Today, I’d like to discuss a tech stock that has been growing revenue rapidly since the company went public back in 2019. This organization is led by its two co-founders and has been an innovator in observability and security for cloud applications (one might even say it’s the top dog). The company is Datadog (NASDAQ:DDOG).

Datadog is founder-led, has a history of innovation, has impressive financials and now has a more “reasonable” valuation compared to earlier in the year. These are the reasons I believe the company is “strong buy” and could be a winner for long-term investors.

The Company

Datadog is a SaaS provider that focuses on observability and security for cloud applications.

Datadog was founded in 2010 by Olivier Pomel and Alexis Le-Quoc who met while working at Wireless Generation. At the time, the two were working within different teams at Wireless Generation, one working on development and the other operations. The two teams had issues collaborating and Pomel and Le-Quoc put their heads together to find a solution and thus Datadog was born. Like Facebook (META) for DevOps (as stated by Pomel) this was one of the first cloud monitoring solutions. It helped developers and operations members see the entire organization’s infrastructure. The platform’s data collection, monitoring, and troubleshooting tools helped the teams work together to solve problems in complex cloud environments.

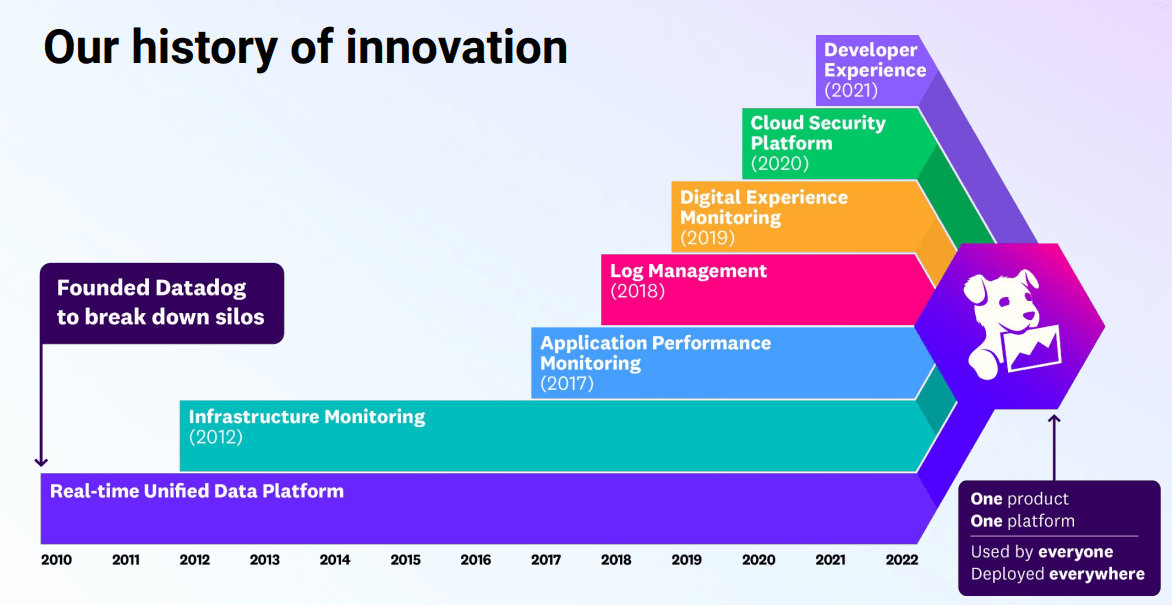

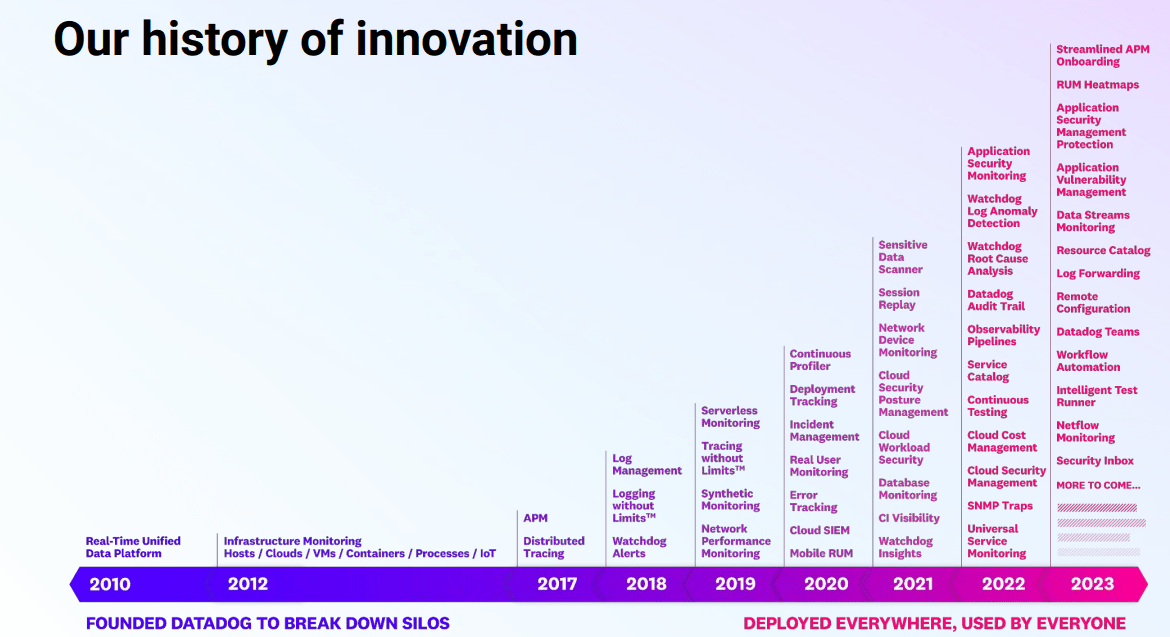

That was just the beginning for Datadog as the company has been innovating since its inception as you can see from the below graphics:

Investor Presentation

Investor Presentation

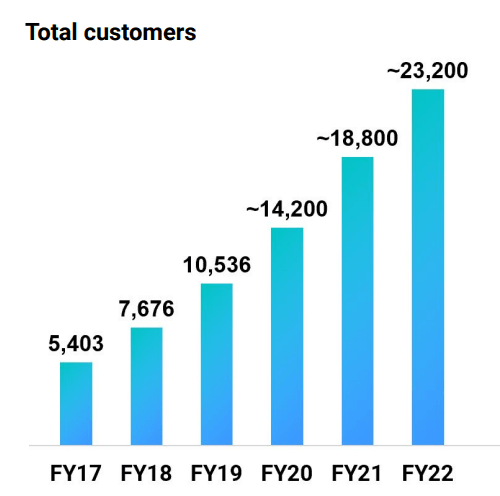

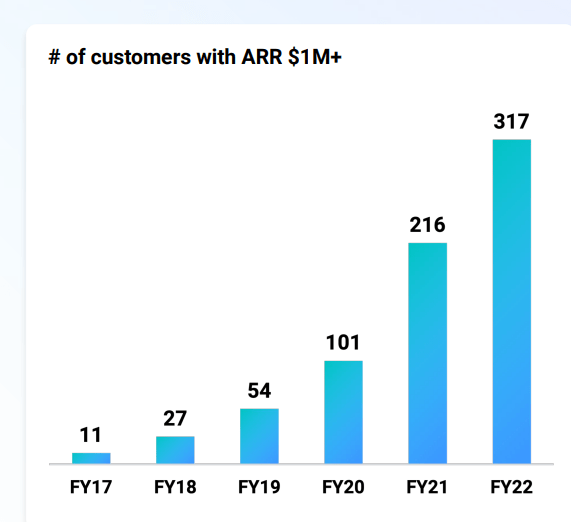

As Datadog has continued to innovate, more and more customers have been drawn to the platform. As you can see from the graphics below, customer count has continued to rise as well as the number of customers with annual recurring revenue (ARR) of over $1 million:

Investor Presentation

Investor Presentation

While customers clearly love the Datadog platform, it has also received various accolades such as being named a leader in The Forrester Wave and for the third year in row was named the leader in the 2023 Gartner Magic Quadrant for Application Performance Monitoring and Observability.

Moat and Opportunity

Datadog operates in a very competitive space. However, I do believe Datadog is a very “sticky” platform. Datadog has been able to upsell customers and has a strong retention rate. As of Q2 2023, the company’s dollar-based net retention rate (DBNRR) was 120%. This was down slightly compared to prior quarters, as companies are dissecting their costs in an attempt to optimize cloud and observability usage. Nevertheless, I believe a DBNRR of 120% is still quite high.

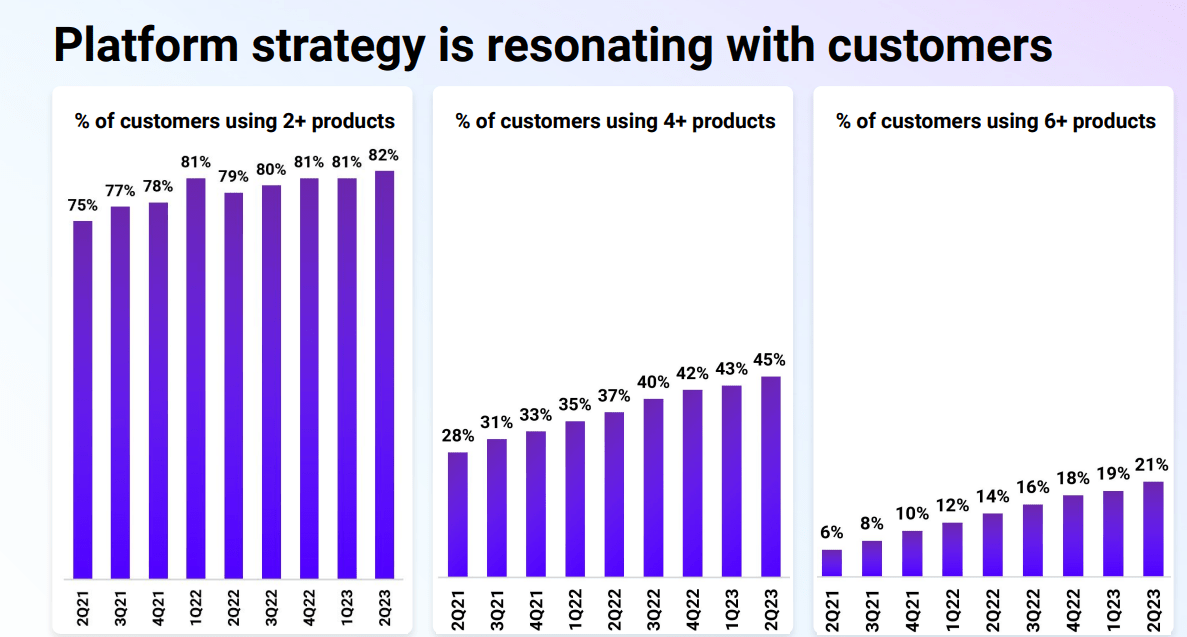

Additionally, as the graphic below illustrates, Datadog’s clients are using more and more of the company’s products:

Investor Presentation

This is rather impressive as the number of customers using two or more is up 79% compared to Q2 2022, the number of customers using four or more products is up 37% compared to prior year and customers using six or more products has increased by 14% compared to the Q2 2022.

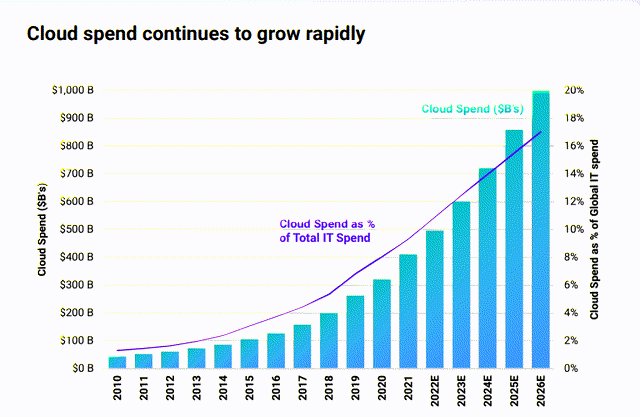

Cloud spending continues to grow rapidly as the below graphic illustrates:

Investor Presentation

Datadog believes the observability total addressable market (TAM) will be roughly $62 billion by 2026.

There are further opportunities for Datadog to innovate and add to its current platform. Two which were mentioned on the latest quarterly call were security and AI. In Q2 2023, over 5,000 customers have adopted Datadog’s security products and 79 customers have spent more than $100,000.

At Datadog’s DASH User Conference, the company introduced its first generative AI and large language model. Bits AI was also introduced. As Pomel explained on the Q2 call:

Bits understands natural language and provide insights from across the Datadog platform as well as from our customers’ collaboration and documentation tools. Among its many features, Bits AI can act as an incident management copilot identifying and suggesting success, generating synthetic tests and triggering workflows to automatically remediate critical issues.”

AI might not play as large a role for Datadog compared to other tech leaders such as Microsoft (MSFT) or Google (GOOG), but I think these features will certainly help Datadog to continue to maintain its strong customer retention rates.

Management

Datadog is led by the two co-founders, Olivier Pomel and Alexis Le-Quoc. Pomel serves as the company’s CEO and Le-Quoc serves as the CTO.

Datadog’s CFO is David Obstler, who prior to Datadog held various CFO roles for companies such as TravelClick, OpenLink Financial, and Risk Metrics Group.

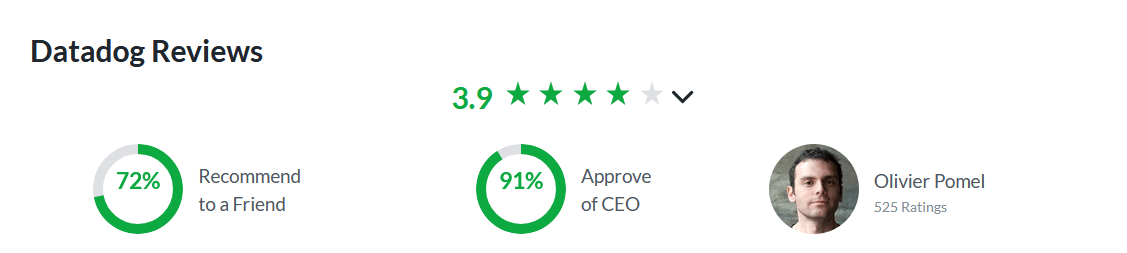

As you can see from these Glassdoor ratings, Datadog is viewed as a fairly good place to work and the employees certainly approve of Pomel.

Glassdoor

As I’ve stated previously, I’m a big believer in founders and like it when the management team has skin in the game. Both co-founders are still with the organization and both still hold company stock (especially Pomel with nearly 50% of the Class B shares and over 2% of the company’s Class A shares). I think Datadog is in good hands with this management team.

Financials

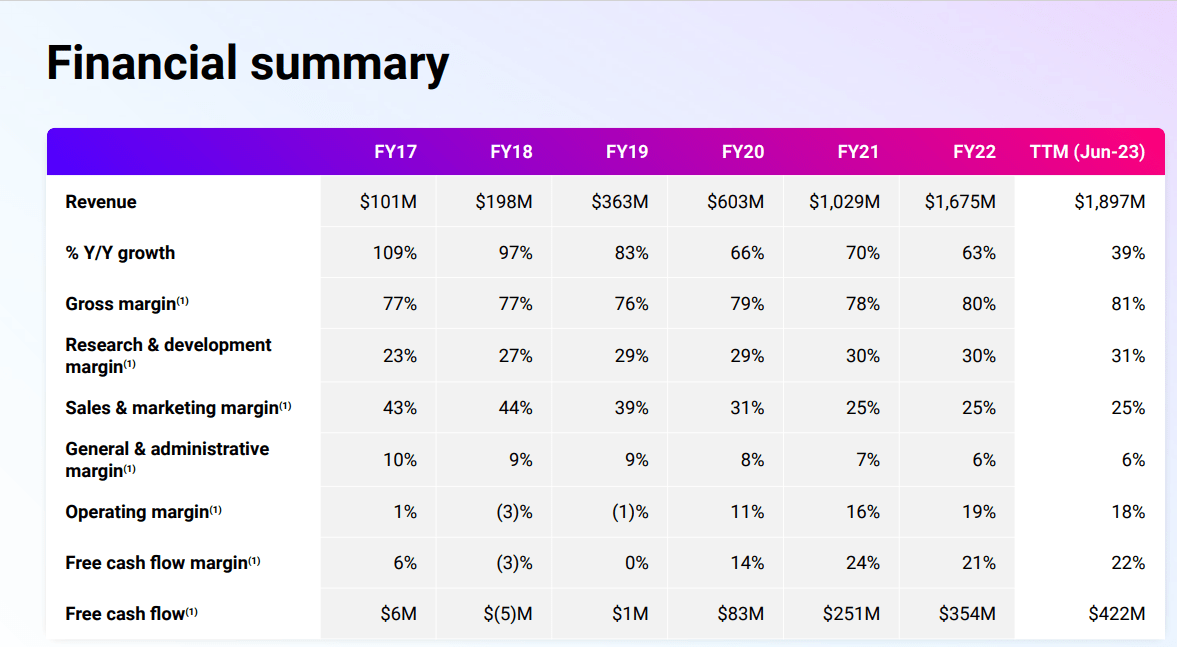

Datadog’s stock significantly dropped after its Q2 2023 earnings as management adjusted their financial outlook. This change certainly surprised some investors; however, I’d urge those concerned with the current quarter to zoom out. This financial summary provided from a company investor presentation should impress any investor:

Investor Presentation

For the current quarter, revenue was roughly $509 million which is an increase of 25% compared to Q2 2022. Gross profit for the quarter was $414 million, which represents a gross margin of roughly 80%. This is roughly in line with last quarter and Q2 2022. Operating income was $106 million and the operating margin was 21%. Operating margin was 3% higher compared to the prior quarter and flat compared to Q2 2022.

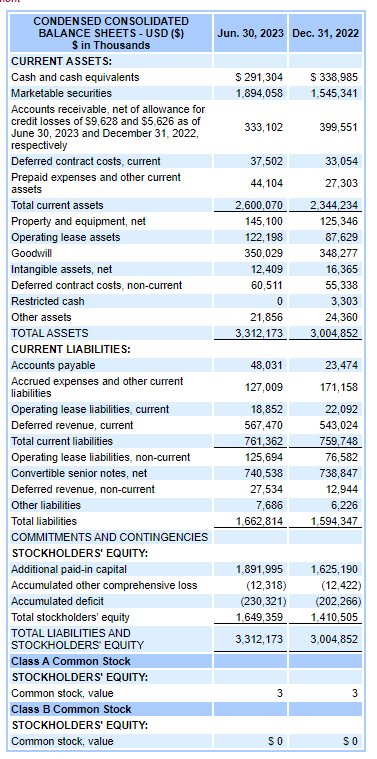

Datadog has an excellent balance sheet as the graphic below illustrates:

SEC.gov

As you can see, the company has roughly $2.2 billion in cash, cash equivalents, and marketable securities, and certainly enough current assets to cover all of the organization’s liabilities.

The company had a free cash flow for the quarter of $142 million and a free cash flow margin of 28%.

Lastly, I would like to mention the company’s remaining performance obligation (RPO). As of Q2 2023, Datadog’s RPO was roughly $1.25 billion which is an increase of 42% compared to Q2 2022. The current RPO (or cRPO) increased 30% year-over-year. Management noted the company signed some larger multiyear deals during the quarter. I view this certainly as a positive sign as clients are making longer and larger commitments.

Risks

Datadog’s various risks are covered in-depth within the Risk Factors section of their 10-K filing. I’m going to discuss two significant risks which I feel could adversely impact the business.

As I’ve previously mentioned, Datadog is a tough, competitive marketplace. Regarding application performance monitoring (APM), Datadog competes with Cisco (CSCO), New Relic (NEWR) and Dynatrance (DT). In terms of on-premise infrastructure monitoring, competitors include IBM (IBM) and Microsoft. Microsoft also competes with Datadog with respect to cloud monitoring as does Amazon (AMZN) and Google (GOOGL). As you see, these are clearly some heavy hitters in the tech industry.

The second issue is growth. As was mentioned on the latest conference call, Datadog customers have been scrutinizing costs to “optimize” their cloud and observability usage. This could be a significant long-term issue if this continued cost-cutting or “cost optimizing” continues for an extended duration.

On the Q2 call, Pomel mentioned the growth slowdown appeared “more pronounced with cloud-native businesses than with traditional enterprises.” Given today’s work environment, I find it hard to believe spending on cloud businesses won’t continue to grow in years to come.

Valuation

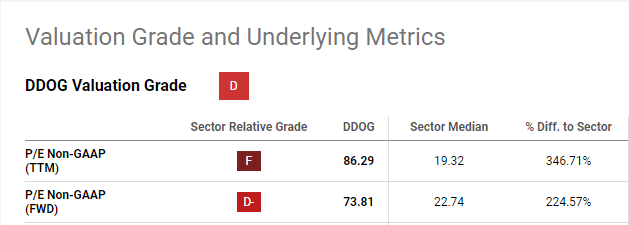

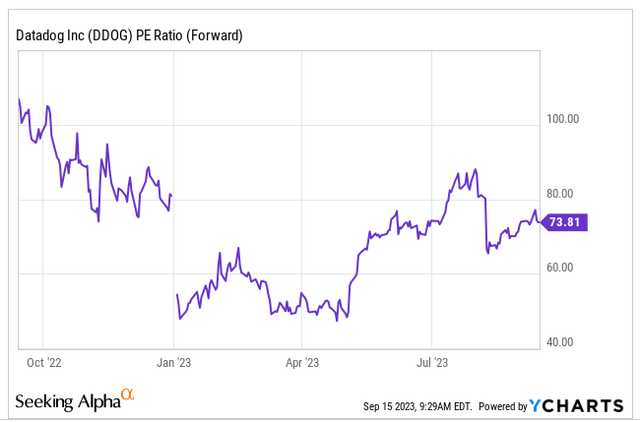

As expected for a premium growth stock, Datadog is not cheap. As you can see from the below valuation metrics from Seeking Alpha, the overall value grade is a “D.”

Seeking Alpha Seeking Alpha

Analysts use different metrics to determine valuation and for Datadog no matter what you’re using it is expensive. However, now it’s far more “reasonable”, in my opinion. The company’s forward P/E ratio (non-GAAP) is 73. As you can see above, it’s dropped from last month and from the prior year when the forward P/E ratio was over 100.

As you can see, it’s clearly higher than the sector median. However, if you compare Datadog to other premium growth stocks such as Snowflake (SNOW), CrowdStrike (CRWD) or Okta (OKTA), Datadog’s valuation is on par.

I believe the valuation consolidation after the company’s Q2 earnings was overblown. As I noted above, I think the cost optimization may continue to impact the company for the rest of 2023, but Datadog is still in an excellent position to grow.

I believe the valuation premium for Datadog is warranted given its stellar growth which I believe will only continue in the decade to come. The high gross margins coupled with a DBNRR at an impressive 120% means this is a sticky platform.

Going back to one of my favorite quotes by author and investor Chris Mayer, “It is rare to get a truly great business at dirt-cheap prices.” Datadog is one of those businesses in my opinion and the valuation is warranted given its impressive growth which will continue in the decade to come.

Conclusion

Datadog is a wonderful founder-led business that is focused on innovation and breaking down silos within organizations. The company has continuously made improvements to the platform and has created a “sticky” product that is loved by my customers. Not only has the customer count increased but customers continue to use more and more Datadog products.

From a financial perspective, revenue has grown impressively since the company’s IPO date and gross margin, operating margin, and free cash flow margin have all increased year after year. The company has an excellent balance sheet as well with an ample amount of cash and cash equivalents. RPO continues to grow as well indicating customers are making longer commitments to the Datadog platform.

Despite current cost scrutiny regarding cloud and observability usage, I believe Datadog will continue to innovate and create excellent products in the years to come. I think the company’s valuation is at much more reasonable levels as well thus I think long-term investors can feel confident buying at these prices given the dramatic stock decline after Q2 earnings. I am confident this is a business that will reward patient long-term investors.

Read the full article here