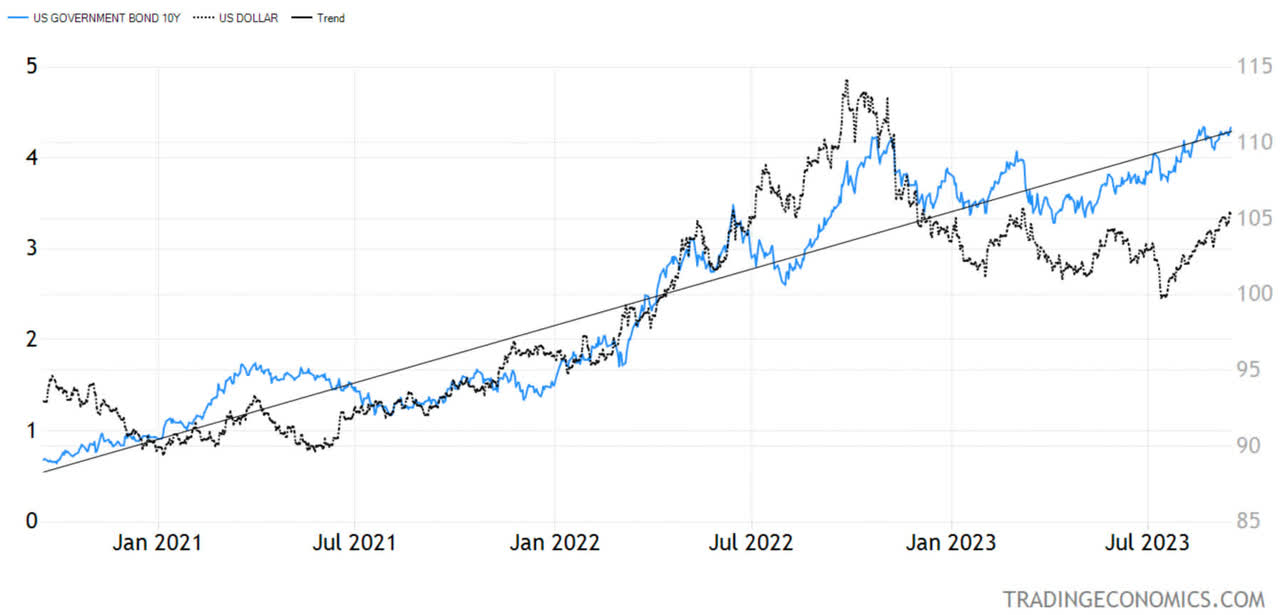

When I penned “Wild Cards for September” at the start of this month, bonds surely were on my mind, as I did not expect six months ago that the 10-year Treasury would trade above the October 2022 yield highs without backing off, but we closed on Friday a few basis points (bps) below 4.34%, and we have traded as highs as 4.36% recently. Could they go to 4.50%? We’ll find out soon enough.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

As the 10-year yield moved up from 3.25% in the spring to 4.35% recently, the stock market generally ignored rising bond yields. First, there was the AI craze, which is great, but I do not believe it will be a major contributor to earnings in 2023 or 2024, which is what this year’s stock market action should be discounting.

If the S&P 500 has risen this far without a considerable rise in earnings, as interest rates are also rising, the discounted value of future cash flows means the index should be a little lower.

We don’t have to enter into a recession to see a normal correction, which right now looks like somewhere in the vicinity of the 200-day moving average, which is rising and is just below 4,200. Typically, an index finds strong support near a rising 200-day moving average after spending a long period above it.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Also, we have a creeping dollar, because of creeping bond yields, as interest rate differentials move in the dollar’s favor, meaning a double whammy situation is developing.

Multinationals don’t like a strong dollar, as it means lower earnings when repatriated to the U.S. While the S&P 500 index gets about 29% of its revenues from abroad, the tech sector, which has been a leader in 2023, gets 59%!

So now we have rising yields that discount future cash flows at a lower level and a rising dollar that suppresses earnings.

If that is not a recipe for a continued correction, I don’t know what is.

Corrections are normal and not a reason to panic. In addition to the rising 200-day moving average on the S&P 500, there is an overlapping and very important trendline that connects key lows on a closing basis (see chart, above). That would be a good target for a shakeout in the next 2-4 weeks.

We’ll reevaluate when we get there, but so far in 2023 both the economy and the stock market have been surprising to the upside, so right now the glass still looks half full, not half empty.

The Euro May Have Further to Fall

The inverse of a rising dollar is a falling euro, as it is the largest component of the U.S. Dollar Index, by far, at 57.6%.

That is because of all the individual European currencies that once floated against the dollar, such as the Deutsche mark and French franc. Still, Europe has a greater challenge than the dollar.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Geopolitically, the Ukrainian counter-offensive has failed, with no gains against the Russian line of defense in the last three months and, by some estimates, the Ukrainians have already lost 20% of the new weapons delivered for the counteroffensive.

The Russians were hopelessly unprepared for the fierce Ukrainian resistance at the start of the war – and for the first Ukrainian counteroffensive last fall. Now they are prepared, and it shows on the battlefield.

The current stalemate is bearish for the euro, since until this conflict is resolved, it will always have the possibility of spilling outside of Ukraine’s borders.

The Russian Federation has made it clear that it will not accept anything short of a neutrality pledge from Ukraine – a constitutional amendment that Ukraine will not join NATO – as well as keeping what they have on their side of the frontline, effectively joining Crimea by land with the rest of Russia.

None of this is acceptable to Ukraine at the moment, so this stalemate may have further to go, which is euro-bearish. Europe will not straighten out its relations with Russia and quickly ramp up natural gas imports, even though it badly needs them, which raises questions about the coming European winter.

All content above represents the opinion of Ivan Martchev of Navellier & Associates, Inc.

Disclosure: *Navellier may hold securities in one or more investment strategies offered to its clients.

Disclaimer: Please click here for important disclosures located in the “About” section of the Navellier & Associates profile that accompany this article.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here