Almost a year ago I published an article analyzing briefly Costco (NASDAQ:COST) and my rushed conclusion was that investors should sell and find better opportunities in the market. One thing that I have learnt from experience is that investors should never try to get rid themselves of a wonderful business. I was completely wrong about Costco and in the following article I will explain why I believe it to be extremely durable and resisting with a moat that widens every day.

Key points of the investment thesis

The following points are key to understand Costco’s long term success:

Expansion into new markets: Costco currently operates warehouses all over the United States. Even though this may seem a very local market, the total inhabitants of the USA add up to more than 300 million people, whilst the company still has 120 million cardholders. Costco dominates a huge part of the American market and has become a recognized brand which people trust. They have benefited from their presence in highly dense populated areas, where a high size market is at their disposition. In addition, the company can continue its expansion in Canada and especially China, where stores have been really successful and have been packed with clients ever since they opened. The Chinese market offers an opportunity that Costco can’t reject, due to its increasing purchase power and its immense population density that give them access to a huge number of clients in areas where they can operate their logistics efficiently. The average member card in China costs around $30 and the company’s first warehouse in China had more than 200,000 subscribers. The potential for growth and consolidation is amazingly high in this region.

Scaled Economics Shared: without doubt, one of the key points of the investment thesis. When assessing the moat of a company, investors think about its capacity to raise prices. Although I agree to some extent with this affirmation, I do believe that what investors should truly understand is whether there is terminal value risk or not. Namely, are the future cash flows of the company at risk or not? And in my opinion, the only way to avoid this terminal value risk is to truly understand the value proposition of the business. Why can it be so resistant in order to last forever? And here comes into play what Nick Sleep defines as scaled economics shared. This concept gravitates around the idea of using excess profits to give value back to the customer. At first glance, this may seem ridiculous, as it would have the immediate consequence of margin depression and profit reduction. Most companies seek scale efficiencies to maintain costs stable and boost profits benefited by revenue increases. Costco seeks to give these scale efficiencies back via lower prices of products in their warehouses. In the center of this strategy lies an underlying paradox. Quoting Nick Sleep in one of his letters: the company grows by giving profits back. Therefore, Costco has a very powerful moat that has been growing over the last years that makes the odds of surviving in the long term very favorable to the company.

This virtuous cycle is beneficial not only for shareholders (as profits increase substantially and terminal value risk decreases) but also for customers, which see how via subscriptions they can access to more economic deals in Costco’s warehouses. Therefore, companies such as Amazon or GEICO have produced profits for shareholders whilst maintaining their attractive value proposition for clients. The company understands that the long-term success of the business is based on the strength of our membership. This approach, alongside the disciplined cost structure of the company and their value-oriented proposition, make me think that the company can deliver great success in the coming years.

Employee satisfaction: another point that I personally like about the company is how it values, not only customer satisfaction, but also employee’s satisfaction. In the United States, Costco’s employees have huge benefits and also earn way more than the minimum wage, unlike other stores such as Walmart. This encourages workers to stay with the company for the long term, increases productivity and improves the quality of customer service.

Financials and valuation of Costco

In fiscal year 2022 the company generated around $7793 million in operating income, $4224 of which corresponded to membership income. This leaves $3569 million from retailing operations, resulting in a margin of 1.6% in operating activities (non-subscription related), way below other competitors in retail selling such as Walmart or Target. The untapped pricing power (gap between Costco and other retailers) is indicative of an expanding defensive moat, in addition to the potential for extraordinary profits to be realized in the event of an increase in margins by the management team.

Can we consider the company to be a cash cow? Maintenance capex could be approximated by D&A, whilst expansion capex is being used to improve the existing warehouses as well as improving their logistical network in China, a promising new market. A point in favor of Costco, unlike BJ (BJ), a direct competitor, is that most of the warehouses are owned by themselves. Of the 838 warehouses, 661 are fully owned, while in 126 they only own the building and in the remaining 51 land and building are leased to the company. This fact is a source of competitive advantage in the form of the high capex necessary to replicate the company’s sales and distribution infrastructure. It is practically impossible for a competitor to replicate the same business model on a large scale due to the enormous need for capital. Even large operators like Sam’s Club have a difficult time stealing market share from the company. The existence of this defensive moat reduces terminal value risk and practically limits to 0 the probability that future cash flows will be zero.

We can estimate the future cash flows of the company based on two main assumptions that will be maintained all over the investment thesis.

Since 2010, the membership revenue growth rate has been 8%, so it is reasonable to assume that this trend will continue in the future as the company continues to increase the value it brings to consumers. I doubt this will happen as renewal rates remain stable at around 93% with new customers added each year. We have an already determined source of income to be able to assess how much future flows are worth in the present. Organic growth through retail activities along with the optimization of own brands is the second essential part of the thesis. To quantify this part, it is necessary to understand how much capex they are investing and at what rate of return they do so. Currently, the company reinvests 30-40% of operating cash flow in capital expenditures. The operating margin on retail activities is 1.6%, such that the operating profit before taxes generated (ex subscriptions) with 2022 sales is $3.6 billion. Costco’s total equity in the same period was $20.6 billion, consequently the return it generates from exclusively retailing activities, based on invested capital, is 17.5%. With this data, we can project a retail income growth rate of 6%, something reasonable based on the annual investment they make.

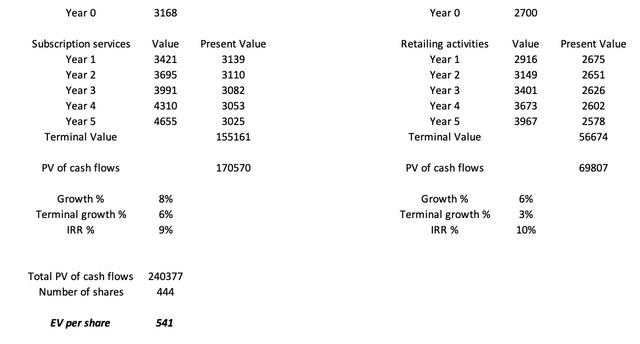

The valuation model that I will use will have two central elements: retailing activities and member subscriptions. We will project a discounted cash flow for both parts, assuming profit growth within the parameters that we have previously determined. The following Figure takes into consideration the following assumptions, with a tax rate of 25%.

COST: alternative approach to its valuation (Own models)

This model has assumed high terminal growth for the subscription model, but it is justified due to the high retention rates (more than 90% in all geographies) and the added-value that it provides to the client. Loyal customers spend more on average and provide the basis for increasing cash flows in the future. Maintaining the satisfaction of clients and increasing their spending levels of Costco are key for the long term success of the business.

Conclusion and risks

To sum up, we need to stress out the most important points of this investment thesis, in favor and against. The favorable points that back the long-term idea of Costco are the following:

- Presence in a stable economic sector which hardly ever suffers in economic downturns and that has decades of secular growth due to the increasing purchase power of the developed countries.

- Growing and recurrent membership income provided by the customer-oriented value proposition developed by Costco.

These two points can maintain the growth prospects of Costco in the coming years and decades, as disruption is difficult when the value proposition is so customer oriented.

Even though these previous positive arguments are indeed attractive, negative points must also be weighed into the equation in order to precisely assess whether the company is attractive for the long term or not. At this moment, the most negative point that I see against Costco is that valuation is not coming down because investors don’t see signs of decreasing strength of moat. Another issue that concerns me is that insiders in the company have been selling shares, but demanding valuation justifies it if they are interesting on repurchasing part of their shares if the company pulls down in price in the following months.

There is no great excitement on buying a warehouse operator which will not become a 100-bagger in the coming two years. As Charlie Munger says: the desire to get rich fast is pretty dangerous. I am sure that Costco will create steady value for shareholders, but the current valuation of the business still prevents me from starting a position for my long term portfolio.

Read the full article here