The British building materials retailer Howden Joinery (OTCPK:HWDJF) has honed its business model over years and I like it. But a potentially worsening outlook in its sector could hurt revenues and earnings, although the company continues to plan for long-term success with dozens of new depot openings in the past couple of years, international expansion and an increase in inhouse manufacturing capacity.

I last covered Howden in June 2020 (More Long-Term Growth To Come: Howden Joinery Group) with a “hold” rating, since when the shares have put on 37%. I maintain that rating.

Business Looks to be Slowing

The Howden business model appeals strongly to me, as I set out in my previous piece. It has an established base of heavy trade customers it has carefully cultivated through trade-relevant marketing activity. Its depot networks offers broad reach and also economies of scale. The brand has been built well over a long period.

However, things look to be slowing down at the business. This comes through in the company’s interim results, published in July.

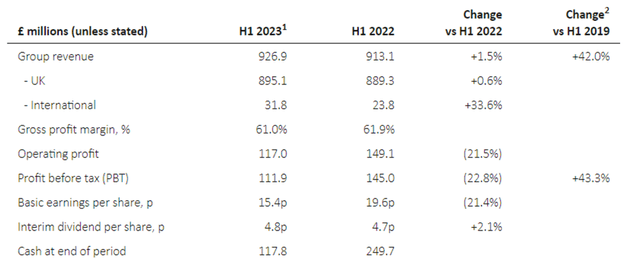

Company announcement (footnotes omitted)

While revenue grew slightly and gross profit margin declined only slightly, pre-tax profit and basic earnings per share fell by almost a fifth.

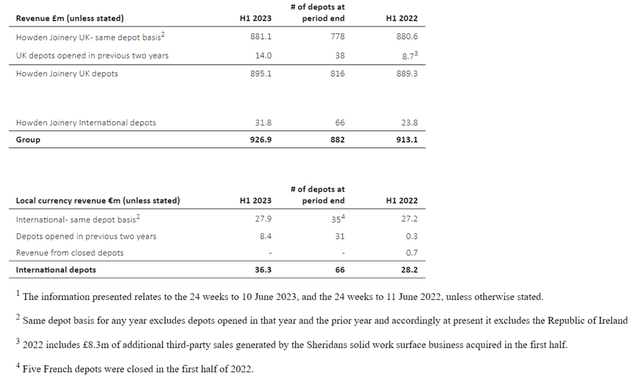

Given price inflation, I suspect a revenue gain of just 1.5% indicates a volume decline. That said, one bright spot was the 33.6% international revenue growth, thanks to the small French business expanding sales. In the long term, I think Howdens rolling out its proven business model in another market close to the U.K. (such as France and the Republic of Ireland, which the company is doing) could be a key growth driver. 10 or so new international depots are planned to be opened this year.

The company said operating costs (before what it deems as investment in strategic initiatives) were maintained at similar levels to the prior year period. So the decline in profit seems to be largely attributable to inflationary pressures, with operating costs growing 8% year on year.

The apparently slowing sales are a concern but I think the bigger concern is what comes next. The U.K. property market is falling in many areas, while British house builders have been warning in recent months that interest rate rises are eating into newbuild sales.

At the interim point, the company maintained its full-year forecast. It said, “Despite the continued challenging macroeconomic backdrop, our builder customers remain busy, with activity levels normalising from the exceptional levels of a year ago”.

Reducing inventory levels now that pandemic-era logistics holdups have reduced, as well as keeping a tight control on operational costs (something I do not think was self-evident from the first half numbers despite the company mentioning “£23m of efficiency actions offsetting cost inflation”) could help boost free cashflows especially in the short term.

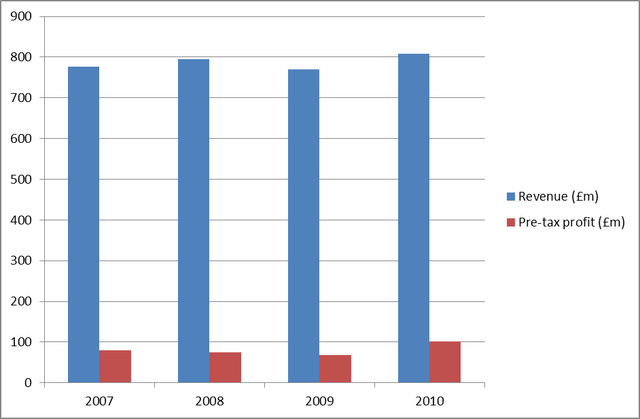

In the medium- to long-term, though, I expect revenues and profits will be affected by the overall health of the U.K. economy and its housing market. Here is a snapshot of what happened during the financial crisis.

Chart compiled by author using data from company annual reports

That was not disastrous, but both for revenue and particularly profit, 2009 saw a notable decline. I see a clear risk of something similar in the next couple of years depending on how bad the British economy gets. Meanwhile, inflation and post-Brexit trading rules could put more pressure on profits this time around than during the financial crisis (although, in fairness, the first half gross profit margin was fractionally higher than its 2010 equivalent).

Building for the Future

Something that I think bolsters the long-term investment case is that Howden’s “strategic initiatives” referred to above could help set it up for more success in future. It is not sitting on its hands, despite concerns about the wider economy.

It spent £32m on such initiatives in the first half. These include expanded manufacturing capabilities, with new kitchen furniture lines and a second architrave and skirting line, commissioning and installing two new production lines for a paint mixing service.

The international division remains fairly small but is growing fast.

Company interim results announcement

Dividend Prospects

The interim dividend was grown 2.1% and the shares currently yield 2.9%.

Last year, the company spent £115m on dividends (and £251m buying back its own shares). Free cash flows excluding dividends were -£88m.

In the first half of this year, the company spent £50m on buybacks and it has not announced any further buyback plans. That ought to mean that the dividend is covered by free cash flow this year, with room for a rise at the full-year level.

Valuation

Since I last wrote, I have bought into and later sold the shares.

Using last year’s basic earnings per share of 65.8p, the current P/E ratio is 11. If full-year results mirror first half earnings performance, that goes up to 14.

If earnings fall due to the concerns I outlined above, the prospective P/E ratio could be high teens or worse, which I think is much less attractive than 11. That said, Howdens is a well-run company that has proved it can be resilient – and it Is not clear how bad things will get (or not) in the U.K. housing market. So, for now, I maintain my “hold” rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here