Investment thesis

In the import market, led by Europe, China, Japan and South Korea, potential gas demand is growing despite record high storage occupancy. In order to substitute gas supplies from Russia, the EU has increased LNG imports by more than 25%, thus becoming dependent on LNG for 2/3 of imports last heating season. In Asia, gas demand is expected to grow moderately due to the abolition of the “Zero COVID” policy in China, normalization of weather conditions and moderate recovery of gas consumption in India and developing Asian countries after a sharp decline in 2022. The strikes in Australia shook up the global LNG market, showing the world how dependent countries are on limited LNG supply. For Cheniere Energy (NYSE:LNG), we, therefore, forecast a wide spread between the realized price and the Henry Hub price and maintain BUY status.

LNG market

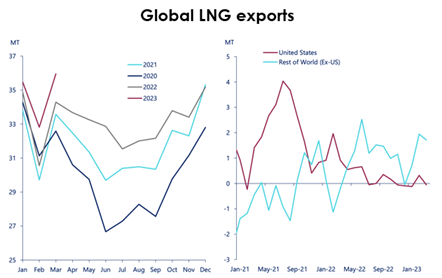

Last quarter, our attention was drawn to the industry’s growing appetite for LNG, with global LNG production in Q1 2023 reaching its highest level since 2020, helping to cool the hot LNG market.

Cheniere Energy

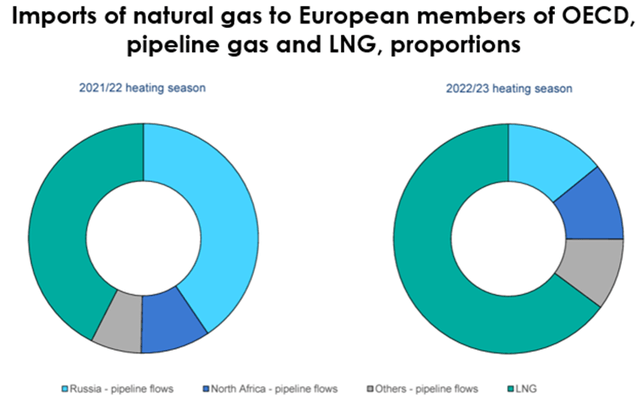

According to the International Energy Agency, the export of Russian pipeline gas to OECD countries in Europe decreased by about 70% (or 50 billion cubic meters) in the 2022/23 heating season compared with a year before. The export of LNG from the Russian Federation to the European Union, on the contrary, increased by 5% (or 0.5 billion cubic meters) compared with the 2021/22 heating season. The share of Russian gas in the total gas demand in the European Union decreased to 10%, and the share of Russian pipeline gas is currently less than 10%.

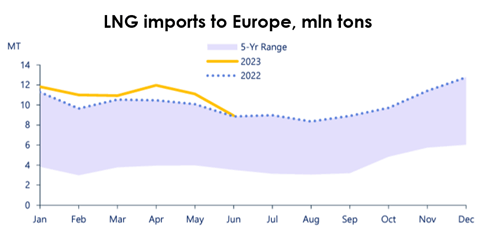

To replace gas supplies from Russia, the EU increased its LNG imports by more than 25% (or 20 bcm) compared with the previous year, reaching a record 94 bcm in the 2022/23 heating season. This means LNG made up two-thirds of all imports in the past heating season

LNG flows from the US jumped by 30% (or almost 10 bcm) compared with a year earlier, further strengthening the US position as the largest gas supplier to Europe. In total, the US accounts for more than 40% of all LNG imports to the region and meets almost 15% of gas demand.

The question of supplies of Russian pipeline gas until the end of 2023 continues to be one of the main factors of uncertainty. Assuming that the volumes of supplies to the European Union remain at the level of the first quarter, the supplies of Russian pipeline gas to OECD countries will decrease by 45% (or more than 35 bcm) in 2023, compared with 2022.

After a significant increase in the first quarter of 2023, the volumes of LNG imports to OECD countries in Europe are expected to fall for the rest of the year as the demand to fill up storage capacity will be shrinking and European gas consumption continues to decline.

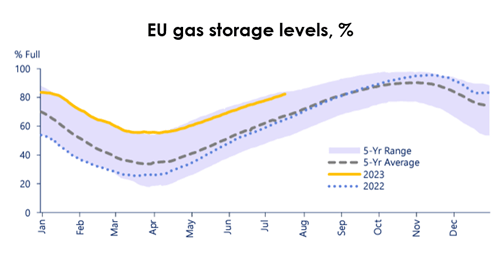

IEA

By mid-November 2022, gas reserves in EU storage facilities reached 95%, which is 9% (or 8 bcm) higher than the five-year average. The sharp drop in natural gas demand, along with continued active imports of LNG, reduced the need for gas offtake from storage. The net offtake of gas from underground storage facilities in the 2022/23 heating season was 38% (or 20 bcm) below the five-year average, totaling 32 bcm. As a result, at the end of the 2022/23 heating season, EU storage facilities were 55% full, and the level of the reserves exceeded the five-year average by 67% (or 22 bcm).

Therefore, in order to fill storage facilities to 90% of their capacity by the start of the 2023/24 heating season, it will be sufficient to pump just half of last year’s volume (about 35 bcm) into storage. The lower demand for gas to fill storage facilities in the summer of 2023 could lead to a weakening of market fundamentals, primarily related to gas demand.

Cheniere Energy

Cheniere Energy

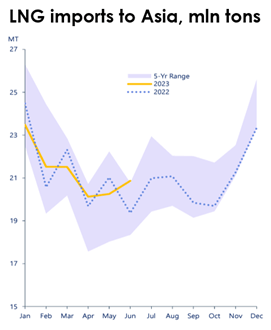

The IEA expects moderate growth of gas demand to resume in Asia in 2023 due to the removal of China’s zero-Covid policy, normalizing weather conditions and a moderate recovery in gas consumption in India and developing Asian countries following a sharp decline in 2022.

Cheniere Energy

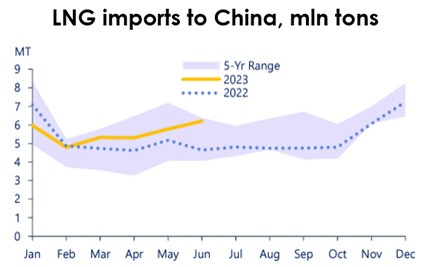

China’s LNG imports were up 20% y/y in 2Q 2023. A warm and dry summer sparked a rebound in spot purchases as prolonged heatwaves and low hydropower generation boosted demand for natural gas.

In the first half of 2023, hydropower generation in China fell by 28% from a year earlier, helping boost demand for electricity from other sources, including gas. Moreover, total gas demand climbed 10% from a year before during the past quarter, despite the macroeconomic factors in China.

Cheniere Energy

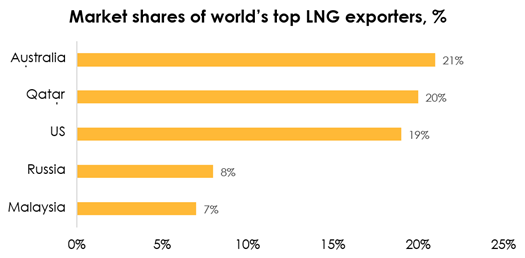

Europe’s new reliance on LNG, which is a globally traded commodity, has made European energy prices more sensitive to supply disruptions around the world, reflected in a nearly 40 percent jump in gas prices in early August amid supply worries in Australia, which is the world’s top LNG exporter, ahead of Qatar and the US.

Bloomberg

According to recent news reports, employees working at Chevron’s liquefied natural gas (LNG) projects in Australia, responsible for supplying 5.1% of the world’s super-chilled fuel, initiated a strike on Friday following unsuccessful mediation talks. The labor unions began their action with brief work stoppages and specific task bans. This strike will continue until next Wednesday, with workers halting operations for up to 11 hours in multiple intervals each day, and they will refuse to carry out certain duties, such as overtime work. If an agreement remains elusive by then, the unions intend to completely cease work for a two-week period.

While the possibility of a prolonged strike exists, several industry experts have minimized its potential impact. They point to the unions’ slight delay in initiating the strike this week and the recent resolution of a similar deadlock with LNG workers at Woodside Energy Group as positive indicators. Nevertheless, a protracted strike could disrupt LNG exports and contribute to higher LNG prices, which are essential for electricity generation.

In recent weeks, European gas prices have exhibited volatility due to labor unrest in Australia. Following Friday’s strike news, these prices surged by as much as 14%, underlining the sensitivity of global energy markets to such developments.

LNG from Australia rarely reaches European shores directly, as the long voyage involves high transportation costs and is therefore unprofitable. But if buyers of Australian gas in Asia have to look for alternatives, it would put them in direct competition with Europe, which is hungry for this type of fuel.

Recently, China has already initiated a tender to acquire over a dozen shipments of liquefied natural gas (LNG) for the upcoming winter season, extending through the end of 2024. This move carries the potential to limit the supply available to other LNG importers. Industry experts and analysts, gathered at the Gastech conference in Singapore, have highlighted various risks looming over the LNG market. These risks encompass challenges ranging from extreme weather conditions and labor strikes to China’s increasing demand for fuel, all of which could disrupt the intricate equilibrium of the LNG market.

Gas prices and spread

The average LNG price across all Cheniere Energy segments totaled $360 a ton in 2Q 2023, down 23% from our forecast for $468 a ton. The difference was driven by the significant decrease of benchmark Henry Hub prices, and consequently lower selling prices for the company’s gas.

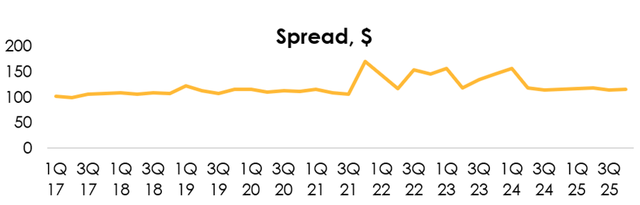

International benchmarks continued to decline throughout 2Q 2023 as global inventories reached an all-time high on the back of warmer-than-expected weather and a temporary slowdown in macroeconomic activity in most key demand hubs. The spread narrowed to $118 in 2Q 2023 due to seasonality and the abovementioned mentioned reasons for lower gas demand.

Amid strong LNG demand and capacity constraints, the spread between the selling price and Henry Hub price will hold wide in the coming year. We expect the spread to be on the wider side in 2023 and return to its historical average levels by mid-2024.

Invest Heroes

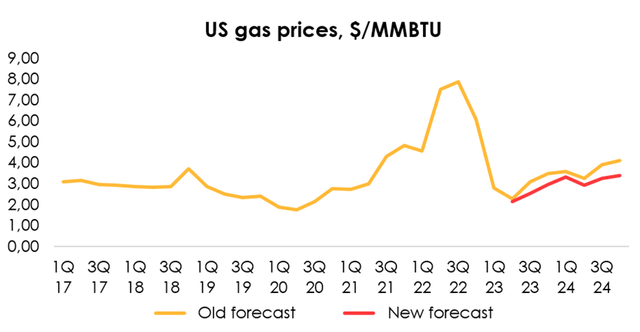

According to the latest forecast from the US Energy Information Administration, the Henry Hub benchmark price forecast through the end of 2024 has been lowered from $3.32 to $2.92 per MMBTU due to weaker US demand for gas, along with fairly full, compared with historical levels, gas storage facilities at the end of the heating season.

Invest Heroes

COGS model

We observe that the company’s gross costs are fairly volatile, fluctuating from 52% to 152% in terms of their ratio to revenue (if derivative trading generates losses) and that the company succeeds in maintaining the average spread of about $200 per 1000 cubic meters between the selling price and costs.

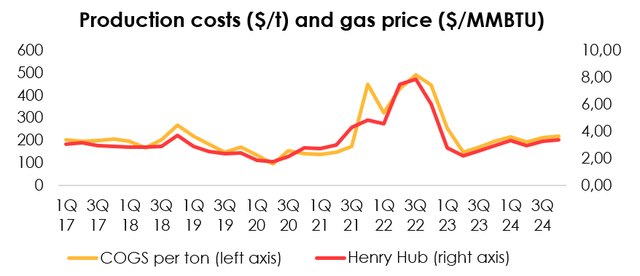

We expect that the performance of net COGS per ton is linked to the Henry Hub gas price and we believe this approach will provide a tighter connection between costs and domestic prices.

Last quarter, we set our gross cost per ton forecast at $283 per ton and projected this level through the end of 2024. In 2Q 2023 we have lowered the forecast for gross costs per ton of product from the average of $283 per ton to $201 per ton through the end of 2024 as costs fell faster in 2Q 2023 amid a sharp decline of US natural gas prices. The cost of production that we use is adjusted for trading in derivatives.

Invest Heroes

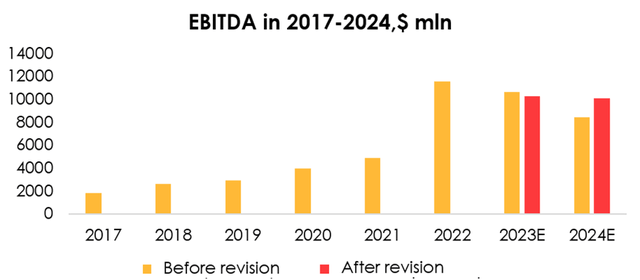

Given the downward revision of the projected average selling prices across all segments from $524 to $460 per ton for 2023 and from $540 to $494 per ton for 2024, along with the downward revision of estimated production costs per ton of product, we are lowering the EBITDA forecast from $10 622 mln (-8% y/y) to $10 262 mln (-11% y/y) for 2023, and raising it from $8447 mln (-20% y/y) to $10 071 mln (-2% y/y) for 2024. The impact from lower LNG production costs has made up for the drop in selling prices.

Invest Heroes

Comparison of valuation approach: Q1 vs. Q2 2023

While analyzing Cheniere Energy’s financial results for the first quarter of 2023, we also paid attention to the macro situation on the LNG market, looking separately at the main importers of this commodity.

In the first quarter of 2023, the European Union continued to increase import volumes, actively compensating for the lack of Russian gas supplies. At the same time, lower production activity in the region kept gas demand relatively low. Gas inventories remained at high levels, putting downward pressure on commodity prices. This, in turn, impacted Cheniere Energy’s costs. As a result of lower gas prices, we set our gross cost per ton forecast in Q1 2023 at $283 per ton and projected this level through the end of 2024.

This trend was also evident in Q2 2023, as we wrote in the LNG market review above: the EU continued to import LNG aggressively to replace Russian gas; by the end of the 2022/23 heating season, underground gas storage in Europe was 55% full, leading to lower gas demand in the summer of 2023. U.S. natural gas prices continued to decline in the second quarter of 2023, falling by more than half between April and June. As prices continue to fall, we have lowered our gross cost per ton forecasts from an average of $283 to $201 by the end of 2024.

As for Asia, LNG demand in March 2023, after China’s economy has fully opened up, accelerated the most in a year. In the second quarter of 2023, China’s LNG imports increased by 20% year on year. As mentioned above, China has announced its intention to make a large LNG purchase in light of the sensitive strike situation in Australia. It is not yet entirely clear why China is making such significant purchases, but, nevertheless, many express concerns that China’s actions could disrupt the current market balance and lead to a spike in LNG prices.

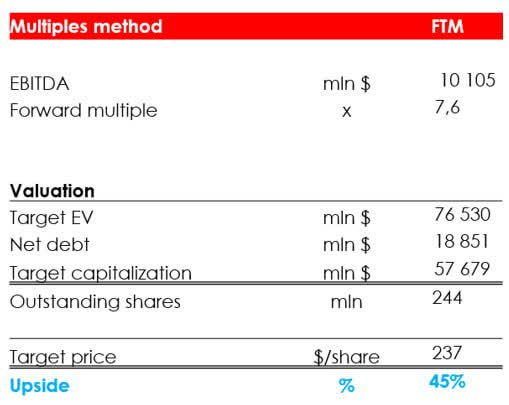

We continue to closely monitor the macroeconomic environment in the LNG market as it provides insight into the demand for gas in the global market. We valued Cheniere Energy’s shares at $227 in the first quarter of 2023, which represented a 60% upside as of May 19, giving it a BUY status. Since then, the company’s share price has risen 14% and the LNG market has continued to develop in line with our expectations, which not only confirms our initial view on the company, but also allows us to raise our price target to $237 and maintain a BUY status.

Valuation

We are raising the target price of the shares from $227 to $237 due to:

- the higher EBITDA forecast for 2024;

- the reduction of the target EV/EBITDA multiple from 8.4x to 7.6x. LNG was earlier perceived as a growth company as it rapidly put in operation terminals in 2018-2021 (its capacity was rising 30% every year), which was reflected in high multiples. However, no new terminals are planned to start operating until 2025, and they will make up a mere 22% of current capacity. That means LNG has almost fully reached its long-term production volume, and the business will grow further only at the expense of high gas prices, which has been reflected in the reduction of fair multiples.

- the shift of the FTM valuation period.

We are maintaining the rating for the shares at BUY. The upside is 45%.

Conclusion

Clearly, there are various risks looming over the LNG market, from extreme weather conditions and labor strikes to China’s increasing demand for fuel, all of which could disrupt the intricate equilibrium of the LNG market. But no matter what, the world needs LNG and the top importers will continue to fight for a limited supply of gas pushing prices higher and Cheniere Energy is one of the beneficiaries of the energy crisis in the world, including in the EU.

Invest Heroes

Read the full article here