Introduction

It has been several months since we last covered ZIM Integrated Shipping Services Ltd. (NYSE:ZIM), where we gave it a buy rating of $21. The stock has since plunged primarily due to very poor Q1 and Q2 results, posting huge losses and missing significantly on the top and bottom lines. The company then decided against paying big dividends, which many investors found attractive about ZIM.

Although ZIM has a free cash flow (“FCF”) yield of over 200% (FCF based on TTM numbers), the stock is hitting new all-time lows. It is, therefore, worth taking a closer look at the stock and seeing how it fares against competitors.

In addition, we will discuss the overall outlook for ZIM on a macro basis, focusing on economic activity in Asia and the interest rate environment in the U.S.

The Thesis Has Changed

When we covered ZIM back in April, our thesis was mainly focused on the robustness of the EU and U.S. retail sales and a belief that freight rates were on the verge of rebounding from their lows in Q1 2023. In addition, we anticipated a significant increase in demand following the drop in mid-2022, which we did not truly see.

Moreover, we anticipated that China’s economy would bounce back hard after the last COVID-19 restrictions were lifted in February 2023. Hence, we anticipated an overall good setup for ZIM at the beginning of 2023 and therefore rated it a buy.

The fact that China is still struggling to re-invigorate its economy may have shown to be the biggest shortfall for ZIM. In addition, freight rates are still showing signs of weakness and have not rebounded yet. Since ZIM’s earnings are directly correlated with freight rates due to the business model, we believe that a buy rating may no longer be justified.

A Casualty Of a Slowing Global Economy

The main contributor to ZIM’s plummeting earnings must be the easing supply-chain constraints that were the main focus for many investors and economists in 2021 and 2022. The COVID-19 lockdowns hit many trade ports hard and made them unable to operate at full capacity. This resulted in long queues at the world’s biggest trade hubs, increasing freight rates. Combined with soaring inflation worldwide and a near-zero interest rate in the same period, shipping companies such as ZIM were very profitable.

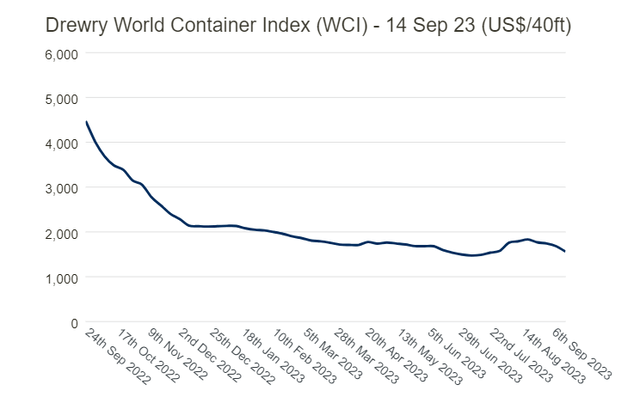

The current environment is very different, though. The Federal Reserve has raised interest rates to combat inflation, with the current effective rate being 5.25% – 5.5%. The continuous rate hikes have caused the global economy to slow down, solving the issue of supply-chain constraints, but caused freight rates to drop sharply. This can be seen from the graph of the Drewry index over the past year below.

Drewry.co.uk

In the latest week, we saw a significant 7.1% decrease in the overall composite index, bringing it down to $1,561.30 per 40-foot container. This decrease highlights a substantial 68.4% drop compared to the same week in the previous year. The latest figure underscores the dramatic shift, at 85% below the peak of $10,377 recorded in September 2021. While it currently resides at a level 42% lower than the 10-year average of $2,680, this suggests a return to more typical pricing conditions.

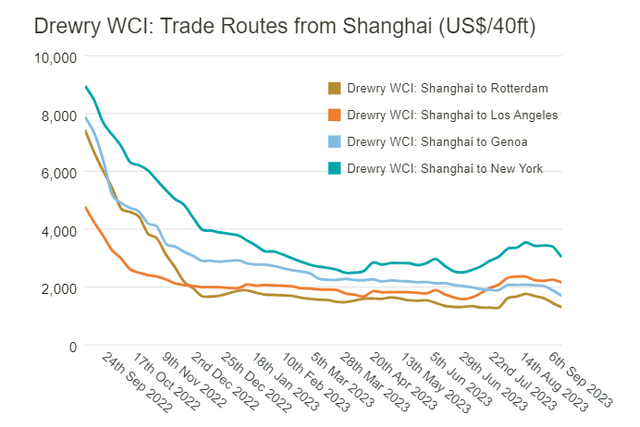

Drewry.co.uk

This week’s decline was especially pronounced in specific shipping routes, with freight rates on the Shanghai – New York route plummeting by 11% to $3,032 per 40-foot container. Similarly, rates on the Shanghai – Rotterdam and Shanghai – Genoa routes decreased by 10% to $1,299 and $1,698 per 40-foot container, respectively.

The Shanghai – Los Angeles route rates saw a 4% drop, amounting to $92 less at $2,162 per 40-foot container. However, rates on the Los Angeles – Shanghai and Rotterdam – New York routes remained steady compared to the previous week. Drewry’s outlook anticipates that spot rates will maintain their current levels over the next few weeks. Thus, ZIM may not have much hope that rates will increase soon.

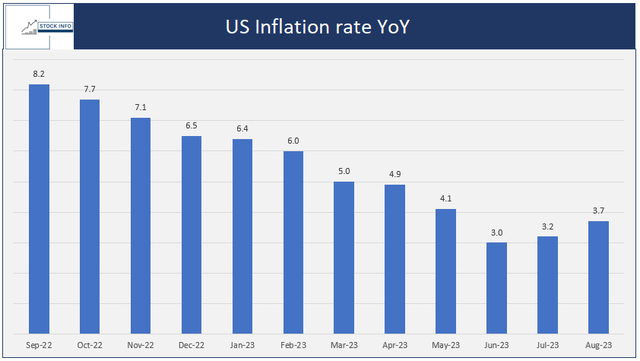

Another worry for ZIM investors is that the inflation rate in the US has started to pick up once again, as it has done in June and August, which can be seen in the chart below.

Stock Info with Trading Economics

Although this could be a temporary jump in inflation, primarily caused by soaring oil prices, it is not a welcome development as it has started to spark worry about future rate hikes.

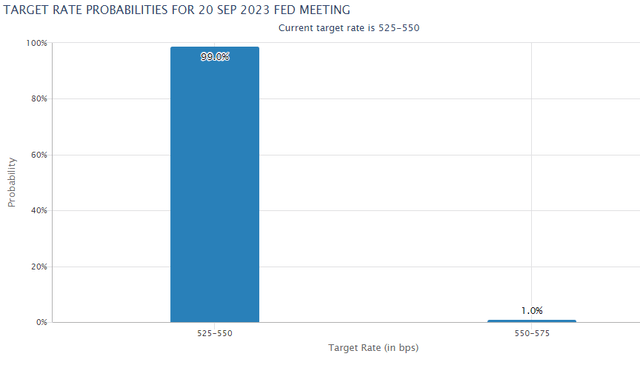

If we look at the market expectations for a hike at the next FED meeting on September 20th, there is an overwhelming belief that the FED will continue to keep the current rates rather than hike.

CME Group

If the FED indeed has decided that interest rates have reached a level that can effectively combat inflation, the real question of how long rates will remain this high is yet to be answered. After several meetings, Jereme Powell clarified that data will affect FED’s actions. Their decision can have enormous implications for ZIM.

Is The China’s Economy Starting To Turn Around?

We have discussed the Chinese economy in our previous articles, which can be found on our profile. There, we mainly talked about how the Chinese economy has shown no signs of proper recovery after they ended the remaining COVID-19 restrictions early this year. August brought glimmers of hope for China’s economic outlook, suggesting that the recent downturn in growth may be finding stability.

Industrial production, a metric encompassing manufacturing and mining, registered a notable improvement, with a year-on-year growth of 4.5% in August. This figure marked an upturn from July’s 3.7%. Similarly, retail sales exhibited signs of relief, expanding by 4.6% compared to the underwhelming 2.5% increase reported in July. The uptick in retail sales is a promising indicator of rising consumer confidence and spending, which plays a pivotal role in China’s economic recovery.

Despite these positive signs, the real estate sector, grappling with a prolonged two-year crisis, remains a pressing concern. Sino-Ocean, a prominent state-backed property developer, recently announced the suspension of repayments on offshore borrowings. This move underscores the persistent challenges within the real estate market and the potential repercussions it may continue to have on economic expansion. Ultimately, it can be a significant obstacle for the Chinese economy to get back on its feet.

While cautious optimism has taken root among some investors, leading to a rally in Asian stock markets following the data release. Larry Hu, chief economist at Macquarie Group, suggests that China’s economy may have weathered the worst challenges, encompassing weak export demand and a severe real estate downturn. He anticipates potential improvements in headline growth figures driven by supportive policies and base effects. However, he cautions that the pace of this recovery may be relatively moderate. Crucially, factors like business and consumer confidence, as well as the dynamics within the property sector, will continue to play pivotal roles in shaping the trajectory of China’s economic rebound.

Despite China’s economic slowdown since April, which led the government to introduce various stimulus measures, including a surprise cut in reserve requirements by the People’s Bank of China, concerns about the nation’s economic health persist. However, China’s Foreign Ministry spokesperson defended its economic resilience, emphasizing its strength and importance as a global economic engine. This is most likely true – it would be shocking if this slowdown would cause any significant change in China’s overall status as an economic powerhouse.

Moreover, China’s inflationary landscape stands in contrast to most other major economies, with the CPI inching up just 0.1% in August, below market expectations but returning to positive territory. The PPI continued to decline at a YoY rate of -3%. Thus, China is in the opposite situation compared to many Western economies.

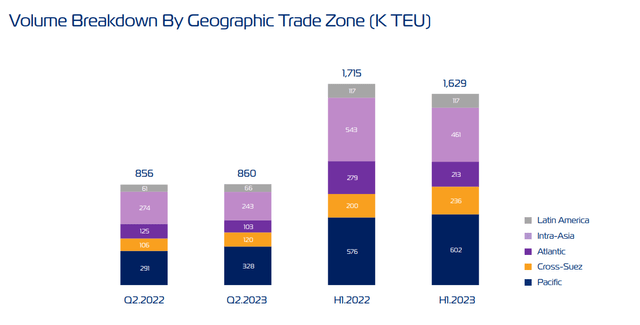

Economic activity in China is of great interest to ZIM because much of the volume comes from the intra-Asia and Pacific trade routes. These are routes that are heavily dependent on demand in China.

While we discussed that freight rates could have quite a long time to go before any significant increase, it could seem likely that a rebounding China could be a catalyst for increased activity in the region.

ZIM Investor Relations

A Tough First Half of The Year

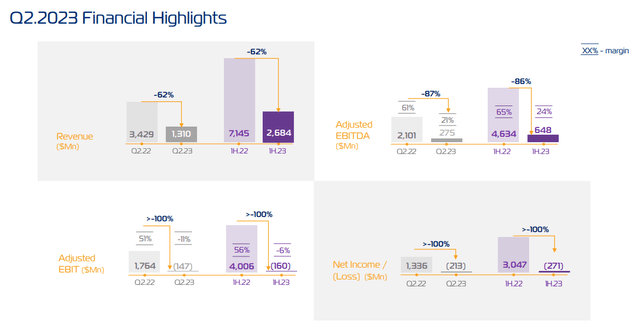

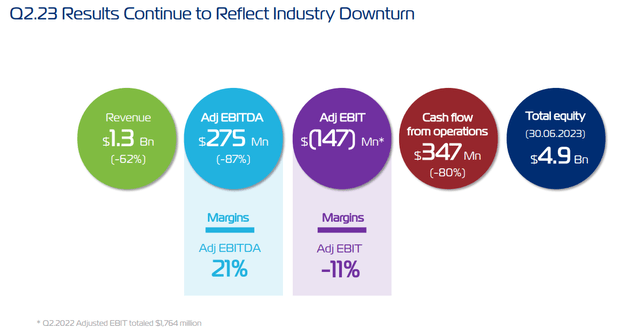

Zim reported a net loss of $213M, a solid contrast to the net income of $1,336M ZIM had in the same period in 2022. This translated to an EPS of -$1.79, compared to an EPS of $11.07 in the previous year’s second quarter. Adjusted EBITDA for the quarter reached $275M, marking an 87% year-over-year decrease. In comparison, adjusted EBIT amounted to $147M, compared to the operating income of $1,764M a year ago.

ZIM Investor Relations

The situation was further reflected in the Adjusted EBIT loss of $147M for the quarter versus $1,764M a year ago. Revenues also substantially declined.

ZIM Investors Relations

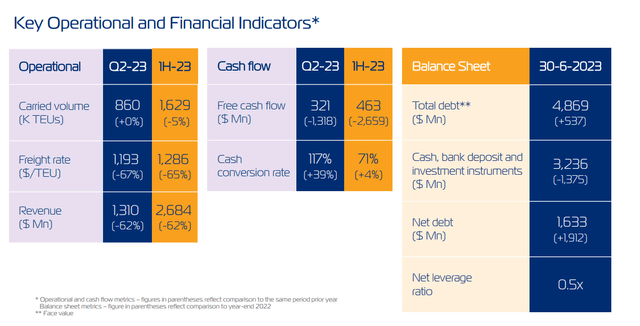

Despite these challenges, ZIM reported a slight year-over-year increase in carried volume, with 860 thousand TEUs, but the average freight rate per TEU declined significantly by 67% to $1,193. In addition, during H1 2023, total revenues plummeted to $2.62B, 62% lower than last year’s recent period.

In H1 2023, ZIM carried 1,629 thousand TEUs, compared to 1,715 thousand TEUs in the first half of the previous year, with the average freight rate per TEU dropping significantly to $1,286 in the first half of 2023, down from $3,722 in the same period in 2022.

ZIM Investor Relations

Overall, ZIM’s H1 2023 performance reflects the poor spot freight rates paid on the market in 2023 thus far. Despite these financial challenges, ZIM generated $520M in net cash, but its liquidity declined by almost $1.4B from $4.6 billion as of December 31, 2022, to $3.2 billion as of June 30, 2023.

Thus, it is pretty clear that ZIM’s balance sheet has taken a sizeable hit over the past six months, which we hope to see improve in the coming quarters. If they improve their operations, the dividends could also be back on the table.

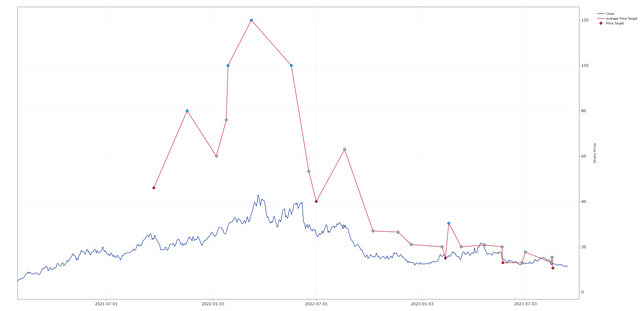

Looking at the evolution in price targets set by analysts, it’s very apparent that overall sentiment is at the lowest for ZIM. Currently, the average price target set by analysts coincides with the current price, which could mean that the stock is relatively reasonably priced.

Stock Info with OpenBB

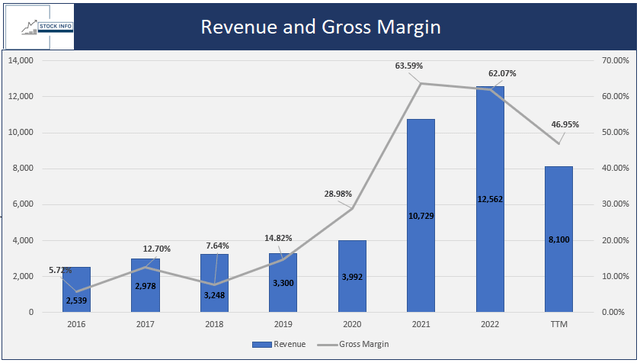

If we zoom out and look back to 2016, there has been a significant increase in Zim’s revenue generation. Revenue steadily grew from 2016 to 2020 but skyrocketed to $10,729 million in 2021 and $12,562 in 2022. However, in TTM, we are starting to see a sharp decline.

Gross margins improved over time, peaking at 63.59% in 2021. Although there was a recent dip in revenue, ZIM’s gross margin remains healthy at 46.95% in TTM.

Stock Info with Seeking Alpha

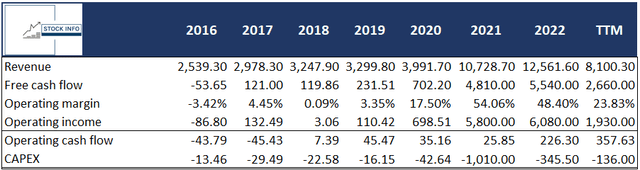

If we look at ZIM’s free cash flow over time, it is still very decent in TTM terms. However, that can quickly change if H2 2023 is as disappointing as H1 2023. While 2023 has not been ZIM’s year, the company still has a 20% CAGR and an enormous 263% operating income CAGR over five years.

This is while having a 201% FCF yield in TTM, which is almost unheard of – much of this is attributed to the steep decline in share price, which we will look at in the next section.

Stock Info with Seeking Alpha

Overall, while ZIM has taken a beating over the past year and a half, its financials do not reflect an immediate crisis, and a drop from $91 to $11 does not seem justified.

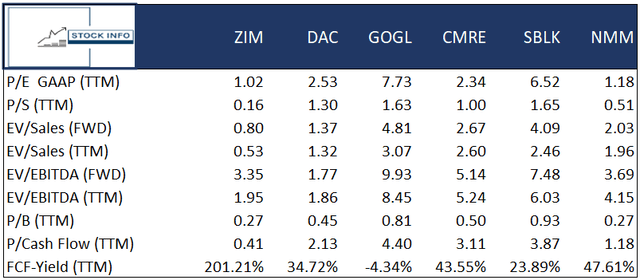

Looking at different valuation metrics, ZIM exhibits exceptionally low P/E ratios. Also, it stands out with notably low P/B and P/Cash Flow ratios, showing that ZIM is significantly cheaper than its peers based on these metrics.

Moreover, ZIM demonstrates an impressive FCF yield of 201.21%, which none of the other companies come close to. These metrics collectively indicate that ZIM’s stock may be undervalued compared to its industry peers. However, it’s essential to consider other factors and conduct a thorough analysis before making investment decisions.

Stock Info with Seeking Alpha

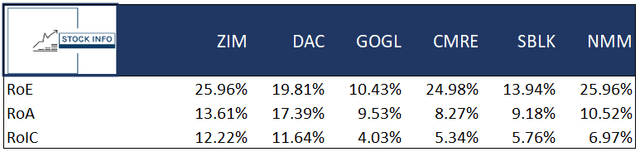

Regarding RoE, ZIM outperforms several of its industry peers with a robust RoE of 25.96%, indicating efficient use of shareholder equity to generate profits. Additionally, ZIM maintains a healthy RoA of 13.61% and RoIC of 12.22%, implying sound returns on assets, capital allocation, and profitability while being best amongst its competitors.

These metrics collectively highlight ZIM’s strong financial performance and efficient use of resources compared to its industry counterparts.

Stock Info with Seeking Alpha

Technical Analysis

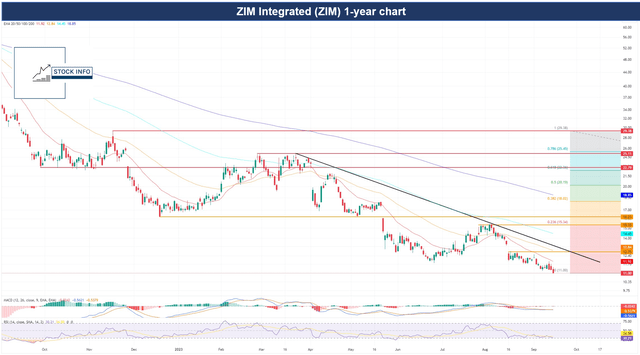

In this technical analysis, you will quickly notice that ZIM is currently trading at an all-time low. The stock closed at exactly $11 on Friday, September 15th, and now has no immediate level of support. In addition, the stock is currently in a pronounced downtrend, shown as the black line in the graph below.

The stock would need to break through this resistance to explore a higher price, which could be challenging given that the current price is under all the included EMAs. ZIM will face many resistance levels on the way up, with the first noticeable level being around the $12.75 mark. Thus, ZIM would need a sizable catalyst to move it upward and change the overall sentiment the market currently has for the stock.

We do not expect the stock to move more significantly from its current level. The market will await further data from China and the US before any significant move is seen. Hence, we rate the stock a hold.

Stock Info with TradingView

Conclusion

To conclude, ZIM has faced a substantial decline in earnings, primarily attributed to alleviating supply-chain constraints that were highly profitable for the company in 2021 and 2022. The onset of COVID-19 lockdowns disrupted global trade ports, elevating freight rates and bolstering the profits of the shipping industry.

However, the economic landscape has shifted significantly since then, with the FED’s aggressive interest rate hikes to combat inflation, causing the global economy to slow down. This has resolved supply-chain constraints but negatively affected freight rates.

Although some optimism has emerged, driven by positive economic indicators in China, the pace of recovery remains uncertain. ZIM’s financial performance in H1 2023 is starkly contrasted to the previous year, marked by a revenue decline and significant drops in average freight rates.

Despite challenges, the company generated net cash but saw its liquidity decline. Although ZIM looks cheap compared to its competitors, with the market sentiment at low and economic factors remaining uncertain, this stock is a hold.

Read the full article here