Investment Briefing

AngioDynamics, Inc. (NASDAQ:ANGO) posted its fiscal ’23 numbers last month, with mixed results. On the one hand, divisional growth was strong in Med Tech and parts of its mechanical thrombectomy lines. On the other, profitability didn’t even attend the party, whereas investors were left with a hangover from the downsides in its stock price, as the 18-month downtrend continues well in situ [Figure 1].

In the last ANGO publication, I rhapsodized at length about the importance of turning a profit and beefing up cash flows. The company’s investment needs aren’t high, but it has ambitious growth plans, and the cash for this needs to come from somewhere. Turning to its ’23 numbers, the major takeout was the Med Tech segment, ANGO’s new focus area. And for good measure, too, it’s also the higher growth, higher-margin business. Per the CEO on the call:

In 2019, we began a transformation of AngioDynamics. The first step of the transformation was to fundamentally change our portfolio to incorporate platform technologies that can provide a unique advantage and compete in higher-growth, high-margin, large total addressable markets.

In July of 2021, we articulated a goal of executing to a three-year CAGR for our Med Tech segment of 30% to 35%. Through two years of that three-year plan, our Med Tech segment has a CAGR of 33%.

The next phase of our transformation is to address the scale and structural limitations of our operating footprint in a capital-efficient manner.”

This report will unpack the company’s results and link this back to its economic performance, and the requirements + expectations moving forward. Net-net, I continue to rate ANGO a hold for the reasons raised here today.

Figure 1. ANGO continues in a c.2-year downtrend, repricing off $30.00 highs to trade in the $7’s at the time of writing.

Data: Updata

Critical investment facts to reiterate hold thesis

1. Key insights from fiscal ’23

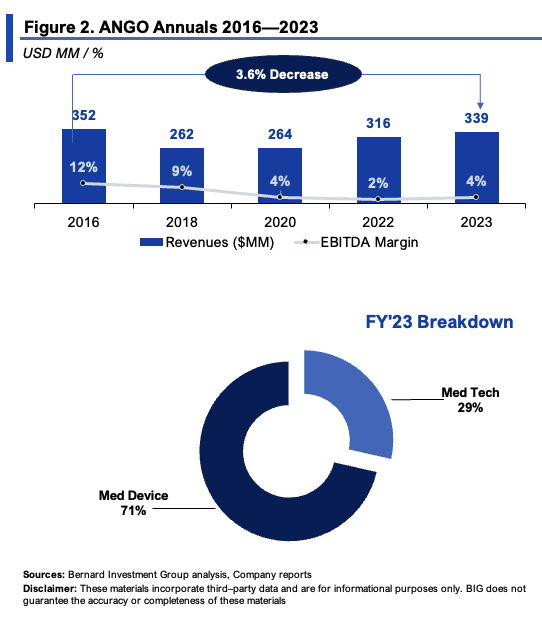

ANGO had a reasonably successful fiscal year in ’23 and put up revenues of ~$339mm, up 7.1% YoY. This was a shade off my estimates of $347mm. Q4 sales were $91.1mm, 4.7% growth YoY. It pulled this to gross margin of 51.4%, ~100bps decompression, on adj. EBITDA of $22.6mm (up 830bps). Whilst it’s still early days, looking out to fiscal ’24, management projects top-line sales $328mm—$333mm on a of loss of $0.28—$0.34/share. Critically, this is a lower number vs. ’23, but ANGO divested from its dialysis and BioSentry business midway through the year. So the ‘pro-forma’ revenues in ’23 are $306mm; hence, it would be looking to grow sales ~8–9% on this basis.

As to the Q4 + FY’23 insights:

- Med Tech and Medical devices are the major focus going forward

- Q4 Med Tech sales came in at $26.5mm and grew 17.2% YoY. On the other hand, the Medical device (“Med device”) segment did $64.6mm of business, up just 30bps. Med Tech was almost 30% of sales which was consistent throughout ’23.

- FY’23 Med Tech sales were up 22.8% to $96.7mm, with Med Device revenues up 1.9% to $242.1mm. As mentioned earlier, the Med Tech business has compounded at a rate of 33% in the last 2 years. Management confirmed it will be the main priority going forward. I’d say this is important, because it carries the highest gross margin at 64%, vs. the medical device margin of ~46%.

- Auryon remains a key growth lever

- Auryon Q4 sales were $11.8mm and grew 22% YoY. For FY’23, the business did $41mm in turnover, up 41% YoY. As noted, Auryon remains a key growth lever for the company, especially given the numbers in ’23. Expansion efforts in the VTE space and adjacent opportunities in the atherectomy market are expected to contribute heavily to Auryon sales in ’24 per management.

- Mechanical Thrombectomy—headwinds remain

- As a reminder, mechanical thrombectomy includes ANGO’s AngioVac and AlphaVac lines. Combined, the segment was up 3.7% in Q4.

- Specifically, AlphaVac pulled in $1.8mm in Q4, $7.2mm for the year.

- But it was the AngioVac division (again) that was a drag on performance. AngioVac turnover was down 8.3% in Q4 and the year respectively, pulling in $24.5mm for the 12 months.

Based on this, it’s clear why management would refocus on its Med Tech and medical devices business. That is where the growth lies in my view, and there’s a chance the market may be overlooking this. I’ll be watching diligently moving forward. Figure 2 gives a broader insight to the year and progress from FY’16, Figure 3 gives a more granular look at Q4.

BIG Insights

Figure 3.

Source: ANGO FY’23 Investor Presentation

2. Critical Insights to economic performance

For ANGO to start adding value to its capitalization it needs to start showing us some profitability in my view. Not just margins either. Indeed, the newly-furbished business, that’s been on the go since ’19, has brought in more revenues, a good sign. As a function of the resources employed to produce this income—not so much.

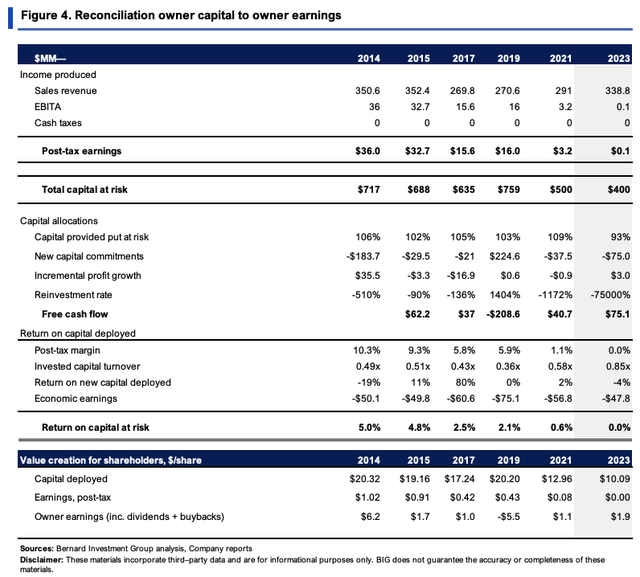

Figure 4 depicts the company’s capital mobility and earnings post-tax since 2014. It’s more relevant to look from ’19—’23 given the above points. Sales have lifted from $291mm to $338mm in this time. The firm has pared right back in capital intensity, mostly in NWC and accounting goodwill, such that $400mm of operating capital is now required to run the business, equating to ~$10.10/share.

Consider that:

- The $10.10/share of investment produced little-to-no post-tax earnings per share last year from $0.01mm of NOPAT. Is this a breakeven? Not really, no, because the earnings have been on the decline since ’19.

- To me, this squares off with the economics at hand. The ‘restructuring’ ANGO has embarked on these past 4 years is a function of poor capital allocation in the first place. What’s to say it all of a sudden it was to turn this around?

- You’re looking at 0–1% at the post-tax margin in ’23, with 0.85x capital turnover. At least 1x would be required to suggest ANGO is rotating its inventories out the door at a reasonable pace in my opinion. I.e., $1 invested bringing in $1 in sales.

As a reprieve, it did throw off $1.90 in FCF/share in ’23, but not as a function of cash flow produced by the assets employed in the business. These were from asset disposals instead, designed to lean up the business.

BIG Insights

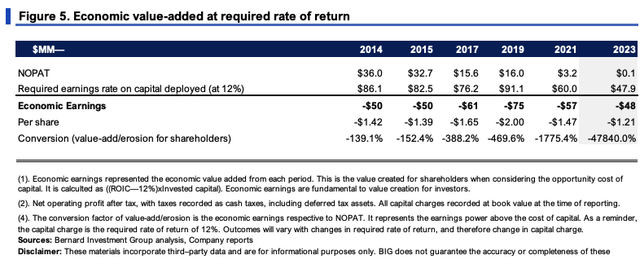

Figure 5 gives an insight into the economic trouble this has spelled for ANGO’s shareholders. As a practical example, to buy ANGO, we’d need it to be doing ~12% rate on capital (that’s our core competency), so it would have needed to produce ~$48mm in NOPAT off the $400mm last year, or $1.21/share. Given that it did $ 0.1mm, the economic loss was $48mm, negative $1.21/share ($0.1–$47.9mm = -$48mm).

BIG Insights

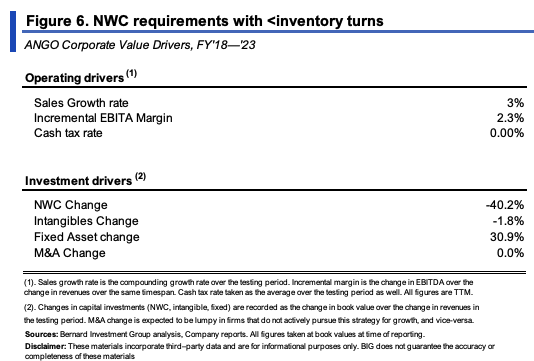

Curiously enough, whilst sales have grown at a 3% rate since ’18 (on very thin operating margins), for every new $1 in sales, ANGO was able to reduce its NWC requirements by $0.40. But fixed asset intensity increased by $0.31 on the dollar, so the net decrease in capital was $0.10 for every $1 in sales growth (Figure 6).

BIG Insights

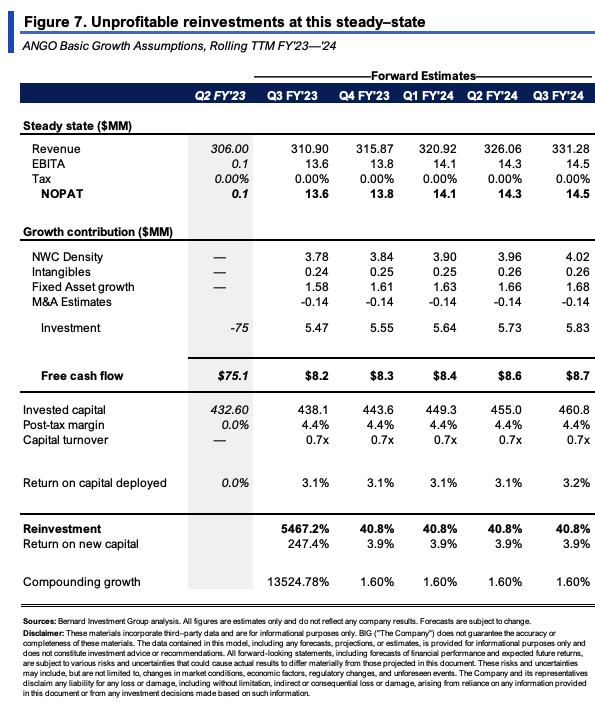

This is useful info to gauge what ANGO would require and could produce in terms of investment and sales going forward. Management guide to 8% ‘proforma’ revenues of ~$333mm in ’24. Surely, NWC won’t continue to decline at a 40% rate. I’ve instead carried it forward at a 2% rate for every $1 in sales growth.

If it were to grow sales by 8% in the next 12 months, it would require ~$35—$40mm of incremental investment and potentially throw off ~$40mm in FCF by my estimation. Just as a reminder, ANGO left the year with $44mm in cash on the balance sheet. This would require it to keep a 4% pre-tax margin and reinvest around 41% of its cash flows each period to grow. Still, the model only spits out a 3% average forward rate on capital, and for intrinsic value to compound ~6.5% over this time. So, would the 8% proforma growth create value for investors? Not so sure on that one.

Note: Calendar Year Periods Are Shown, and Do Not correspond with ANGO’s fiscal year. Instead, they correspond with the normal calendar year.

Valuation and conclusion

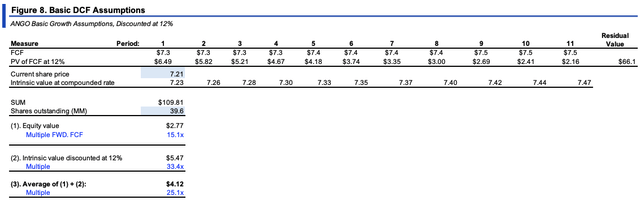

ANGO sells at heavily compressed multiples: 0.9x forward sales, 0.7x book value, 0.77x EV/invested capital. It’s clear the market isn’t holding high hopes for the company in ’24. Are these multiples over-extending the downside? In my view, no, and consider this:

- ANGO has a gargantuan effort ahead of itself to reverse the economic picture discussed here (likely the underlying cause of its tiny multiples).

- An 8% sales growth in ’24 is equally as ambitious, and it mightn’t throw off the profitability needed for its stock to catch a bid.

- The company would still likely need to invest in the realms of $30–$40mm to hit 8% in my estimation. That $40mm has to come from somewhere. ANGO finished the fiscal year with $44mm on the balance sheet, so cash flow is absolutely paramount for the firm these next 12 months. A critical fact, in my view.

- Projecting the numbers in Figure 7 out to FY’28, then discounting back at the 12% hurdle rate used here, gets you to just $2.77 in equity value. Compounding its market value at the function of the estimated ROIC and reinvestment rate gets you to ~$5.45. The average of the two is ~$4.10.

That ANGO trades at such a discount is more understandable given these economics, so I’m not surprised that investors value its invested capital below par. The capital isn’t deemed to be valuable. Alas, with these points in mind, I’m retaining a hold rating on ANGO. Happy to be proven wrong in this instance.

BIG Insights

In short, ANGO is potentially at an inflection point in its investment career. It’s either a reversal in market value from here or a continuation of the multi-year downtrend. The market isn’t as irrational as Ben Graham made it out to be in his “Mr. Market” characterization. Over time, it’s actually a fairly accurate proxy for a company’s intrinsic value. Keeping that in mind, it’s likely going to price ANGO where it ‘deserves’ to sell. It’s entirely up to ANGO to muster up the investment demand to buy its stock at higher multiples. So ’24 will be the critical year in my view. A number of its strategies look to be working at the sales level. But as a function of the resources required to get there, it still languishes. Key things to benchmark this fiscal year in my view:

- Profitability, both at the margin and as a percentage of capital/assets employed.

- Cash flows, because its investment needs have to stem from somewhere.

- An insatiable focus on getting the higher-margin Med Tech business front and centre, deploying as many resources as possible to expand this segment.

Net-net, I continue to rate ANGO a hold, but as mentioned earlier, happy to be proven wrong here.

Read the full article here