Liquified natural gas is still heavily used in the world and expected to continue to grow at a decent rate despite the use of renewable energy sources becoming more and more widely adopted. Cool Company (NYSE:CLCO) is a company that has direct exposure to this market as they engage in operating and managing LNG carriers, which aid the supply chain for the energy sector.

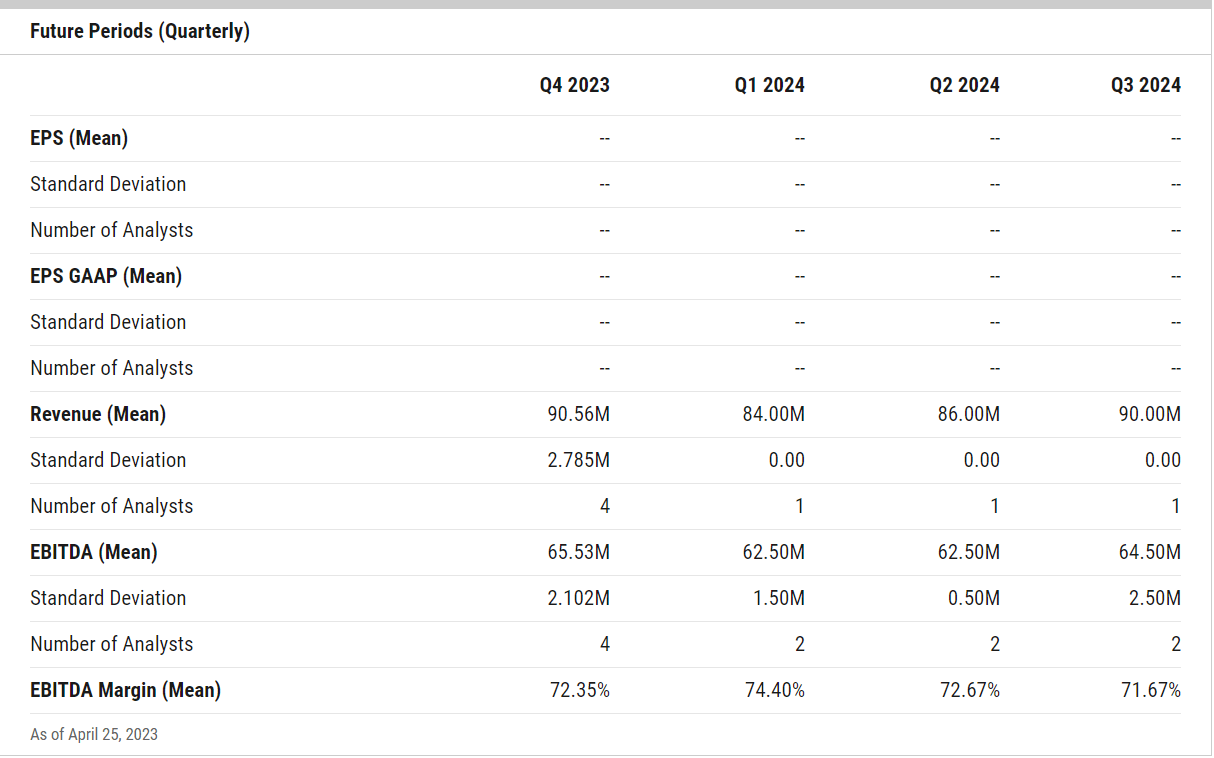

Estimates (YCharts)

A slight decline in the operating revenues for the company comes from the sale of Golar Seal in late March this year, which caused the sequential decline. The valuation however for the company maintains to be very appealing in my opinion as the earning multiple is below 4 currency. The upside here is strong because if CLCO can grow the margins efficiently in the current market conditions then perhaps a multiple of 8 – 9 could be applicable. The TCE for the company is largely outside of their control as the market demand and the competitiveness in the market are setting these prices unless CLCO has contracted some prices for themselves. The company is noting some seasonable demand is coming up and I think the Q3 FY2023 report for the company will display a strong amount of growth. With an appealing valuation as well I think that CLCO represents a buy right now.

Volatility In The Market

Where I think a lot of the attention has to go for shipping vessel companies like CLCO is how they are managing their contracted TCE and how they are affected by volatility in the market.

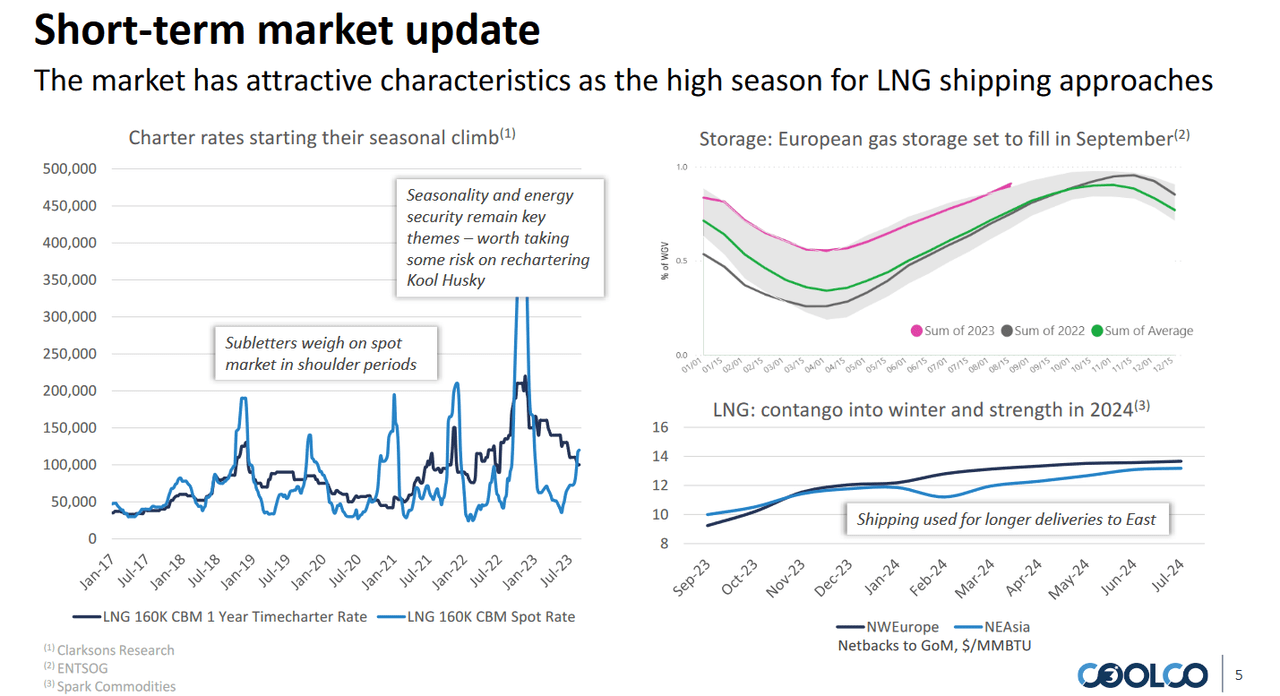

Short-Term (Investor Presentation)

The short-term outlook provided by the company indicates a decent upside potential as seasonal demand for LNG is starting to increase. Securing energy sources for the EU is a high priority as the war in Ukraine has brought some insecurity to this market and resulted in the company seeing strong demand from this market and region.

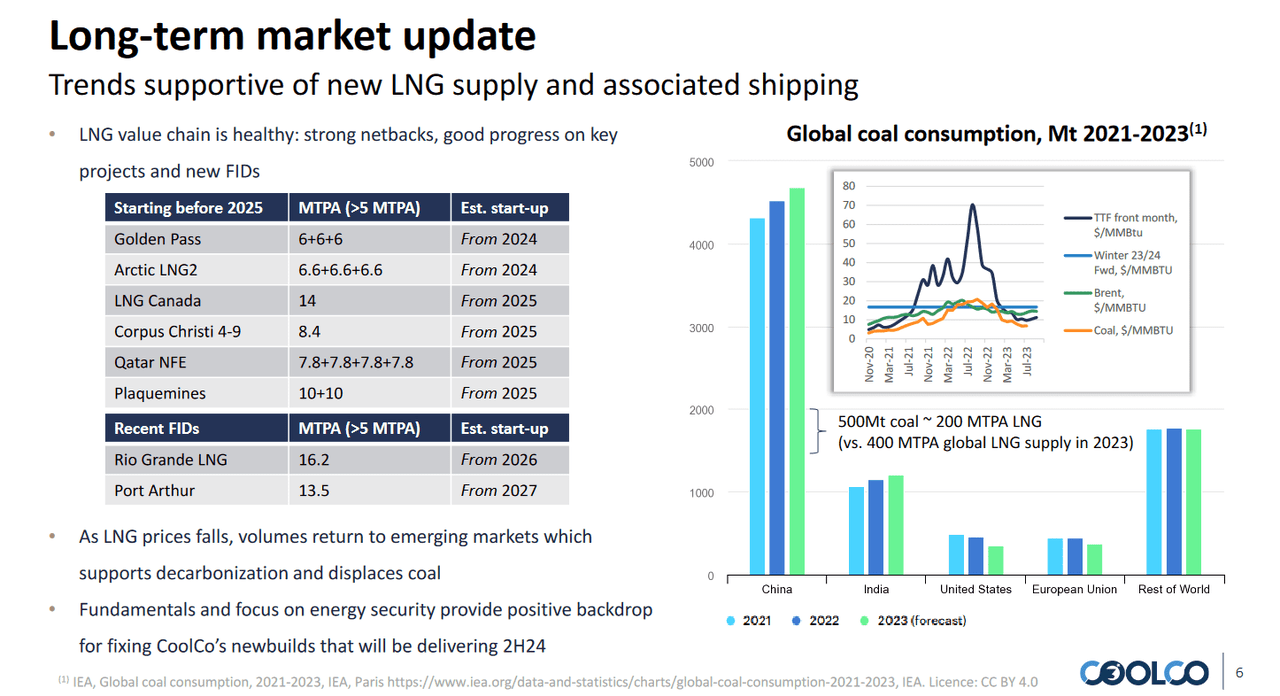

Long-Term Outlook (Investor Presentation)

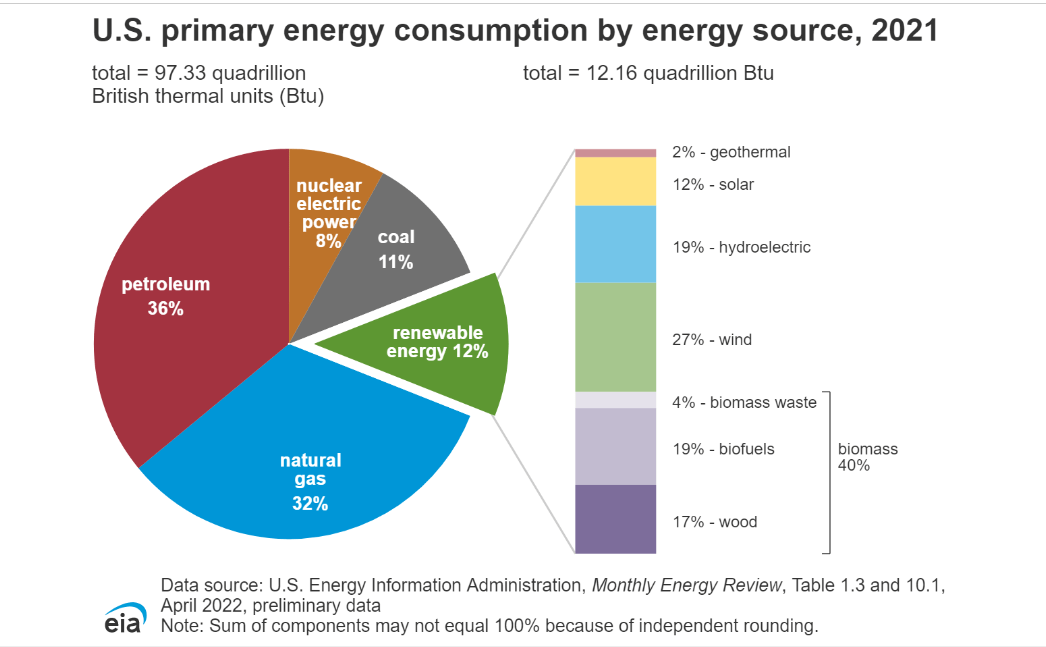

One of the largest consumers of coal is China right now and eventually, I think it will start falling and this open up the room for LNG to start being a significant energy source instead. This boosts the long-term outlook for the commodity and should bring CLCO a lot of demand from this region. Markets like the US and EU are already showcasing clear signs of the weening of the dependency on coal but still have some ways to go.

Looking at backlogs becomes important as well for CLCO as it helps investors gauge how the coming years may look in terms of earnings potential. For CLCO the company has over $1.5 billion in order backlogs already which is around twice as much as the current market cap.

Valuation

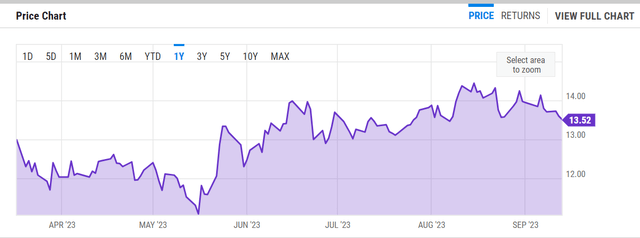

The valuation of CLCO continues to be very appealing in my view. The company trades at an FWD p/e of under 4 and it has gotten this low because CLCO has been able to surprise the market and deliver a strong last few earnings.

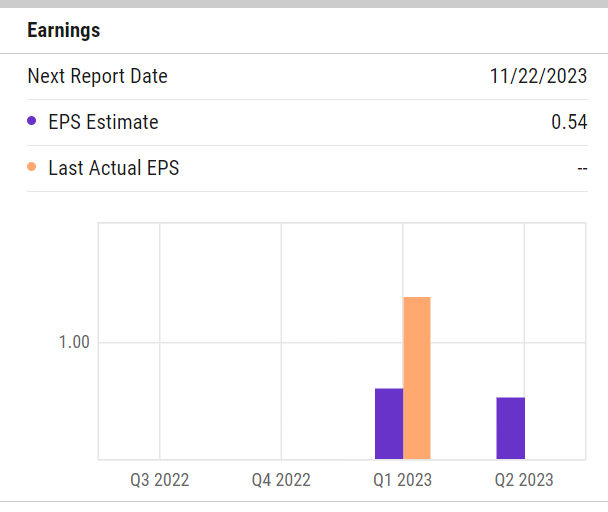

EPS Estimates (YCharts)

The last report showed an EPS surprise of over 120%. A continuation of this is going to make the company look even more appealing as raising the dividend will be easier with earnings growth like this. The company hasn’t been publicly traded for that long so I think that is partly one of the reasons for the significant discount the company is receiving right now. But that of course leaves us with a good opportunity to invest. The volumes are quite low as well at just 44.000 as most recently. If CLCO continues to deliver similar EPS as last quarter I think a fair multiple for the earnings is the same as the sector, meaning around 10.7. That gives CLCO a target price of $21. On the p/s side of things CLCO instead has a premium of 25%. I am staying true and saying that a sector median multiple should be applied so CLCO here has a target price of $10. Lastly, the p/fcf multiple is 20% lower, so CLCO has a target price here of $16. All added together and divided by 3 we end up with $15.6 which is the target I have for them, indicating an upside potential of 15% at least, which makes it a buy in my book.

Risk/Reward

LNG is in a favorable position poised for growth, particularly as the world shifts away from the allure of traditional fossil fuels like oil and coal. This transition towards cleaner and more sustainable energy sources is propelling LNG into the spotlight. However, even amid this promising landscape, it’s essential to recognize the inherent vulnerabilities that could affect LNG’s trajectory.

The appeal of LNG comes from its capacity to carve out a more substantial share of the global energy product mix as a less emitting energy source or harmful one. It offers a cleaner alternative, aligning perfectly with the ongoing energy transition and sustainability initiatives. As a result, LNG stands as an attractive choice for various sectors, including transportation, electricity generation, and industrial applications. With broad demand prospects, I think that the expected over 6% CAGR for the market valuation I think that CLCO is in a strong position to benefit from this.

Energy Share (IEA)

For the company itself more specifically, there is the risk that volatility in the shipping and vessel industry is going to affect the earnings potential and in turn the likelihood of dividend raises for them. The company has a large part of its earnings affected by the TCE the company can secure. On a sequential basis, we saw a slight decline for the company, going from $83.700 to $81.100 instead. If the positive outlooks that CLCO has don’t come true in the coming quarters then a correction in the share price may be in order as the market is looking ahead right now and expecting the business to grow the bottom line. A drop towards the $11.5 range might happen, indicating a drop of more than 10 – 15% at least from today’s levels. However, at such a low valuation I think the company would offer little downside risk and be an excellent long-term addition instead.

Business Financials

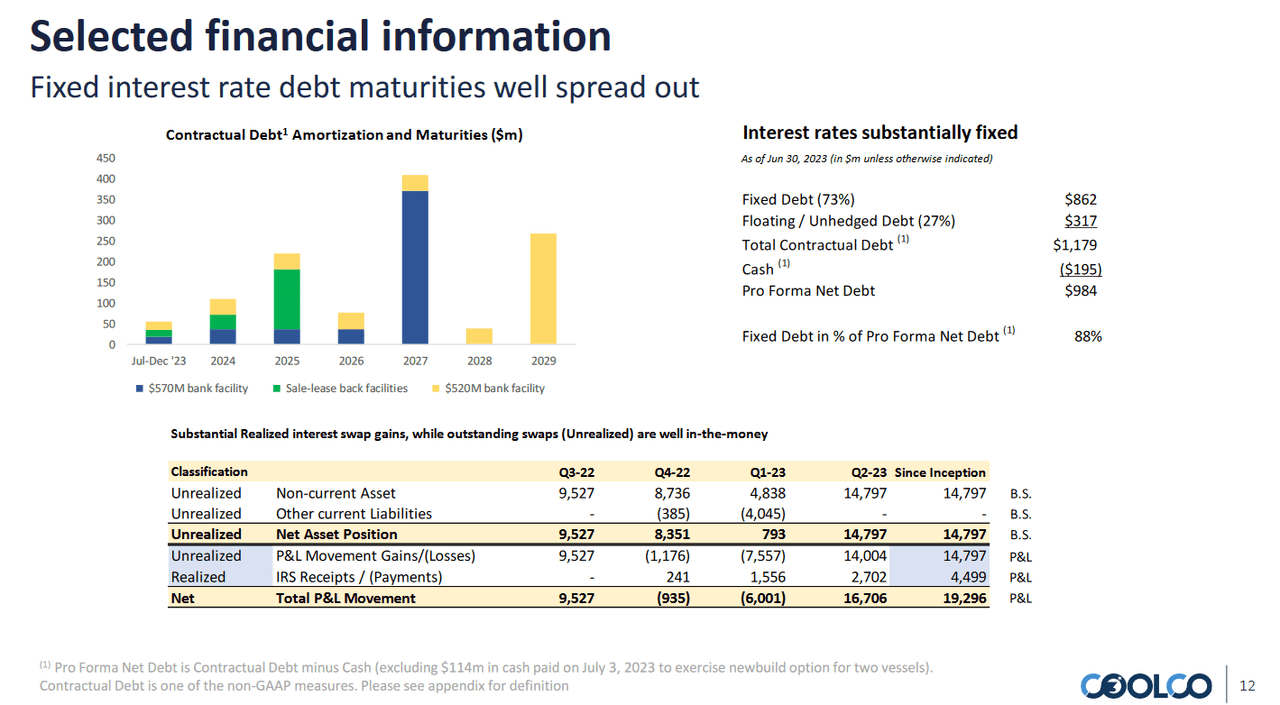

Financials (Investor Presentation)

The company has net debts nearing $1 billion in total and this is in my opinion a slight concern for investors. The largest amount of debt is still a few years out to be repaid, with 2027 being a significant year. I think that as CLCO is already generating strong FCF margins and I think if the company continues building up the cash position the debt position is nothing to worry about really. With over $300 million in cash, it can cover nearly one-third of the net debts. That puts CLCO in a strong financial position right now in my opinion and based on p/b may be trading higher actually. A p/b of 1.72 which is the same as the sector leaves a significant upside potential as the current multiple is just 1.04 right now.

Valuation & Wrap Up

I think that the valuation of CLCO is right now very appealing and a big reason for the buy rating for the business. The FCF margin is impressive and will help drive the dividend growth forward in eh coming years. Despite there being some volatility in the shipping market for LNG, I find that the outlook remains strong for the long term, and in the short term, the seasonality of shipments is likely to boost earnings in the third quarter of 2023.

CLCO Price (YCharts)

I am willing to buy CLCO stock below a p/e of 7 and right now it’s under 4 even. For investors that seek a company that has been able to build up a strong backlog of orders in the LNG market then I think CLCO offers a good opportunity. Investors are getting an over 2% yield and this to me represents a buy right now.

Read the full article here