Symbotic (NASDAQ:SYM) has been a beneficiary from the AI wave as its share price rallied almost 428% year to date at the peak.

I have actually published an article on Seeking Alpha about Symbotic in October 2022, but much has changed since then and I aim to provide an updated analysis of Symbotic here, which I think you will enjoy.

To be clear, my opinion on Symbotic today is that it is clear to me that it is the largest winner in this warehouse automation theme, with a huge backlog, strong management team and long runway.

However, to me, the key here is valuation.

I think that’s the reason why I have delayed publishing this article given that Symbotic was trading at crazy valuations due to the AI hype. I think that this is clear given that the stock has fallen more than 40% from its peak and I am glad that we did not have to participate in that.

That said, I will provide you with what I think is the one-year price target of the company and go into more detail about the fundamentals of the company.

Brief description

Symbotic is in the business of developing, commercializing and deploying end-to-end innovative products and solutions that improve supply chain operations. It automates the majority of the processes in warehouses and distribution centers, using autonomous mobile robots that are controlled by AI-enabled software. In addition, it has blue chip customers as part of its customer base.

Symbotic has a first mover advantage due to its differentiated platform architecture, and this has resulted in tangible advantages and benefits to customers, highlighted below. The new technologies developed by Symbotic is protected via a portfolio of 490 issued or pending patents.

Symbotic platform technologies

Symbotic has an innovative platform architecture that differentiates itself from other systems, supported by eight key pillars that drive the ultimate benefits to customers, which are highlighted below.

The eight pillars of its platform are:

- Autonomous movement in the platform: Symbotic utilizes fully autonomous mobile robots that are controlled by AI-enabled software and can operate with speed, all day every day of the week.

- AI-powered software enhances the platform and improves the automation and outcomes achieved.

- As you will read more in the next section, Symbotic has an emphasis on atomizing goods, meaning goods entering the system are broken down into their smallest units, from pallets to cases.

- Symbotic’s platform digitizes each individual case and randomizes them, which improves the optionality for their algorithms.

- Unique package handling by lifting individual cases using an automated fork system, allowing all kinds of cases to be handled.

- Symbotic provides an integrated end-to-end system that is able to meet a customer’s supply chain needs and maximize the efficiency of the entire supply chain.

- Symbotic uses a system-of-systems architecture philosophy, which removes the chance for any single point of failure. At the end of the day, this helps to improve system resiliency.

- Platform is highly modular and scalable, which means that customers can start and ramp up in phases.

Entire flow of the Symbotic platform

The first part of the process is the in-bound process. Products entering the system can be palletized or unpalletized, which highlights the unique ability of the Symbotic’s system to handle all kinds of products. Palletized products coming into a warehouse are de-palletized using Symbotic’s very automated de-palletizing robots that use vision technology and automated tools to pick up products and transfer them to singulating robots. Symbotic’s singulating robots then are meant to orientate each individual product optimally for storage and handling later on. They then enter the scan tunnel next. Other products that enter the system unpalletized enter the scan tunnel immediately.

The second part of the process in the scan tunnel, where each product, called case, goes through a scan tunnel where sensors and vision technology are used to digitize the dimensions and characteristics of each case entering the system.

The third part of the process is known as the buffering structure. This is the part of the platform where the goods are then stored, in a structure with each level almost three feet tall. Symbotic has an AI-enabled software that determines the optimal location for each good to be stored.

In terms of placing and picking up the goods at the buffering structure, this is done by Symbotic’s very own Symbots, which are fully autonomous robots meant for goods handling. Symbots can operate all the time every day of the week because they are charged as their charge plates run over the floor of the buffering structure. Again, Symbots are operated and routed by Symbotic’s AI-enabled software. The final part of the process is the outbound, where Symbots pick cases from the buffering structure and these cases are then palletized once again using its AI-based software, ready to be delivered.

Benefits of the Symbotic platform

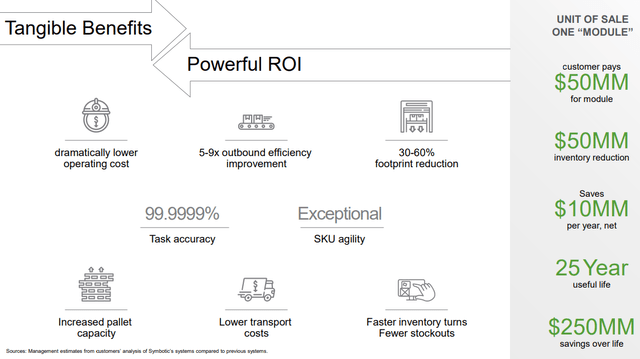

At the end of the day, the improved technology should bring tangible performance benefits and savings to the customer and bring strong returns on investment.

So, what benefits does the Symbotic platform bring?

As a result of its AI-enabled store and retrieve software, Symbotic has managed to achieve fulfillment accuracy of its platform to 99.9999%.

In addition, Symbotic’s platform’s better accuracy, throughput speed and density led to its customers achieving better availability of goods, larger variety of goods while having less inventory.

On top of that, Symbotic’s platform enables a high-density system and storage, and it achieves this by managing goods at the case and tote level as compared to at the pallet level, and its platform will remove space that is not used at the distribution center and ensure that goods are stored more densely while increasing the product throughput.

Lastly, the high density of Symbotic’s platform, in addition to the speed and agility of its autonomous mobile robots reduces movement and improves throughput.

All that leads to the tangible benefits seen below, where a customer pays $50 million for a module and sees an equal value of inventory reduction, $250 million in cost savings over the 25-year useful life of module and resulting in lower footprint, higher efficiency and accuracy.

Benefits of using Symbotic solutions (Symbotic)

Clearly, the return on investment from using Symbotic’s platform is huge and one that customers will benefit from.

Backlog

Symbotic has a backlog of $12 billion as of its 1Q23 quarter, that is expected to be delivered over the next eight years.

With the recent joint venture with GreenBox, the total backlog was increased to $23 billion. This joint venture is between SoftBank and Symbotic and meant as a Warehouse-as-a-Service, making Symbotic’s AI and automation technology accessible globally to automate supply chain networks. In addition, management did highlight that GreenBox has a non-cancelable, committed contract to buy $7.5 billion in Symbotic systems.

I went deeper into the backlog to see what this $23 billion means to Symbotic.

The backlog is protected against inflation and increases in price due to supply chain because the majority of the backlog is structured based on a cost-plus fixed profit manner. This means that Symbotic is able to continue to protect and maintain its margins even as costs creep upwards. One example is that the rising prices of steel was passed from Symbotic to its customers, which helped the company protect its gross profit.

Another point to note is that the majority of the contracts do not allow for termination and can only be terminated if Symbotic does not deliver the systems that were ordered based on their specified standard. As such, this implies that the contracted backlog is sticky and will largely not have the risk of termination.

Lastly, the backlog is expected to ramp up but as of September 2022, about 8% of its backlog was expected to be delivered and recognized as revenue in the next 12 months.

All in all, I think that Symbotic’s strong backlog is impressive not just because it makes up almost 38 times of its 2022 revenues, but also because it is able to pass on inflation and price increases to its customers to maintain its margins, while also having low risk of customer termination.

Valuation

Symbotic is trading at 10x 2024 Price/Sales, which is rather expensive for a company growing revenues at a CAGR of 40%.

The maximum one-year price target I can give is based on an 8x 2024 Price/Sales multiple, which implies the one-year price target for Symbotic is $27.

While I do think that this is an elevated valuation multiple, I can see why the market is willing to give a premium multiple to Symbotic given the strong backlog position of the company, the value proposition that the Symbotic platform brings, and the technology focus of the company, that will continue to drive growth in the long-term, in my view.

Conclusion

All in all, while the stock looks to have priced in pretty much all the upside in the near-term, the deep dive has shown me exactly why the company has run up so strongly in 2023.

Firstly, I think that one of Symbotic’s strong suits is the innovation that it brings to the table that differentiates itself from other players. At the end of the day, this innovation autonomous movement, it is enabled by AI-powered software and it is highly scalable. On top of all that, the end-to-end, comprehensive nature of Symbotic’s platform also adds to its competitive advantage.

Secondly, while an innovative and differentiated platform is important, it must have a strong value add to customers. This is clearly the case as Symbotic’s platform provides better accuracy, throughput speed and density leading to its customers achieving better availability of goods, and a larger variety of goods while having less inventory. There are many other benefits that Symbotic’s platform bring, including higher efficiency, reduced costs and lower footprint, among others.

In addition, I like that Symbotic has a huge $23 billion backlog, blue chip customer base and a strong value proposition as a result of its innovative and proprietary Symbotic platform. This is one of the positive signs that show that Symbotic’s platform of products and solutions do not just differentiate itself from competitors, but it also brings real life benefits to its customers that leads to this huge backlog. Of course, as mentioned earlier, the backlog has protections against inflation and typically does not allow for termination.

With all that said, I do like the fundamentals of the company. Everything points towards a company poised for continued visibility in growth.

However, in my view, the current stock price does reflect much of the optimism.

While prospects are good for Symbotic, I would rather be patient and buy a great company at a good price when the opportunity arises.

Read the full article here