Vodafone (NASDAQ:VOD) has reported improved operating trends recently, but a quick turnaround is not likely. Its shares are interesting for investors who are willing to hold for some time, collecting a high-dividend yield in the meantime.

As I’ve covered in previous articles, Vodafone’s track record is not impressive and its shares have a relatively weak performance in recent years, as competition in the telecom industry is fierce and pricing power of established players is not great.

Despite that, Vodafone’s valuation was clearly cheap and its high-dividend yield was attractive to income investors, making it an interesting yield play within the European telecom sector. Since may last article, its shares are slightly up and more or less in-line with the market, and in this article I analyze its most recent earnings and update its investment case to see if it remains a good income pick or not.

Recent Operating Trends

Vodafone has a mature business and its operating trends have not been impressive in recent years, which led its management to make some efforts to improve its business profile and monetize some assets. The company decided to sell a large part of its tower business, listed as Vantage Towers (OTCPK:VTAGY), and more recently it announced a deal to combine its U.K. operations with its competitor Three, owned by CK Hutchison Holdings Limited (OTCPK:CKHUY), creating the largest mobile operator in the country if the deal is approved by regulators.

While these are positive steps to unlock value and make Vodafone more competitive in an important market, its organic operating trends have remained challenging in recent quarters, showing that a quick turnaround is not likely.

Indeed, Vodafone has changed its CEO some months ago and a new strategy was presented, which at the time was not well received by the market as it wasn’t much different than previous ones. Moreover, execution has not been flawless given that, for instance, Vodafone wanted to dispose its Spanish business in a potential $4 billion deal, but so far there haven’t been many developments on this potential sale.

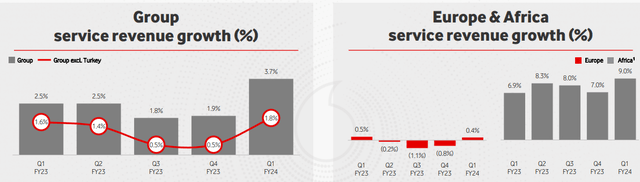

Regarding its operating performance, Vodafone’s Q1 fiscal year (FY) 2024 trading update reported an improved trend, which is an encouraging sign about its business turnaround prospects.

Indeed, group service revenue increased by 3.8% YoY, being the highest growth rate over the past five quarters, with Europe reporting growth of 0.4% YoY after three consecutive quarters of reporting declining service revenue. In Africa, growth remained quite strong as usual, with service revenue increasing by 9% YoY and being the company’s major growth engine.

Service revenue (Vodafone)

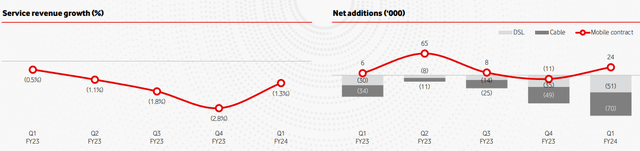

Despite this overall positive quarter regarding its service revenue growth, in its largest market the company continued to report weak trends, given that service revenue dropped by 1.3% YoY in Germany during the last quarter. This country represents some 31% of its total revenue and is therefore key to a successful turnaround, but Vodafone continues to struggle to grow revenue in this market.

The company raised prices recently which led to higher cable disconnections compared to previous quarters, while in mobile its net new additions have been more stable. Overall, Vodafone’s revenue performance improved compared to the previous quarters given that service revenue decline moderated compared to the previous two quarters, but it’s still not enough to at least report stable revenues in the country.

Operating trends in Germany (Vodafone)

In other European markets, such as the U.K., Vodafone has been able to report higher revenue in the past quarter, growing revenues between 4.1%-5.7%, which is a positive trend given that these markets represent some 28% of total revenue (U.K. plus other Europe). On the other hand, Italy and Spain remain a drag (together represent 21% of revenue), with Spain being the worst market with a service revenue decline of 3% YoY.

While this was Vodafone’s best performance over the past four quarters, competition in the country remains intense, especially in the low-end segment, thus a quick turnaround is not likely. While pricing was adjusted linked to CPI, which led to a smaller revenue decline than in previous quarters, the competitive profile of the Spanish market is challenging and the best option for Vodafone maybe is to exit the market through and asset sale as the company doesn’t seem to have scale to compete with Telefonica (TEF) and Orange (ORAN), which would also help it to reduce debt.

In Africa, Vodafone continues to report much better growth rates, especially in countries like Turkey or Egypt, a trend that is likely to persist for many years as market penetration is lower and growth prospects are much stronger than compared to Europe.

In the business segment, Vodafone was also able to report a positive performance, given that service revenue increased by 4.5% YoY in Q1 FY2024, with most markets reporting higher revenue. Again, an exception was Spain, showing that this market is quite challenging for Vodafone both for its consumer and business segments.

As the company only reports a trading update related to the first quarter of each fiscal year, there aren’t disclosures about its profitability, but Vodafone confirmed its EBITDAaL guidance of around €13.3 billion for FY 2024 and adjusted free cash flow of around €3.3 billion. This represents an EBITDAaL decline of 9.5% YoY and a 30% decline on adjusted free cash flow, showing that Vodafone’s turnaround plan is not going to change the company’s financial performance in a rapid way.

Indeed, according to analyst’s estimates, Vodafone is not expected to improve that much its operating performance in the next few years, considering that revenue is expected to be €43.5 billion in FY 2024 and increase to only €44.6 billion by FY 2027. This means that top-line growth will be quite muted in the coming years, as the market does not give much credit for the company’s strategy to overhaul its operating momentum.

This is not surprising given that Vodafone’s turnaround plan focused on improving customer service and reducing business complexity, but none of this is revolutionary and the telecom industry is mature and competition is not expected to go away, thus Vodafone does not seem to have much room for top-line improvement in the near future.

Regarding profitability, the company wants to cut around 11,000 jobs and reduce administrative expenses, which could be important support for higher earnings ahead. The market seems to give more credit regarding these efforts, as current estimates expect Vodafone’s EBITDA to be about €14.5 billion by FY 2027.

Nevertheless, these aren’t particularly impressive growth and profitability trends over the next few years, being a key reason why its shares trade at a very low valuation. Moreover, as the company operates mainly in countries with a mature telecom industry (except Africa) and there hasn’t been much progress on disposals, a re-rating is not much likely to occur in the near term. A positive catalyst could be a regulatory approval of its planned merger in the U.K., but that is likely to take some time and most likely will only be approved, or not, during 2024.

Reflecting this background, Vodafone is currently trading at 10.3x forward earnings, at a significant discount to its own historical average of about 14.6x over the past five years, which already reflects most of its own woes. Moreover, compared to other large European telecom companies this is also a low multiple, thus Vodafone’s shares seem to be cheap right now.

Conclusion

Vodafone’s operating trends have been weak for the past few quarters and a quick turnaround is not likely, justifying its current low valuation. While its trading update regarding Q1 FY 2024 showed some improving trends, this wasn’t enough for a re-rating of its shares. Despite that, I think Vodafone remains interesting as a value play, plus it also offers a high-dividend yield, making it a buy for investors who are willing to hold for three to five years, as a turnaround will take some time to improve markedly the company’s fundamentals.

Read the full article here