This article is part of a series that provides an ongoing analysis of the changes made to Prem Watsa’s 13F portfolio on a quarterly basis. It is based on Watsa’s regulatory 13F Form filed on 8/14/2023. Please visit our Tracking Prem Watsa’s Fairfax Financial Holdings Portfolio series to get an idea of his investment philosophy and our previous update for the fund’s moves during Q1 2023.

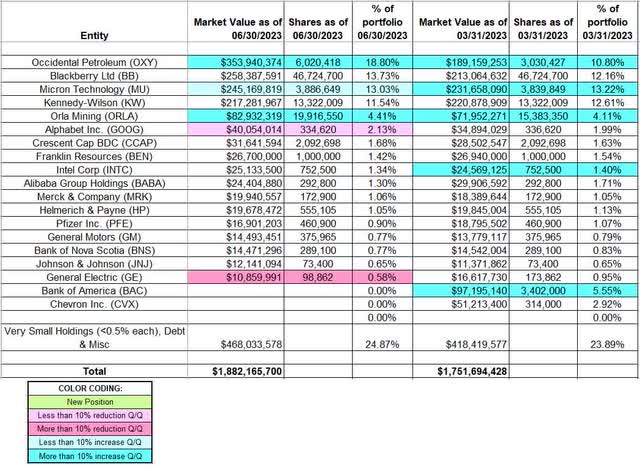

This quarter, Watsa’s 13F portfolio value increased from $1.75B to $1.88B. There are 61 securities in the portfolio, but it is concentrated among a few large stakes. The focus of this article is on the larger (greater than 0.5% of the portfolio each) equity holdings. The top three positions are Occidental Petroleum, Blackberry, and Micron Technology. Together, they account for ~46% of the entire 13F portfolio.

Note 1: Fairfax Financials’ (OTCPK:FRFHF) 13F holdings only represent a small portion of their overall investment portfolio. The total size as of Q2 2023 was ~$58B of which ~$6.5B was in cash and short-term positions. FRFHF currently trades at ~$846 compared to Book Value (Q2 2023) of ~$834 per share. The equity portfolio was 100% hedged starting from around 2003, but those were removed in Q4 2016.

Note 2: Prominent equity allocations not in the 13F report include investments in Greece and India (OTCPK:FFXDF). Greek allocation primarily consists of a ~32% ownership of Eurobank (OTCPK:EGFEY) (OTCPK:EGFEF). Other prominent stakes include ~27% of Thomas Cook India, 54% of Bangalore International Airport Limited, and 31% of Quess Corp Limited.

Stake Disposals:

Bank of America (BAC): The 5.55% BAC stake was established during Q2 and Q3 2022 at prices between ~$27 and ~$37. It was sold this quarter at prices between ~$27 and ~$31. The stock currently trades at $28.84.

Chevron Inc. (CVX): The ~3% of the portfolio CVX stake was doubled in Q2 2022 at prices between ~$142 and ~$181. The disposal this quarter was at prices between ~$151 and ~$172. The stock is now at ~$167.

Stake Increases:

Occidental Petroleum (OXY): OXY is now the largest 13F stake at ~19% of the portfolio. It was built during the last four quarters at prices between ~$57 and ~$67. The stock is now at $66.15.

Micron Technology (MU): MU is currently the third largest 13F position at ~13% of the portfolio. It saw a ~60% stake increase in Q1 2019 at prices between $31 and $44. The position was increased by ~115% in Q1 2020 at prices between $34.50 and $60. That was followed with a whopping ~400% stake increase during Q3 2022 at prices between ~$49 and ~$65. That was followed with a ~12% further increase last quarter. The stock currently trades at ~$70. There was a marginal increase this quarter.

Orla Mining (ORLA): ORLA is a 4.41% of the portfolio stake purchased during Q3 2022 at prices between ~$2.40 and ~$3.70. The last quarter saw a ~45% stake increase at prices between ~$3.85 and ~$4.90. That was followed with another ~30% increase this quarter at prices between ~$3.90 and ~$4.85. The stock currently trades at $4.50.

Stake Decreases:

Alphabet Inc. (GOOGL): GOOG is a ~2% stake purchased in Q1 2020 at prices between ~$53 and ~$76. There was a ~22% stake increase in Q4 2020 at prices between ~$71 and ~$91. This quarter saw a marginal reduction. The stock currently trades at ~$138.

General Electric (GE): The very small 0.58% stake in GE was reduced by ~45% this quarter.

Kept Steady:

BlackBerry Ltd (BB): BB stake is now at ~14% of the portfolio. The position was first purchased in 2010 at around $50 for 2M shares. The stake was aggressively built up to 46.7M shares in the following years. Their net cost on a fully converted basis is ~$10 per share, and the stock currently trades at $5.39. There has only been very minor activity in the last ten years.

Note: In Q4 2013, Fairfax co-sponsored a cash-infusion of $1B through convertible debentures ($10 conversion price earning 6% interest) – they financed $500M of that transaction and the remaining was funded by a consortium of other investment funds. In Q3 2016, those shares were redeemed, and new ones issued ($605M in 3.75% debentures convertible at $10 due 11/13/2020) to the same entities in a private placement. On 9/2/2020, those were redeemed, and new ones issued ($330M in 1.75% debentures convertible at $6 due 11/13/2023). Assuming full conversion of these debentures, Fairfax would beneficially own ~16.4% of the business (~102M shares).

Kennedy-Wilson Holdings (KW): KW stake is a large (top five) 11.54% of the 13F portfolio position, first purchased in 2010. Q4 2016 saw a ~40% increase at prices between $20 and $23 and that was followed with a ~8% increase in Q1 2018. KW currently trades at $16.54.

Note 1: They also have a 13M share stake in the warrants (7-year term, $23 strike) that they received as part of a $300M investment in perpetual preferred stock (4.5% dividend) made last February. Their overall ownership stake in the business is ~20%.

Note 2: The original 2010 stake was from a private placement for Kennedy Wilson convertible preferred stock. The total investment from that point through Q3 2016 was $645M. Since then, they invested another ~$85M. By EOY 2015, they had already received distributions of $625M and so the net investment was ~$105M. That is compared to the current market value of ~$225M.

Crescent Capital BDC (CCAP): CCAP is a 1.68% of the portfolio stake purchased in Q1 2020 at prices between $6.21 and $17.10 and the stock currently trades at $16.78.

Note: Their ownership stake in the business is ~6.8%.

Franklin Resources (BEN): The 1.42% BEN position was established in Q1 2020 at prices between $15.30 and $26.25, and it is now at $26.25.

Alibaba Group Holding (BABA), Bank of Nova Scotia (BNS), General Motors (GM), Helmerich & Payne (HP), Intel Corp (INTC), Johnson & Johnson (JNJ), Merck (MRK), and Pfizer Inc. (PFE): These small (less than ~1.50% of the portfolio each) stakes were kept steady this quarter.

The spreadsheet below highlights changes to Watsa’s 13F stock holdings in Q2, 2023:

Prem Watsa – Fairfax Financial’s Q2 2023 13F Report Q/Q Comparison (John Vincent (author))

Source: John Vincent. Data constructed from Fairfax Financials’ 13F filings for Q1 2023 and Q2 2023.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here