Back in January, I detailed how electric vehicle startup Fisker (NYSE:FSR) was one of the names that intrigued me the most this year. The company was getting ready to deliver the first units of its Ocean SUV, with an aggressive production ramp scheduled for 2023. Early on Tuesday, we received first quarter results from the company, and with management cutting production guidance for this year, the stock dropped quite a bit.

For the Q1 period, Fisker reported revenues of just under $200,000, missing street estimates. While the Ocean production ramp was ongoing, deliveries only started last week, so the current period is expected to be the first with any meaningful revenue figures. On the bottom line, the company lost over $120 million in the period, which despite some additional dilution, resulted in a $0.38 per share loss that missed analyst expectations by roughly a dime.

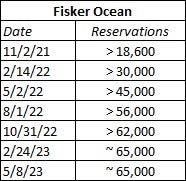

There were a couple of negative items in this quarterly report. The first was that the company reported approximately 65,000 reservations for the Ocean. While that seems nice for a company that is just starting deliveries, the table below shows that there has been no additional growth in the count over the past couple of months. Management stated in the press release that it was disciplined with its marketing spend amidst the ongoing macro turbulence, but investors were hoping to see more reservation growth. The company’s second vehicle, the Pear, was up to more than 6,000 reservations, as opposed to previously being above 5,600.

Fisker Ocean Reservations (Company Press Releases)

The second negative item, and perhaps the biggest one in Tuesday’s report, was the significant production guidance cut for this year. Originally, the company was expecting to build 42,400 units of the Ocean this year. However, due to updated homologation timing and supply chain issues, the target this year is now 32,000 to 36,000 vehicles. Fisker expects to produce 1,400 to 1,700 vehicles in Q2, to have a steep ramp up in Q3, followed by a monthly run rate of approximately 6,000 vehicles for the rest of the year.

One of the items I previously discussed in regards to Fisker was the potential need for more capital. As we have seen with many other names in the electric vehicle space, starting from scratch can be very expensive. The company raised another $47 million in Q1 from its ongoing at-the-market equity sales program, finishing the period with cash and cash equivalents of $652.5 million as of March 31, 2023, excluding $22 million of pending VAT receivables. Weighted average shares outstanding totaled 321 million for the three months ended in March, up a little more than six million shares on a sequential basis.

As for Fisker’s stock, it opened Tuesday down more than 13% to $5.75. The average analyst price target of $11.56 represents significant upside from current levels. However, that valuation figure has come down by a dollar since my previous article and has been more than cut in half since February 2022 when it was over $25. Given the ongoing dilution we are seeing plus the production guidance cut, it would not surprise me to see the average target come down a bit in the coming weeks, perhaps even into the single digits. The drop also put shares below their 50-day moving average, which currently sits at $5.91 but is starting to head lower again. That could provide more technical resistance if shares can’t get back above this key trend line.

In the end, Fisker’s disappointing Q1 report sent shares dropping below $6 again. The headline results showed misses on the top and bottom lines, although meaningful revenues are just starting this quarter. It’s a bit troubling that Ocean reservation growth has stalled out before deliveries really start to occur in volume. As I thought we might see given the trouble of EV production ramps, management cut its production forecast for the year. This name still has some potential ahead of it, but I will need to see some improved execution before I can feel comfortable about this being a potential buy here.

Read the full article here