The INTC Investment Thesis Remains Sentiment Driven

We previously covered Intel (NASDAQ:INTC) in July 2023, discussing the management’s pessimistic commentary on its lower gross margins over the next few years, thanks to its impacted ASPs and underloaded capacity.

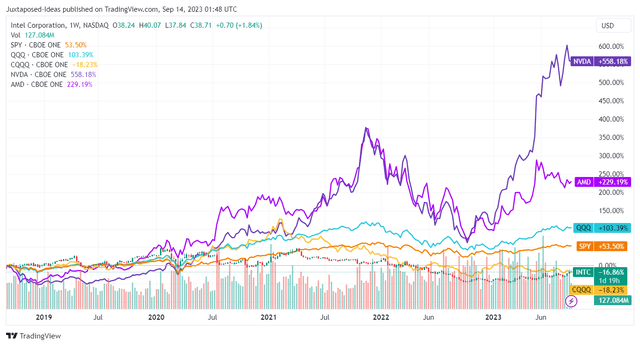

INTC 5Y Performance

Trading View

Combined with the previous dividend cut, we were not sure about INTC’s income and/ or growth thesis, as witnessed by its underperformance over the past few years compared to its chip peers.

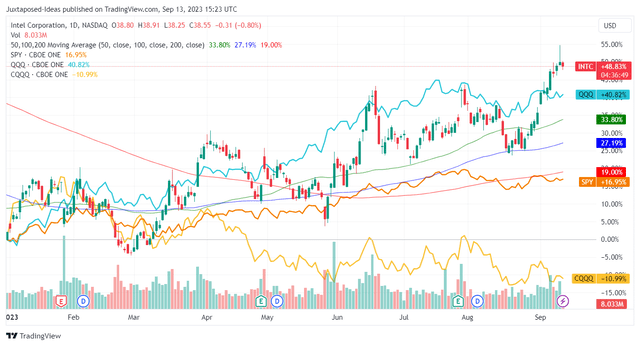

INTC’s YTD Stock Performance

Trading View

For now, market sentiments have turned increasingly bearish on China (including Taiwan), as observed in the CQQQ’s YTD performance, with the intensifying trade war already impacting Micron’s (MU) and Apple’s (AAPL) prospects.

As a result of the worsening geopolitical scene, we can understand why investors have flocked to INTC, due to the foundry’s supposedly secure geopolitical supply chain upon commencement by 2025.

This cadence has already triggered the stock’s YTD impressive performance, with it easily outperforming the SPY and QQQ.

INTC’s 1M Stock Performance

Trading View

Thanks to the INTC management’s ambition to be “the Western supplier for wafers,” the recent news release of the foundry prepayment has further boosted its stock prices by over +9% at its peak.

And yet, we are confused, since no further details have been offered in terms of the whale’s identity and the contracted sum:

And yet we’re not all lined up in terms of the definitive agreement and all that stuff. And so the request was to — what ultimately the request was driving was an acceleration of our Arizona build out, which, of course, requires capital but also we needed to see a little bit of commitment from the customer to make sure that they were really serious about the demand.

That said, we still don’t have our 0.9 PDK yet out, that should be out pretty soon. And that, I think, is really where you start seeing customers get real serious around, okay, now we’ve got a 0.9 PDK, we can kind of track our way to 1. It’s time to start locking in agreements for the volume. (Seeking Alpha)

The narrative above suggests that things may be indefinitive for now, depending on the actual results of INTC’s 0.9 Process Design Kit and manufacturing yields. The latter is extremely important indeed, since it is a precursor to the foundry’s efficiency and profitability.

For example, Taiwan Semiconductor Manufacturing Company Limited (TSM) has recently made global headlines, by reportedly offering a “sweetheart deal” to AAPL.

Based on the report, the former supposedly absorbs the costs for all of the latter’s 3nm A17 Bionic defective kits, potentially comprising 20% to 30% of its new manufacturing process.

Therefore, with INTC’s yield still unknown and capability untested, we believe its prospects have also been adversely impacted by the terminated acquisition of Tower Semiconductor’s (TSEM) foundry expertise.

In addition, we believe that while sentiments surrounding Made-in-America chips have grown tremendously, these also come with immense expectations. The US government has banked on INTC to make the country’s chip supply chains more resilient, potentially triggering its “Too Big To Fail” status.

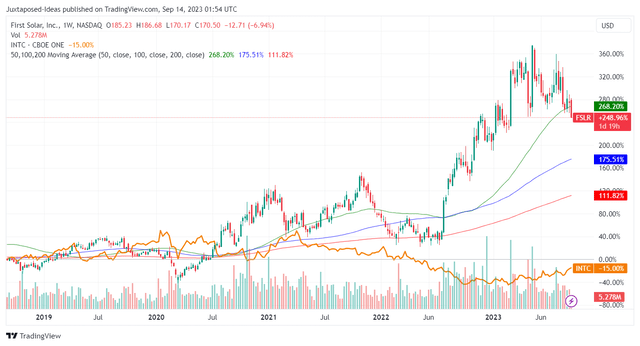

This may be a double-edged sword in our opinion, returning to bite INTC if the management fails to deliver. This is a stark contrast to another US-based stock, First Solar (FSLR), a company producing cadmium-telluride based solar panels for utility usage.

With FSLR entirely side stepping any geopolitical impact from polysilicon-based solar panels, with over 75% of the raw material made in China as of 2022, it is unsurprising that the solar company has reported a fully booked backlog through 2027 with deliveries staggered through 2030, thanks to Biden’s electrification goals.

FSLR’s 5Y Stock Performance

Trading View

This has justifiably led to the FSLR stock’s outperformance over the past few quarters, as seen by its rally of over +168.2% since the June 2023 bottom.

And it is for this reason, we believe that the premium embedded in INTC’s stock valuations and prices may have been pulled forward too early. Only time may tell how the company may execute, despite the potential contribution from the Inflation Reduction Act’s regulatory credits.

INTC’s Premium Valuation Is Partly Attributed To Its AI Prospects & x86 CPU Demand

INTC 10Y EV/Revenue and P/E Valuations

S&P Capital IQ

For now, INTC trades at eye-watering valuations at NTM EV/ Revenues of 3.37x and NTM P/E of 31.55x, while moderated compared to its 1Y mean of 2.57x/ 33.88x, but still elevated against its 3Y pre-pandemic mean of 3.28x/ 12.23x, respectively.

It is important to highlight that while its peers, such as Advanced Micro Devices (AMD) and Nvidia (NVDA), have directly benefitted from the generative AI boom, INTC’s intermediate term prospects remain somewhat decent.

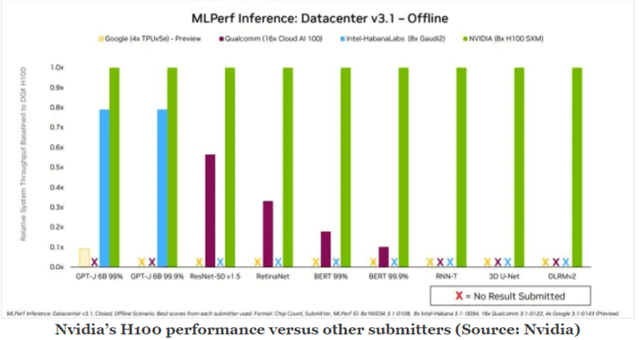

MLPerf Inference Benchmark Scores

EEtimes

This is because INTC’s Habana Gaudi2 may be able to deliver an improved performance-per-dollar compared to NVDA’s H100. For example, based on NVDA’s latest performance submission, Habana Gaudi2 is able to achieve approximately 80% of H100’s MLPerf inference benchmark scores.

Now, with INTC’s Habana Gaudi2 priced at approximately $14.86K, nearly half compared to NVDA’s H100 at $26.84K, there is no doubt that the former may offer an extremely cost-effective alternative in comparison.

With market demand for these products being insatiable, with H100 being sold out with a long lead time of up to three quarters, INTC may potentially fill part of the vacuum in the near term, depending on its available inventory and its capacity agreement with TSM.

In addition, with the AMD CEO estimating an AI chips Total Addressable Market size of $150B by 2028, we believe the market is large enough to accommodate multiple players.

INTC has also launched a similarly pared down AI line-up for China markets, following in NVDA’s A800 footsteps while complying with the trade policies, potentially gaining some traction in combination with the Sapphire Rapids CPU.

Naturally, it remains to be seen how the AI race may develop moving forward, with AMD’s MI300 to be launched by Q4’23 and NVDA’s next-gen GH200 Grace-Hopper superchip by Q2’24. With these being complete solutions, it appears that the next leap in generative AI chips may entirely bypass INTC’s CPUs moving forward.

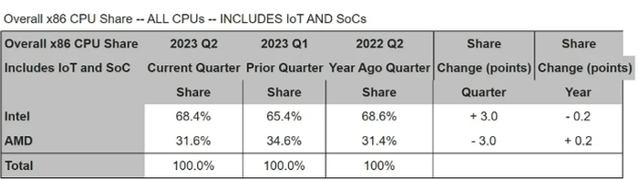

INTC’s x86 CPU Market Share

Venture Beat

Therefore, while INTC may have recorded recovering overall x86 CPU shipments of 68.4% in Q2’23 (+3 points QoQ/ -0.2 YoY), temporarily contributing to its recovery thus far, investors may also want to monitor its market share over the next few quarters.

So, Is INTC Stock A Buy, Sell, or Hold?

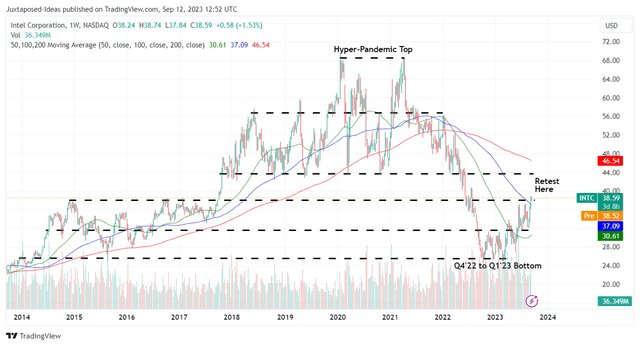

INTC 10Y Stock Price

Trading View

Therefore, based on these optimistic sentiments, it is unsurprising that the INTC stock has also recorded impressive recovery of +55.5% since the Q1’23 bottom.

This is despite the deteriorating financial performance, based on its LTM revenues of $54.04B (-26.3% sequentially) and EPS of -$0.23 (-104.9% sequentially), and an annualized FQ3’23 management’s revenues guidance of $53.6B and adj EPS of $0.80.

This is compared to its FY2019 levels of $71.96B (+1.6% YoY) and $4.71 (+5.1% YoY), respectively.

Consensus Forward Estimates

Tikr Terminal

INTC’s eventual reversal may also take longer than expected, based on the consensus estimates, with things only somewhat normalizing by FY2026.

Even then, it remains to be seen how big a contribution its foundry segment may eventually be, with it only recording FQ2’23 foundry revenues of $232M (+96% QoQ/ +90.1% YoY).

As a result of its uncertain execution over the next few years of transition, we will not be adding to our small position as well, resulting in our reiterated Hold (Neutral) rating for the INTC stock.

Read the full article here