Thesis

Pan American Silver (NYSE:PAAS) experienced strong reserve growth year over year. The primary driver was the deal with Yamana. The Jacobina mine, a producing asset with enormous potential for exploration with high grades and low AISC, became part of the Pan American portfolio.

PASS has a clean balance sheet with sufficient liquidity. Ross Beaty is among its directors and it’s still undervalued to its peers when measured by NAV. The current price offers the opportunity to start building a long-term position while using pullbacks to add more.

Despite all the positives, Pan American has scattered its operations in seven countries. Before considering an investment in PAAS, I will wait patiently to see how the management will handle the incoming challenges. Having mines in more than a few countries, even in one region, puts the company’s leadership in a precarious situation in my view. That said, I give PAAS a hold rating for now.

Company Overview

Pan American Silver is among the major silver miners in the world. However, the production of silver contributes to around 20% of their income, gold contributes to about 65%, and base metals (copper, zinc, and lead) make up the remaining 20%. By acquiring Tahoe Resources, they joined the group of silver miners who had expanded into the gold mining industry.

Pan America’s plausible reserve base is outstanding. They have 24.2 million oz of gold and nearly 1.3 billion oz of silver. They are expected to produce roughly 930,000 oz of gold and 22 million oz of silver in 2023.

Those numbers exclude the Escobal mine in Guatemala, which has permit problems due to political issues. The Escobal restart will add another 20 million oz silver annual production with low AICS. PAAS has another project in its pipeline: the enormous and underdeveloped Navidad in Argentina. The Escobal and Navidad projects now have permit concerns that might not be resolved.

PAAS anticipates producing 930,000 oz in 2023 at all-in costs of about $1,550 per oz to have a healthy cash flow. Additionally, they have a strong balance sheet, especially for a business of their size, and their next long-term debt payment isn’t due until 2027.

The deal with Yamana brought four producing mines to Pan American’s portfolio. This gives them 12 operating properties in seven countries in the Americas. No single operation provides more than 23% of production, giving them diversification if they lose a mine.

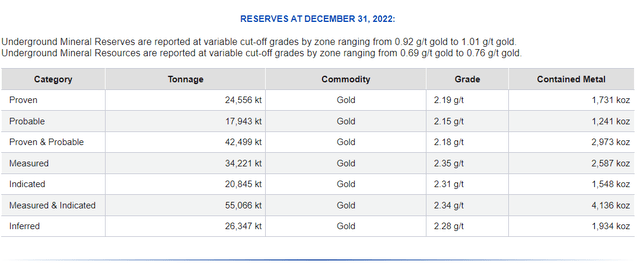

Among Yamana’s mines, I like Jacobina in Brazil. It comes with a large land package measuring around 80,000 hectares, among the largest and undoubtedly one with a significant exploration upside compared to other operating mines. It is more significant than Chapada, a former Yamana asset, and almost twice as significant as Hounde. The latter is one of Endeavour Mining’s mining assets in the Birimian Greenstone belt in West Africa. The table below from Mining data online shows Jacobina’s resource, reserve base, and ore grade.

Mining data online

As seen, the numbers are impressive. The grade exceeds the world average for underground mines. Currently, Jacobina is under Phase 3 expansion to increase its annual production to 270 thousand ounces of gold.

This is significant for Pan American because Jacobina, the company’s arguably best asset, produces about 190,000 ounces at under $900 per ounce all-in sustaining costs, making it one of the highest-margin gold assets in the sector even though it only operates at 50% of what could be its maximum annual capacity (about 350,000 ounces).

Special mentions are deserved for Ross Beaty. He, along with Sean Boyd, Mark Bristow, and Pierre Lassonde, is a living legend in the precious metals mining industry. Mr. Beaty is Chairman of another excellent miner, Equinox Gold (EQX). He has a distinct style of managing his company’s financial affairs. Among his best traits is his prudent approach to debt. PAAS has a solid liquidity position with well-diversified debt.

Q2 results

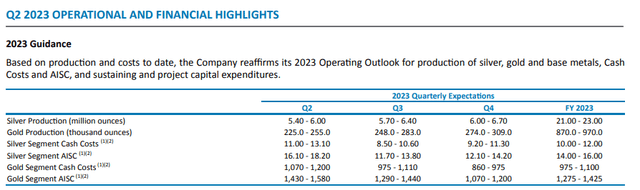

PAAS had an exceptional last quarter. A few points I wish to highlight. 6.02 million ounces of silver and a record 248.2 thousand ounces of gold were produced-production up 55% for silver and 102% for gold compared to Q1 2023. The table below from the last company financial report shows the 2023 projections.

Pan American Q2 financial statement

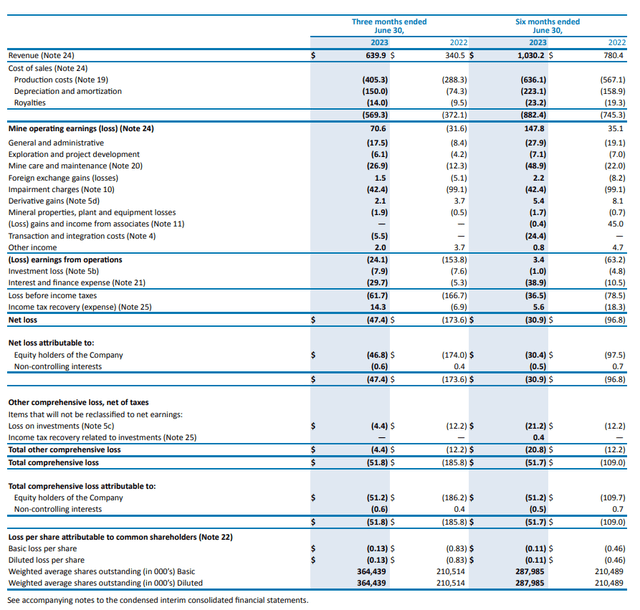

All-in Sustaining Costs per silver ounce were $15.70, respectively-Gold AISC $1,342. The production growth is reflected in the company`s revenue. The latter increased by 64% to $639.9 million from Q1 2023 to Q1 2019. The table below represents the Q2 income statement.

Pan American Q2 financial statement

Revenues almost doubled while production costs increased by less than 50 %. The company’s non-cash accounting impacts result in the bottom line. PAAS realized a net loss of $47.4 million, including a $42.4 million impairment charges related to the sale of its 92.3% ownership interest in the Morococha mine and $26.1 million net of tax fair value adjustments on finished goods inventories related to the Yamana transaction accounting.

Adjusted earnings, which do not include the impairment charge and the fair value adjustment mentioned above, were $14.7 million, or $0.04 adjusted earnings per share. On August 9, 2023, PAAS declared a dividend of $0.10 per share for Q2 2023.

Company Financials

As I mentioned, Pan American has robust financials for miners. The table below shows some liquidity and solvency metrics I use to asses balance sheet health. The data is from the last financial report.

|

EBITDA/Interest expenses |

15.6 |

|

EBITDA – CPX/Interest expenses |

3.96 |

|

Quick ratio |

0.94 |

|

Current ratio |

2.13 |

|

Net debt/EBITDA |

1.87 |

|

Net debt/EBITDA – CPX |

7.4 |

|

Long-term debt/Equity |

19.6 % |

|

Total debt/Equity |

19.6 % |

|

Total liabilities/Total assets |

39 % |

On the liquidity side, PAAS is doing great. Its EBITDA exceeds the gross interest payment. Its quick ratio could be better. However, PAAS spends heavily on CAPEX to increase its annual production. Capital investments will bear fruit in the long term, improving the company’s bottom line.

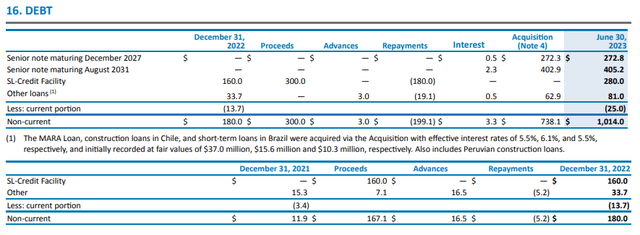

The mining business is an asset and thus requires access to cheap financing with proper maturities. The table below shows Pan American’s debt composition.

Pan American Q2 financial statement

A large portion of the debt matures after 2026. The first round is due in 2027, with $272 million in senior notes. The next significant debt maturity is 2031, $405 million senior notes.

Last year was tough for PAAS, reflected in the company’s profitability (TTM) metrics. The table below presents Pan American’s TTM results.

|

FCF/EV |

0.38 % |

|

Sales/EV |

24 % |

|

FCF Margin |

0.72 % |

|

Gross Margin |

27 % |

|

ROI |

(0.57) % |

|

ROE |

(7.44) % |

|

Net income per Employee |

(44,352 ) USD |

Given the last strong quarter and few catalysts on the horizon, PAAS results will improve.

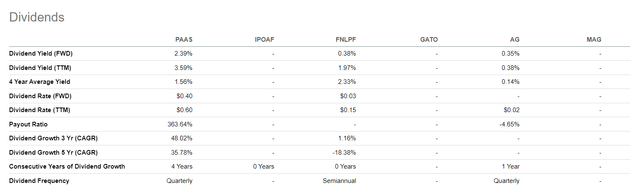

Among silver miners, dividends are not common, at least for now. PAAS leads the pack with a respectable 2.39% yield.

Seeking Alpha

Valuation

Gold mining is not an industry where you can project steady future growth. Its cyclicality, lack of pricing power, and asset-heavy nature make cash flow predictions often misleading. I value companies in the mining and precious metals sector using two methods:

- Net asset value.

- EV/Annual production and EV/Plausible reserves.

I calculate net assets as follows:

NAV = PR*(SP-AISC) + cash + inventories + total receivables – total liabilities.

PR (plausible reserves) = 100% * P&P Reserves + 50%*M&I Resources + 30%*Inferred Resources.

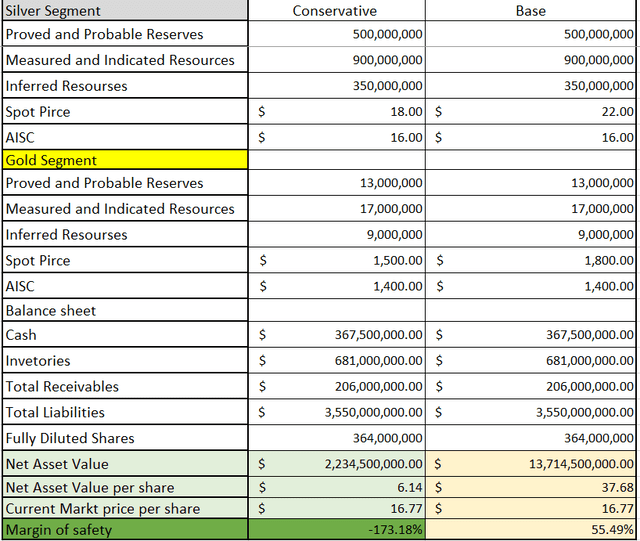

Pan American Q2 financial statement and author’s database

I examine two scenarios. One conservative with spot prices for gold at $1500/oz and silver at $18/oz. The other is the base scenario is using a gold price of $1800/oz and silver price of $22/oz.

Conservative NAV per share = $6.14.

Base NAV per share = $37.68.

Even my base approach is conservative, but this is a safer way of thinking. Assuming lower prices is the best way to explore the downside risk. Using my forecasted prices (silver > $40/oz and gold > $2200/oz in the next 18 months), I will obtain outstanding figures but neglect the downside risk inherent in gold mining. On the way north, gold and silver will be very volatile, thus challenging our resilience and patience.

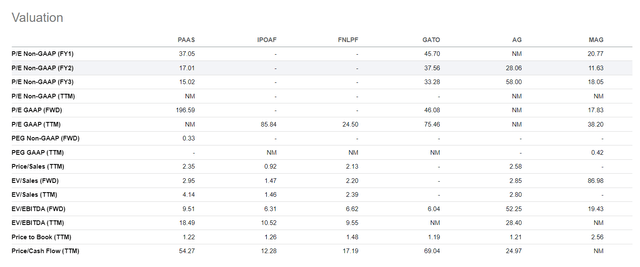

Pure silver miners are rare. PAAS revenue derived from silver is 36% and gold 63%. Hence, I will compare it against major silver miners because it is ambitious to become the next major player. The companies below are:

- Industrias Penoles (OTCPK:IPOAF).

- Fresnillo PLC (OTCPK:FNLPF).

- Gatos Silver (GATO).

- First Majestic (AG).

- MAG Silver (MAG).

Seeking Alpha

PAAS stands in the middle, using Price to Sales and EV/Sales. However, GATO and PPAS are overvalued, measured with the Price/Cash flow metric.

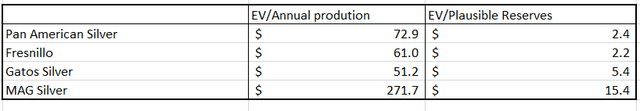

Another helpful metric comparing producing miners is EV/Plausible reserves and EV/Annual production. I need to calculate silver equivalent ounces (Ag Eq oz) for gold miners like PAAS. To do that, I use today’s spot prices to obtain a gold-to-silver ratio and then multiply gold plausible reserves. In the table below, I compare the same companies from above on EV/Annual production and EV/Plausible accounts.

Gold Stock Data and author’s database

PAAS is cheap based on what we receive after paying the company’s debt. Only Fresnillo is cheaper based on EV/Plausible reserves. However, we spend more compared to its primary competitor, Fresnillo.

Risk

The risks carried by Pan American are no exception for gold miners. The geological and metallurgical risks are the most challenging to assess as investors due to a lack of knowledge and access to information. That said, considering the management’s expertise, those risks are under control. Pan American has a clean balance sheet with well-distributed debt maturities, thus mitigating the liquidity risk.

One more subtle risk is worth mentioning. The company has mines in 7 countries. This is positive on one side because it provides diversification. However, on the other hand, it is a significant drawback because the company’s managers have to be very flexible and adaptive to various countries’ inherent risks. I prefer miners focused in a few countries, knowing their peculiarities inside out.

Conclusion

Pan America is a major silver/gold miner with growing resources and reserve base, improving production figures, experienced managers, and cheaply priced. Pan America has operations in seven countries. That fact significantly increases the company’s operational risk. I will observe closely how the company handles the complexities of multinational operations. Till then, however, I give Pan American a hold rating.

Read the full article here