By Dina Ting, CFA, Head of Global Index Portfolio Management, Franklin Templeton ETFs

India is growing in influence on the world stage, and its vibrant market is worth paying attention to, according to Dina Ting, Head of Global Index Portfolio Management, Franklin Templeton ETFs. Find out more.

From back-to-back celestial successes to a commanding role in pulling off a consensus declaration as host of the world’s highest profile global economic assembly – the G20 – India has been on quite a roll this year.

The world’s most populous nation celebrated a milestone in space exploration, engineering and technology when it became the first country to land an unmanned robotic spacecraft near the moon’s south pole in late August.

The historic lunar mission – which made India just the fourth country to touch down on the moon after the United States, the Soviet Union and China – was designed to search for signs of frozen water and other elements.

Mere days later, India’s triumphant mission to study the sun’s outer atmosphere for a better understanding of space weather fortified its assertiveness on the world stage.

It added an exclamation point to these wins recently by flaunting diplomatic clout with a G20 summit agreement over such areas as debt resolution, overhauling institutions like the World Bank and formally welcoming the African Union to the bloc for better representation. India also helped steer the leaders in overcoming deep divisions over the war in Ukraine to produce a consensus document.

Prime Minister Narendra Modi took the opportunity to further promote several measures aimed at better integrating the “Global South’s” developmental needs and ambitions with that of the G20.

He announced a new multilateral rail and sea corridor project to connect India with the Middle East and the European Union, describing it as a beacon of partnership and innovation.

In such an environment of shifting global political alliances, the trade pact stands to be a compelling counterweight to China’s vast Belt-and-Road infrastructure corridor.

Modi also met with US President Joe Biden, and the two leaders issued a 29-point joint statement which outlined areas of cooperation toward mutually beneficial goals, including resilient global supply chains and scientific and technological research.

Diversifying away from China has also meant a surge of new investment for India, where companies like Amazon (AMZN), Apple (AAPL), Boeing (BA), Samsung (OTCPK:SSNLF) and Nokia (NOK) are banking on the country as a formidable manufacturing alternative.

China’s weaker-than-expected economic recovery furthermore appears to be lending positive momentum to Indian equities, especially among international investors who have favored smaller, domestically-focused companies.

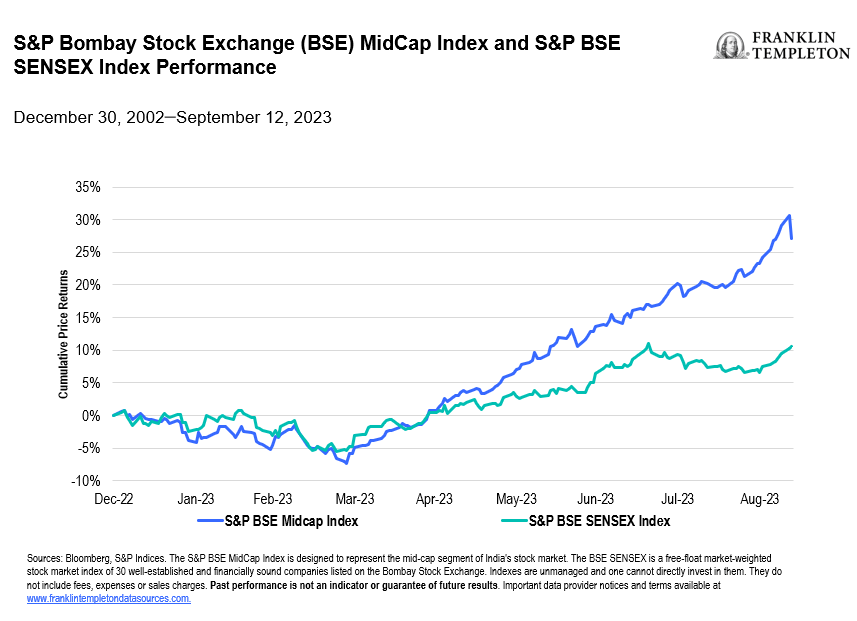

Last year, India’s equity market experienced significant outflows, but the tide seems to be turning. At the end of the first quarter, overseas investors saw renewed appeal in Indian midcap stocks – the S&P BSE MidCap Index rose more than 20%, compared to a 7.4% gain in the S&P BSE Sensex Index, which is India’s most tracked bellwether index, designed to measure the performance of its 30 largest blue chips.1

Bloomberg data revealed that India’s equity market received about US$15.5 billion in net foreign inflows year-to-date through August, roughly US$1.5 billion short of cancelling last year’s record outflow.2

India’s gross domestic product (GDP) expanded 7.8% on an annual basis in the June quarter – picking up pace from the prior quarter when it grew 6.1%. We believe this bodes well for smaller, more domestically-focused companies.

Improving infrastructure in the fast-growing economy should continue to attract more multinationals to set up shop, further advancing India’s overall economy and potentially benefiting small- and mid-capitalization firms.

For investors seeking more exposure to India’s growing segment of mid-cap stocks, in our view, it’s worth paying attention to deviations in index construction.

As a measure of the broader Indian market, nearly 32% of the 210 constituents of the FTSE India Capped Index were smaller-cap holdings (under US$5 billion market cap) as of the end of August 2023, while the MSCI India Index, which has 115 companies, held less than a 21% concentration to smaller companies.3

In terms of performance, the FTSE India Capped Index has returned 13.5% year-to-date, compared to 10.7% for the MSCI India Index.4

Contributors to performance include mid-cap firms not represented within the more mega-cap focused MSCI India Index. These included health care firms Zydus Life Sciences and Glenmark Pharmaceuticals as well as Exide Industries, which makes batteries for railways and automotives.

In our view, India’s structural trends, rising affluence, expanding manufacturing prowess, government reforms and burgeoning influence on the world stage, are compelling growth drivers that investors should be watching closely.

What are the risks?

All investments involve risks, including possible loss of principal.

Equity securities are subject to price fluctuation and possible loss of principal.

International investments are subject to special risks, including currency fluctuations and social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets.

ETFs trade like stocks, fluctuate in market value and may trade above or below the ETF’s net asset value. Brokerage commissions and ETF expenses will reduce returns. ETF shares may be bought or sold throughout the day at their market price on the exchange on which they are listed. However, there can be no guarantee that an active trading market for ETF shares will be developed or maintained or that their listing will continue or remain unchanged. While the shares of ETFs are tradable on secondary markets, they may not readily trade in all market conditions and may trade at significant discounts in periods of market stress.

Commissions, management fees, brokerage fees and expenses may be associated with investments in ETFs. Please read the prospectus and ETF facts before investing. ETFs are not guaranteed, their values change frequently, and past performance may not be repeated.

Any companies and/or case studies referenced herein are used solely for illustrative purposes; any investment may or may not be currently held by any portfolio advised by Franklin Templeton. The information provided is not a recommendation or individual investment advice for any particular security, strategy, or investment product and is not an indication of the trading intent of any Franklin Templeton managed portfolio.

1. FactSet, MSCI August 31, 2023. The S&P BSE MidCap Index is designed to represent the mid-cap segment of India’s stock market. The BSE Sensex is a free-float market-weighed stock market index of well-established and financially sound companies listed on the Bombay Stock Exchange. Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator or a guarantee of future results. MSCI makes no warranties and shall have no liability with respect to any MSCI data reproduced herein. No further redistribution or use is permitted. This report is not prepared or endorsed by MSCI.

2. Source: Bloomberg. “Goldman Says India Midcaps Getting Popular With Foreigners Again.” August 17, 2023.

3. FactSet, MSCI August 31, 2023. The MSCI India Index is designed to measure the performance of the large- and mid- cap segments of the Indian market. Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator or a guarantee of future results. MSCI makes no warranties and shall have no liability with respect to any MSCI data reproduced herein. No further redistribution or use is permitted. This report is not prepared or endorsed by MSCI.

4. Bloomberg, September 11, 2023. The FTSE India RIC Capped Index is a market-capitalization weighted index representing the performance of Indian large and mid-capitalization stocks. Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator or a guarantee of future results.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here