Investment Thesis

The EC summer forecast just recently revealed that Germany’s economy is set to contract this year. It does not seem like a particularly dramatic event on its own. However, when it is coupled with a few other factors, such as the recent EU decision to launch an investigation into Chinese EV subsidies, which will likely trigger retaliation from China, which would hit Germany particularly hard, the situation seems set to dramatically worsen. There are other risk factors, such as potentially more energy price shocks, which could be triggered by weather trends as soon as this winter. Therefore, the iShares MSCI Germany ETF (NYSEARCA:EWG) is a very risky bet, with very little upside potential. In a worst-case scenario, we could see the entire German business and economic model implode.

The Chinese market could close to most German & EU goods, including products made in China by EU companies, in retaliation for worsening relations. This might come in addition to Europe’s and Germany’s already acute problems and potential risks ahead. Periodic energy price shocks are likely to occur, in large part due to the EU-Russia breakup. The EU itself, Germany’s largest export and business investment market is likely to plunge into severe economic, political, and social crises, due to pressures converging from several directions. Within the context of an already struggling EU economy, already-existing risks to the economy, as well as structural weaknesses an economic war with China could be the last nail in the coffin for the EU economy, and even for the EU as an entity. Germany’s economy and German companies are the most exposed of all EU economies, making the EWG ETF one of the riskiest investment options within the European space.

The EWG ETF at a glance

Arguably, one of the advantages of an ETF over picking individual stocks is the fact that it helps to spread the risk that might arise from company-specific issues that may occur within any particular company.

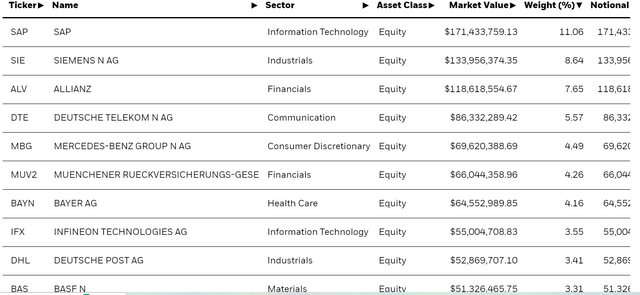

EWG top holdings (iShares)

The EWG ETF has 59 holdings in the fund currently. While that does not amount to a massive exposure to a wide number of stocks, the nature of the stocks themselves arguably provides adequate exposure across sectors of the economy. Looking at the top holdings, we have IT, financials, chemicals, automotive, health, and industrials. As I shall explain in the following section of the article, the storms that are gathering over Germany’s and the EU’s economy will probably directly or indirectly impact the entire broader economy, therefore the diversified nature of the fund does not provide as much safety as one might expect.

Other note features include the .5% management fees, which can play a role in potentially eating away at returns, especially if investors are looking for a longer-term hold strategy. With a P/E ratio of under 13, it is currently priced reasonably, in comparison with the S&P for instance, which is currently trading at a P/E of about 26. There is also a somewhat generous dividend of about 2.8%. These details put together make for a seemingly strong fundamental argument in favor of investing in this ETF but looking beyond this simple argument, it looks like a low-potential benefit, high-risk investment opportunity.

EU’s launch of an investigation into Chinese EV subsidies risks igniting a brutal economic war between the two economic giants

Chinese EV sales in the EU and across the world are rising at a very fast pace, even if Chinese brands are yet to reach anywhere near a dominating position in the EU market. China’s share of the global EV export market rose from just over 4% in 2018 to over 35% in 2022. China is not only the largest EV market in the world, but also emerging as one of the biggest exporters of EVs, as well as batteries. Aside from exports, Chinese companies are starting to set up shop in Europe to produce EVs as well as batteries. CATL, China’s EV battery producer is set to build the largest battery factory in the EU, in Hungary.

It seems that the investigation will stretch up to nine months and China is seeing this as a prelude to tariffs or other curbs on its EV exports to the EU as more or less a foregone conclusion. What this means is that China will probably start preparing retaliatory measures. It remains to be seen what shape or form those measures will take. Coupled with recent EU remarks that amount to an intent to decouple from the Chinese economy while calling it “de-risking”, it is more than likely that nine months from now, assuming that the EU investigation will lead to curbs on Chinese EV imports, it will probably signal the start of an all-out trade war. Furthermore, China could potentially retaliate against EU companies that produce and sell goods & services in China, which could have an even larger impact than trade frictions.

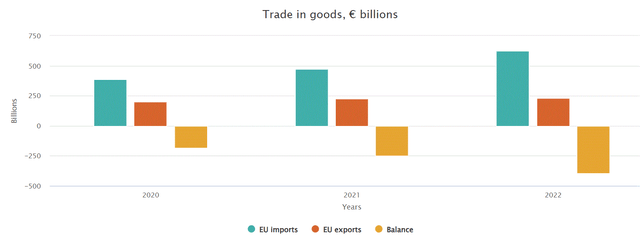

On the face of it, strictly looking at trade flows, it might seem that China is the more exposed party in this relationship. The EU hawks that are pushing for this confrontation might be swayed by only considering the trade data, without taking into account other connections.

EU-China trade (EC)

In reality, the EU business sector arguably has an outsized exposure to China, compared with Chinese companies and their exposure to the EU. In other words, a significant portion of the import volumes depicted in the graph above actually represent goods that EU companies that are operating in China are exporting back to the EU. Furthermore, several EU companies are producing and selling very large volumes of goods in China.

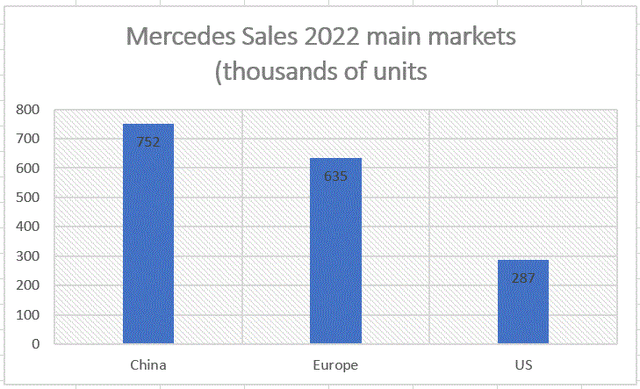

Data source (Car Sales Statistics)

Based on a 2021 report, Mercedes (OTCPK:MBGAF) produced over half a million cars in China, presumably most of them meant for the Chinese market and it has plans to increase that production capacity by about 45%. The sales & production volumes that Mercedes can count as market exposure to China amount to about 1/3 of its total sales. Most of this relationship does not show up in the trade data I cited above between the EU & China, but clearly, it would be devastating for Mercedes as well as its shareholders if it were to become a target of China’s retaliation. Mercedes currently makes up 4.5% of the EWG fund, but it is by no means the only company represented in the fund that has significant exposure to China.

Looking at other companies just briefly, Siemens (OTCPK:SIEGY), its Chinese revenues accounted for over $10 billion of its total sales of $78 billion in 2022. It probably produces significant volumes of its goods & services in China, which are then sold all over the world. It is constantly expanding its China operations. Siemens accounts for about 9% of the EWG fund.

SAP (SAP), which is a German software company and makes up 11% of the EWG fund, does not have a great deal of exposure to China. This is a useful particular case for us to consider, where direct exposure might be negligible, but indirect exposure could be massive. SAP caters specifically to business entities, helping them deal with customer relations and so on. It is hard to envision German and European businesses spending money on software updates, even as most of them are likely to take a massive hit on their China exposure. SAP is therefore likely to suffer a significant drop in sales due to the ripple effects of a potential economic war.

Investment implications

During much of the Merkel era, Germany was known as the EU’s engine of growth, especially through the difficult post-2008 period, where the Greek financial crisis exposed the shortcomings of the euro currency. Germany’s economic miracle through much of the last decade had a few key components that made it possible. First and foremost, there was the availability of cheap Russian energy, which is now gone, replaced with more expensive sources relative to the rest of the world, which makes doing business in Germany more expensive.

The second factor was Germany’s integration of the Eastern part of the EU into its supply chains. Like cheap Russian energy, cheap East European labor helped to keep input costs low for German companies, helping to make their goods and services globally competitive. In the past decade, average wages more than doubled in most Eastern EU member states, making those inputs still cheaper, but nowhere near levels from a decade ago.

Germany’s export industry was also helped a great deal by the financial crisis faced by Mediterranean EU members. It helped to keep the euro perpetually lower than it would have been if it were to only reflect Germany’s economy, even as Germany’s export strength was perpetually strangling the Southern EU members by pulling the euro higher than it would have been if it had only reflected their economies.

The one German economic strength that helped to take advantage of all the above-mentioned competitive advantages was Germany’s already established line-up of global brands.

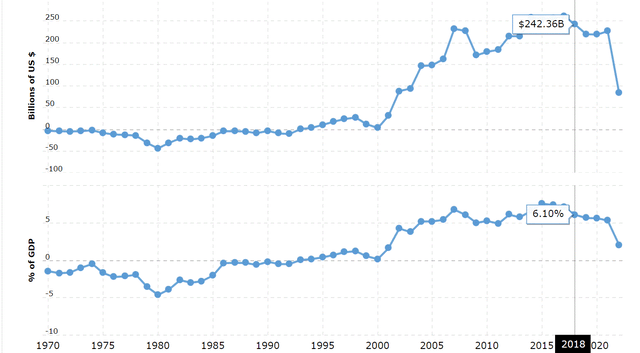

Germany’s trade balance (Macrotrends)

As we can see, Germany’s trade balance started to improve, coinciding with the introduction of the euro at the turn of the century, as well as the large wave of East-ward enlargement of the EU in 2004, due to the related factors already spelled out. One of the greatest expansions of German business took place in China.

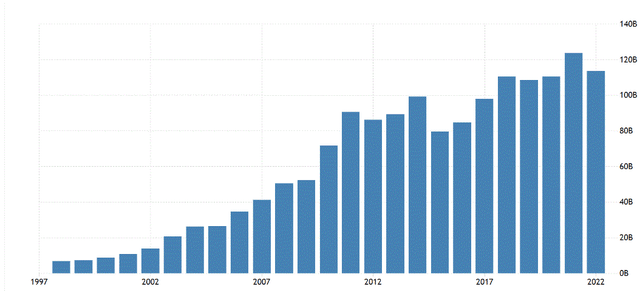

Germany exports to China (Trading Economics)

As I pointed out in the article, the relationship of Germany’s industry with the Chinese market goes far beyond what is captured within trade data, which itself is formidable in magnitude. It is hard to quantify, but based on data we have from Mercedes and other companies, the exposure that companies that produce in China and sell in China, may far exceed the exposure due to trade.

EU officials recently stated that the EU economy could absorb any retaliation that may come from starting an economic war with China. I expect that they may be looking only at the trade data between China & the EU, which only captures a small portion of the exposure that EU & German companies in particular have to China’s economy. Perhaps they expect China not to retaliate against companies that produce & sell in China, on the mistaken assumption that China might fear the negative economic consequences. This may have been the case perhaps a decade ago. In reality, there is very little that European companies bring to China that would prevent Chinese companies from stepping in and filling the void. China’s own domestic companies have built a competent and sophisticated supply chain, as evidenced by Huawei’s return to the phone business, which was thought to be impossible for the next few years.

If one takes a step back and thinks about it, a Chinese attack on EU companies producing in China might be a good thing for the Chinese economy, because Chinese companies can fill the void, and thus gain market share. The only thing that may still be keeping China from pulling the trigger is the hope that the EU market will remain open to Chinese goods & services, as well as Chinese companies. The recent EU decision on Chinese EVs seems to be the first significant shot being fired aimed at restricting that access, which is likely to lead to a rethink of Chinese calculations in this regard. China is very likely to retaliate on this, and it might do so more ferociously than expected.

The German economy is particularly vulnerable to a potential economic war breaking out between the EU & China. This may come on top of the significant hit that Germany’s economy took on the proxy war with Russia, over the Ukraine issue. The EC recently confirmed that Germany’s economy is likely to contract this year. The EWG ETF, which is dominated by German companies that have significant exposure to the Chinese market is therefore a very high-risk bet within this context, with very little upside. On the downside, it could become one of Europe’s worst-performing ETFs, given the outsized exposure to the arguably emerging global economic & geopolitical confrontation that we are marching into, with a level of enthusiasm for conflict that we have not seen since 1914. Unless we sober up and do so soon, and all sides decide to step back from the brink, in everyone’s mutual interest, EWG will probably become the first ETF that offers broad exposure to a major developed economy to be officially counted as a casualty of the emerging economic war, since Germany is likely to be the first economic casualty.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here