Even though there has been a lot of volatility in the markets over the past month, growth and tech stocks are still largely up for the year, offsetting very weak performance in 2022. Going forward, investors need to be very vigilant with the positions they are keeping in their portfolios, however, as incredibly high interest rates can upend the rallies of all but the highest-quality names.

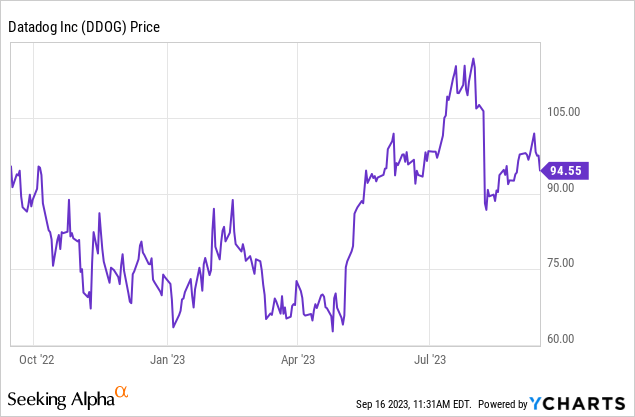

Year to date, shares of Datadog (NASDAQ:DDOG) have surged more than 30%. At the end of 2022, I wrote a bullish article on this stock when it was trading closer to ~$75. That bet has paid off: but in spite of the stock’s recent strength, I think there’s plenty of upside still to go.

I remain bullish on Datadog for a number of reasons. First, the company has continued to demonstrate growth at scale in spite of a tough macroeconomy. It is both adding new customers as well as continuing to adhere to its “land and expand” strategy of upselling existing clients. Second, the recent acquisition of competitor New Relic (NEWR) by private equity at a hefty premium demonstrates the attractiveness of the infrastructure/application monitoring space. Ongoing profitability improvements and margin gains also make Datadog a rarity in the mid-cap tech space.

Here is my updated long-term bull thesis on Datadog:

- Greenfield market opportunity is demonstrated by aggressive growth at scale- At a >$2 billion revenue run rate, Datadog is still growing at a mid-20s pace in a tough macroeconomy that is pulling back on complex IT projects. This demonstrates how wide-open Datadog’s overall market opportunity is.

- Huge $62 billion market opportunity- Datadog recently sized the observability market as a $62 billion total opportunity by 2026 (its prior sizing was $53 billion by 2025), which means that Datadog is still only single-digit penetrated into this overall market opportunity.

- Mission critical, recurring revenue software- Once installed, Datadog becomes a fixture of a company’s IT stack, necessary to maintain performance and security. This gives Datadog a rich, reliable stream of recurring revenue to build on. Its expansion rates and number of customers using multiple products is also quite high.

- Rule of 40 company- Very few companies growing as quickly as Datadog are able to achieve meaningful profitability. Datadog has 20%+ pro forma operating margins. On top of 20%+ revenue growth, this puts Datadog into a stratospheric “Rule of 40” club, which is rare in the current environment.

We note as well that because Datadog’s pricing is usage-based, it’s more capable of capturing upside quickly when customer usage levels rebound in a post-recession scenario: versus seat-based pricing software, which will take some time to recover as companies rebuild headcounts following layoffs and cost reductions this year.

From a valuation standpoint, Datadog certainly isn’t (and never was) cheap – but in my view, there’s still plenty of room for upside. At current share prices near $95, Datadog trades at a market cap of $30.73 billion. After we net off the $2.18 billion of cash and $740.5 million of convertible debt on Datadog’s most recent balance sheet, the company’s resulting enterprise value is $29.29 billion.

Meanwhile, for next fiscal year (FY24), Wall Street analysts are expecting Datadog to generate $2.54 billion in revenue (+23% y/y) and $1.63 in pro forma EPS (+29% y/y). Revenue growth estimates may be modest if usage levels rebound quickly and comp against a softer 2023, but taking estimates at face value, Datadog’s valuation multiples stand at:

- 11.5x EV/FY24 revenue

- 58x FY24 P/E

Again, these are not modest valuations. But while I usually advocate for investing in cheaper growth stocks, it’s difficult to argue that Datadog is among the highest-quality businesses in the mid-cap software space, balancing tremendous growth alongside significant bottom-line expansion in a software subsector where it has quickly unseated the previous category leader (New Relic) and grown to new heights.

Shares are down from a near-term peak above $110 notched in July, so it’s a great time to buy the dip and hold on for more upside ahead.

Q2 download

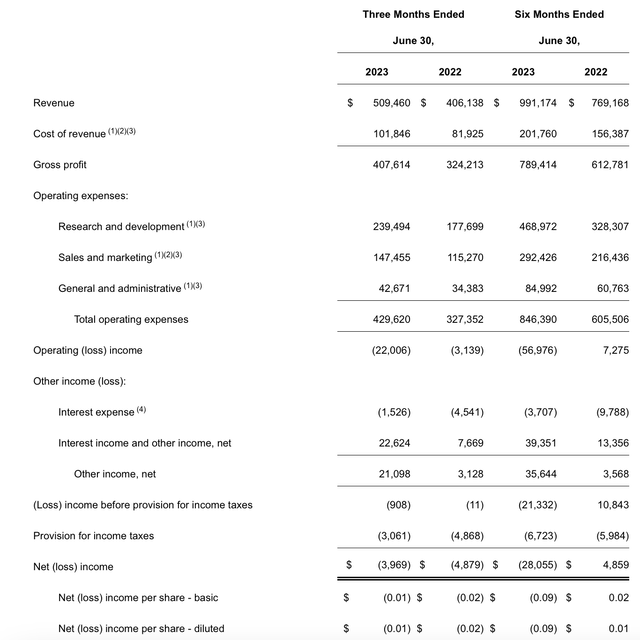

Let’s now go through Datadog’s most recent quarterly results in greater detail. The Q2 earnings summary is shown below:

Datadog Q2 results (Datadog Q2 earnings release)

Datadog’s revenue grew 24% y/y to $509.5 million, beating Wall Street’s expectations of $501.0 million (+23% y/y). We do note that Datadog has been on a sharp deceleration trajectory over the past few quarters: Q1 growth had been much stronger at 33% y/y, and Q4 had been even higher at 44% y/y.

This is largely a result of a slowdown in usage, as Datadog’s net revenue retention rates have slowed down to 120% (from 130% in the pandemic era, though this metric still stands above most other software companies in the current macroeconomy). Here are some helpful anecdotal remarks from CEO Olivier Pomel’s prepared statements on the Q2 earnings call, detailing the recent go-to-market trends:

At a high level, first, we saw Q2 usage growth for existing customers that was a bit lower than it had been in previous quarters. Second, we do see signs that cloud optimization may start to subside. And third, we continue scaling our sales with strong new logo bookings in Q2. Going one-level deeper. In Q2, we saw usage growth for existing customers that was a bit lower than it had been in previous quarters.

We continue to see customers, particularly some larger spending customers, scrutinize costs and optimize their cloud and observability usage during Q2. We are reflecting this lower growth in our updated guidance for 2023, and David will provide more commentary regarding our guidance geography.

On the other hand, we are seeing signs that the cloud optimization across our customer base may start to subside. The cohort of customers who began optimizing about a year ago appear to have stabilized the users growth at the end of Q2, as indicated by the recent activity and the related commitments with us. And we saw usage growth in aggregates rebound in July to levels that are more similar to what we see in Q1.

While it is too early to call an end to cloud optimization and a significant level of macro uncertainty remains, these new trends, along with the tenor of our customer interactions are encouraging. Lastly, our bookings were strong in Q2. Our new logo and new product bookings and deal cycles haven’t been impacted by the period of cloud optimization and we continue to see healthy growth on the sales side.”

What I find encouraging, however, is the company’s statements that new logo wins are strong – whereas most software companies have reported difficulty in closing deals due to tighter budgets and higher scrutiny. It was the second-highest quarter for new logo bookings in the company’s history, and a record for any Q2.

Yes, Datadog’s growth may be softer now as companies limit their usage of Datadog products to save on opex: but as Datadog continues to grow its customer base (the count of customers generating >$100,000 in ARR grew 24% y/y to nearly 3k), the company is setting the stage for a healthy rebound in the post-recession period as more customers are able to expand their billings.

It’s worth noting as well that Datadog’s CFO noted that usage trends in the month of July (after the close of Q2) improved relative to Q2 and were “similar to Q1” in terms of levels. We note as well that billings in Q2 were 31% y/y, and the fact that billings growth rates were higher than revenue is a good leading indicator that growth may re-accelerate in future quarters.

Profitability wise, Datadog maintained its sky-high gross margins of 81% (flat y/y), and pro forma operating margins of 21% were also consistent y/y.

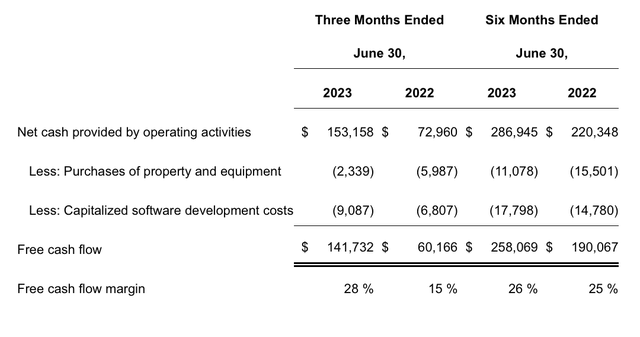

Datadog FCF (Datadog Q2 earnings release)

And as shown in the chart above, free cash flow for the first half of FY23 grew 36% y/y to $258.1 million, representing a 26% FCF margin – one point higher than the prior-year period.

Key takeaways

There’s a lot to like about Datadog, especially as the company keeps up strong new logo wins in the wake of a softer sales environment for most competitor software companies. Though a relatively expensive stock (though nowhere near as expensive as during the pandemic when Datadog traded at >20x revenue multiples), Datadog’s price is more than justified by its “Rule of 40” fundamentals and wide-open market opportunity. Stay long here.

Read the full article here