NIO Inc. (NYSE:NIO) stock has struggled for momentum as sellers intensified their pressure, overwhelming dip buying sentiments over the past six months.

The October 2022 bottom we had envisaged to hold robustly has been dismantled, invalidating our previous thesis.

We postulated NIO’s March bullish reversal to gain momentum, but that didn’t play out in April. Accordingly, NIO fell to a lower low in the first week of May as investors reacted to a weak April deliveries report from the EV maker.

Nio’s April deliveries were much weaker than expected, suggesting that it lost momentum against the broader market. The company posted deliveries of 6.66K in April, down 36% MoM. While it notched a YoY gain of 31.4%, it was predicated against a weak April 2022 base as China’s COVID lockdowns intensified last year.

As such, NIO couldn’t lift its recovery following a weak Q1 deliveries scorecard, as “demand for NIO’s ET5 and ES7 appear to be weakening.” It was an inopportune moment for the company as it navigates a platform transition from NT 1.0 to NT 2.0.

China’s weak purchasing managers index or PMI in April demonstrated that China’s nascent post-COVID economic recovery is facing stumbles, suggesting investors need to be prepared for an “uneven recovery.”

Notably, “domestic demand as a main drag” on April’s PMI metrics worsened by a deteriorating job market, leading to weakness in consumer sentiments.

However, the challenge that NIO faced was that China’s auto market didn’t crumble. Accordingly, recent data from the China Passenger Car Association or CPCA indicates that China’s retail EV sales in April increased by 87% YoY and down by just 3% MoM.

It’s well above NIO’s 36% MoM decline, suggesting that NIO could be getting squeezed out by its peers. China’s EV share of new car sales in April remained robust, posting a penetration rate of 32%, down from March’s 34.2%. However, it’s well within Morningstar’s 2025 penetration target of 30%, indicating that EVs have gained substantial traction in China.

Deutsche Bank (DB) also noted “weak demand” for NIO’s vehicles, which could be complicated further “as industry demand remains soft.” Therefore, DB analysts expect “another wave of price cuts” to follow subsequently, as market share gains remain a critical objective for automakers.

NIO is ramping up its new product launches, with the new ES6 rumored to be launched on May 24. Management is expected to adopt a different launch/deliveries cadence from its previous models, with CEO William Li emphasizing “deliveries beginning soon after the launch.”

As such, NIO is likely pressing ahead with its various launch models and deliveries between Q2 and Q4 after a highly disappointing Q1 and April deliveries report card.

NIO posted total deliveries of 37.7K over the past four months, averaging just 9.43K monthly deliveries. As a result, it’s way below the 20.9K monthly deliveries cadence it needs to post to meet its deliveries target of 250K for FY23.

Wall Street analysts’ estimates suggest that NIO’s operating performance is significantly H2-loaded. Accordingly, NIO’s H2 revenue is expected to account for nearly 63% of its FY23 revenue base.

With a disappointing report for April, we expect management to face tough questions at its first quarter earnings call on whether its 250K deliveries target still makes sense.

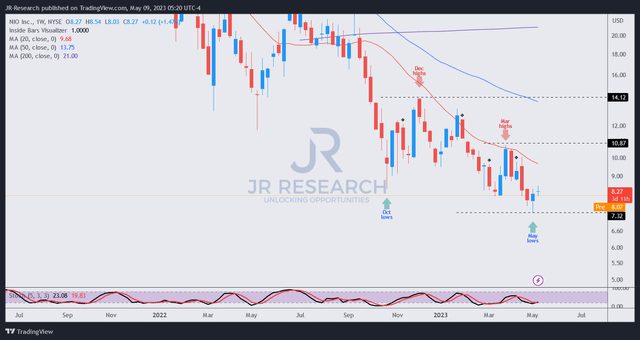

NIO price chart (weekly) (TradingView)

With NIO sellers taking out its March 2023 and October 2022 lows, sellers are clearly in control.

NIO buyers attempted to stanch the selling pressure last week, with NIO’s price action showing a bullish reversal against March’s lows. NIO’s oversold momentum suggests that high-conviction investors might find the current levels viable for a speculative set-up with a defined profit/stop-loss target.

However, we are losing conviction and patience with the Chinese EV maker. NIO’s price action indicates that buyers have been unable to defend robustly against selling pressure as the downtrend in NIO continues unabated.

While we are not looking to sell NIO yet, as it could potentially revert toward its near-term mean, we are not keen to add more.

Rating: Hold (Revised from Speculative Buy). See additional disclosure below for important notes accompanying the thesis presented.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here