REITs (VNQ) are very opportunistic right now.

They have crashed and now essentially offer an opportunity to buy real estate at a large discount to its fair value with the added benefits of liquidity, diversification, and professional management.

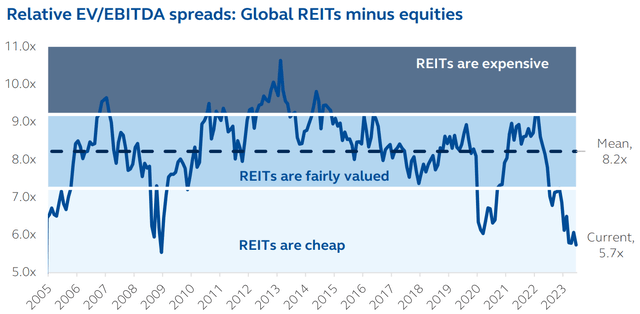

It may seem hard to believe but there are quite a few REITs that now trade at literally 50 cents on the dollar. According to a recent study by Principal Asset Management, REIT valuations relative to regular stocks are at their lowest levels since the great financial crisis:

Principal Asset Management

The valuations have gotten so low that even the big private equity players are now buying REITs left and right.

Here’s what Barry Sternlicht, billionaire investor and co-founder of Starwood Capital, said recently:

There are some unbelievable bargains in REITs. We did the same thing during the pandemic. We bought a dozen stocks all over the world and we had a 70% IRR on that stuff. We are already buying some stuff in the public market…” Barry Sternlicht, CEO/Chairman, Starwood Q3 2023 CNBC Interview.

Shortly after, Starwood’s 13F filing revealed that they had initiated a position in Camden Property Trust (CPT) and made it their largest holding of any securities.

Similarly, Blackstone (BX) has been aggressively buying REITs, taking many private through multi-billion-dollar buyouts, and their latest 13F filing showed that they had bought some shares of Mid-America Apartment (MAA) among a few other REITs. All these investments happened after they had made the following comment last year:

“The best opportunities today are clearly in the public markets on the screen and that’s where we’re spending a lot of time.” Jonathan Gray, President/COO, Blackstone Q2 2022 Earnings Call.

So you get my point: now is the best time in years to buy REITs. They allow you to invest in real estate at a steep discount and even the big players are taking advantage of this.

But how should you capitalize on this opportunity?

You really have two main options:

- Option #1: You could buy a REIT ETF.

- Option #2: You could buy individual REITs.

The first option has the benefit of offering broad exposure to the REIT sector at a relatively low cost. If you have no interest in learning about REITs or reading their annual reports, then this option makes a lot of sense. It will save you a lot of headaches.

But if you are “seeking alpha” as most of us are here on this site, then the second option could allow you to earn much better returns over time.

Here are the 5 reasons why I won’t buy REIT ETFs and prefer to invest in individual REITs instead:

Reason #1: ETFs Hold Exposure to Undesirable Property Sectors

This one is simple.

ETFs invest in property sectors, but I don’t want to invest in some of them.

Offices such as those owned by SL Green (SLG) are facing very significant long-term risks due to changing tenant needs, rising capex, expanding cap rates, and too much leverage. Office REITs are cheap, but I fear that they will turn into value traps.

SL Green

Hotels are also suffering from the rise of Zoom (ZM), which is replacing a lot of business trips, and the competition coming from Airbnb-like (ABNB) services is ever-growing.

Host Hotels & Resorts

Data centers such as those of Digital Realty (DLR) get a lot of hype, but I fear that depreciation is a real expense in this sector and once you account for that, the expected returns are actually quite disappointing. Competition is also very intense and a lot of the big tenants like Google (GOOG) (GOOGL) and Amazon (AMZN) are now building their own properties to fully control their own data.

Digital Realty

Self-storage is also overbuilt and could suffer as increasingly many people return to the office and suddenly see less need for having a home office:

Public Storage

And there are many other examples of property sectors that aren’t appealing to us. We prefer to be selective to mitigate risks and maximize our return prospects.

Reason #2: ETFs Invest in Poorly Managed REITs

There are also many REITs that are poorly managed and suffer significant conflicts of interest.

To give you an example, some REITs are managed “externally”, which means that they will outsource the management to an outside asset management company, creating significant conflicts of interest. In many cases, the managers will then be incentivized to grow the volume of assets under management as this increases their fees.

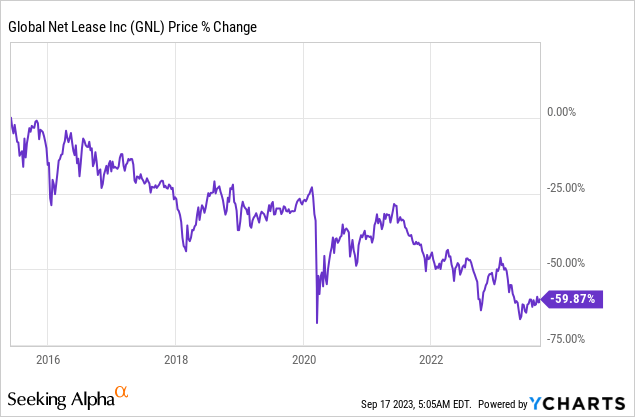

These conflicts of interest explain why so many REITs like Global Net Lease (GNL) have been recurrent underperformers over the long run:

But despite that, ETFs also invest in these.

By simply skipping all of these externally managed REITs, you could improve your long-term performance and that’s very simple to do.

Reason #3: ETFs Are Exposed Mostly to Large Cap REITs

Another big issue of ETFs is that they are typically market-cap weighted and as a result, most of their capital will be invested in large-cap REITs.

The problem here is that all this buying from ETFs has pushed the valuations of large caps to a lot higher levels than those of small caps.

Today, the spread between small and large REITs is quite large:

| Large cap REITs | Small cap REITs | |

| FFO Multiple | 17.2x FFO | 12x FFO |

Put simply, you get a lot more for your money when investing in some of the smaller and lesser-known REITs.

This is not to say that all large REITs are overpriced, but they often aren’t the best opportunities in the REIT sector.

Reason #4: ETFs Offer Low Dividend Yields In Most Cases

Because ETFs mostly invest in the more expensive large-cap REITs, naturally their dividend yield will also reflect that.

Today, the most popular REIT ETF, which is the Vanguard Real Estate ETF (VNQ) offers a mere 4% dividend yield.

Yet, there are some good REITs that offer up to 8% dividend yields today.

Even some of the blue chips like W. P. Carey (WPC) and Crown Castle (CCI) offer nearly 7% and that’s despite retaining a lot of their cash flow for growth.

I want to earn a good yield while I wait for the long-term upside. This helps me to stay patient.

Reason #5: Active Can Beat Passive In The REIT Sector

Finally, and perhaps most importantly, the REIT sector is filled with mispricings, offering opportunities for asymmetric risk-to-reward for active investors who know what they are doing.

REITs are a bit of a weird category that fits right in between stocks and real estate. But real estate investors typically don’t trust the stock market and stock investors typically don’t understand real estate.

Not surprisingly, REITs then often get mispriced and I want to take advantage of that because it allows me to earn higher returns.

To give you a good example: BSR REIT (OTCPK:BSRTF) owns a portfolio of apartment communities in strong Texan markets but because it is listed in Canada, it is now priced at a huge 40% discount to its net asset value. It appears that Canadian investors aren’t well-informed about the rapid growth that’s happening in Dallas and Austin and it is causing the company to trade at a much lower valuation than it should.

BSR REIT

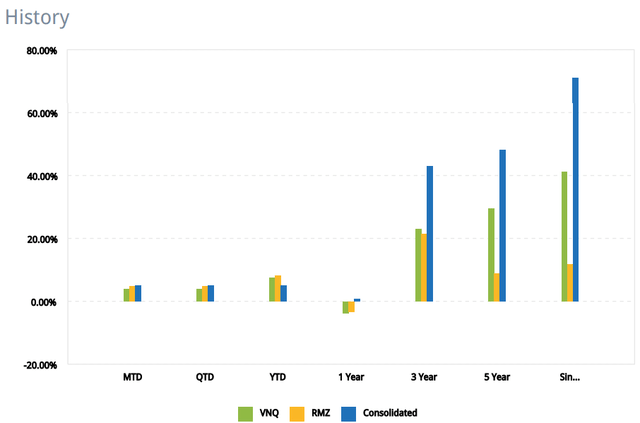

By targeting such mispriced REITs, I have managed to do materially better than the average of the sector over the long run:

Interactive Brokers

And so this is the main reason why I buy individual REITs. I believe that by being selective and focusing my capital on the best opportunities that the sector has to offer, I can target much higher returns than what I could get from ETFs.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here