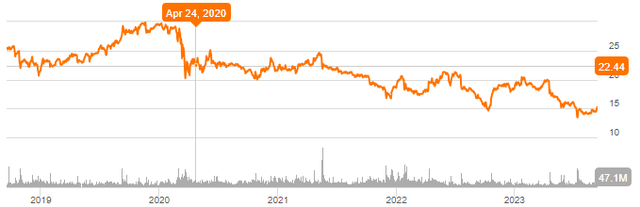

As someone who has invested in and followed AT&T Inc. (NYSE:T) for over a decade, I have seen my fair share of false dawns. For example, many believed Randall Stephenson was the problem and him stepping down would spur the stock. Here we are, more than three years after he stepped down in April 2020 and AT&T has not set the world on fire, as shown by the chart below. Another example: after the well-publicized T-Mobile US, Inc. (TMUS) failed merger and the resulting $3 billion breakup fee, there were hopes that the company learned its lessons on adding debt to buy growth. This was dashed fairly soon as well, with two successive mega-acquisitions in the form of DIRECTV and Time Warner. We all know what followed. AT&T became a debt-laden enterprise that eventually had to spin-off its non-telecom assets to avoid being crushed by its self-inflicted debt load. And AT&T’s dividend was cut as a direct consequence of these mis-steps.

ATT Chart (Seekingalpha.com)

So, excuse us AT&T investors if we are skeptical of any talks around a potential turnaround from the company and the stock, such as this recent report that the company is well on track to meet or beat its FY 2023 Free Cash Flow [FCF] expectations. And the stock has been surprisingly strong over the past month, gaining about 8%. That, once again based on the stock’s history, makes me wonder whether we are looking at another banana skin moment.

However, if I try really hard to keep my long-term skepticism aside and look at the recent events, there are enough signs that AT&T has finally realized that it may be better off operating as the “old” AT&T rather than trying to reinvent itself by getting into markets it has no expertise in. I am presenting three such signs below in the first section of the article below, followed by a few other reasons why I believe AT&T stock may have finally turned the corner.

My most recent AT&T coverage was about two months ago after the company’s Q2 earnings report. I had rated the stock a “Buy” and since then, the stock has gone up about 2%, matching the market’s returns.

The Magic Word

The key word I’d like to highlight with the “new” AT&T is focus. I am providing three examples highlighting AT&T’s recent focus since the Warner Bros. Discovery, Inc. (WBD) spin-off.

- The company has been laser focused on enhancing its Free Cash Flow and reducing its debt. More encouragingly, there have been no recent talks on di-worsifying into non-Telecom businesses. As a direct contrast, archrival Verizon Communications, Inc. (VZ) is still continuing to be distracted with the content and entertainment business.

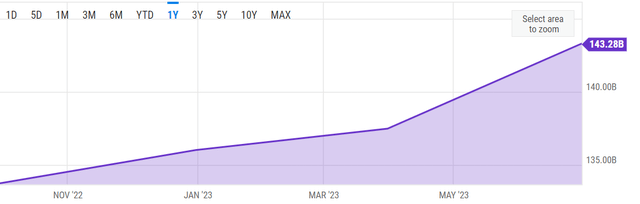

- A few months after AT&T spun-off WBD, I wrote this article warning investors of the fact that AT&T had increased its revolving credit facility’s limit from $7.5 billion to $12 billion. In that article, I mentioned $150 billion debt as the line in the sand that would make me re-evaluate my position in the stock. To the company’s credit, almost one year later, the debt remains below $150 billion.

AT&T Debt (YCharts.com)

- As individuals and investors, we tend to focus on making more but don’t pay as much attention to retaining more of what we make. A dollar saved is worth more than a dollar earned due to tax consequences but this simple fact is forgotten by most of us and corporations are not exempt from this fallacy. AT&T has started focusing on this of late. Not content with delivering a strong Q2 (covered below), AT&T also announced an additional $2 billion in cost-cutting efforts over the next three years. And the good thing is that this cost-cutting is focused on retiring legacy products and related infrastructure. I am personally wondering if that may also help the company with its lead-cable situation (covered below).

- In summary, focusing on what you do best (Telecom) and doing that within your abilities (not borrowing more) while operating efficiently (cost-cutting) is a recipe for success. For some companies, just doing what they do best may make them a sitting duck. But the fact that AT&T happens to be one of the cornerstones of modern day’s biggest addictions augurs well for the company to stick to its guns in the medium term at least.

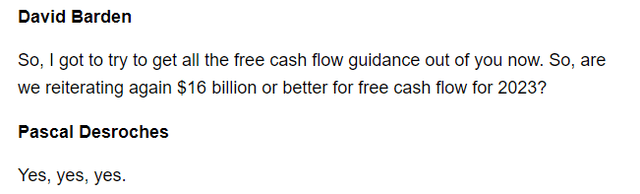

With Focus, Confidence and Results Follow

As I covered in AT&T’s Q2 review, AT&T’s FCF came in pretty strong with 2023 H1’s $4.2 billion bettering 2022 H1 by 30%, which pushed the payout ratio below 50% based on both FCF and Earnings Per Share [EPS]. More recently, the company aggressively stood by its $16 billion FCF guidance for 2023, as the CFO emphatically answered with “Yes, yes, yes.” when asked about its guidance at the recent Bank of America Securities Media, Communications and Entertainment Conference.

Focus not only leads to results but to confidence as well.

ATT CFO (Seekingalpha.com)

With Confidence and Results, Analysts Follow

For a stock that is generally used to analyst downgrades and price target cuts, AT&T stock has recently found momentum in this regard too:

- An upgrade by Citi a few weeks ago, citing strong FCF and hence the potential to reduce the debt load.

- Although this upgrade was 3 months ago, it is noteworthy because it was from a firm that has a rich history of successfully downgrading AT&T stock, as can be seen here, here, and here.

- AT&T stock’s median price target is at $19, which is a good 25% above the current market price. Adding the 7% yield, that represents a potential 32% return for buying here. $19 looks all the more attainable when you consider that based on forward EPS of $2.43, the stock’s earnings multiple of 7.81 would just nudge past the current yield of 7.29%.

Could Good PR Be The Next To Follow?

This section is pure speculation on my part but when misery can pile up in quick succession, why not good fortune?

When I wrote this article following the lead-sheathed cable related sell-off, I argued that it was likely a case of darkest before dawn for AT&T. The company had been hit with triple or even quadruple-whammies in the form of general business concerns, economic concerns around inflation and rates, J.P. Morgan downgrade, and finally the lead cable worries. No wonder, this powerful combination sent the stock tumbling to a 30-year low. Since that article, AT&T stock has gained 12.50% compared to the market losing 1.60%.

In the recent Bank of America conference referenced earlier in the article, AT&T CFO Pascal Desroches confirmed that the company is closely working with and providing the Environmental Protection Agency [EPA] all that is needed. The company stated as soon as the issue broke out that less than 10% of its network had lead-covered cables. Any positive around reducing that percentage and/or results from its own testing and/or encouraging words from the EPA may provide another reason for the beaten-down stock to run up further.

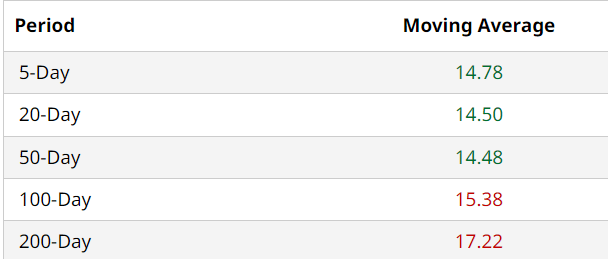

Technically Strong

From a technical perspective, AT&T stock’s current price is more or less in line with its 100-Day moving average, which suggests the stock should have at least moderate support in this region. More importantly, the gap between the current price and 200-Day moving average is now at 13%, which has narrowed from down from the 20% at the end of Q2. I interpret this to mean the stock is forming a new, slightly lower but stronger base.

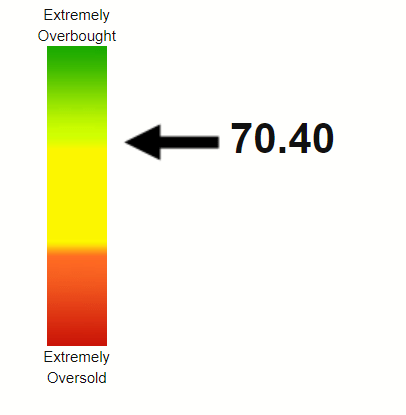

AT&T stock’s Relative Strength Index [RSI] is approaching overbought levels but that does not concern me yet as the market rarely goes gaga over this stock. Stocks with momentum tend to go higher in the short to medium term before reversing. AT&T investors may even be justified if they feel this strength is long overdue as the stock had one of the lowest RSIs I’ve seen among well-known stocks, just 4 months ago at 11.

AT&T Moving Avgs (Barchart.com)

AT&T RSI (Stockrsi.com)

Conclusion

I continue to believe that the $13 range AT&T stock saw after the lead-cable sell-off was the darkest before its dawn as the rebound has been backed up by fundamental and technical indicators. I am retaining my “Buy” rating on the stock and would be comfortable holding till $18, subject to AT&T not undertaking additional debt and continuing to deliver on its FCF promises.

Read the full article here