Investment Rundown

The trajectory for Stepan Company (NYSE:SCL) has been a steady decline the last couple of months and I don’t think the price has by any means managed to approach a level where it looks appealing unfortunately. Based on the FWD earnings multiple the company still displays a premium of over 100% in comparison to the sector median. As the company is included in the specialty chemicals industry they tend to have somewhat volatile earnings reports and results. The last report had the net income come in at $12.7 million, down from the record $52.1 million 12 months earlier. I don’t think it was reasonable to assume that the numbers last year were by any means realistic to maintain. Instead, the price has now been decreasing heavily and a lot of investors are left holding heavy bags.

Estimates suggest a decent bounce back for the earnings, but I am skeptical before I see solid improvements. Until then I think the company offers more downside risk from here and it feels like a falling knife scenario and staying on the sidelines may be the best option. Rating SCL a sell now.

Company Segments

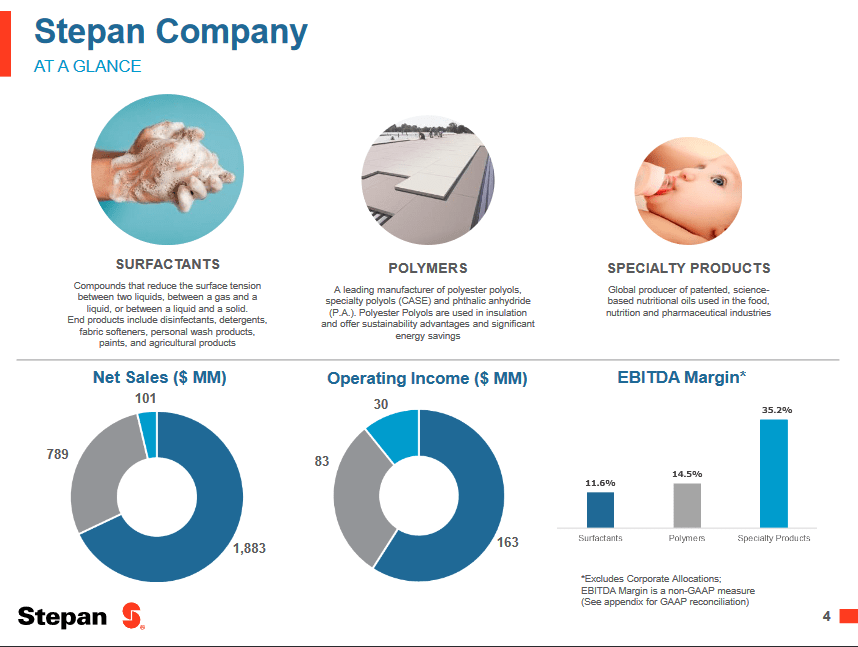

SCL is a global company specializing in the production of specialty and intermediate chemicals for third-party manufacturers. Established back in 1932 the company has managed to grow quite well over the years, with a market cap of around $1.7 billion and an annual 10-year revenue growth rate of 3.66%. SCL operates through three distinct business segments, namely Surfactants, Polymers, and Specialty Products, each contributing to the company’s diverse chemical offerings.

Company Overview (Investor Presentation)

Within its operations, the Surfactants segment specializes in crafting chemical agents that find applications in a wide array of products. These versatile agents are integral components in detergents designed for cleaning clothes, dishes, carpets, delicate fabrics, floors, and walls. Moreover, they play essential roles in various personal care items like shampoos, conditioners, fabric softeners, toothpaste, cosmetics, and more. This is the largest segment in the company and yielded nearly $400 million in sales in the last quarter alone. Going forward this is also the segment where I think most of the attention should be placed as SCL tries to get back to the results they had last year.

Earnings Highlights

Quarter Highlights (Investor Presentation)

As we have learned, the surfactants are the largest segment for SCL and it comprised $391 million in sales last quarter, heavily down from $485 million a year prior. This has come from a decline in volumes of 15%. The sifter pricing environment seems to also be a key driver behind this shift I think. I think that until we see a further uptick in the volumes for the company it will continue in this downward spiral. Apart from this, it seems that SCL is facing challenges from other areas as well, like competitiveness from improvements in the Latin American region. The selling prices for the business were down an additional 5% as the lower material costs forced a softer pricing environment.

Valuation

P/E (Seeking Alpha)

As mentioned earlier, the factor that persists with SCL right now is the right valuation. The company trades above a 100% premium to the sector median based on earnings. That is an outrageous premium in my opinion and with sales declining the company looks even more expensive. I would estimate that the coming quarters will see little remedy in this valuation as SCL sees softer demand and it will likely result in the share price falling even further.

In comparison to a peer like Ingevity Corporation (NGVT), I think SCL doesn’t look like the better option. NGVT trades at a slight discount to the sector median based on earnings. Over the last 5 years as well for NGVT the EPS has at least increased over the last 5 years. SCL has averaged a decline instead. So in short I think the valuation for SCL is far too high and on the surface NGVT looks quite appealing.

Risks

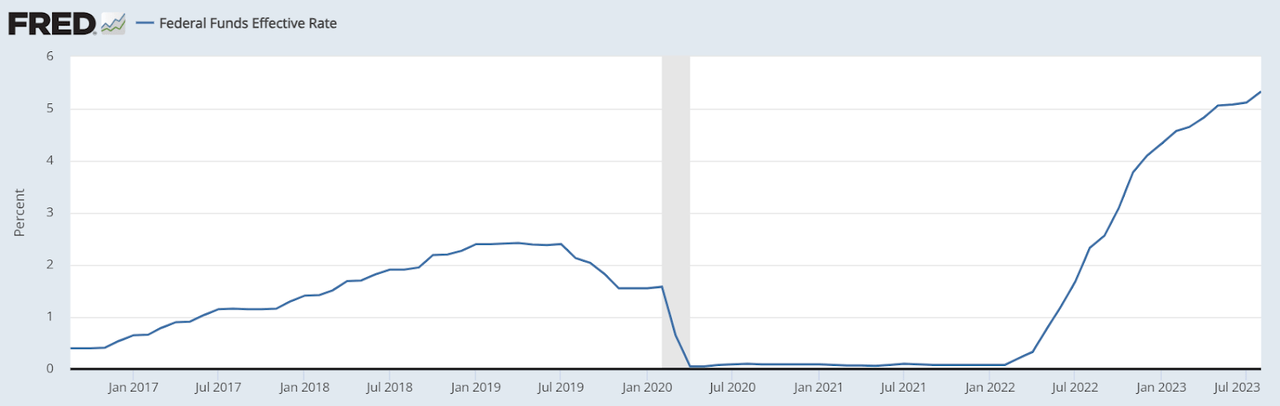

The recent upward adjustments in interest rates have raised concerns about the possibility of a global recession, the severity of which remains uncertain. Such an economic downturn could potentially lead to a significant reduction in overall volumes, sales, and profit margins across various industries.

Interest Rates US (FRED)

This challenging scenario underscores the importance of closely monitoring economic conditions and adapting strategies to navigate potential headwinds effectively. SCL has noted a significant change in volumes for the worse which I think comes as interest rates are taking a toll on the spending power of companies and they are therefore cutting imports, hurting the earnings for SCL ultimately.

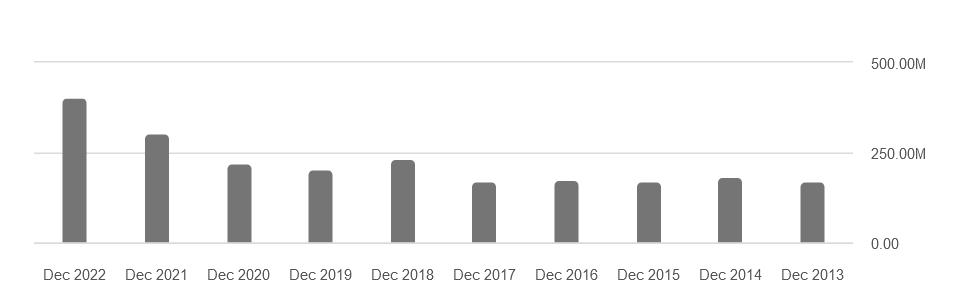

Inventory Levels (Seeking Alpha)

The company may encounter challenges in efficiently depleting its inventories due to a substantial decline in global demand for its products in recent quarters. While the management has shown a modest decrease in inventories over the past two quarters, a continued drop in demand could pose difficulties in converting these inventories into actual cash. It is crucial for the company to closely monitor market dynamics, adapt its production levels, and explore strategies to align its inventory management with evolving demand patterns. If the inventory instead starts to become a drag for the business I fear that the share price will continue to fall as the expense to halt and then try and manage the operations efficiently during high inventory levels will just be too great.

Financials

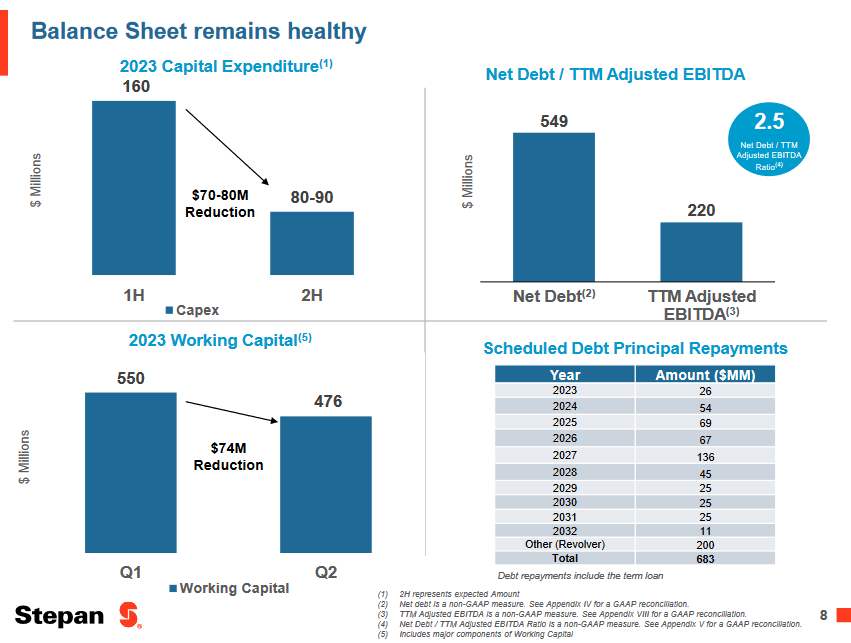

Balance Sheet (Investor Presentation)

Where SCL has been able to get some progress done though is the balance sheet where capital expenditures have been decreased following the softer demand and lower pricing environment. But paying back debt has also been a key priority. SCL has $683 million in total debt with the largest amount maturing in 2027, which is $136 million.

What I think is important to realize though is that SCL still has a larger debt position than December 31, 2022, when it was below $590 million. The cash position has also been decreasing as SCL seems forced to take some from there to pay down debt obligations. So in conclusion, there has been some good progress on the balance sheet and the business is in better shape financially than last quarter, but it’s shrouded by the fact that SCL took on debt that quarter as well. The long-term still holds a significant amount of debt for SCL to pay back, which will take away from the potential of paying out higher dividends for investors.

Final Words

I think that SCL exhibits a falling knife scenario right now where it won’t be bottoming out until there is a clear shift in the volumes of the company. The long-term may be sound, but the short-term holds a lot of downside risk in my opinion. This is what results in me rating the company a sell right now. The p/e of the business is still very high and displays a 100% premium based on earnings in comparison to the sector. The estimates may suggest a bounce back in the bottom line, but I remain skeptical and will be staying on the sidelines here.

Read the full article here