Simplify Volatility Premium ETF (NYSEARCA:SVOL) is one of my favorite ETFs and I’ve covered it with a couple articles in the past.

SVOL Can Be A Good Addition To Your Income Portfolio

SVOL: Holding On Strong Despite Rising Volatility

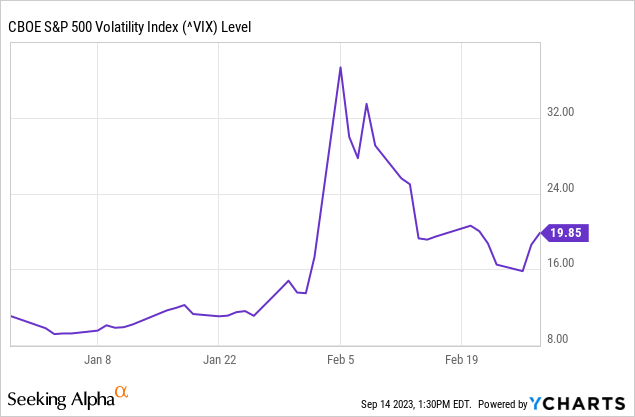

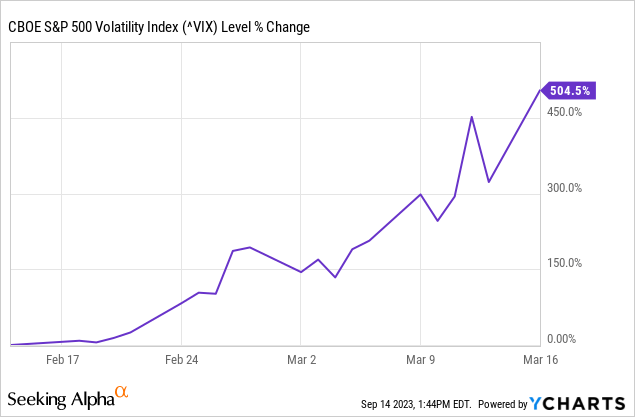

One question I often get about SVOL is what happens to the fund under different scenarios including a black swan event like what we saw in 2018 or 2020. Many people are familiar with “Volmageddon” event of 2018 where VIX suddenly climbed from 10 to almost 40 and this had some serious implications for several funds who were shorting VIX at the time. Some famous funds like XIV completely blew up and dropped to zero so investors lost everything.

So it’s fair for investors to be reluctant and wonder what will happen to SVOL in an event like this. In this article we will try to calculate effects of different scenarios on SVOL.

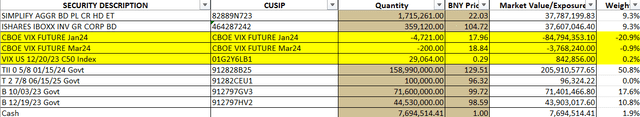

In order to better understand implications of different VIX levels on SVOL, we have to look under the hood and see what the fund is holding right now (which is subject to change without notice since the fund is actively managed). We are only interested in the holdings highlighted in yellow because these are the “active ingredients” of the fund while everything else is bonds, cash and bond funds that SVOL uses as collateral. These add about 5% to the total yield of the fund but they don’t affect outcome of its VIX plays.

SVOL Holdings (Simplify)

As you can see the fund is shorting VIX futures expiring in January 2024 and March 2024 and it’s long VIX 50 calls expiring in December of 2023. Another thing to note is that the fund is using only about 22% of its assets to short VIX futures so it doesn’t have full exposure. Technically speaking, for every 10% VIX rises, this fund could lose only about 2.2% in value in theory but it isn’t that simple either as we will show below. Also, we could have an event like 2020 where VIX climbed 500% in 3 weeks. What then? Does that mean this fund blows up?

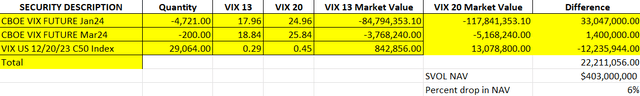

Currently VIX is at 13 at the time of writing this article. What would happen if VIX were to suddenly jump to 20 overnight? We see that the January 2024 VIX futures contracts would climb in value from $17.96 to $24.96, March contracts would climb from $18.84 to $25.84 and VIX 50 options would climb from 29 cents to 45 cents. As a result of this, SVOL would lose about $33 million from its futures contracts but gain $12 million from its VIX options for a total net loss of $22 million. This would result in a NAV drop of 6% for SVOL which isn’t bad considering VIX is almost doubling overnight in this scenario.

VIX 20 Scenario (Author)

What is VIX climbs to 30 overnight? Now we have VIX futures gaining quite more value but same with the VIX options held by the fund. All in all we see the fund lose about $59 million of NAV or 15%. It might sound scary but VIX rarely climbs from 13 to 30 overnight and fund still seems to be far from being blown up like how XIV was in 2018.

VIX 30 Scenario (Author)

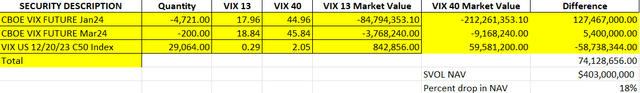

Now let us replicate the events of “Volmageddon” of 2018 where VIX suddenly jumps to 40 overnight. Notice that the fund’s short future contracts are gaining a lot of value but so are its VIX options that it bought as a hedge. This is because in a scenario where VIX jumps from 13 to 40, VIX 50 options will also jump from 29 cents to $2.05 in value because IV of VIX itself will also rise significantly (yes even VIX options have their own IVs). This softens to blow by quite a lot and the fund only loses 18% in NAV. So the difference between VIX jumping to 30 or 40 has only 3% effect on SVOL’s NAV which is impressive. One thing for sure though, the fund doesn’t blow up in this scenario, not even remotely close.

VIX 40 Scenario (Author)

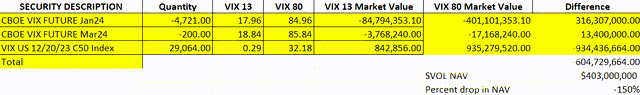

What happens if VIX quickly jumps to 80 like it did in March 2020? You would be surprised. Not only does SVOL not blow up but it actually turns positive because of all those VIX 50 calls it has. The fund loses $330 million from its futures contracts but gains a whooping $934 million from its VIX call options which means a gain of $604 million or 150%. Unbelievable right?

VIX 80 Scenario (Author)

As a matter of fact, the fund loses value up until VIX climbs to 50 but anything after that the fund actually starts making money because of how many VIX contracts it holds as a hedge.

Having said that, it’s extremely rare for VIX to climb above 50. It only happened once in the last 14 years and that was when the global economy was completely shut down in March of 2020 which was a total black swan event. My point is that this fund is specifically designed in a way to ensure that it will not blow up like how several funds like XIV did in 2018.

The fund can still lose value and it did last year when VIX climbed to mid-30s. Just because a fund can’t blow up doesn’t mean it can’t lose in value. Also keep in mind that this is an actively managed fund so the managers of the fund can always change its holdings and they might get greedy and make a mistake or two where the hedges are removed or reduced which would expose the fund to larger losses. Just because the fund’s current set up is designed to avoid a blow up today doesn’t mean it will be in the future.

Also notice that the fund’s futures contracts are dated January and March of 2024 whereas its VIX 50 calls are dated December 2023. This calculation assumes either that the VIX blow off event will happen before SVOL’s VIX calls expire or SVOL will keep rolling its VIX call options (like it’s been doing). If the fund somehow “forgets” to roll its hedges and VIX blows off, SVOL could lose significant value. I’ve never seen this fund not to have hedges in place though so this makes me feel better.

The fund has only been around for a couple years and its total return of 27% since inception beats S&P 500’s (SPY) total return of 13% by a comfortable margin. One can only hope that the fund continues this outperformance in the future.

All in all, I think this is still a great income generator. No investment is risk free and this investment can also lose value over time but I think chances are higher than it will continue to outperform if the management stays in discipline. We’ve seen too many good funds get ruined in the past when their management got greedy and loosened their hedges but I am optimistic that this won’t one of them.

Read the full article here