average strategy outlined in the previous commentary to keep on trading TMV for short-term periods from the long side. We look forward to continued coverage.

Read the full article here