ChatGPT may be hitting a growth bottleneck

Microsoft (NASDAQ:MSFT) offers plenty of positives for investors without the artificial intelligence (“AI”) potential already. Its recent extension into AI adds further growth opportunities. As seen in the chart below, ChatGPT (where MSFT is a major investor) is still the most popular AI website. Many of MSFT’s products and services (such as intelligent cloud, search, and the Office suites) integrate well with ChatGPT. For example, its Azure OpenAI Service provides developers with access to ChatGPT and other OpenAI models. This means that developers can build and deploy ChatGPT applications on Azure and makes it easy for MSFT customers to deploy and use its generative AI solutions.

Combined with the huge (and loyal) customer base, growth opportunities indeed seem boundless.

Source: a16z consumer report

Against this background, the thesis of this article is to analyze some of the signs that MSFT’s generative AI growth potential may have plateaus, at least in the near term. And as a consequence, its current valuation may imply an overly optimistic expectation. As detailed in the section immediately below, the top signs I see are the slowed growth of ChatGPT, the rise of companion AI, and the competition intensification from other top AI players like Google (GOOG) and Meta Platforms (META).

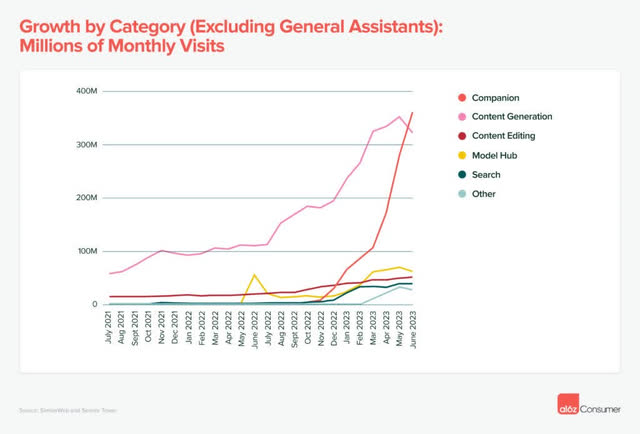

Rise of Companion AI and Evolution of Google

Recent research has shown that Chatbots based on Large Language Models (“LLM”) still accounted for the majority of AI total traffic (about 68%). And as just mentioned, ChatGPT is still the leader in this space. However, there are signs that both the overall segment and also ChatGPT’s growth are slowing down (see the next chart below). As shown in the figure, usage of content generation based on Chatbots has shown a decline in the monthly number of visits for the first time since July 2021. The ChatGPT website has also suffered a 9.7% decrease in its August monthly visits compared to the previous month. These data have also shown that the two categories that have been driving significant usage in recent months are AI companions (with Character.AI as the leader in this space) and creative tools for image generation and video generation – neither of which is MSFT’s strong suit.

Source: a16z consumer report

At the same time, the competition in the chatbot space is also intensifying. The biggest and most immediate threat for MSFT comes from Google, especially the anticipated release of its next-generation AI tool: Gemini. Existing Chatbots (including ChatGPT and Bard) are limited in the way that they can only process texts. As such, Gemini may represent the next leap in generative AI as its biggest advantage lies in its multi-modal capabilities. It is expected to not only understand and generate text and code but also understand and generate images. Demis Hassabis, DeepMind’s CEO, commented that Gemini “will eclipse ChatGPT” and I totally see the reason behind his confidence. META is another strong contender in this space. Microsoft recently announced that it is making Meta’s new AI large language model (“Llama2”) available on Azure. To me, this arrangement sends two signals: A) MSFT’s plan to seek alternatives besides ChatGPT, and B) an acknowledgment of the technical capabilities of META’s AI language model.

Consensus forecast is overly optimistic

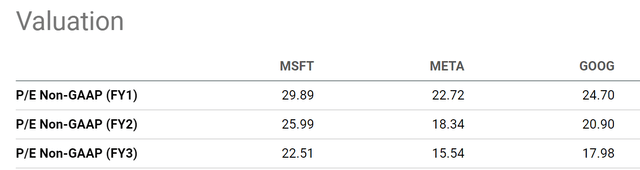

Despite the above signs and competition intensification, MSFT is currently trading at a sizable valuation premium above both Google and Meta as you can see from the chart below. I view such a premium as a reflection of the market’s overly enthusiastic expectations for its growth potential.

Source: Seeking Alpha

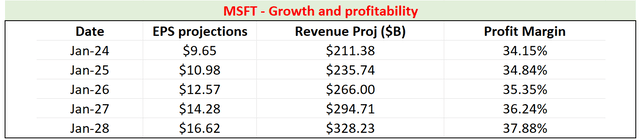

To further compound the valuation risks, the market is also overestimating its future margins in my view. The table below is my estimate of its future net profit margin (“NPM”) in the next 5 years based on the projections made by consensus estimates. The data involved in my estimates are the consensus estimates of its EPS and revenues for the next 5 years. As seen, if things do pan out as consensus projected, MSFT’s NPM would gradually expand from the current level of ~34% to about 38% in 5 years.

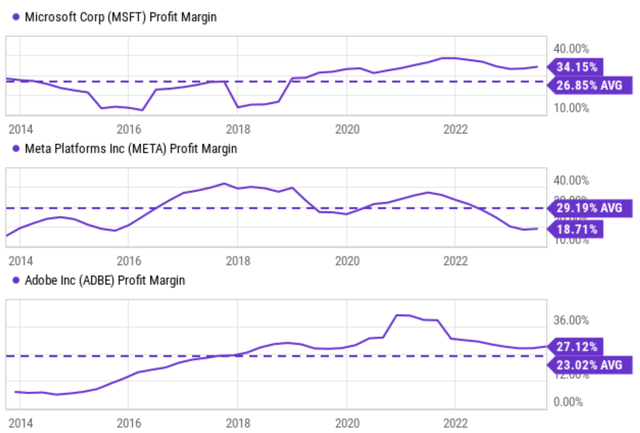

Such a projected margin expansion is overly optimistic in my view for at least two reasons. First, it is substantially above MSFT’s historical average. As seen in the second chart below, MSFT’s NPM has never reached 38% in the past 10 years and its average NPM was “merely” 27% in this period. The quotation mark emphasizes the comparative nature of this statement (which will be my second point next). I view the current competition pressure for MSFT as much stronger than it has faced in the past for the reasons analyzed above. If MSFT has been averaging 27% NPM in the past with lower competitive pressure, I highly doubt its margin would expand to 38% with competition intensification.

Second, MSFT’s average NPM in the past 10 years is on par with some of the most profitable software companies as shown in the second chart. A common trait among these companies is that they all feature products that enjoy dominating positions in a segment, be it Office, social media, or creative content generation. Thanks to such dominance, these companies have been enjoying superb margins in the range of 23% to 29%, more than 2x higher than the overall economy’s margin of ~10%. Under this broader context, the expectation that MSFT’s margin can expand to 38%, which would make it an outlier among outliers, seems too unlikely to materialize to me.

Source: Author using Seeking Alpha data Source: Seeking Alpha

The above projection certainly agrees with the long-term trend historically. As shown below, MSFT has been slowly but gradually improving its NPM in the past decade, from about 26% in 2013 to the current level of 34.6%.

However, I do not think the past trend can be extrapolated indefinitely. An expansion of NPM beyond a certain threshold is always an invitation for more competition and more regulatory scrutiny. In my mind, the expected NPM expansion implied in the consensus is either A) overly optimistic or B) close to this threshold if it indeed materializes. And I think A is more possible by vertical and horizontal comparison. Historically, MSFT’s NPM has been below 34% except for a few outlier quarters as seen in the chart below. Its average NPM has been 26.9% “only” in the past decade. The quotation mark here is meant to highlight the context. An average NPM of 26.9% is remarkable already. As seen, the NPMs from close peers like Google and Adobe (ADBE) have been averaging around or below this level in the long term. As a result, the consensus expectation that MSFT’s NPM would steadily expand in the next 5 years, to a level that is far above MSFT’s past average and its peers, seems overly optimistic to me.

Summary

To recap, I am seeing a few key risks associated with MSFT, both in the upside and downside directions. MSFT stock certainly enjoys tremendous growth potential thanks to the strong synergies between its existing products and generative AI. The company is a leader in office software, cloud computing, and gaming, which could all benefit from AI applications.

However, the negatives should not be ignored either. This article focuses on its AI potential, which is the main cause for its recent valuation expansion in my view. I am seeing a few concerning signs. First, the growth of both Chatbot in general and ChatGPT in particular may be hitting a bottleneck, at least for now. Growth recently has shifted to companion AI. At the same time, the competition is intensifying quickly as major competitors such as GOOG and META evolve their products. Notably, GOOG’s Gemini could be an immediate threat given its multi-modal capabilities. Finally, I view the market’s valuation and margin projection to be overly optimistic.

Overall, I am seeing a tug-of-war between the positives and negatives. I don’t see a clear dominating force emerging soon and hence rate MSFT stock as a “hold” under current conditions.

Read the full article here