Investment action

I recommended a buy rating for Darktrace (OTCPK:DRKTF) when I wrote about it the last time, as I expected the business to maintain its high rates of growth (25+%) in the absence of any major disruption in the world (i.e., another COVID). More importantly, the stock was trading at a cheap valuation of 3x forward revenue previously. Based on my current outlook and analysis, I recommend a buy rating. I expect growth to continue sustaining at a high level, with the possibility of accelerating, as management continues to put focus on its GTM strategy to target larger accounts.

Review

The stock has undergone a significant rally, resulting in an overall increase of approximately 50% since March, which was when I last discussed it. Nevertheless, I remain optimistic about the stock’s potential for further gains, given DRKTF’s continued strong performance. To assess its recent achievements, in FY23, the company recorded a 31% growth in revenue, reaching $533 million. Additionally, ARR (Annual Recurring Revenue), excluding foreign exchange impact, surged by 30%, reaching $628.4 million, while net new annual recurring revenue (NNARR) remained steady at $146 million, aligning with guidance, despite challenging macroeconomic conditions, particularly in acquiring new business. Moreover, the customer base expanded by 18% to 8,799, and ARR per Customer increased by 9.5% to $71.4K. Notably, the company’s Adjusted EBITDA for FY23 reached $140.2 million, with a 26% margin, significantly surpassing the expected minimum of 22%. Lastly, the RPO (Remaining Performance Obligations) saw a 25% increase, reaching $1.26 billion.

As can be seen, high levels of performance were maintained across the board. Now that the company has reorganized its go-to-market [GTM] function over the past few months, I anticipate that the rapid growth of recent months will continue. In my opinion, DRKTF has hit the ceiling with its previous GTM strategy, as all GTM strategies eventually plateau. Thus, it was encouraging to learn that management is putting an emphasis on strategic accounts as of early this year (with the hiring of Denise Walter as CRO from VMWare (VMW) in January). Considering the phrases “increase in average contract ARR” and “account distribution again shifted larger” used by management, I infer that the strategic accounts in question are the larger ones. Management’s apparent interest in expanding the company is reflected in the hiring of Chris Kozup, formerly of Zscaler (ZS), as chief marketing officer [CMO] in May. Chris Kozup has a proven track record of increasing sales at ZS, so I have high hopes for his new position. Between November 2020 and June 2023, when Chris was ZS’s CMO, the company saw an impressive increase in quarterly revenue, from around $200 million to around $420 million. Since DRKTF’s revenue is roughly the same as Chris’s ($280 million in 2H23, or $140 million quarterly), I anticipate that Chris will be able to use his expertise to expand DRKTF’s business. In the upcoming months, as the sales representatives and their teams gain experience and become more proficient, sales rep and team need some time to become mature before they can reach 100% productivity and efficiency), I anticipate that this emphasis will contribute to fostering further growth in the future.

Management is also expanding its channel sales strategy, which should contribute to growth. In my opinion, DRKTF’s in-person demonstrations are a crucial part of their sales process, as this is where they truly shine in comparison to the competition. How many customers, honestly, can tell the difference after reading about it online? As a result, I anticipate that the company’s efforts to expand its channel sales strategy will generate more sales leads for its team to pursue. Again, this points to the importance of DRKTF investing in its sales team by hiring more mature sales reps, which is particularly important when DRKTF is now moving towards larger accounts. These large corporations are notoriously time-sensitive and require a higher number of configurations and customizations. Therefore, it is crucial that the sales rep is effective at pitching, can identify the issues, provide appropriate solutions, and keep the relationship going strong.

As part of the larger restructuring, DRKTF is now offering compensation plans that include paying 100% of sales commissions up front, up from 50% previously. This is excellent news, and should make DRKTF more attractive to and able to keep talented salespeople. Since July, all commissions have been required to be capitalized, effectively deferring their cost until later periods and making them more consistent with Revenue recognitions. In my opinion, the accounting effects of this shift are minimal, amounting mainly to a matter of timing, and the overall effect on DRKTF’s bottom line is positive. In particular, DRKTF should see Improved Sales Representative Retention, higher output because of commission incentives, and improved financial clarity for modeling by consensus. The optical downside is that management amended its definition of adj EBITDA. All commissions are now amortized into Adjusted EBITDA as though they were cash expenses. As a result, beginning in FY23, DRK will begin paying both new commissions and 2H commissions, resulting in a short-term decline in both Adj EBITDA and FCF.

Valuation

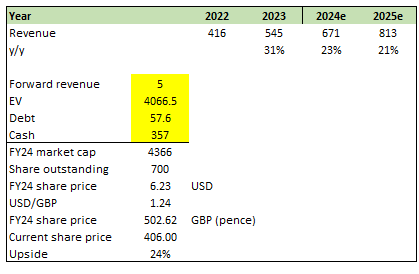

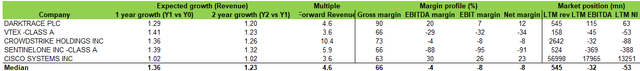

Author’s work

I believe DRKTF can grow above 20% for the next 2 years given the ongoing growth momentum and support from the new GTM strategy. In particular, I expect the GTM strategy to improve productivity over the next 12 to 24 months as the team gets accustomed to dealing with larger accounts and working under the new leadership. The growth runway is extremely long here, as can be seen from peers who are growing in the 30 to 40%+ range. I expect DRKTF valuation multiples to slowly creep up towards higher-growing peers like CrowdStrike (CRWD) and SentinelOne (S) as it shows that its growth can be accelerated with the new GTM strategy (I did not model this as I wanted to remain conservative).

Author’s work

Risk and final thoughts

My growth assumption lies in DRKTF successfully executing its change in GTM strategy, which might not go as smoothly as I expected. This would really impact the near-term growth trajectory, as DRKTF is currently at a stage where it is shifting focus to larger accounts.

In summary, my recommendation for DRKTF remains a buy, supported by its strong recent performance and strategic changes in its GTM approach. Despite a significant 50% rally since my last update in March, I am optimistic about the company’s growth potential. With the recent restructuring of its GTM strategy, targeting larger accounts, and hiring key personnel, I expect DRKTF to maintain its growth trajectory. The company’s expanded channel sales strategy, upfront commission payments, and improved sales retention are all positive indicators. While there may be short-term adjustments in Adj EBITDA and FCF due to accounting changes, the overall outlook remains favorable.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here