Dear subscribers,

Quality prevails – that’s the core of my investment approach. I don’t really care how long it takes for quality to recover, provided that it’s within a 5-7-year cycle. If I can get my quality for a cheap enough price, I’m willing to accept a very long correction period.

There are plenty of examples of this in the REIT space – even plenty of examples that have already begun their correction since I started investing in them. That REITs have been punished fairly extensively is no secret – and subsectors like healthcare and office have been punished very excessively, with some in recovery. Not all are yet in recovery. Cannabis, with Innovative Industrial (IIPR) is still in a correctional pattern, though very recently started recovering from the “worst of the worst”.

But the logic and the patterns remain the same. If you buy companies with underlying fundamental quality and upside, ignoring the fear-mongering that sometimes seems immune to logic, then you’re usually in a pretty good place.

I’m not saying surprises can’t happen. They can. But that’s why we diversify. That’s why we don’t go above 4-5% in any one investment, no matter how safe we consider any company to be. That 4-5% is plenty to realize a good upside, and for that upside to be big enough.

With that, let’s review Boston Properties (NYSE:BXP).

Boston Properties – The upside has begun

I bought plenty of BXP back at just above $50/share. All it would take is looking at the valuation trends to know, well, anyone who invested in that is now up 20%. It wasn’t in any way a strange investment, despite the perceived risk that was there, and in some ways still is there.

The arguments against the office sector were clear, and are still fairly clear. Office space isn’t in as high demand as it once was, and it’s unlikely to be in as high demand for the foreseeable future. This impacts Office REIT growth rates, including BXP growth rates. For the next few years, the company is expected to not go above 2-3% per year in terms of FFO.

It’s only natural that this should impact what we should pay for the company, given that it’s possible to get a 4-5% yield fairly easily completely risk-free.

However, this has also resulted in some fairly amazing buying opportunities – that I took advantage of.

Boston Properties is one of those opportunities.

Since I bought the lion’s share of my position, the REIT is up over 40% including FX. My YoC for BXP is over 8%. What’s the yield for the company today?

That would be 5.9%.

The company has seen significant normalization. I only hope that many of you ignored the short-term illogical view of some of the nay-sayers, which I view it as being, and were able to put capital to work here, ensuring a good return. One of the more difficult things to do is to move into opportunities like this, when they are cheap, with a high conviction.

Even I am, at times, still struggling with this. It takes courage and conviction to go against the grain, and it should never be done with a lack of logic or fundamentals.

BXP, for all the risk that’s argued about here, has never been unsafe. The company is BBB+ rated and owns premier office space.

TSR for BXP investors since the 1997 IPO comes to over 580% – and that is even at the current valuation. If you had woken up to the company’s overvaluation a few years back, you could have easily made double that TSR, and the same potential was something I saw a few months back, and was very vocal about when the company was close to $50/share.

The company’s operating areas may not sound like the most exciting or the least impacted, given that we’re looking at properties in Boston, Washington DC, San Francisco, Seattle, and Manhattan. Every single one of these geographies is currently mostly out of favor, which goes some way to explain at least part of the discount, which by the way is still there today.

The latest set of results we have are the 2Q23 ones. Those results, once again, showed no evidence of a structural slowdown or shift to the company’s operations.

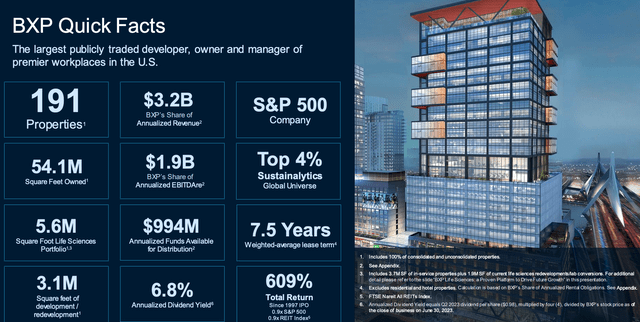

BXP IR (BXP IR)

That isn’t to say that there isn’t a vacancy in the company’s portfolio. We’re seeing a double-digit vacancy for BXP, with a higher vacancy rate for what the company considers non-premier spaces.

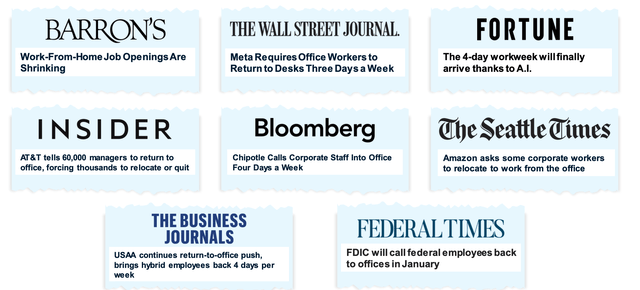

However, the notion that the work-from-home fad is here to “take over” is something I have an issue with – the proof is quite the opposite, with more and more companies demanding that workers return.

BXP IR (BXP IR)

While we may, once again, see a decline in demand for office space, this decline and these trends are already part of the current set of expectations. The 2023E FFO already includes the expectation of a decline and a higher vacancy rate. At the same time, the company is seeing growth in new business areas such as AI.

The notion that there isn’t growth here, or leasing activity is completely wrong. Not only is the company signing hundreds of thousands of square feet in new leases, with an average length of 8 years, in 2Q23 alone, but those leases also come at a positive mark/market in net rents. If you need further proof that the company’s strategy is working well, then all you need do is look at the company’s leasing trends – on a forward basis, with its pipeline for active development already over 50% pre-leased.

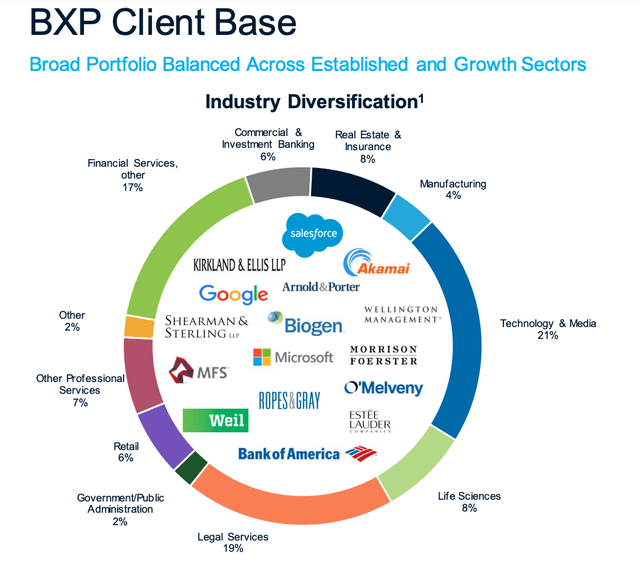

Part of the company’s challenge here is its operating geographies. However, if you’re open to the notion that not all of these geographies are bad, which you should be, then there is an upside to the company. The company has exposure to some of the best brands on earth, and the continued leasing interest confirms that even if some of those geographies are in decline, it’s not as bad as all that.

BXP IR (BXP IR)

The company’s strategy at this time involves making sure that its portfolio is refreshed to the degree where it can sustain and resist the current downturns. This is done through recurring upgrades, and recycling assets where necessary, aside from its pipeline.

I said in my last article that I don’t see the fundamental and long-term downside for this company – but I did expect the downturn, or even hope for it, to last longer than it has. Imagine picking this company up at over a 8-9% yield with the upside we’re seeing now. I did invest in BXP with conviction – over 3% of my commercial portfolio is in the company now, a result of the growth we’re seeing. I’m not selling my stake either – far from it. The REIT still has an upside working for it, though the upside is now far lower than it was previously.

It highlights the crucial importance of being willing to invest with conviction at low valuation, as well as two of my primary rules for successful investing.

1. Focus on quality.

2. Patience.

That’s really it.

Let’s look at valuation.

BXP Valuation – Plenty to like, just not as much as 3 months ago.

When last I wrote about Boston Properties, the sense was of a capitulation for the office sector overall. Quality names were trading at garbage-type levels, with upsides well over 25% per year to normalized P/FFO valuations.

Those times are, unfortunately, mostly over for Boston Properties.

Because in the end, this company is a REIT that is forecasted to essentially grow 0-3% for the next few years – that requires a bit of discounting. Anything above 10-12x P/FFO just isn’t realistic, despite the credit rating. The fact is that there are qualitative REITs today that offer a realistic and conservative higher upside than Boston Properties.

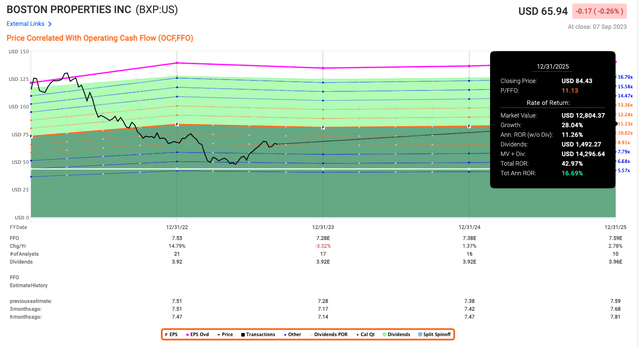

As you may recall, my minimum conservative investment requirement for an investment into a business via the common shares comes to 15% per year. Boston Properties, at the midpoint of 11x P/FFO, now offers 16% – or thereabouts.

Boston Properties Upside (F.A.S.T graphs)

So, while investing is still very much possible, I want to highlight just how much less attractive those investors are putting their money to work today.

Back in May/June, your comparative upside to the premium was over 50% per year. today it’s less than 40% per year – and that’s to the premium of around 17x, which I don’t consider valid for a REIT growing 0-3% per year.

So after over 35% RoR in a short time, quite a bit of your upside is already there. And for those of you who didn’t invest a few months ago, I have this question.

What has changed in the meantime?

What has changed from when BXP traded at almost below $50/share to where it’s now back above $65/share, and I’m seeing investors seriously argue for investing in the company – people that seemed intent to avoid this company only a few months back?

Nothing has changed, beyond that the market has corrected some of the undervaluation. The estimates are almost identical. The 2Q23 results could have been and were expected by me and other analysts.

Investing in a time when a company or a sector is hated is hard – you’ll typically have everyone “against you”. That’s typically the time when I invest.

Don’t get me wrong. You can’t just pick any hated company or sector and invest willy-nilly. But we at iREIT on Alpha are pretty apt at picking out the qualitative players in the various sub-sectors in the REIT space.

Anyone who seriously believes, even with BXP’s somewhat unfavorable geographical exposure, that the company is in for a significant downturn or risk should obviously think twice prior to investing here. But in those cases, I’d also love to see and hear the logic and estimates behind those. Because I have crunched the numbers, and estimates, in a variety of scenarios. And under no scenarios I can find beyond catastrophe – which I don’t consider likely – I find the company experiencing fundamental decline to where their survival is threatened.

My previous price target for this company was $80/share. I’m not shifting this PT here, because nothing has changed as I see it.

But I hope this article comes as a bit of a lesson to those of you who want those “Ultra-value picks” that we deliver, but then wonder where they are.

The fact is that when I put out most of my ultra-value picks, only very few investors actually go into them – because of the perceived safety they have at that particular time. When I invest in them, it “seems” realistic to most investors that they are in for a serious decline. Remember, we can’t say when the company’s turnaround. It could have taken BXP another month. Or a year. Or more.

All we can do is pick quality and go in with conviction when they are undervalued.

And I also don’t want to give the impression that I’m some sort of flawless stock picker. When it comes to tech, for instance, I’m not that good (yet) at picking undervaluation reliably. If I had been, especially for the larger caps, I would have gone into Meta (META) at a cheap valuation. I didn’t.

But when it comes to anything real estate, industrial, basic materials, consumer goods, and the like? I consider myself knowledgeable in the companies I cover there.

And when it comes to BXP, I still like what I see.

Thesis

-

Boston Properties is one of the 4 highest-quality office REITs I follow and invest in. The company has a solid credit rating, good yield, good safety, and underlying fundamentals that are going the right way. Between encouraging valuation trends, insider buying, excellent scores, and good results, I do not see a long-term negative trend for this company materializing – unless you count low growth as a negative trend.

-

Based on this, I am positive on BXP, and give the company a “BUY” rating, though I will follow quarterly results closely to note any sign of serious deterioration.

-

My PT for the company comes to a bare minimum of 10-11x P/FFO, which is around $80/share conservatively.

Remember, I’m all about :1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

-

This company is overall qualitative.

-

This company is fundamentally safe/conservative & well-run.

-

This company pays a well-covered dividend.

-

This company is currently cheap.

-

This company has a realistic upside based on earnings growth or multiple expansion/reversion.

BXP fulfills all of my fundamental requirements for an investment. Because of this, I consider it a “BUY”.

Read the full article here