I shorted Carnival Corporation & plc’s (NYSE:CCL) stock three months ago and wrote this article presenting 5 reasons that backed my trade back then. Although I intended to stay short for a while, an unexpected personal situation forced me to liquidate some funds and this short position was among the first ones to go, which I disclosed immediately in the comments section of the article.

Since that article, Carnival’s stock has lost nearly 6% compared to the market’s 0.50% gain. I am presenting this follow-up article evaluating the same 5 reasons/factors used in the June article in addition to presenting a couple of new sections. Is the stock still a short? Or have things improved since then? Let’s find out.

Monstrous Debt – Slight Improvement But Largely Concerning

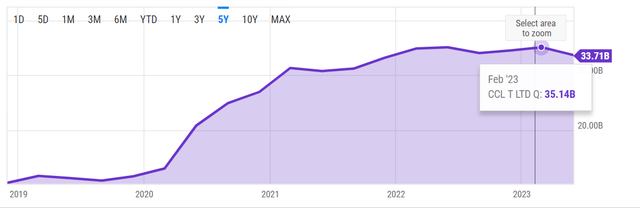

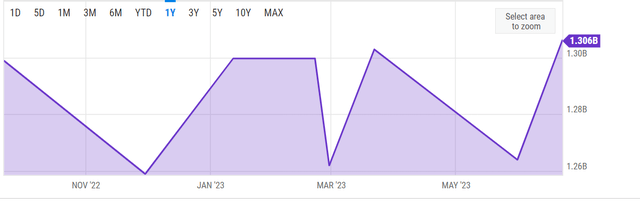

Carnival’s debt level has gone down from $35.14 billion to $33.71 billion in the last 3 months. That’s $1.43 billion or slightly more than 4%. However, the long-term story (backward looking) remains that the debt has gone up 226% in the last 5 years. To put that debt load into perspective, Carnival’s current market capitalization is $19.04 billion, which is slightly more than half the debt load.

CCL Debt (YCharts.com)

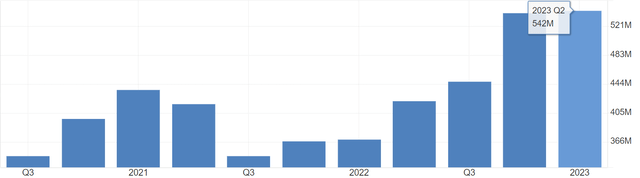

Another way to break down the impact of a company’s debt is by looking at its interest expense on debt. Carnival’s most recent quarter showed it paid $542 million in interest expense, which is the highest ever the company has paid for debt in a single quarter. While the company highlighted its adjusted Free Cash Flow [FCF] being positive in Q2 report, the fact that interest expense ate up most of what was left over offers a sobering reminder of the company’s toxic debt level. Overall, I rate this section a “Neutral” with neither major improvements nor deterioration since last quarter.

CCL Interest Expense (tradingeconomics.com)

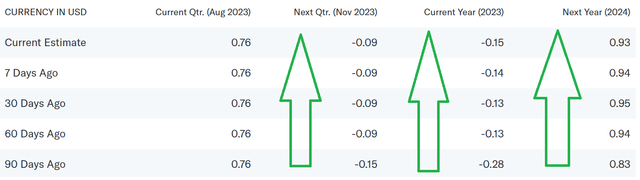

Revisions Are Trending Up

This section is an emphatic “Positive” for Carnival’s stock since my June review. While at that time every revision was trending downward, this time around, Carnival’s recent earnings revisions have all been upward. Should the company meet its current 2024 EPS projection, that would represent a forward multiple of 16 based on current share price of $15.19.

CCL EPS Trend (Yahoo Finance)

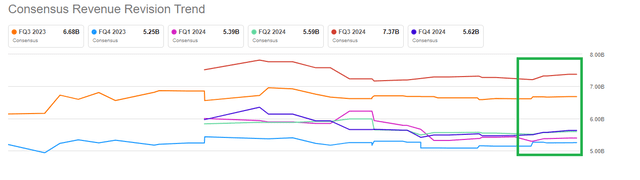

Carnival’s revenue revisions have also been to the upside as shown in the Seeking Alpha chart below. Based on current FY 2024 revenue projection of $21.85 billion, the stock is trading at 0.87 times sales. This looks extremely undervalued on surface, although I’d once again like to remind readers about the debt level.

CCL Revenue Revisions (Seekingalpha.com)

Dilution Increases Slightly

This section is another “Neutral” since last review and understandably so, given that only 3 months have lapsed. Total shares outstanding has gone up a hair by about 3 million, which represents a 0.23% increase in dilution. The long term (backward looking) concern remains the fact that the total shares outstanding has nearly doubled in the last 5 years.

CCL Shares (YCharts.com)

YTD Run

At one point in July 2023, Carnival’s stock had more than doubled since the beginning of the year, reaching about 112% YTD. Since then, the stock has lost 22%, pushing the YTD run to a slightly lower but nonetheless impressive 90%. While the median price target is still 28% away, I firmly believe the easy, turnaround money has been made for the time being. This section remains a “Neutral” since my last review.

CCL Chart (Seekingalpha.com)

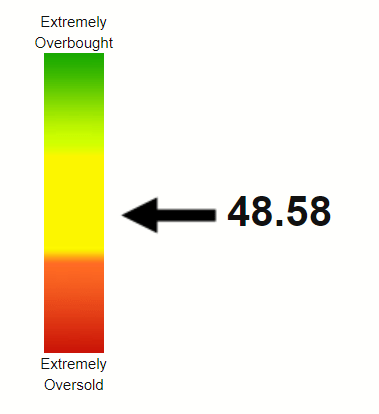

Technically Better Off

This is the second section where Carnival has a “Positive” rating compared to the June review. During my June review, Carnival’s stock was well past the textbook overbought levels with a Relative Strength Index [RSI] of 82. The stock has cooled off since then on this metric as indicated by its current RSI of 48.58. Despite losing more than 20% since July highs, the stock is currently trading more than 22% above its 200-Day moving average, which can be an indication of strong technical support.

CCL RSI (Stockrsi.com)

Other Updates Since My Last Review

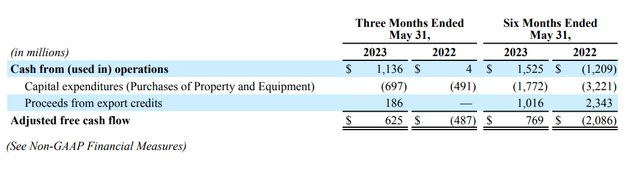

- The most important event since my June review was the company’s Q2 earnings report where it reported another loss. Carnival reported a positive quarter on its adjusted FCF and is expecting more positive quarters using this metric. Obviously on a YoY basis, Q2 2023’s FCF numbers were outstanding as shown below. However, when you consider the fact that the company paid $542 million in interest expense, the $625 million in adjusted FCF shown below dwindles quickly.

Carnival FCF (carnivalcorp.com)

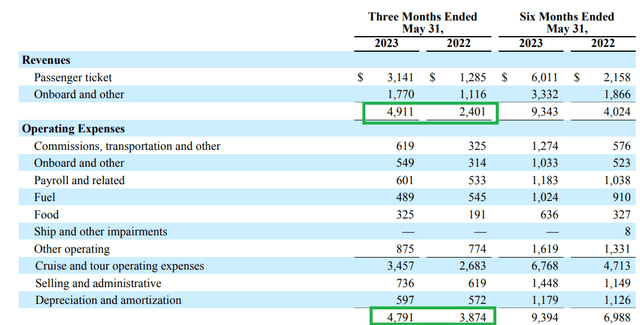

- A positive aspect that stood out from Carnival’s Q2 was that operating expenses went up by just 23% while revenue went up 100% (doubled). This shows the company’s expenses don’t increase in line with its revenue, hence making the case for higher operating margin.

Carnival Rev and Expenses (carnivalcorp.com)

- Moving away from Q2 earnings, Carnival is expected to raise more debt with $1B senior secured notes expected to mature in 2027 and another that may raise $500 million expected to mature in 2029. While the proceeds are expected to help the company pay off existing debt, it is still concerning that the company is refinancing when interest rates are at historic highs and when its own debt load is humongous as is.

Forward Looking Thoughts and Conclusion

The stock gathered plenty of steam in June and July with analyst upgrades as can be seen on Seeking Alpha’s landing page for the stock. The upgrades have since dried down as the stock has clearly lost its momentum, making me wonder if the analysts were getting too optimistic at a potential recovery that they forgot that Carnival was already reporting strong occupancy rates. For example, Q3 2023 and FY 2023 are expected to have 107% and 100% occupancy rates respectively. As I noted in my June review, the company was already back at its pre-pandemic highs when it came to revenue and the story of “pent up demand” can only last so long. Hence, from a valuation perspective, at 16 times 2024’s projected earnings, the stock is still overvalued for my liking.

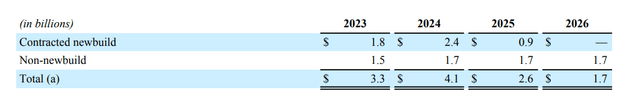

On a positive note, the company expects a strong 2024 in booking as its pre-booking for 2024 is above even the high end of its usual historical range. However, the company has already guided for $2.4 billion in capital expenditures towards replenishing its fleet with new builds.

CCL CapEx (carnivalcorp.com)

To summarize, I am upgrading (I am using that term very loosely) the stock to a “Hold” since my previous rating was a “Sell” and things have improved just a little bit combined with the stock selling off. When your existing resources are operating at 100% capacity, the only way to bring new revenue is to build new ships, which is not an easy decision nor is cheap nor is guaranteed to have the same returns. With the economy still looking shaky, sooner than later, I expect the “pent up demand” story to change to “we’ve had enough for now” story. I recommend not pushing new money into the stock for now.

Read the full article here