Background

Known internally as ‘The Monthly Dividend Company,’ Realty Income Corporation (NYSE:O) is the largest single-client property landlord in the U.S., with 255.5 million square feet of leasable space across more than 13,000 locations. Despite the company’s strong balance sheet and moves over the past year to pay down its commercial paper and line of credit balances from $2.7 billion to $990 million, the stock has suffered alongside other REITs as investors fret over what the longer-term impacts of a higher interest rate environment will be.

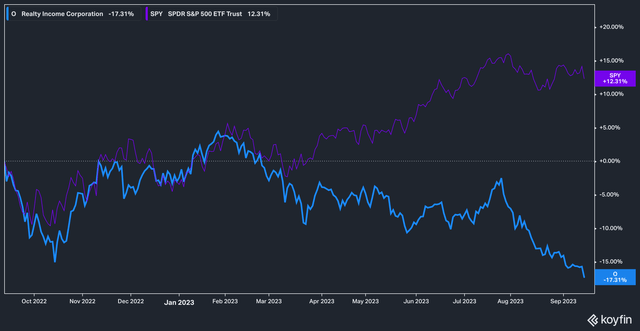

Koyfin

Over the past three years, Realty Income’s stock has fallen 17% on a price return basis versus the S&P 500’s (SPY) gain of 12% in the same time frame. This fall has even outpaced the largest REIT ETF by assets, the Schwab U.S. REIT ETF (SCHH), which has fallen 10% over the last three years.

That, in a nutshell, encapsulates the idea that the market has lost the plot when it comes to Realty Income, a point we hope to solidify in this article. Let’s get to it.

What, Me Worry?

Everyone in the world, it seems, is fretting about interest rates. There’s good reason for this, of course–after a long stretch with interest rates sitting at essentially zero, investors almost seemed to forget that it can (should!) cost businesses to borrow.

At any rate, zero interest rates provided a boon to rate-sensitive industries and businesses such as those operating in the real estate sector. With plentiful access to capital, there was little reason to worry that REITs would struggle to acquire new properties with cheap debt and the good times would continue to roll.

Rising interest rates, however, have thrown some cold water on the REIT-bull party, particularly in the commercial real estate sector (and more particularly, office space). Thus, in the hurry to get away from anything that might continue to suffer in a higher interest rate environment, investors seem to have essentially thrown the baby out with the bathwater, leaving stocks like Realty Income looking quite cheap.

The two things we’ll take a look at here are Realty Income’s properties, and its debt load–the two items which we think present the largest risk to a company in this sector. If the tenant mix is vulnerable to economic variables, then vacancies could become an issue. If debt is onboarded recklessly, then, well, that’s just bad.

On the property side, 82.5% of Realty Income’s properties are in the retail space, with industrial properties at second place with 13.1% of the portfolio.

Realty Income concentration by store type (Company Filings)

The main point we will make about Realty Income’s property concentrations is that the company is, first and foremost, not exposed to sectors with secular headwinds. Office space is notably absent, as is the type of retail that is susceptible to loss of market share due to online shopping (also known as death by Amazon (AMZN)).

On the debt side, Realty Income has proven adept at managing the current rate environment against its returns. In the company’s latest quarterly report, Realty Income disclosed that it had issued a total of $1.1 billion in debt with coupons between 4.7%-5.05%. It also issued 48 million new shares of common stock via its at-the-market [ATM] program for proceeds of roughly $3 billion.

Entering the debt market at these levels when cap rates across the single-tenant net lease sector have risen for five consecutive quarters is a bold move, but Realty Income’s management addressed it directly on the latest conference call. CEO Sumit Roy hit the issue directly on the head:

Our second quarter initial cash lease yield of 6.9% represents a 120 basis-point increase compared to the second quarter of 2022 and resulted in a realized investment spread of approximately 133 basis points when calculating our WACC on a leverage-neutral basis using the cost of equity and debt raised in the quarter.

Now, we just want to pause for a moment and applaud management here (something we rarely, rarely do at Ironside Research), for the transparency of disclosing the company’s internal estimated spread over their weighted average cost of capital. WACC is notoriously difficult to estimate, and the fact that the company discloses they are able to earn 133 basis points over their estimated WACC in the current market says something to us about the company’s leverage in the space.

Valuation

According to Seeking Alpha, Realty Income currently trades at 13.3x forward FFO estimates, which represents an 8% premium over the sector. However, we think that the premium is likely justified given:

- Realty Income’s size and leverage,

- the make-up of its tenant base, and

- the spread it can earn over its cost of capital.

These three things are vitally important, and we think that many REITs would fall short of all three if evaluated on those criteria.

Analysts also estimate that the earnings power of Realty Income is not likely to be negatively affected by interest rates in the future.

Analyst Future EPS Estimates for Realty Income (Koyfin)

While EPS estimates for 2023 have fallen over the past three years (which is to be expected given the understandable downward revisions from analysts as rates rose through 2022), the conviction of the market that rates will begin to fall again in 2024 is still quite good. This, we think, is the primary rationale for assuming that Realty Income will be able to preserve its earning power in the coming years.

The Bottom Line

With a dividend yielding 5.6% as of this writing, we think that Realty Income is well positioned in the market for the reasons outlined above. Risks to our thesis include a ‘hard landing’ for the economy, which would likely place downward pressure on tenant margins and slow the pace of acquisitions for Realty Income. Today, however, we believe a compelling risk-to-reward scenario exists.

Read the full article here