Investment Thesis

I believe CVS Health Corporation (NYSE:CVS) stock is a buy. The company’s strong positioning in the healthcare sector, bolstered by various industry tailwinds such as increasing prescriptions and an aging population, makes it a compelling investment for long-term growth. CVS’s significant market share and near-duopoly with Walgreens further enhance its competitive advantage. Additionally, its focus on cost leadership allows for better supplier negotiations and customer value. Conservative financial projections indicate a promising CAGR of 19% over the next five years. While there is a risk of a dividend cut or a pause in the share buyback program due to potential economic downturns, the company’s overall strengths make it a robust investment option in my view.

Company Overview

CVS Health Corporation is a diversified health services company based in the United States. The company operates in the U.S. healthcare sector with three key business segments: Retail/LTC, Pharmacy Services, and Health Care Benefits. Retail/LTC primarily involves CVS Pharmacy, where the company sells prescription drugs and general merchandise. Pharmacy Services focuses on pharmacy benefit management, offering services like plan design. Health Care Benefits provides various insurance products and services.

In my opinion, CVS faces stiff competition from multiple angles. Traditional retail pharmacies like Walgreens are direct competitors, but CVS also contends with online pharmacies and big-box retailers like Walmart (WBA) that offer pharmacy services. The company is also up against healthcare providers and insurers. CVS aims to differentiate itself by evolving into an integrated healthcare provider, striving to offer a comprehensive range of services to its customers.

CVS’s Favorable Industry Tailwinds

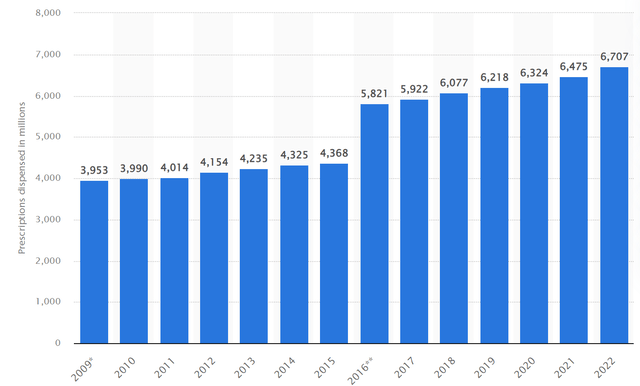

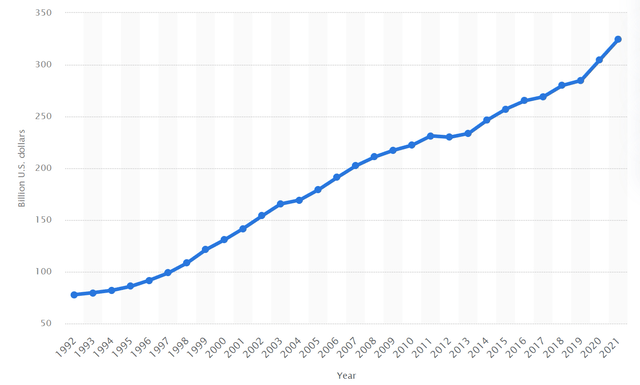

In my view, CVS Health Corporation stands to benefit from several industry tailwinds that are likely to drive its slow and steady growth. A key indicator supporting this outlook is the rise in prescriptions dispensed in the U.S., which increased from 5,821 million in 2016 to 6,707 million in 2022, reflecting an annual growth rate of about 2.3%. Additionally, pharmacy and drug store sales have shown a robust increase, growing from $78 billion in 1992 to $325 billion in 2021, with an annual growth rate of approximately 4.2%.

Statistica

Several factors contribute to my optimism that these growth trends will continue. Firstly, the aging U.S. population is a significant driver. As people age, they typically require more medications and healthcare services, ranging from chronic disease management to preventive care. This demographic trend is likely to result in a higher volume of prescriptions being dispensed, directly benefiting CVS’s pharmacy operations and potentially its managed healthcare services as well. Secondly, the expansion of healthcare coverage, including programs like Medicare and Medicaid, is making healthcare more accessible to a broader swath of the population. This increased accessibility is likely to result in more prescriptions being filled and more frequent use of healthcare services, both of which are areas where CVS has a strong presence. Thirdly, technological advancements in the pharmaceutical sector are continually introducing new medications and treatments. These innovations could lead to an increase in the number of prescriptions dispensed as new medications become available for conditions that were previously untreatable or not as effectively managed. CVS, with its extensive pharmacy network, stands to gain from this uptick in prescription volumes. Lastly, there’s a growing emphasis on preventive healthcare, fueled by a societal shift towards wellness and early intervention. This trend is likely to result in more regular screenings, vaccinations, and preventive treatments, all of which could be services offered through CVS’s Minute Clinic or pharmacy counters.

Statistica

Overall, the consistent upward trajectory in both prescriptions dispensed and pharmacy sales, along with demographic and systemic shifts, positions CVS favorably for sustained growth in the foreseeable future.

CVS Is A Market Leader

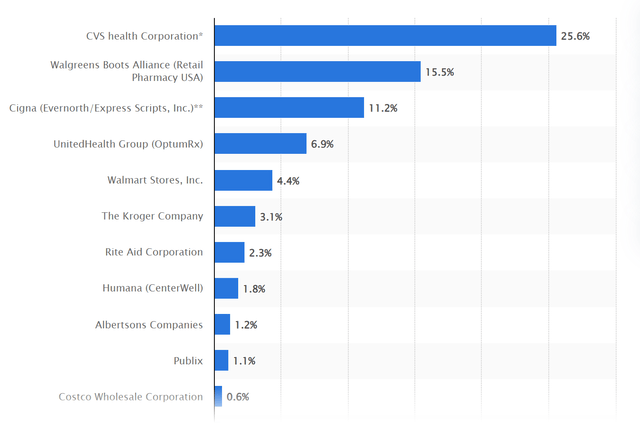

In my view, CVS Health Corporation is a market leader in the U.S. pharmacy and healthcare sector. Along with Walgreens, it operates in what can be seen as a duopoly. With close to 10,000 stores in the U.S., CVS sets a high barrier for new competitors. This large network helps CVS achieve economies of scale and strengthens its market position. Data shows that CVS has a 25.6% share in the U.S. prescription drug market. This market penetration is a strategic advantage, allowing CVS to negotiate better terms with suppliers and lower costs. The widespread presence of CVS stores also makes it convenient for customers, reinforcing loyalty and encouraging repeat business. Overall, I think CVS’s leadership, scale, and market share make it well-positioned for ongoing success.

Statistica

CVS Leverages Cost Leadership

In my opinion, CVS Health Corporation has strategically positioned itself in the market through a dual-focus business model that encompasses both retail pharmacy and managed healthcare services. The company’s primary strategy is cost leadership, aimed at reducing healthcare expenses for consumers. This is particularly evident in their Pharmacy Benefit Management (PBM) operations, where they use collective bargaining power to negotiate lower drug prices, keeping a portion of the savings as profit.

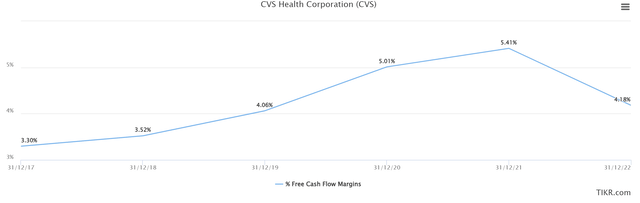

CVS employs a blended online and offline model, often referred to as click-and-mortar, to extend its market reach and offer convenience to customers. This approach complements their cost leadership strategy and is a cornerstone of their market penetration efforts. The sheer scale of CVS’s operations, with nearly 10,000 stores across the U.S., is a testament to their focus on economies of scale. The ubiquity of CVS stores—often found on multiple street corners in the same town—enables them to serve a large customer base efficiently, further driving down per-unit costs. CVS’s focus on cost leadership has yielded significant financial benefits, most notably in the expansion of its free cash flow margin. This key metric has improved from 3.3% in 2017 to 4.2% in 2022.

Overall, the synergy between CVS’s business model and strategic plans aims to deliver consumer value while sustaining profitability. By focusing on cost leadership and market penetration, CVS has been able to maintain a competitive advantage that is deeply rooted in economies of scale and widespread market presence.

Tikr Terminal

Financial Analysis

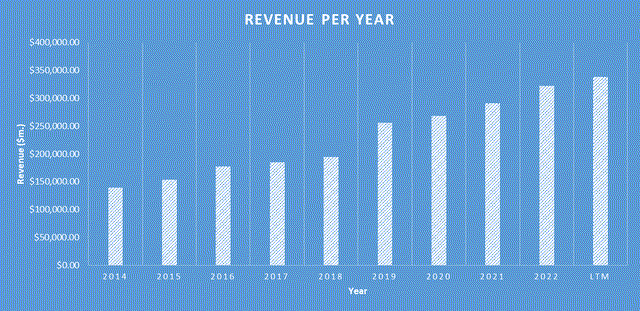

Over the past 5 years, the company has demonstrated reasonable financial performance. Its revenue has shown consistent and strong growth, increasing from $193,919.00 million in 2018 to $338,072.00 million in the last 12 months in 2023, representing a compound annual growth rate (CAGR) of approximately 12%.

DJTF Investments

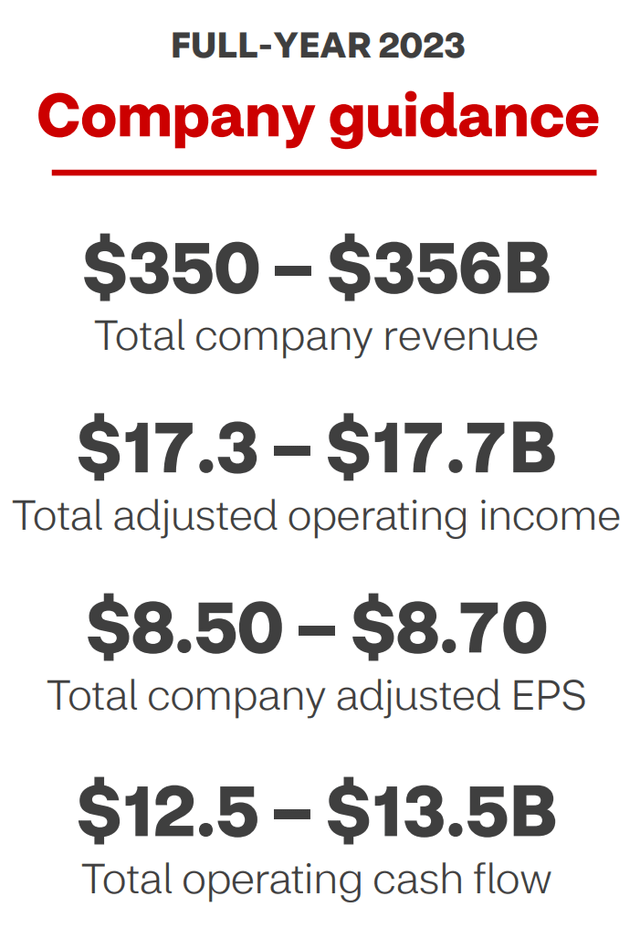

The earnings per share (EPS) has been inconsistent, effected in 2018 by an acquisition that caused the EPS that year to be -$0.57, peaking at $5.95 in 2021 and then settling at $2.15 in the last twelve months. The book value has seen a consistent upward trend, growing from $58,543.00 million in 2018 to $73,002.00 million, indicating a CAGR of approximately 4.5%. This suggests that the company has been successful in increasing its intrinsic value over the period. CVS’s management team projects that in Fiscal Year 2023, the company will achieve guidance operating cash flow of $12.5 billion – $13.5 billion. I believe they will achieve this projection, as long as we do not see a significant macro-economic downturn that would decrease overall store traffic and discretionary spending.

CVS Q2 2023 Investor Presentation

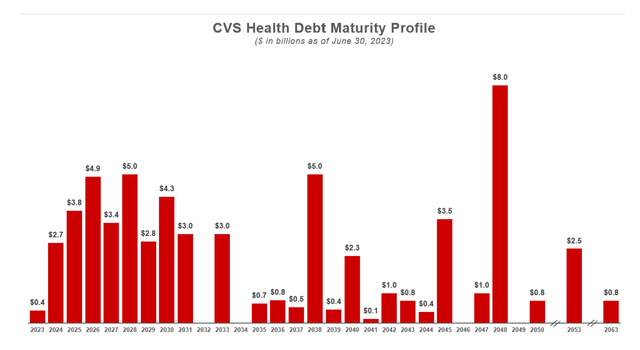

As of the most recent quarter, the company reported cash and cash equivalents of $13,807 million. The company’s total debt stands at $59,920.00, quite a significant amount, however the maturity profile of the debt is spread across multiple decades. While significant, based off CVS’s market free cash flow generation, the debt will likely be repaid without major issues.

CVS Investor Relations Debt Maturity Profile

It should be noted that CVS pay a substantial dividend that is currently 3.41%, since roughly 30-50% of the projected free cash flow over the next 3 years will be allocated to debt repayments, should we see a decline in free cash flow due to a recession or macroeconomic headwinds, a dividend cut or a pause in the share repurchase program may occur. Therefore, in my view investors should be quite vigilant on the macro, to avoid potential downside in this investment.

Valuation

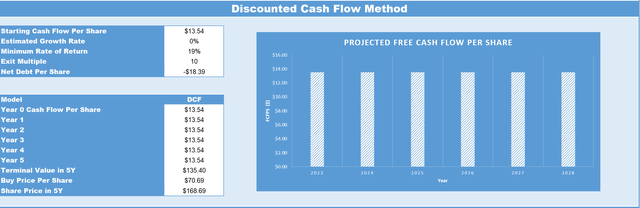

When considering valuation, I always consider what we are paying for the business (the market capitalisation) versus what we are getting (the underlying business fundamentals and future earnings). I believe a reliable way of measuring what you get versus what you pay is by conducting a discounted cashflow analysis of the business as seen below.

CVS’s current TTM Cashflow per Share as of Q2, 2023 is $13.54. To be conservative as free cash flow can be quite volatile for CVS and since the previous twelve months have been quite strong on a free cash flow basis, I believe that CVS Cashflow per Share should grow conservatively at 0% annually for the next five years. Therefore, once factoring in the growth rate by Q2 2028 CVS’s Cashflow per Share, is expected to be $13.54. If we then apply an exit multiple of 10, which is based off a reasonable price to free cashflow ratio using the previous 10 years of data, this infers a price target in five years of $168.69. Therefore, based on these estimations, if you were to buy CVS at today’s share price of $70.87, this would result in a CAGR of 19% over the next five years.

DJTF Investments

Conclusion

In my view, CVS Health Corporation is well-positioned for consistent growth, thanks to multiple industry tailwinds like rising prescription numbers, an aging U.S. population, expanded healthcare coverage, and a growing emphasis on preventive care. The company’s substantial scale and market share, along with its near-duopoly with Walgreens, solidify its status as a market leader and create a formidable barrier for new entrants. CVS’s focus on cost leadership adds another layer to its competitive advantage, enabling better negotiations with suppliers and providing value to customers. Conservative estimates even suggest a potential CAGR of 19% over the next five years. However, it’s important to consider the risk of a dividend cut or a pause in the share buyback program in the event of adverse macro-economic conditions like a recession. In such a scenario, CVS would likely prioritize debt repayment, which could impact shareholder returns. Overall, despite this risk, CVS remains a compelling long-term investment in the healthcare sector.

Read the full article here