Introduction

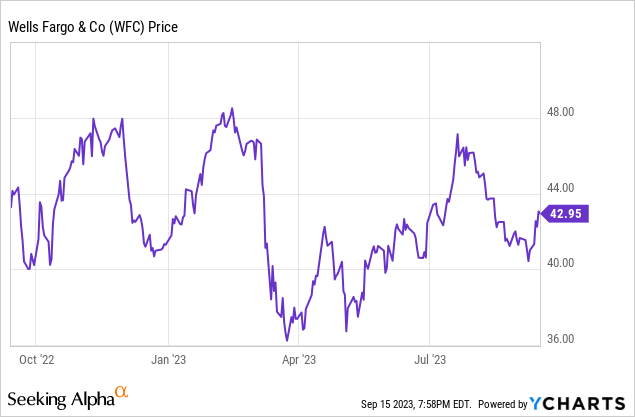

I don’t think Wells Fargo (NYSE:WFC) needs a lengthy introduction as it’s a household name in the US financial sector. Rather than discussing the common shares, I wanted to zoom in on the non-callable preferred shares L which are trading with (NYSE:WFC.PR.L) as a ticker symbol. While the potential for capital gains is limited, those preferred shares offer a 6.5% yield which is pretty attractive, even in the current climate of high interest rates.

A closer look at Wells Fargo’s H1 results

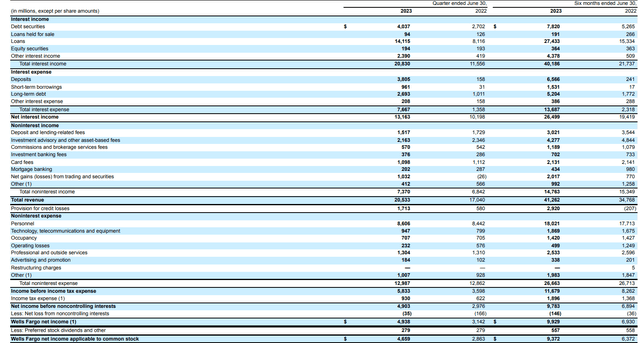

Before discussing the specifics of the Series L preferred shares, I wanted to make sure Wells Fargo ticks two important boxes. First of all, I want to make sure the dividend coverage ratio is strong, and secondly, I want to make sure the asset coverage ratio is sufficient as well. Looking at the bank’s income statement (shown below), we see the bank reported a total interest income of $20.8B in the second quarter of the year, and after deducting the $7.7B in interest expenses, the net interest income was approximately $13.2B. That’s almost 30% higher than in the second quarter of last year and that definitely is a positive surprise as it indicates Wells Fargo is navigating through the current volatile times pretty well.

Wells Fargo Investor Relations

Meanwhile, the total non-interest income came in at $7.4B while the non-interest expenses increased to $13B for a total net non-interest expense of $5.6B. This resulted in a $5.8B pre-tax income after also taking a $1.7B loan loss provision into account, and as you can see in the income statement above, the net profit was approximately 4.9B.

From that amount, the bank had to take the impact of non-controlling interests into consideration, and the $35M net loss attributable to those non-controlling interests caused the net income attributable to the shareholders of Wells Fargo to jump to $4.94B. The total amount required to cover the preferred stock dividends was $279M resulting in a net income of $4.66B attributable to the common shareholders of Wells Fargo.

More importantly, this also means the bank needed less than 6% of its attributable net income to cover the preferred dividends and that is a pretty healthy ratio.

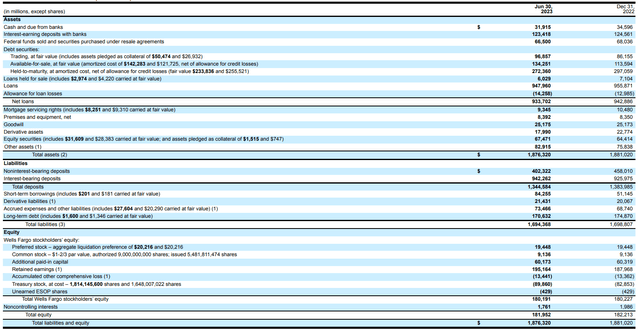

Secondly, I always like to have a look at the balance sheet of a company. And looking at Wells Fargo’s balance sheet (shown below), you see the total liquidation value of the preferred shares is just over $20.2B.

Wells Fargo Investor Relations

While that is a lot of money by any standard, considering the total equity value exceeds $180B, there’s approximately $160B in common equity which ranks junior to the preferred shares. And that is a pretty decent cushion, especially when you realize the bank recorded a net attributable profit of $9.4B of which $2.25B was paid out in cash dividends (the vast majority of the earnings was spent on share buybacks).

The details of the Series L preferred shares

The Series L preferred shares are an interesting issue. Wells Fargo is “stuck” with this preferred share after its acquisition of Wachovia during the Global Financial Crisis. This specific preferred share has an issue price of $1,000 per share and is non-callable. This means Wells Fargo cannot call these preferred shares for redemption and will have to continue to make the 7.5% preferred dividends. Those preferred dividends total $75 per share per year, payable in four equal quarterly installments of $18.75 per share. Based on the current share price of approximately $1150, the yield is currently approximately 6.5%.

Seeking Alpha

The owners of the preferred shares have the right to convert the preferred shares into common shares of Wells Fargo in a ratio of 6.3814 common shares per preferred share. This means the conversion price is $156.7, and with the current share price of the common shares trading at less than $45/share, it is pretty clear not a single preferred shareholder will convert the preferred shares into common shares.

Although this series of preferred shares cannot be called by the bank, there is one way for Wells Fargo to get rid of these shares. When the common share price trades at 130% of the conversion price for 20 trading days during a 30 trading day period, Wells Fargo may convert the preferred shares into common shares. But as 130% of $156.7 equals $203.71, the odds of this scenario unfolding in the next decade are practically zero. And even if that scenario would unfold, the preferred shareholders would still come ahead. If the common shares are for instance trading at $205 and the preferred shares are mandatorily converted into common shares, the 6.3814 common shares will be worth north of $1300 per preferred share for a capital gain of approximately 13%.

Investment thesis

Although the preferred shares issued by Wells Fargo (or in this case, the Wachovia preferred shares it absorbed with the M&A deal) are non-cumulative in nature, they do offer a pretty intriguing 6.5% preferred dividend yield. As these preferreds are non-callable and as the price of the common shares would almost have to five-fold from the current level, it’s safe to assume this series of preferred shares will remain outstanding for quite a while.

As Wells Fargo remains very profitable and only needed less than 6% of its net income to cover the preferred dividends, I’m quite satisfied with the dividend coverage ratio. And while the preferred dividends are non-cumulative, there doesn’t appear to be a reason for Wells Fargo to suspend the preferred dividend payments and I expect the bank to continue to make the quarterly preferred dividend payments.

Read the full article here