Hims & Hers Health, Inc. (NYSE:HIMS) has been on my personal radar pretty much since its market debut via SPAC in 2020, but I never actually decided to really dig deeper into the business and thus to ever initiate a position. Too much was going on at the time, too many SPACs were miserably failing and frankly part of me expected HIMS to slowly fade away as well. The stock price movement over the past 3 years also hinted at a challenged business given that still now the company is trading far below the initial $10 price set by the SPAC.

To my surprise, after reviewing HIMS I completely changed my point of view. The company seems very healthy, it’s growing at incredible speed and has also hinted at possibly being consistently profitable on a Free Cash Flow basis from this point forward. Management has a clear path forward to fuel much more growth ahead, by increasing the company’s offerings while also expanding into new geographies. I actually think that the stock might represent a great value at today’s depressed price and thus I believe it is a strong buy.

Modern and customizable health care for everyone

Hims is on a mission to provide a better solution to manage certain health conditions through a digital platform. The company primarily offers treatment for sexual health, hair loss, dermatology, mental health, and primary care. Hims connects patients via telemedicine with healthcare professionals who are then able to prescribe medications that will be fulfilled online. Hims also provides a range of educational content regarding general health and wellness which is accessed on the website or through an official app. On top of this, Hims develops over-the-counter medications and supplements that may be recommended by healthcare professionals following a visit but are also available in top retail locations in the United States.

Hims & Hers Second Quarter 2023 Presentation

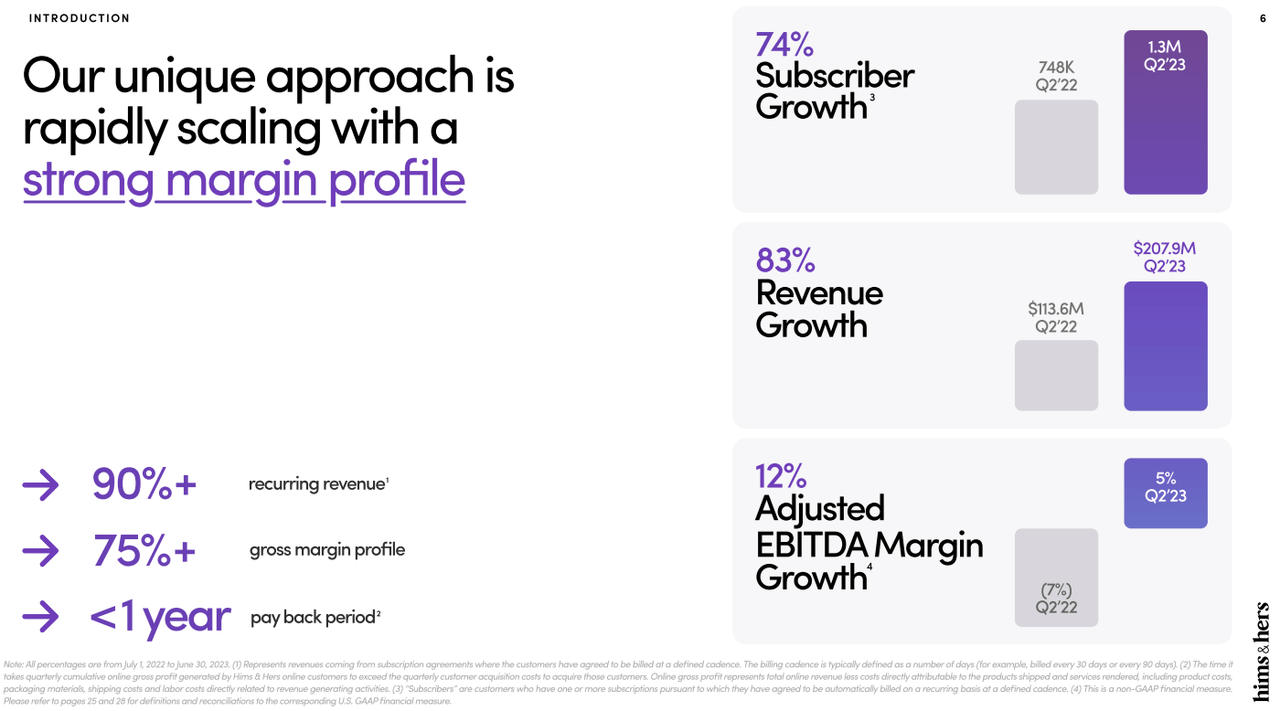

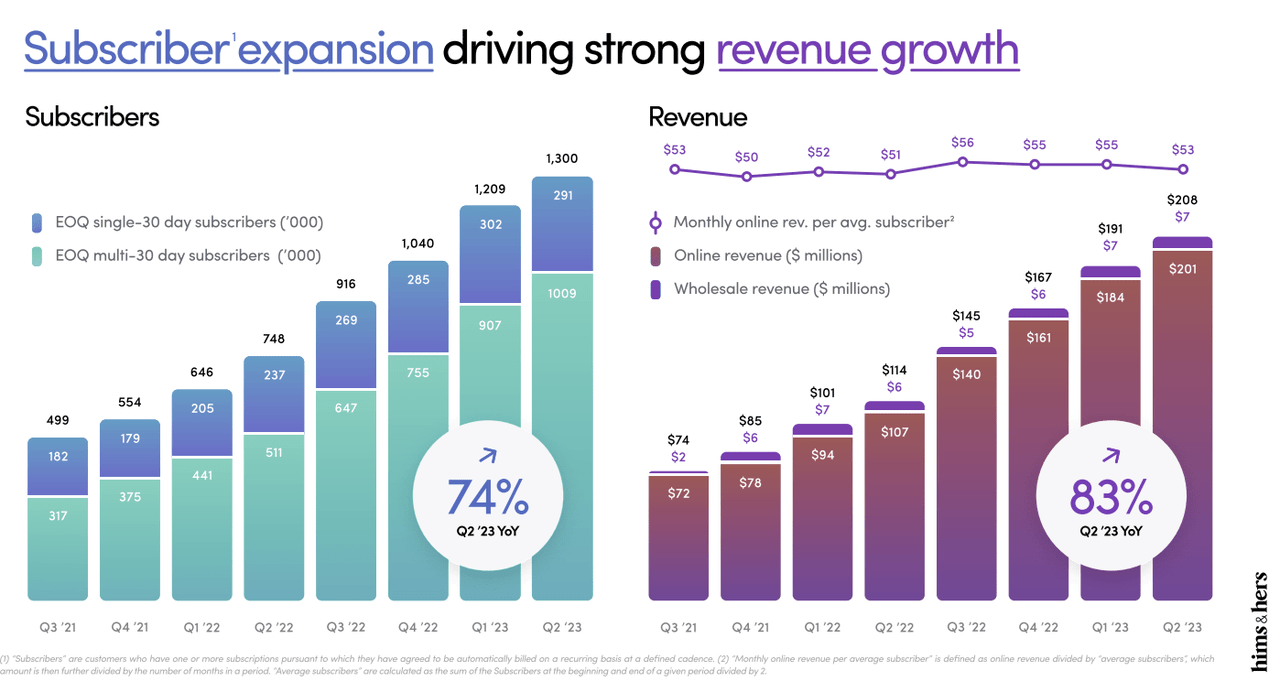

The company targets specific conditions that are generally of a sensitive nature and that patients often don’t feel comfortable talking in person about (such as erectile dysfunction or hair loss). Many of these issues require sometimes a very long ongoing, recurring care and HIMS has done a great job so far offering constant care via subscription plans. Thanks to effective marketing depicting the company as a modern, personalized solution to sensible issues, HIMS managed to attract a growing number of subscribers (the latest figure is 1.3 million).

One of the biggest selling points for HIMS is its capacity to provide its customers with personalized care plans, tailored to specific individual needs. From the latest call:

Our confidence in personalized solutions is high, based upon insights and feedback from hundreds of thousands of customers on our platform. […] Over 35% of online revenue from customers acquired in the second quarter came from personalized treatments. […] In Hims Hair, over 80% of new subscribers in the quarter opted for personalized treatment. […] They select to get more, willing to pay more, engaging with the platform more, adhering to treatment more, and even indicating that they have no desire to return to the world of generic treatment.

The way Hims & Hers is able to provide precision medicine to its customers is the availability of high-quality data on its customers, as well as AI capability in interpreting it. On AI, it is not very clear to me yet if there is anything tangible here or is just a sapient use of trendy buzzwords: management hinted that during the next quarter, they will be able to showcase in detail how AI is being used behind the hood through an application called MedMatch. For now, that’s a wait-and-see for me.

The business has grown at an incredible pace

On the business side, many of the offerings listed on the company’s app or website are available to customers mostly on a subscription basis. As mentioned before, HIMS primarily treats patients that require ongoing care, and subscription plans allow customers to automatically receive medications at a cadence of their choice, based on their needs. That is a great business to be in as it allows HIMS to generate revenue that is highly predictable.

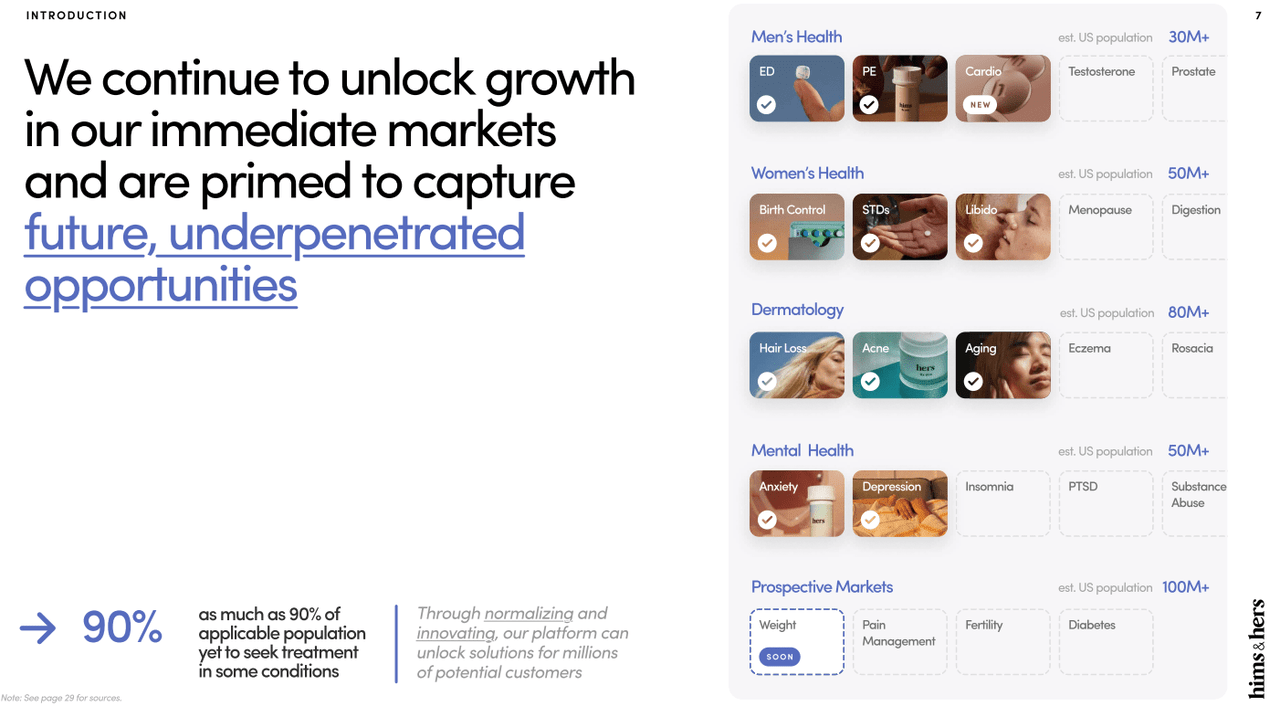

Exciting pipeline of new market segments (Hims & Hers Second Quarter 2023 Presentation)

HIMS is still laser-focused on growing as fast as possible, as evidenced by sky-high sales and marketing expenses (in the latest quarter 51% of revenue was directed toward marketing expenses alone). The way management plans to grow is first and foremost by growing its customer base and brand awareness; secondly, HIMS has a large pipeline of future expansions into new segments of healthcare, a strategy well implemented already by management so far. In the next few years, HIMS has plans to target areas such as testosterone treatment, menopause, sleep disorders, PTSD, weight management, diabetes, and others as examples of future areas of interest. The common denominators among these ailments are that they can easily be treated through telehealth, they require ongoing and recurring care and regular established medications have been identified for their treatment.

The latest segment that was launched was cardiovascular care (“Heart Health by Him”), which debuted during the summer 2023. Management estimates that nearly 100 million people in the US are suffering from some kind of heart disease which makes it a potentially very lucrative market to tackle.

Hims & Hers Second Quarter 2023 Presentation

Revenue growth has been nothing but spectacular since the company joined the public market in 2020. On a YoY comparison, HIMS has generally recorded amazing Revenue growth every quarter in the 70%-90% range. The latest results available show 83% YoY growth to $207.9 million for Q2 2023, thanks in particular to 74% growth in subscribers to 1.3 million. The quality of the business model is also evident by the great margin profile, with gross margins always stable between 73% and 80% for the past 3 years.

Hims & Hers Second Quarter 2023 Presentation

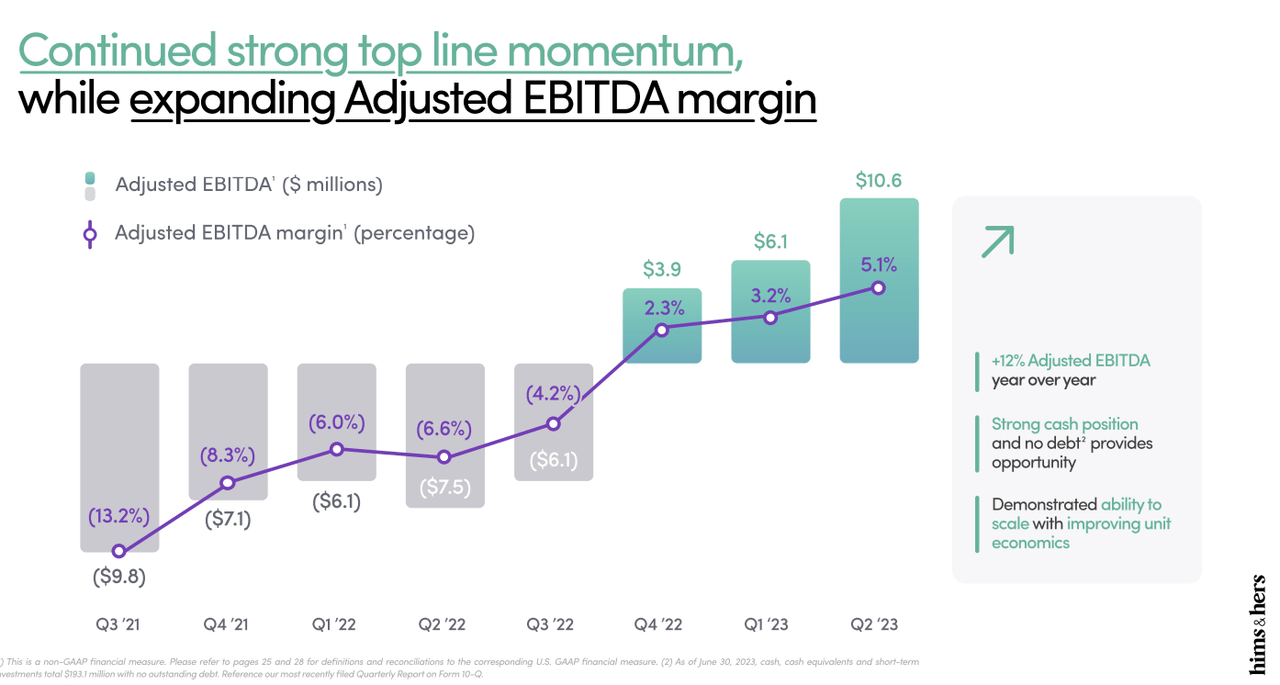

The latest guidance released by management is hinting at a modest slowdown in the growth pace, although in absolute terms it remains quite stellar. For the third quarter 2023, management is forecasting between 50% and 53% top-line growth, while for the full year, it is expected that Revenue will reach around $840 million for a 59% growth at the midpoint of the guidance. I am not particularly worried by the slowdown as the bigger HIMS gets, the harder it will be to maintain a sky-high growth pace, that is a given. About 59% top-line growth is still amazing, and management reaffirmed their goal for 2025 to reach at least $1.2 billion in revenue and $100 million in adjusted EBITDA.

Moreover, one of the culprits for the slowdown will be a negative impact between $12 million and $18 million in the second half of the year due to strategic pricing changes that the company willingly adopted. Based on these changes, customers will have access to personalized care for somewhat less than before, a tradeoff that should however reduce churn and improve subscription duration. From the latest call:

We are already seeing the signs that these strategic actions are having a strong market impact. After the implementation of strategic pricing adjustment the ratio of new Hims & Hers loss subscribers that selected a personalized offering with the duration of five months or more, increased over 25 points during the course of the second quarter.

What is most exciting about HIMS in my opinion is that it is constantly providing signs of improving profitability metrics alongside growing Revenue super-fast. Over the years, the adjusted EBITDA margin went from negative 12.2% to positive 5.1% in a very steady and consistent way, as perfectly exemplified by the slide presented below. Even on a Free Cash Flow basis, the company posted for the first time the second quarter in a row with positive FCF, which came in at a record $9.9 million. It is hard not to be excited about a business that is growing very fast, is strongly hinting at growing profitability, and with such a high number of growth initiatives ahead.

Hims & Hers Second Quarter 2023 Presentation

Key Takeaways and Valuation

Overall I am really impressed with this one. The company has performed tremendously well, has a very interesting pipeline ahead of new market segments to enter, and potentially can also expand internationally further after starting to operate in the UK, their first international market. I love seeing fast-growing companies rapidly reaching profitability because that has truly the potential to unlock a lot of value for shareholders.

Is today’s price a good entry point? As always with growth stocks that is a particularly hard question because at this stage the company is not optimized for profitability, which makes any standard metric such as Price to Earnings or Price to FCF nearly useless.

I do not normally like Price to Sales as a metric because there is a great deal of difference in the quality of Revenue between different businesses based on their margin profile; however, as explained before HIMS’s gross margins are very exciting at over 80% in the latest quarter, which makes any additional revenue earned by the company very valuable. I have to be honest, I find it quite shocking seeing HIMS trading at 1.57 FWD P/S, for a company growing this fast and with such high gross margins the market is clearly severely discounting something that at the moment I personally do not see. I understand that HIMS is probably years away from generating high earnings, however, the company seems able from now on to fund itself, has $193 million in cash, and has no debt on the balance sheets. The stock is trading at $1.33 billion of market cap, which means that if management will hit the 2025 revenue and adjusted EBITDA target the stock is now trading nearly at FY2025 P/S of 1 and P/EBIDTA (adjusted) of 13. That is frankly shockingly low for such a high-growth company.

I personally think that the current market cap might represent an excellent entry point for a small, speculative position in a well-balanced portfolio. I will therefore most likely open a small position to slowly accumulate more on stock weakness.

Read the full article here