SLB (NYSE:SLB), formerly known as Schlumberger, has been a strong performer over the past year, benefitting from increasing oil & gas drilling and exploration spending as it is the world’s premiere oilfield services firm. Shares have rallied nearly 50% since I recommended buying SLB last October. Even after this run, I see further upside, albeit not as significant, because the company is operating strongly, generating fantastic incremental margins, in what is a multiyear upcycle in activity.

Seeking Alpha

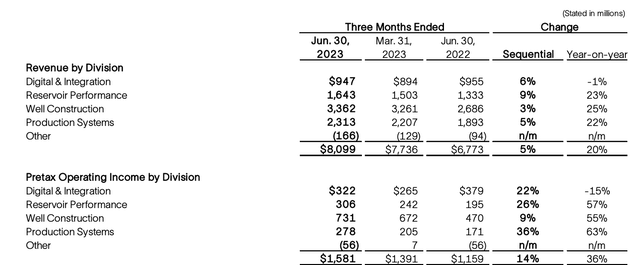

In the company’s second quarter, it generated adjusted EPS of $0.72, up 44% from last year as revenue of $8.1 billion was up 20% from 2022. We are seeing tremendous profit growth as expanding margins compound double-digit revenue growth to cause substantially faster profit growth. This is because the company maintains a degree of fixed cost in developing technological platforms that help explore for fossil fuels, operate wells, and maximize production. Like a traditional software company, this technology development cost is similar whether you sign up 1 or 100 users, so as SLB services more wells, much of that incremental revenue drops right to the bottom line.

This was the core of my thesis last year, when I thought by 2024 the company could expand margins by 100bp and get to about $2.80 in earnings. It is now running that pace in mid-2023. Pretax operating margins rose 240bp from last year to 19.5%. This was the tenth straight quarter of year-over-year margin expansion. With revenue continuing to grow, I expect this trend to continue. As you can see below, in each of its four units, profit growth moves significantly more than revenue growth, speaking to the significant operating leverage in its business.

SLB Corp

I would note that digital & integration had a one-time surge in exploration transfer fees in Q2 2022, which has created an unfavorable comparison. Over the past three years, this unit has grown by about 50%. Elsewhere, growth was broad-based with international revenue up 21%, led by the Middle East, Asia, and offshore. North American revenue rose 14%. International accounts for about 78% of the business, so that stronger growth rate is critical to SLB’s results. While the US is an important part of SLB, this is truly a global company.

These strong operating results are leading to significant free cash flow: $986 million in the quarter. Free cash flow will likely accelerate further in the second half as SLB’s payment cycle leads to unfavorable working capital movements in H1 and favorable ones in H2. SLB is on track to deliver about $4 billion in free cash flow, holding working capital constant this year while still investing $2.5-2.6 billion in cap-ex. Management is committed to return $2 billion to shareholders via dividends and buybacks. It has also reduced net debt over the past year by $900 million to $10.1 billion. With its balance sheet well positioned, I expect a faster pace of buybacks over time.

Fortunately, the global environment is favorable for more oil & gas servicing activity. Of course, recently, crude oil prices have been rising, moving past $90 a barrel. This is partly because Russia and Saudi Arabia have announced they will be extending their oil production cuts through year-end, contributing to a tightening supply environment. I would not recommend owning SLB simply based on a short-term move in oil prices, though.

As a services company, SLB does not have direct exposure to each movement in oil prices, like an Exploration & Production (E&P) company does. Rather, it has a second derivative exposure, insofar as higher prices lead to more drilling and exploration activity. While US fracking is “short cycle,” meaning drilling programs can be turned on and off in weeks, SLB is, as noted above, a largely international firm, where the focus is on longer-cycle, megaprojects with multiyear time horizons, like deep-water.

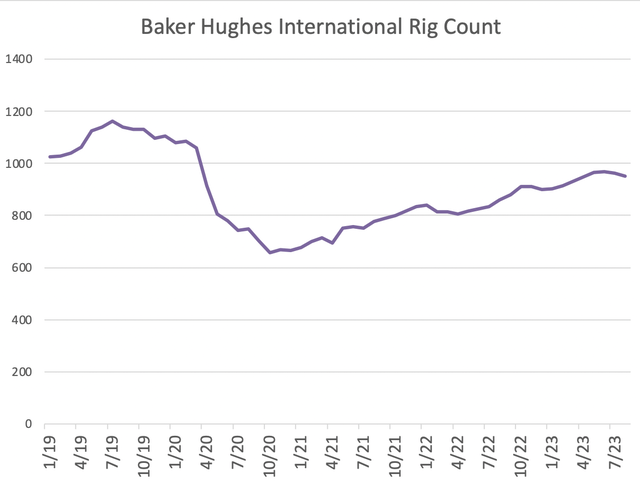

For instance, Guyana has become an increasing focus of oil majors with Exxon Mobil (XOM) proposing yet another project worth over $12 billion that will run through much of this decade. In Brazil, there are plans to spend $200 billion on infrastructure with increased exploration activity by Petrobras (PBR) a major contributor. Saudi Arabia is expected to invest 60% more on cap-ex over the next 3 years than the past 3 years. This is why SLB management says international investment momentum is “accelerating” with $200 billion in deep-water projects (where SLB is the leader) by 2025. We are still in the early innings of these projects, which will provide a runway of solid earnings and cash flow growth for SLB. As you can see below, after falling throughout 2020, the international rig count has been steadily rising over the past three years, but it still remains below pre-COVID levels.

Baker Hughes

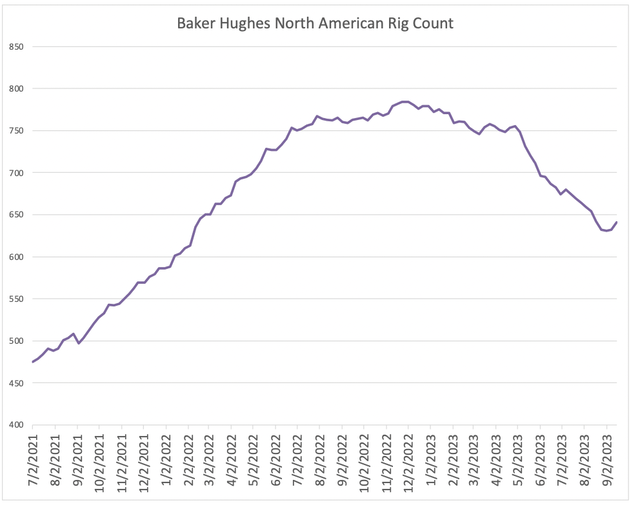

Given US shale production, by its shorter-term nature, is more oil price sensitive, the rig count fell earlier this year alongside oil prices. As this is a smaller piece of SLB’s business, it was a relatively modest headwind. With crude oil prices rising, we are actually now seeing an inflection point in the US rig count. At the margin, this will provide a cyclical tailwind to SLB’s earnings profile beyond the secular tailwind of large-scale international projects.

Baker Hughes

While decarbonization is an indisputable long-term trend, it is important to remember even under the most aggressive assumptions, fossil fuel usage will remain high for a long time, particularly with emerging economies growing. In fact, by 2028, the International Energy Agency (IEA) expects global oil demand to be about 5.5% higher than it was in 2022. As COVID-19 caused prices to fall, there was a major pullback in investment activity in the oil & gas sector. That lack of investment is now why we are seeing rising investment to catch up and meet this demand. The fact many countries are trying to source energy away from Russia is only a further tailwind.

As these projects, like Exxon’s in Guyana, are greenlit, SLB will be generating revenue for several years, because it provides to technology to evaluate the reservoirs, drill, and then manage production flows. SLB services the life-cycle of the well. I think investors should expect the combination of operating leverage in a secular growth environment that has powered such strong earnings growth this year to persist. Over the next twelve months, I am expecting 10% revenue growth and 100bp margin expansion, which can get earnings past $3.30. Assuming a 2% share count reduction via buybacks, 2024 earnings should be $3.35-$3.45. Given the scale of international activity, 10% revenue growth may prove to be a conservative assumption.

That level of results should translate to about $5-$5.25 billion in free cash flow. For a business generating 15+% earnings growth, with a stellar balance sheet, and expanding margins, I would be a buyer down to a 5% free cash flow yield. That is about $70/share, or just about 20x earnings. This represents about 15% upside from current levels. Given the need for more hydrocarbon around the world to meet demand, I see risks to my outlook as skewed to the upside, barring a significant, global recession.

While returns over the next year may not repeat the past year’s 50% rally, I believe there is still double-digit upside, and I would be a buyer of SLB shares.

Read the full article here