Introduction

Kenvue (NYSE:KVUE) emerges as a significant market player, born from the consumer health division of Johnson & Johnson (JNJ). This strategic transformation, marked by an IPO and a subsequent split-off from JNJ completed recently, has set the stage for Kenvue’s independent journey. However, as I explore Kenvue’s business model as a standalone entity, financial performance, valuation, and associated risks, I’ll find that this new contender in the consumer healthcare arena faces serious challenges. While its stability due to the nature of its non-cyclical business model and dividend prospects may appeal to some investors, I’ll delve into why Kenvue might not be the ideal choice for those seeking a “better JNJ.”

JNJ Split-Off

Kenvue Inc. once operated as Johnson & Johnson’s consumer health division. Following an initial 10% stake divested through an IPO earlier this year, raising $3.8 billion (with approximately $1.2 billion allocated to Kenvue), JNJ took the decisive step of shedding its majority stake in Kenvue through a split-off in late August. JNJ retains a mere 10% interest, which it intends to divest in the near future.

So, what prompted Johnson & Johnson to part ways with Kenvue? Two compelling reasons stand out:

Sluggish Growth in the Division: Johnson & Johnson, a diversified healthcare conglomerate encompassing pharmaceuticals, medical devices, and consumer healthcare products, sought to channel its focus towards internal growth opportunities. By spinning off Kenvue, JNJ aims to enable the consumer division to concentrate on its areas of strength while it pursues its own growth initiatives.

Anticipated Legal Liabilities: Johnson & Johnson’s consumer division had been linked to the manufacturing of baby powder containing talcum powder, raising concerns about potential asbestos contamination. This issue triggered a wave of lawsuits in the USA, with over 40,000 cases related to ovarian cancer reported. The unpredictable nature of these legal penalties becomes evident when considering Bayer’s case, which reached an $8.9 billion settlement to resolve all existing and future US lawsuits. Kenvue, thus, assumes responsibility for Canadian lawsuits and other pending legal actions, further rationalizing its separation.

Business Model

Nonetheless, let’s now explore Kenvue in Kenvue’s new standalone capacity.

In its current iteration, Kenvue can be best described as a conglomerate within the consumer healthcare space, seamlessly merging consumer goods and pharmaceuticals. The company’s product portfolio targets over-the-counter (OTC) health applications and is neatly divided into three segments:

Self Care: This segment encompasses non-prescription medications, including pain relievers, cold and allergy remedies, and smoking cessation aids.

Essential Health: Within this category, Kenvue offers an array of personal care products, such as band-aids, baby powder, mouthwash, tampons, sanitary pads, and other female-centric paper products.

Skin Health and Beauty: This segment comprises an assortment of body and hair care products, featuring body creams, hair care solutions, hair growth treatments, and dietary supplements.

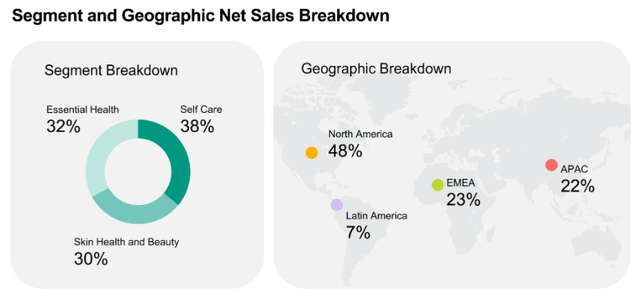

Kenvue’s primary market focus centers on North America, where it generates half of its revenue, with the USA, Canada, and Mexico playing pivotal roles. Several of Kenvue’s brands have carved out niches for themselves, basking in considerable popularity and success in the United States. Internationally, revenue distribution is more balanced, with Europe and Asia contributing 21% each.

Kenvue – Segment & Geographic Breakdown (Kenvue – S-1 SEC Filling)

Kenvue operates in markets experiencing modest growth, as consumer healthcare products typically fall under the category of non-cyclical consumption. Kenvue anticipates medium-term market expansion at a rate of approximately 3% to 4%. I see several factors contributing to that, including the surging demand for cosmetic and skincare products, an increasing appetite for dietary supplements, and heightened health-related concerns stemming from an aging population.

However, I believe that Kenvue’s business model faces the challenge of substantial competition. Unlike traditional pharmaceuticals, consumer healthcare products lack patent protection and are rarely covered by health insurance. Consequently, pricing power is restricted, leading to an array of competing products addressing similar health concerns. This, in turn, forces Kenvue to navigate the competitive landscape while contending with thinner profit margins compared to traditional pharmaceutical firms.

Moreover, I see that the majority of Kenvue’s brands only occupy middle-tier positions within their respective markets. The company competes across seven product categories on a global scale, with most of its brands settling into secondary or lower-ranking slots.

Financials

Now, let’s delve into Kenvue’s financial data and evaluate its performance in three critical areas. It’s noteworthy that the company has issued guidance for the full year, expecting net sales growth to fall within the range of 4.5% to 5.5%. These figures provide us with valuable insights into Kenvue’s financial health and hint at its potential performance outlook.

Revenue

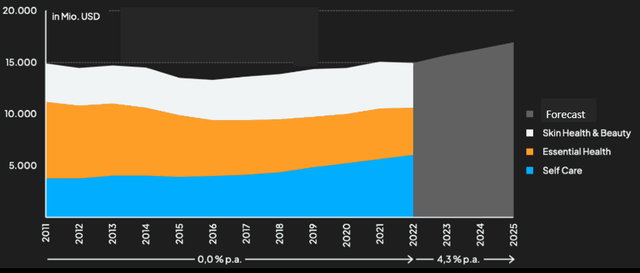

Over the past 11 years, Kenvue’s revenues have exhibited a near-static trend, with an annual growth rate of zero. At first glance, this might suggest a considerable lag behind the broader market. However, when we adjust for portfolio shifts, such as the sale of the Splenda brand, it becomes evident that Kenvue has managed to achieve slight growth. As already mentioned, Projections indicate a future revenue growth rate of 4.3% per year.

Kenvue – Revenue by Segment (Author based on data from Kenvue, JNJ, S&P Global Market Intelligence)

EBIT

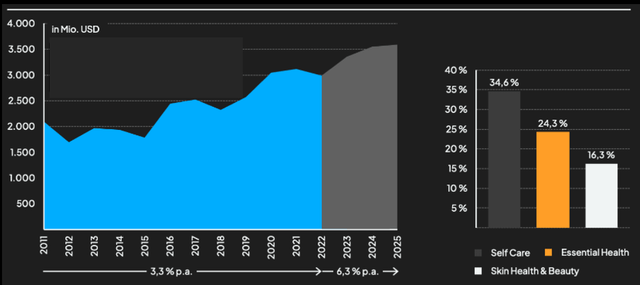

Kenvue’s EBIT showcases a steady upward trajectory, growing at a rate of 3.3% annually. This impressive growth owes much to the Self Care segment, which boasts an EBIT margin of 34.6% and contributes more than 50% of the profits. While the EBIT margin currently stands at about 20.0% due to a temporary decline in COVID-related business, it is anticipated to rebound in the future.

Kenvue – EBIT & Adjusted EBIT Margins by Segment (Author based on data from Kenvue, JNJ, S&P Global Market Intelligence)

Debt

Kenvue carries a net debt of around $7 billion, partially due to Johnson & Johnson’s transfer of a portion of its debt to Kenvue. However, this debt level remains manageable, considering an EBITDA of $3.3 billion achieved last year. This potential allows Kenvue to potentially retire the debt in a relatively short span of 1.7 years. It’s worth noting that Kenvue’s balance sheet includes over $9 billion in goodwill, comprising approximately 45% of its equity. This introduces some risk if brands fail to meet expectations.

Valuation

In my valuation, I have deliberately chosen a multiple-based approach for assessing Kenvue’s value, considering its limited historical data and the market’s ongoing evaluation of the company. This method provides the advantage of benchmarking against comparable firms, shedding light on what investors are willing to pay for similar entities.

For this comparison, I selected the following competitors:

Haleon: GSK’s Consumer Health division, spun off just a year ago, shares a similar size with Kenvue. Notably, Haleon possesses fewer brands but holds a stronger presence in the OTC and Essential Health markets. Haleon’s brand portfolio includes Sensodyne, Centrum, Otrivin, Voltaren, Advil, TUMS, and Fenistil. It stands as the global leader in all categories except dental care.

Procter & Gamble: As a leader in the consumer goods industry, Procter & Gamble manufactures a wide array of Essential Health and Skin Care products.

Reckitt Benckiser: This British company primarily focuses on cleaning products, Essential Health, select OTC medications, and, to a lesser extent, baby food. Notable brands include Calgon, Cillit Bang, Clearasil, Durex, Finish, Nurofen, Vanish, and Veet.

When compared to these competitors, Kenvue holds its ground. But one main aspect is that it lags in terms of margins. In terms of valuation, Kenvue is rated as average, which I actually find somewhat surprising given even only its potential legal risks.

In terms of quality, Procter & Gamble stands out as the strongest contender. From a valuation perspective, Reckitt Benckiser might become attractive due to its significantly lower price.

To provide some more context additionally to the previous section, in the last fiscal year, Johnson & Johnson’s former Consumer Health division, generated approximately $15 billion in revenue and a net profit of nearly $2.1 billion. In 2022, this spun-off division accounted for about 15% of Johnson & Johnson’s total revenue.

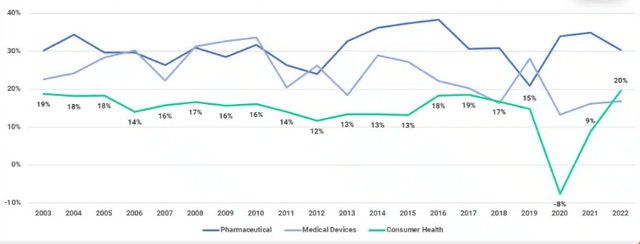

JNJ – Margins by Segment (Aktienfinder.net)

However, when comparing Kenvue to the remaining segments at Johnson & Johnson, such as Pharmaceuticals and Medical Devices, it’s evident that the Consumer Health division (now Kenvue) exhibited significantly lower profit margins. Products in this industry have faced intense competition, with operating margins ranging between 12% and 19% until 2019. During the COVID-19 pandemic, the Consumer Health division even incurred losses. Additionally, its 10-year revenue growth rate of only 0.8% per year is far from impressive.

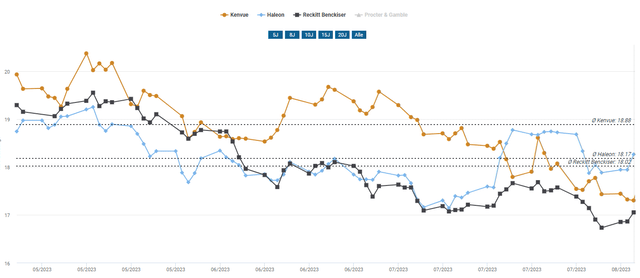

When stacked against competitors like Haleon, a joint venture between GlaxoSmithKline and Pfizer, or Reckitt Benckiser, Kenvue cannot be considered a bargain. While both Reckitt Benckiser and Kenvue boast P/E ratios of around 18, Haleon is slightly more expensive with a P/E ratio of 18.7.

Adj. PE Ratios (Aktienfinder.net)

Risks

In this section, I provide an overview of the primary risks I associate with Kenvue, with some of these risks being a reiteration of points already touched on earlier in this article. These risks encompass a range of factors that pose challenges and uncertainties to Kenvue’s operations and its standing in the consumer healthcare industry.

Talcum Lawsuits: Kenvue faces potential legal risks stemming from talcum-related lawsuits in Europe and other countries, as Johnson & Johnson’s coverage extends only to talcum lawsuits in the USA and Canada. While it’s unlikely that Kenvue will face billion-dollar fines like those seen in the USA or experienced by Bayer, the possibility of such legal challenges remains theoretical.

Competition: OTC medications and consumer products typically have low competitive barriers. Kenvue acknowledges that it holds regional leadership in many product categories but is also aware of the robust competition it faces. With only a few exceptions, such as Nicorette with its over 50% market share, enjoying significant dominance, the competitive landscape could intensify, particularly with the emergence of new distribution channels and online brands.

Generic Competition: Kenvue’s active ingredients and products lack patent protection, resulting in numerous generic alternatives available in pharmacies and supermarkets. For example, products like Tylenol face stiff competition in markets like Germany, where it essentially represents a paracetamol product. This exposes Kenvue’s brands to the risk of losing market share entirely to generics.

Dividends

While the non-cyclical nature of Kenvue’s business imparts stability, thereby enhancing the likelihood of consistent future dividends, I’m inclined to believe that aspirations for substantial dividend growth may be somewhat limited.

Kenvue has formally unveiled its dividend policy. The inaugural Kenvue dividend is scheduled for distribution on September 7, 2023, at an annual rate of $0.80 per share, offering an approximate yield of 3.6% based on the current share price.

Although Wall Street estimates peg Kenvue’s earnings per share at $1.30 for this year, signifying a modest year-over-year decline of 4%, I prefer to place emphasis on Free Cash Flow (FCF) as a more precise metric, as FCF illuminates the company’s capacity for generating surplus cash, which, in turn, underpins its ability to sustain dividend payments.

Assuming Kenvue generates approximately $2.2 billion in FCF for the current year, CY23, this equates to a payout ratio of about 85%, considering the company’s outstanding shares of approximately 1.9 billion. While I don’t anticipate the company encountering difficulties in distributing dividends, it’s important to acknowledge that this relatively high payout ratio may constrain its flexibility.

I certainly don’t foresee challenges in Kenvue’s ability to maintain dividend payments, I do perceive limitations on its capacity for significant dividend growth in the near term.

Conclusion

Kenvue, as the spun-off consumer health division of Johnson & Johnson, faces an array of challenges in the consumer healthcare sector. Its formation was prompted by JNJ’s reasonable strategic decision to divest due to sluggish growth and potential legal liabilities. Also, intense competition, middle-tier brand positions, and pricing constraints present hurdles.

In the context of being a potential “better JNJ,” Kenvue’s lackluster performance numbers and similar outlook do not present a compelling risk-reward ratio to me. Furthermore, its valuation, while not excessive, does not appear to be a bargain either. Comparatively, Johnson & Johnson, despite its own transformation and risks, which I outlined in a separate piece, remains, in my opinion, a more appealing choice for dividend investors.

Read the full article here