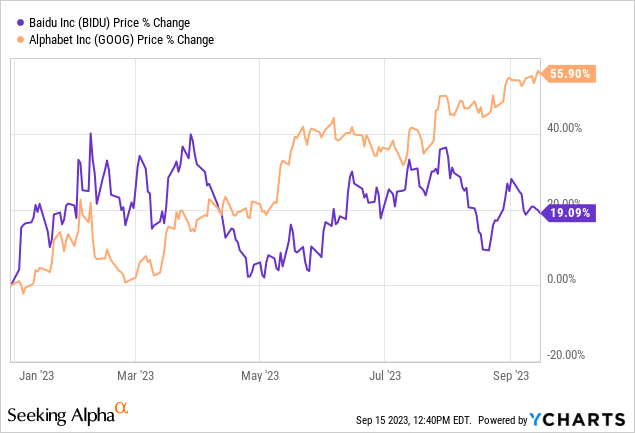

Shares of Baidu (NASDAQ:BIDU) have been range-bound in 2023, but the tech company is opening up a new chapter in its history by releasing a Chat.GPT rival that could offer new impulses for an upside break-out. While Baidu, like Alphabet (GOOG) (GOOGL), is dominant in the search business, Baidu is seeing stronger top line growth than Google, in part due to Baidu’s recovering online marketing sales. Baidu delivered strong results for Q2’23 and the recent release of its own artificial intelligence bot, which should ultimately be integrated into Baidu’s search engine and drive advertisers’ conversion results, has the potential to be an accelerant for Baidu’s core business. Considering that Baidu is significantly cheaper than Google, based on both P/E and P/S, and since Baidu has under-performed lately, I believe shares could be set up for upside break-out soon!

Previous rating

I previously rated Baidu a buy — The Case For Upside Revaluation In 2023 — due to a potential recovery related to its core advertising business. Baidu, just like Google, suffered a temporary slowdown in its advertising business which lead to decelerating top line growth in FY 2022. However, in the second-quarter, Baidu showed promise as its digital advertising business re-accelerated. Importantly, Baidu recently developed its own Chat.GPT rival and made it available to the public, which could further fuel the company’s top line growth.

Strong second-quarter results

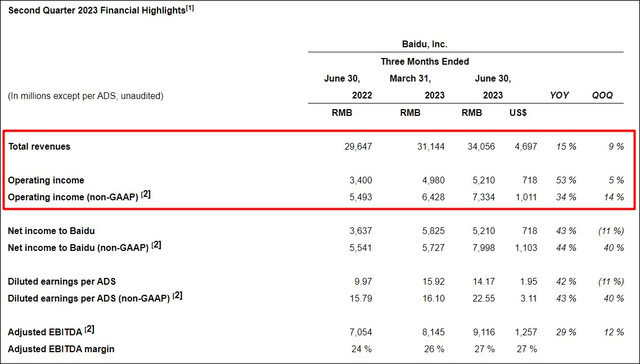

Baidu submitted a strong second-quarter earnings sheet which included a 15% year-over-year increase in total revenues to 29.6B Chinese Yuan ($4.7B) as well as a massive 53% increase in operating income. Baidu’s revenues in FY 2022 dropped 1% year over year.

For context, Google saw top line growth of 7% in Q2’23 and year over year operating income growth of 12% (Source). I believe the top line and operating income growth prospects are better for Baidu than they are for Google, at least in the short term, as Chinese tech firms continue to rebound from crushing COVID-19 lockdowns that resulted also in a decline in advertising spending on Baidu’s search platform. With post-pandemic demand being unleashed, I believe Baidu has a good chance of out-performing Google’s shares going forward.

Source: Baidu

Baidu moves into the AI chatbot arena

OpenAI first kicked off the AI chatbot frenzy with the launch of Chat.GPT which took the public by storm due to its ability to efficiently reply to queries and hold a conversation with the user. That AI chatbots mean big business became evident when Microsoft (MSFT) ultimately decided to invest $10B into Chat.GPT creator OpenAI. Google launched its own chatbot, Bard, earlier this year, which has since been integrated into its core services, such as Google Cloud.

Baidu just recently launched its own chatbot, ERNIE, a proprietary AI bot that could also be integrated into Baidu’s search engine and therefore help drive engagement from users as well as lead to higher conversions for merchants placing digital ads on Baidu’s search platform.

That Baidu owns the most popular online search engine in China is obviously a key asset that could give Baidu a major advantage in terms of AI chatbot adoption compared to its smaller rivals. While other companies also developed their own AI assistants, like Alibaba (BABA) (Source), Baidu has a major digital advertising business to fall back on.

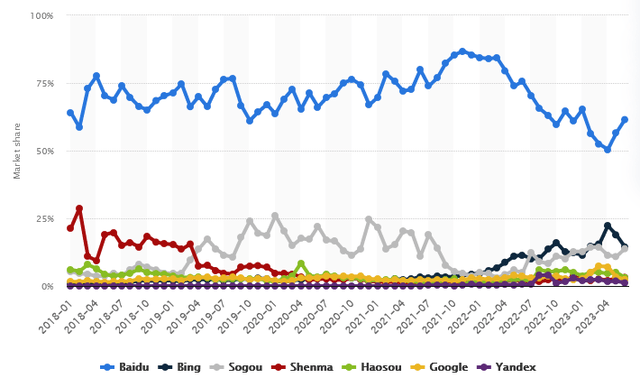

As of June 2023, according to Statista, Baidu was by far the most successful and most sought-after search engine in the Chinese market. Since Baidu captures a majority share (in excess of 60%, as of June 30, 2023) of the search engine market, Baidu has much more potential to include AI chatbot functionality in its search business than its competitors. The inclusion of AI technology in Baidu’s search platform could be an accelerant for Baidu’s already re-accelerating top line.

Source: Statista

Huge valuation discrepancy between Baidu and Google

Baidu is often referred to as the “Google of China.” What both companies have in common is that they own the most popular search engine in their countries and operate their own respective Cloud businesses. Baidu, however, is more attractive from a valuation point of view.

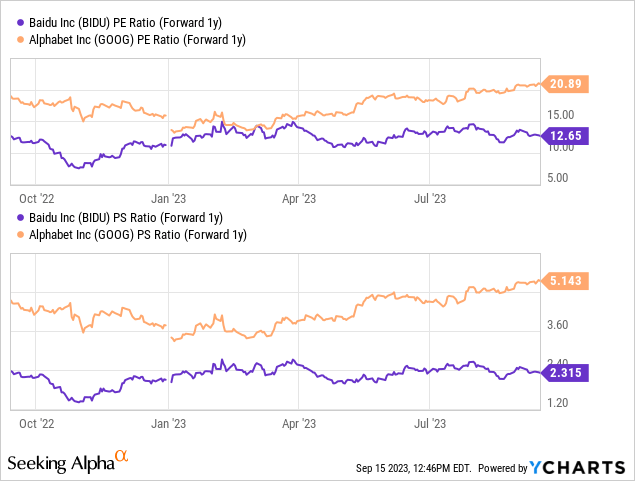

Baidu is expected to grow its EPS 20% in FY 2023 compared to a projected EPS growth rate of 23% for Google. However, the slight difference in speed of revenue growth doesn’t justify the huge discrepancy in valuation ratios, in my opinion: Baidu is currently valued at a P/E ratio of 12.7X while Google trades at 20.9X forward earnings.

While some of this valuation differential is likely due to the notion that investors have become more hesitant investing in China, due to multiple rounds of regulatory crackdowns that hurt investor confidence, the valuation discrepancy seems unreasonably large.

Based off of revenues, Baidu is also significantly cheaper with a P/S ratio of 2.3X compared to 5.1X for Google. I like Google, a lot, and continue to see more upside for the tech company, but Baidu clearly seems to be the underrated AI stock here.

Risks with Baidu

I have learned that the biggest risk factor when it comes to investing in Chinese tech stocks is China itself. The country has earned a reputation for erratic and regulatory crackdowns, which comes on top of commercial risks, such as a slowdown in the digital advertising business. Only investors that can handle China exposure should consider buying shares in a Chinese enterprise.

Final thoughts

Baidu is a very attractive Chinese AI stock for investors that are comfortable with handling China-specific risks. Baidu not only saw a re-acceleration of its top line in the second-quarter, but the tech company also recently released its own Chat.GPT rival to the public. AI technology represents a huge opportunity for tech firms, but especially for those that own the largest and most popular search engines. Baidu’s own chatbot could help customers find better products, enhance the search and shopping experience, which may in turn lead to higher conversion rates… which could further be an accelerant for Baidu’s recovering digital market business. Since shares of Baidu are significantly cheaper than those of Google, based off of both earnings and revenues, I believe Baidu could be set for a break-out to the upside!

Read the full article here