Crocs, Inc. (NASDAQ:CROX), together with its subsidiaries, designs, develops, manufactures, markets, and distributes casual lifestyle footwear and accessories for men, women, and children worldwide.

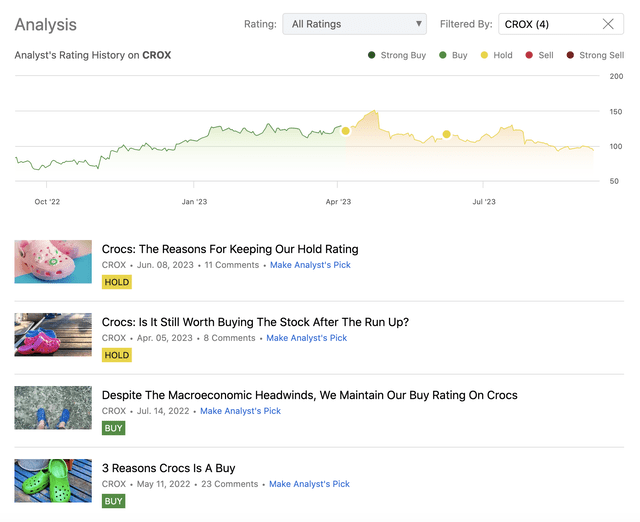

We have started coverage on the company in May 2022 with an initial “buy” rating, which we have maintained until April 2023. In April, we have decided to downgrade to a “hold”, due to macro- and microeconomic headwinds, including depressed consumer confidence levels, elevated inflation levels, and deteriorating profitability, with increased valuation metrics.

Since our first article, the stock has gained more than 80%, substantially outperforming the broader market.

Analysis history (Author)

Today, our article will be focusing on what to expect from the firm’s financial results in the third quarter. The primary question is, is the “hold” rating still justified or today may be a good opportunity to buy the stock as the price has been trending downwards in the past months?

To answer these questions, we will be discussing two aspects: valuation and macroeconomic factors.

Valuation

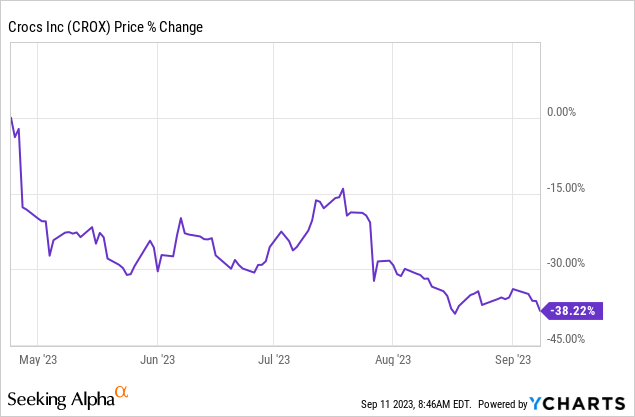

The stock price has peaked in April 2023 and since then it has dropped by more than 38%. This is a remarkable change in the market value of the firm, and it naturally has a meaningful impact on the firm’s valuation multiples.

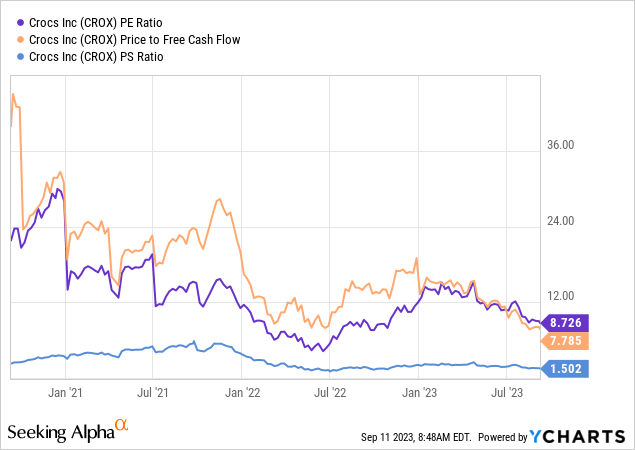

The following chart shows how three commonly used price multiples, namely the P/S, the P/E, and the P/FCF ratio have been developing over the past three years.

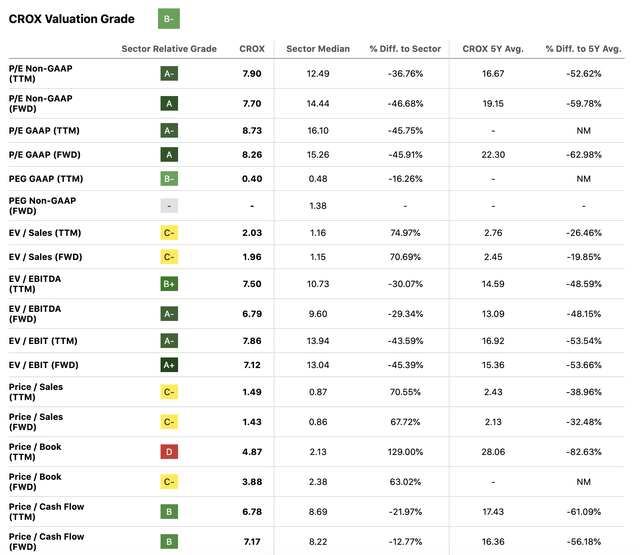

It is clear that all three of them have been trending downwards. As a result, CROX’s stock is currently selling at a significant discount compared to the consumer discretionary sector median, its own 5YR averages, and also its narrower peer group, according to most metrics shown in the table below. These exceptions are the sales and book value multiples, which we believe are less relevant figures for a profitable and rapidly growing firm.

Valuation metrics (Seeking Alpha)

Comparison (Seeking Alpha)

Now, these figures by themselves do not mean that the stock is currently undervalued. Value traps also appear attractive from a valuation point of view, but they normally have poor prospects looking forward and that is why they have low price multiples.

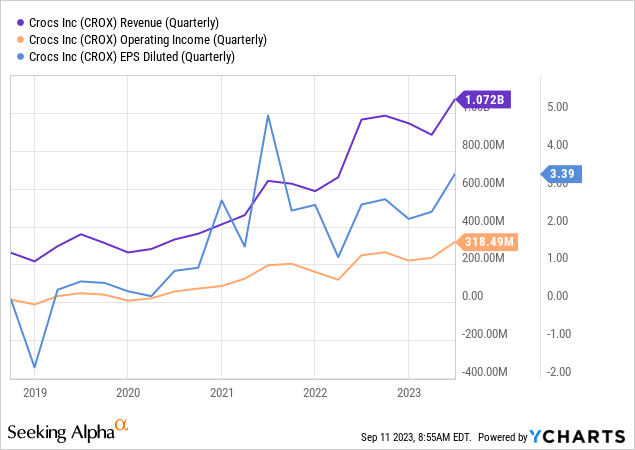

We, however, do not believe that CROX is a value trap. The company has been showing impressive growth in the past years. Revenue, operating income, and EPS have all been trending upwards.

Last, but not least, we also need to mention the firm’s commitment to returning value to its shareholders in the form of share buybacks. While this is not directly reflected in the valuation, it is an important factor looking forward to, which shapes the earnings per share figure.

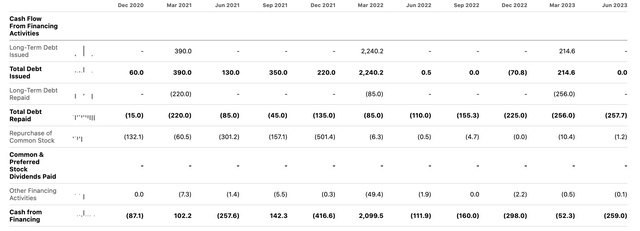

The following table shows how much the company has been spending on share buybacks in the past quarters. While the amount spent on repurchases has declined, we believe that it is directly linked to the valuation. Now that the valuation has fallen, we expect that Crocs will once again start buying back its shares. Looking forward, in our view, this could be a positive catalyst for the stock price and potentially generate capital gains for the investors. Crocs has once again highlighted recently that they are aiming to have a healthy balance between share buybacks and debt repayments.

CFO (Seeking Alpha)

While many retailers have been struggling due to softer-than-expected demand and increased costs due to inflation, we believe the current valuation of CROX makes the stock an attractive opportunity for investors looking for value and growth.

Macroeconomic factors

When talking about the consumer discretionary sector, normally we discuss two macroeconomic factors that can have a significant impact on the financial performance of companies. These two factors are consumer confidence and inflation. On one hand, consumer confidence has a material impact on demand, while inflation has a significant influence on costs.

Consumer confidence

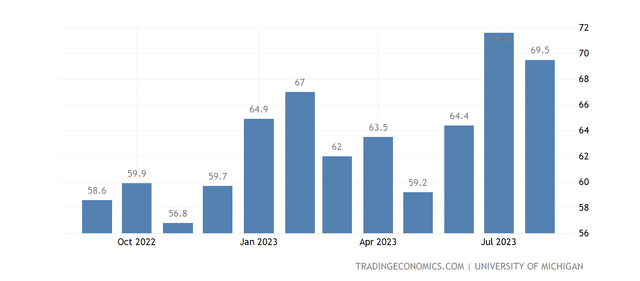

In our previous writing, we have pointed out that consumer confidence has been staying at a relatively low level in the first half of the year, which likely had been (potentially still has) a negative impact on the demand for discretionary products.

Since then, however, the reading has substantially increased. In our opinion, this development is likely to have a positive impact on the demand for CROX’s products as people are becoming more and more willing to spend on discretionary items as their financial outlook becomes clearer.

U.S. Consumer confidence (tradingeconomics.com)

As consumer confidence is a leading economic indicator, we do not expect the positive impacts immediately. We believe the third quarter results may still be defined by a more cautious consumer, but from Q4 onwards we expect to see a positive development.

As a risk, it is important to note that the demand for HEYDUDE brand is considered relatively uncertain, as there is not much historical data available for evaluation. For this reason, analysts have stayed relatively conservative and assume a significant reduction in demand on a wholesale level for HEYDUDE in the first half of 2024.

Further, it is also important to note that student loan repayments will restart in October, which may also have a meaningful impact on the demand.

Inflation

Inflation has been hurting many firms in the past two years. The inflation level has been far above historical averages and far above the target rate foreseen by the Fed. As a result, costs have been trending up, putting significant downward pressure on the margins.

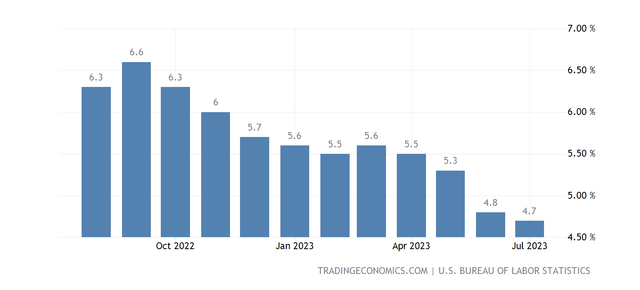

While inflation is still elevated, it has been declining gradually since its peak in 2022.

U.S. Core inflation (tradingeconomics.com)

Core inflation rate in the United States has fallen from 6.6% to as low as 4.7%, due to the Fed’s aggressive rate hikes to combat inflation. We believe the Fed is likely to remain aggressive as long as the inflation does not come down to its foreseen target level.

Looking forward, we expect the inflation to keep gradually decreasing, which is likely to have a positive impact on the costs and therefore on the profitability of the firm in the near- to mid-term.

Important to note that high interest rates can also make debts more expensive, which means that refinancing existing debts can lead to higher interest costs. However, we believe that due to the firm’s strategic focus on debt reduction, this is not likely to pose a significant risk for shareholders.

Conclusions

The macroeconomic environment remains uncertain. While declining inflation and improving consumer confidence could be promising signs, the restart of student loan repayments and the conservatism on HEYDUDE demand may have a negative impact on the overall demand in the near term.

The firm has become more attractive from a valuation perspective than it was during our last writing. The firm appears to be significantly undervalued compared to the consumer discretionary sector median, its own 5YR averages, and also to its narrower peer group.

For these reasons, we believe that CROX could be an attractive buy, despite the uncertainties.

Read the full article here