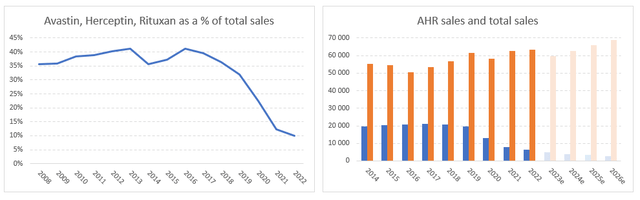

Roche’s (OTCQX:RHHBY) stock price has declined from a peak of CHF 385 in April 2022 to CHF 250 today, underperforming its peers and the broad equity market. Roche relied heavily on three blockbusters (namely Avastin, Herceptin and Rituxan, also called AHR). Before losing their patent protections between 2018 and 2020, these drugs generated over CHF 20B in revenue and accounted for~ 40% of total sales. Following a 70% collapse in sales resulting from the loss of exclusivity, they now account for 10% of revenue (equivalent to CHF 6.3B in sales).

(Source: Annual reports and author)

Despite facing a CHF 14B patent cliff, revenue has grown by +11% since 2018. Such performance has been possible for several reasons. First, Roche has protected a portion of its AHR franchises by developing second-generation drugs such as Perjeta and Kadcyla (protecting the Herceptin franchise) as well as Gazyva and Venetoclax (protecting the Rituxan franchise). From a clinical standpoint, these drugs are superior to initial drugs. Moreover, they are more convenient because of a subcutaneous method of administration. Roche also decreased the price of AHR drugs by a similar amount that the price of second-generation drugs, enabling the price of the combination to be stable. Such a pricing strategy aimed to move value from previous-generation drugs to new ones, reducing the risk of a price war with biosimilars. Then, Roche has also developed new drugs in new therapeutic areas such as Hemlibra in haemophilia, Tecentriq in oncology, Ocrevus in multiples sclerosis or Vabysmo in ophthalmology (more information about these drugs in our previous article). While many investors were sceptical about these developments, Roche clearly exceeded expectations as many of these drugs have disrupted the current standard of care. As a result, the pharmaceuticals business grew revenue by 4% between 2018 and 2022 despite the loss of exclusivity and biosimilar competition. Finally, the diagnostic segment benefited from the pandemic with a 38% surge in revenue over the same period.

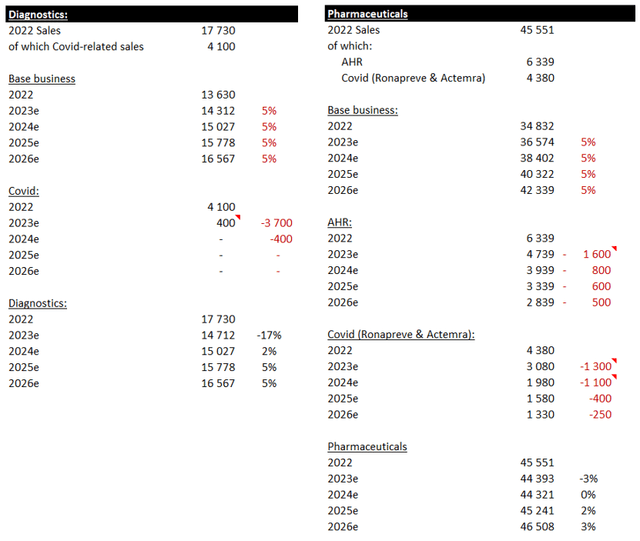

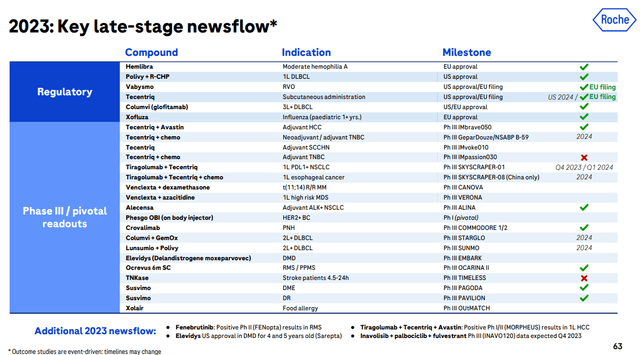

However, 2023 was expected to be a challenging year for Roche (and it has been). Per company guidance, COVID-related revenue should decline by CHF 5B (mostly from the diagnostic business) and biosimilar competition should reduce AHR revenue by CHF 1.6B. The strong performance of the underlying business is not enough to offset the expected cumulative headwinds of CHF 6.6B. For instance, the company reported -2% revenue growth at constant currency during the first half of 2023 whereas, once adjusted for the Covid headwinds, revenue growth reached 8%. As a result, Roche is expected to report low-single digit revenue growth at constant currency in 2023. In addition, the company has reported several late-stage pipeline setbacks in recent quarters. For instance, Gantenerumab, Tiragolumab (also known as TIGIT) in combination with Tecentriq and Giredestrant failed in their respective indications (Alzheimer, lung, and breast cancers, respectively). Finally, changes in the top management (Retirement of the CEO and resignation of the head of the pharmaceuticals division) as well as limited late-stage pipeline candidates have further reduced investor confidence in the company. The combination of all these elements are the likely causes for the stock’s underperformance.

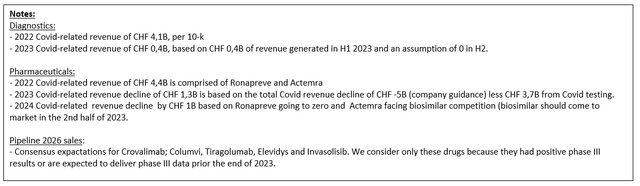

2023 should probably mark the bottom for Roche as revenue should grow again in 2024 and beyond (even assuming no pipeline contribution). We believe that Covid and AHR erosion will have a negative impact of CHF 1.4B on average while the base business, assuming a mid-single digit growth rate, should add CHF 2.7B per year on average (the base business is defined as total sales less Covid-related revenue and AHR sales).

(Source: Author) (Source: Author) (Source: Author)

The base business will grow thanks to recently launched drugs such as Tecentriq, Ocrevus, Vabysmo, Phesgo, Evrysdi, and Hemlibra. Pipeline products should have a limited contribution to revenue growth given the time lag between phase III clinical success and drug commercialization. Crovalimab (PNH), Columvi (Blood cancer), Tiragolumab (Lung cancer), Elevidys (Duchenne Muscular Dystrophy), and Inavolisib (Breast cancer) are the potential pipeline contributors to 2026 revenue. Consensus expects CHF 3.1B sales for these drugs in 2026 while Roche believes they can aggregate more than CHF 7B in peak sales over time.

(Source: 2023 Pharma day)

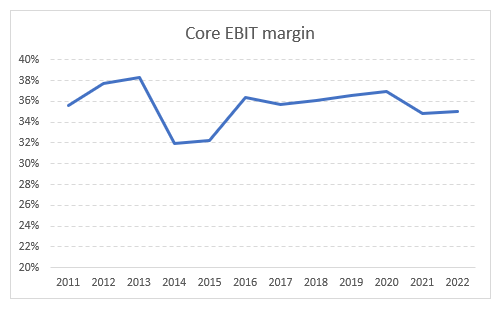

Historically, the core EBIT margin has been stable and should remain so, in our view. During its 2023 pharma day, the company acknowledged some weaknesses: a lower success rate in phase III clinical trials than the industry (currently at 56%, below the 76% industry average) and a higher drug development cost than peers (the cost of developing an NME is estimated at US$5.7bn vs. US$4.7bn for peers). As a result, the company will be more selective for starting phase III clinical programs, have a greater focus on the cost of drug development, and has strengthened its Executive Committee with R&D experts. On the negative side, the diagnostic business could deteriorate as Covid tailwinds fade. As a result, EPS should grow roughly in line with revenue growth.

(Source: Annual reports and Author)

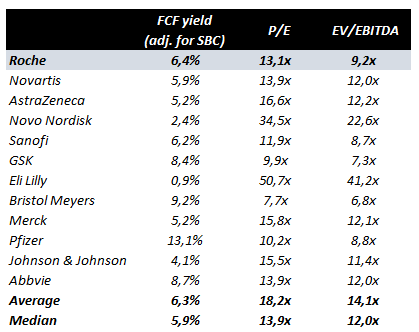

From a valuation perspective, Roche looks attractive. It trades at a 6.4% FCF yield, 13.1x EPS and 9.2x EBITDA. All these metrics suggest that Roche is trading at cheaper valuations than peers. From a historical perspective, Roche used to trade at an average of 15x EPS over the last five years while it is trading at only 13x today.

(Source: Bloomberg and Author)

We think that the stock can re-rate from 13x to its historical average of 15x, once investors’ confidence surrounding its R&D capabilities and the pipeline is restored. In addition, even though not very impressive, EPS should grow by mid-single digits. Finally, Roche offers a ~3.5% dividend yield. All in all, we can expect over 10% IRR over the coming years if Roche delivers positive clinical results and starts to grow the topline again (which we think it will do).

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here