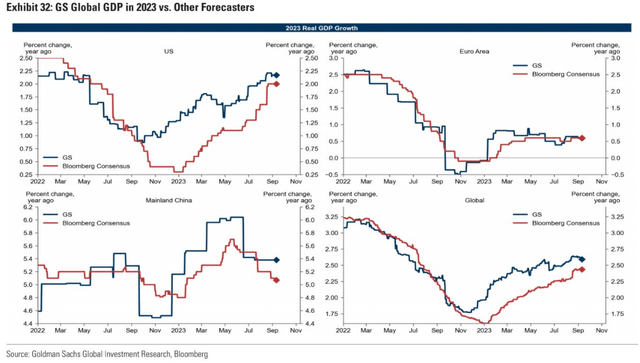

The global growth outlook has improved in recent weeks despite concerning data trends out of China. The US and Europe are helping to improve what 2023 real economic expansion will be, and that trend benefits cyclical firms and worldwide energy demand.

I always pay close attention to these moves at the macro level. Today, I am reiterating my hold rating on TORM plc (NASDAQ:TRMD). I assert that the valuation case has turned more upbeat, but the technicals have softened.

Global GDP Growth Estimates on the Rise

Goldman Sachs

According to Seeking Alpha, TRMD operates as a shipping company and it engages in the transportation of refined oil products and crude oil worldwide. It operates in two operating segments, Tanker and Marine Exhaust. The company transports gasoline, jet fuel, naphtha, and gas oil, as well as dirty petroleum products, such as fuel oil. It also engages in developing and producing advanced and green marine equipment.

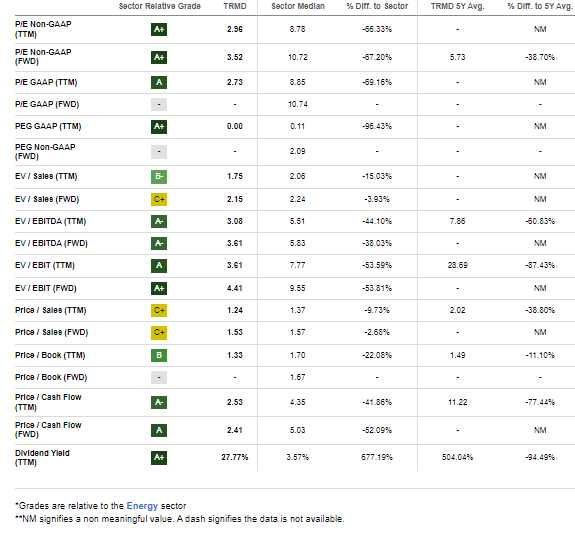

The London-based $2.1 billion market cap Oil and Gas Storage and Transportation industry company within the Energy sector trades at a low 2.7 trailing 12-month GAAP price-to-earnings ratio and pays a high 27.8% dividend yield as of September 15, 2023. While there is no short interest, the stock has a moderate 37% implied volatility percentage ahead of its November earnings report.

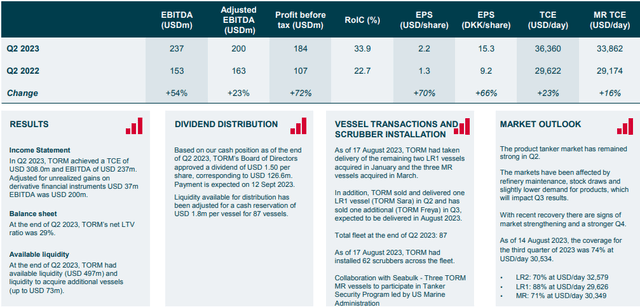

Back in August, TORM reported second-quarter GAAP EPS of $2.14 while revenue rose 13.5% year-on-year to $384 million. For FY 2023, Time Charter Equivalent (TCE) earnings are seen in the $1.05 – $1.175 billion range, narrowed from the previous outlook, but on the low end of guidance. EBITDA, meanwhile, was also on the disappointing side with expectations now forecast to be $775 – $900 million. Shares wavered following the announcement, but it was the firm’s best Q2 profit period on record and the company used futures markets to secure freight rates given elevated levels last quarter. The firm issued a $1.50 dividend (paid last week).

Q2 2023 highlights

TORM IR

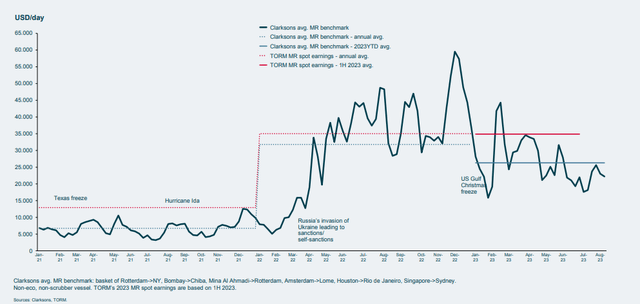

During the conference call, the management team reported that the company has been expanding its fleet, acquiring 10 secondhand vessels in the first half of the year, focusing on vessels built between 2010 and 2015. The product tanker market has seen increased demand due to geopolitical conflicts (a protracted benefit, which the bulls like to see) and trade recalibration, leading to higher volatility in freight rates. I like the risk management program of engaging in futures trading to hedge some of that risk through Forward Freight Agreements (FFAs). And while OPEC+ oil production cuts have had just modest impacts, I perhaps overstated that risk in my initial analysis.

Geopolitical tensions leading to a step change towards higher average freight rates

TORM IR

TORM said they are comfortable with extending the service life of vessels beyond 15 years, with associated maintenance costs typically ranging from $0.5 million to $1 million. Cost management is a priority, with strict cost control measures in place across its One Torm platform. A key risk, though, is weak shipyard capacity which could inhibit new ship-building activity.

On valuation, analysts expect next-12-month earnings to be near $7 per share. FY 2024 EPS is seen dropping about 10%, however, as the tanker market normalizes. If we assume $5 of normalized earnings and apply a 7 forward P/E, then shares should be near $35; that is up from my initial analysis. That is a bit more sanguine from my previous outlook based on what appears to be strength persisting in the industry and improved global growth prospects. A modest P/E is warranted given this still-bullish part of the market cycle and a higher margin of safety should be used by value investors here.

TORM: Compelling Valuation Metrics Persisting

Seeking Alpha

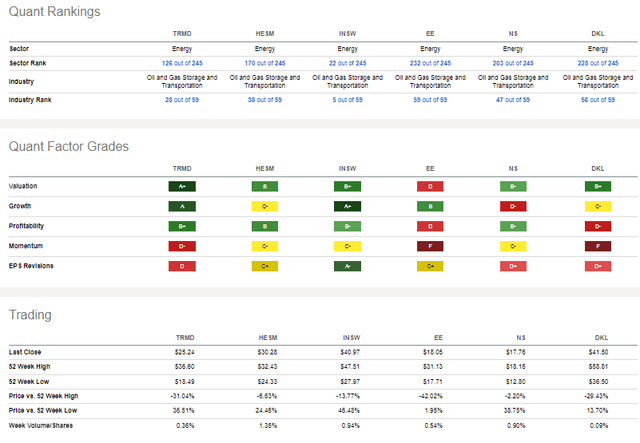

Compared to its peers, TRMD features the strongest valuation rating, which is hard to argue with given such low earnings multiples. I differ from the quant system with respect to the growth A-grade, though, since earnings are seen as dipping over the coming quarters with declining top-line growth, too. However, the firm is nicely profitable and able to pay large dividends. I’d like to see the stock’s momentum improve, and another strong earnings report could help improve the consensus EPS forecast.

Competitor Analysis

Seeking Alpha

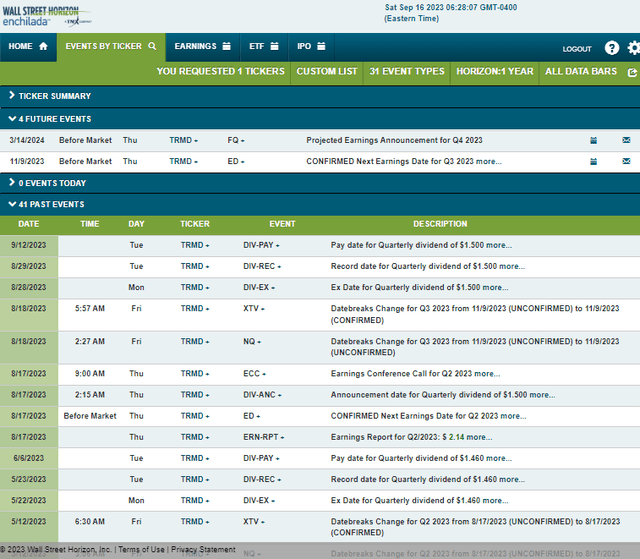

Looking ahead, corporate event data provided by Wall Street Horizon shows a confirmed Q3 2023 earnings date of Thursday, November 9 BMO. No other volatility catalysts are expected until then.

Corporate Event Risk Calendar

Wall Street Horizon

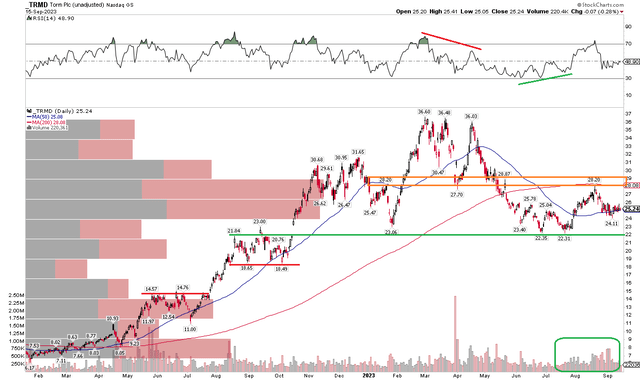

The Technical Take

Not a whole lot has changed since my Q2 review of TRMD’s chart. Notice in the graph below that shares have been consolidating under the now-falling 200-day moving average. That only serves to further enhance the importance of the $28 to $29 that I called out before – the stock sold off in an attempt to rise above the 200dma in August. Moreover, the $22 to $23 zone was successfully defended by the bulls over the summer, which was encouraging. Long here with a top under, say, $21 could make sense, but I would really like to see the stock climb above an area with high volume by price up to about $30 – that would likely portend an eventual move back toward the $36 to $37 highs from earlier this year.

Of course, holders are paid a very high yield along the way, so keeping a total return perspective is always important. Also, keep your eye on trends in the RSI momentum gauge at the top of the chart – it printed a bearish divergence pattern at the top and a bullish divergence feature as shares formed a near-term low from June through July. Interestingly, volume picked up in August and early September, so traders may be positioning themselves for a big move in the stock.

Overall, it is a slightly bearish chart given the rollover in the 200dma and TRMD trading under that key trend indicator line.

TORM: A Continued Trading Range, Falling 200dma Is Bearish

StockCharts.com

The Bottom Line

I reiterate my hold rating on TRMD. The valuation case improved in my view, but the technicals have turned a bit more bearish.

Read the full article here