Introduction

When I shop, I tend to make quick decisions. If I need shoes, I often buy the first pair that catches my eye in the initial store I visit. My wife, on the other hand, is meticulous. She explores multiple stores, compares prices and features, and ultimately selects the best value. Consequently, she always gets the finest items at the most reasonable prices. This principle is not just relevant to shopping – it applies to investing as well.

We’ve all encountered that seemingly outstanding stock at first glance. However, it’s crucial to weigh it against its peers. You might discover that other stocks not only come at a better price but also offer superior benefits. Therefore, comparing stocks is vital. But remember, the comparison must be accurate – you wouldn’t compare apples with oranges. Thorough research is essential before committing your hard-earned money.

That’s precisely what unfolded with iShares U.S. Energy ETF (NYSEARCA:IYE). While this ETF initially appeared as a promising avenue to capitalize on the oil bull market, a closer examination alongside its counterparts painted a different picture. I discussed the iShares U.S. Energy ETF two years ago. While it has provided decent returns since then, it hasn’t outperformed its primary competitor. This reinforces my view that it might not be the optimal choice to capitalize on the oil sector’s bullish trend.

Oil-Rich ETF

The iShares U.S. Energy ETF offers investors a comprehensive exposure to U.S.-based firms engaged in the production and sale of oil and gas. This ETF serves as a gateway to the U.S. energy sector’s major players, encompassing everyone from vertically integrated giants like Exxon Mobil (XOM) to independent oil producers such as EOG Resources (EOG), oil refiners like Valero Energy (VLO), oilfield service providers such as Schlumberger (SLB), and energy infrastructure operators like Kinder Morgan (KMI). In essence, the iShares U.S. Energy ETF encompasses the full energy spectrum.

Within its portfolio, the IYE holds 40 prominent large to mid-cap energy companies. However, these companies aren’t represented equally. The fund is structured to be top-heavy, prioritizing larger corporations over their smaller counterparts. This structure mirrors the energy market’s dynamics, where numerous firms operate, but market movement predominantly hinges on a handful of heavyweights.

Predictably, IYE’s top holdings are Exxon Mobil and Chevron (CVX) – two vertically integrated titans involved in every stage of the oil process, from extraction to petrochemical production. In the ETF’s composition, Exxon Mobil holds a significant 21.82%, while Chevron makes up 14.32%. Together, they constitute over a third of the ETF’s total assets. Following them are two major independent oil producers, ConocoPhillips (COP) (3rd largest holding) and EOG Resources (5th largest holding), along with the world’s top oilfield services provider, SLB (SLB) (previously called Schlumberger, 4th largest holding). Combined, these five companies represent a substantial 52.62% of the ETF’s assets.

IYE is a respectfully sized energy sector focused ETF, with $1.38 billion of assets under management. It offers a 30-day SEC yield of 2.98% and comes with an expense ratio of 0.40%.

Oil’s Bullish Run

In recent months, oil prices have seen a significant uptick. Both WTI and Brent crude have surged nearly 25% in the last three months, reaching 10-month highs. As of this writing, they are trading at $90.77 and $93.93 per barrel, respectively. Unless there’s an unforeseen decline in the coming two weeks, this quarter might witness the steepest hike in oil prices since Q1-2022 – the time of Russia’s invasion of Ukraine. This robust growth has been spurred by strong demand indicators, particularly from China, coupled with supply reductions from OPEC and its allies.

“Recently, WTI breached the $90 per barrel mark for the first time in 2023. This surge followed an announcement from Saudi Arabia and Russia, two major players in OPEC+, about their intent to continue supply cuts throughout the year. Specifically, Saudi Arabia plans to reduce its output by a million bpd, while Russia aims to decrease its oil exports by 300,000 bpd. At the outset of the year, OPEC+ had already trimmed production by 2.5 million bpd. According to the group’s projections, this could lead to a supply deficit of 3.3 million bpd by the next quarter. Such a significant deficit hasn’t been witnessed in over a decade. This factor alone might bolster high oil prices. Moreover, when combined with the uptick in demand, it potentially reinforces the environment for sustained elevated oil prices.

I think China’s trajectory has been somewhat unexpected. As the world’s foremost crude oil importer, it was anticipated to witness a robust economic rebound this year which was supposed to accompanied by a rise in oil demand, especially after lifting COVID-19-related lockdowns and travel restrictions. However, contrary to these expectations, the economic recovery remained tepid, prompting Beijing to introduce stimulus measures, such as key interest rate reductions, to invigorate the economy. Given these economic dynamics, one might assume a corresponding tepid demand for oil. Yet, contrary to this assumption, oil demand has remained vigorous, a trend underscored by numerous data points.

In my view, a clear testament to China’s robust oil demand is the surge in its crude oil China’s oil imports surge in August as fuel exports, inventories rise, which reached 52.8 million tons in August – a 21% sequential increase and a remarkable 31% jump year-over-year. Additionally, the nation witnessed a China oil refinery output rises to record on firmer demand, export margins refinery throughput of 64.69 million tons in the same month. During the initial eight months of 2023, China’s crude oil imports surged by 14.7% compared to the prior year. Concurrently, there was a nearly 12% spike in China’s refinery throughput as refiners scrambled to cater to the skyrocketing demand for fuels, including gasoline, kerosene, and aviation fuel, both domestically and internationally.

According to the International Energy Agency’s forecast, global oil demand was projected to grow by 2.2 million barrels per day this year, with China being a key driver of this upsurge. This projection aligns with the current trends we’re observing. I believe that as we approach the colder months, we could see an uptick in fuel demand. Paired with the persistent supply cuts from OPEC+, the looming substantial deficit might further exert upward pressure on oil prices. Even if prices don’t surge significantly, I think they are likely to remain elevated.

In my opinion, the prevailing high oil price environment is poised to significantly benefit the holdings of IYE, enabling them to markedly enhance their revenues and profits. Consider Exxon Mobil, IYE’s top holding, as an example. In Q2-2023, the average prices for WTI and Brent were $73.78 and $78.40 per barrel, respectively. In that environment, Exxon Mobil managed to achieve realized prices of $70.08 internationally and $71.36 domestically. However, with the recent surge of oil prices to $90 a barrel this week, and the potential to escalate further to as high as $100 a barrel in the subsequent quarter, WTI might average around $82 per barrel for Q3-2023 and possibly $90 or even more in Q4-2023, by my estimates. Such prices will undoubtedly give a boost to Exxon Mobil’s upstream earnings. Moreover, other oil producers within IYE, like Chevron, ConocoPhillips, and EOG Resources, are also poised to register higher profits.

Beyond just oil prices, there’s potential for drilling activity in the US to rebound. As I discussed in detail in a prior article, we may already be witnessing initial indications of a resurgence in the US land drilling market. Given the robust oil prices, there’s a likelihood of a spike in the US rig count. This anticipated rise bodes well for the profitability of IYE’s oilfield service holdings, including SLB. Additionally, refining margins, which experienced a decline in the second quarter, negatively impacting refiners’ earnings, have shown signs of strengthening. In August, these margins saw a sharp incline, with the Mid-Con WTI 3-2-1 crack spread jumping from under $19 per barrel in July to over $26 in August, as per data from Marathon Petroleum (MPC). Such trends are likely to augment the earnings of refiners like Valero and also benefit the refining divisions of Exxon Mobil and Chevron.

In summary, I believe that all of IYE’s holdings, spanning majors, independent E&Ps, and refiners, are well-positioned to report growth in revenues, earnings, and cash flows in upcoming quarters. An upswing in cash flows will further enable them to boost shareholder returns via increased dividends and buybacks. Collectively, these factors are poised to lift their share prices, which, in turn, might also propel IYE’s shares upwards.

Is IYE the Best Option?

While the prospects of IYE seem promising, it’s essential to acknowledge that other ETFs with portfolios akin to IYE’s are also poised to capitalize on oil’s rally and the robust demand for the commodity. Some prominent contenders in this space include the Energy Select Sector SPDR Fund ETF (XLE), Vanguard Energy Index Fund ETF (VDE), and Fidelity MSCI Energy Index ETF (FENY). Much like IYE, these ETFs are top-heavy, dominated by the giants of the energy industry, with Exxon Mobil and Chevron commanding the top two positions. These two behemoths account for between 38% to 40% of the net assets in each of these ETFs. To put things in perspective, in IYE, these two oil titans represent 36.14% of the total assets.

However, for investors specifically seeking concentrated exposure to primarily the large and mid-cap energy companies – the stalwarts of the energy domain – VDE and FENY might not be as appealing. Both these ETFs encompass approximately 120 energy stocks, which includes a significant proportion of small-caps. On the other hand, with its 26 holdings, XLE’s portfolio closely mirrors that of IYE. While not identical, the top-ten holdings of both IYE and XLE largely overlap, only differing slightly in terms of portfolio weights. Thus, I believe a comparison between these two funds would be apt.

When it comes to selecting between XLE and IYE, in my view, XLE has a definitive edge and may be the go-to choice for investors aiming to capitalize on oil’s revival. Here’s why:

- Size and Liquidity: First and foremost, XLE towers over IYE in terms of size and liquidity. Widely regarded as the gold standard for energy sector funds, XLE boasts an impressive $40 billion in Assets Under Management (AUM). This monumental figure renders it the most significant player in the energy sector ETF arena and puts it leagues ahead of IYE, which is nearly 30 times smaller. Liquidity, too, tilts the scale in XLE’s favor. Data from Seeking Alpha shows that an average of 18.7 million XLE shares trade hands daily (3-month average), a stark contrast to IYE’s 460,000 shares. While IYE’s liquidity and AUM are respectable in their own right, XLE simply outclasses it. Why settle for good when you can have the best?

- Expense Ratio: I believe the high expense ratio of IYE, standing at 0.40%, is a significant drawback. In simpler terms, for every $10,000 invested, investors will fork out $40 annually. This is notably steeper than its counterparts: XLE and VDE both have a frugal 0.10% expense ratio, and FENY emerges as the frontrunner with a mere 0.08%. Given this competitive landscape, it’s surprising why IYE would charge such a hefty fee, especially when its rivals offer a more cost-efficient alternative.

- Dividend Yield: IYE’s 30-day SEC dividend yield is pegged at 2.98%, which is lower than XLE’s 3.10%. While this difference might appear marginal initially, it can amplify over an extended investment horizon.

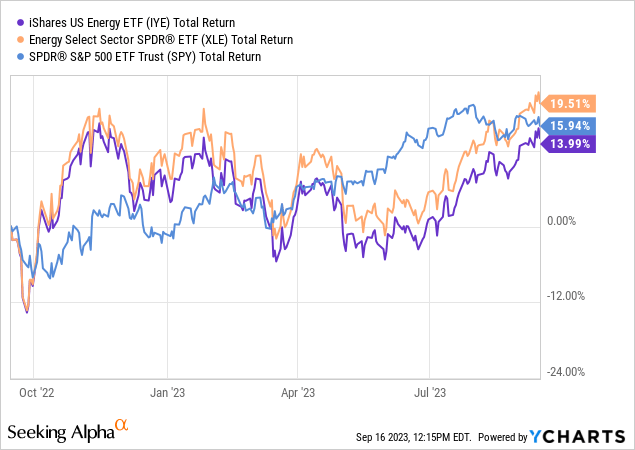

- Outperformance: Small variations in expense ratios and dividend yield can have profound implications in the long run. Historically speaking, when two ETFs showcase analogous portfolios, the one endowed with a leaner expense ratio and a more generous dividend yield typically reigns supreme. This trend has manifested itself in recent times. Over the past year, IYE’s returns stood at 14%, nearly matching the S&P-500’s (SPY) 16%. However, XLE, with a surge of nearly 20%, has eclipsed both. I believe this historical pattern could very well persist, with XLE continuing its dominance over IYE.

Conclusion

IYE offers a broad-based exposure to the energy sector, concentrating predominantly on the titans of the industry. With holdings that span across the oil majors, independent E&Ps, refineries, and oilfield service providers, IYE is anchored in a sector that’s positioned to capitalize on the current favorable market dynamics. Given the likely surge in earnings of these companies due to prevailing market trends, it’s reasonable to predict an upward trajectory for their share prices, which in turn, will provide an impetus for IYE. However, a holistic evaluation reveals some chinks in IYE’s armor, especially when juxtaposed with its contemporaries like XLE.

While IYE certainly has its merits, in my view, it may not be the optimal choice for maximizing returns in the current bullish oil phase. Investors might find it worthwhile to broaden their horizons, exploring alternative ETFs that align better with their investment goals and promise superior returns.

Read the full article here