Introduction

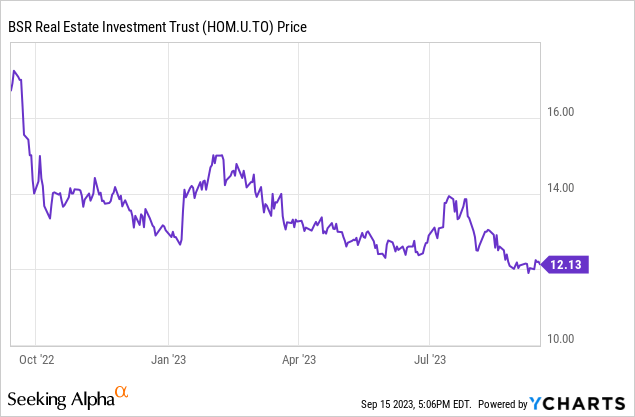

I have been keeping an eye on BSR REIT (OTCPK:BSRTF) (TSX:HOM.UN:CA) for several years now, and although I thought the 2.85% dividend yield two years ago made the stock interesting, the increasing interest rates caused the share price to move down resulting in an even higher yield. The distributions barely increased but the AFFO per share definitely has. This reduced the payout ratio and makes the distribution even safer than two years ago.

BSR’s website isn’t the greatest and most documents open in a pop-up, but all relevant information can be found here.

The FFO and AFFO should stabilize at these levels

As a reminder, BSR REIT is an internally managed REIT focusing on Texas, Oklahoma and Arkansas, but as you can see below the vast majority of the apartment units are in Texas.

BSR REIT Investor Relations

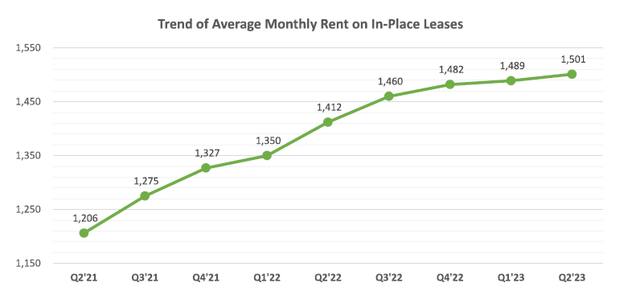

BSR REIT has a strong history of being able to increase the rent for its units and this has helped the company to boost its net operating income once again. On a YoY basis, the weighted average rent increased by 6.3% to US$1,501 per suite. These rent hikes did not discourage renters as the occupancy actually increased from 95% to 95.3% compared to one year ago.

BSR REIT Investor Relations

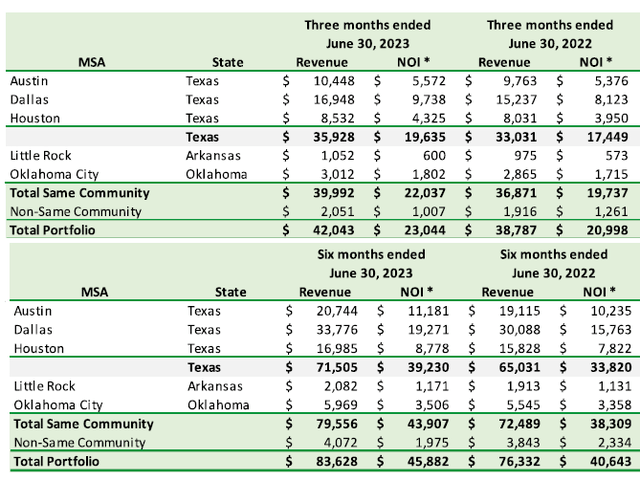

The image below indeed clearly shows the same community NOI increased from US$19.7M in Q2 2022 to US$22M in the second quarter of the current year. And as the new acquisitions contributed about $1M in NOI, the total consolidated NOI for the quarter came in at $23M, and that’s slightly higher than the Q1 result. This meant the H1 NOI came in at $45.9M.

BSR REIT Investor Relations

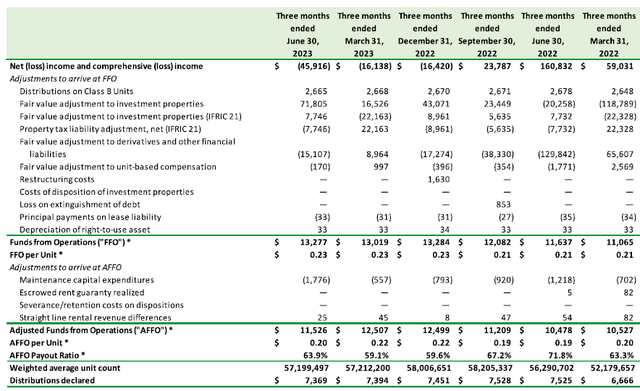

The strong NOI result was positive as it also helped to keep the FFO and AFFO result under control. That being said, the AFFO was somewhat “disappointing” relative to the previous few quarters as interest expenses are obviously increasing.

As you can see below, the REIT reported an FFO of C$13.3M in Q2, which is about 15% higher than in the second quarter of last year, but the AFFO increased by just 10% as the sustaining capex was substantially higher. On a relative basis that is, as the $1.8M sustaining capex in absolute terms isn’t bad at all.

BSR REIT Investor Relations

With a total AFFO of $0.20 per share, the YTD AFFO comes in at $0.42. I do expect the sustaining capex to come down a bit in the next few quarters (the sustaining capex is traditionally higher in the second quarter of the year), so I’m not too worried about the full-year result which I expect to come in at around $0.85-0.88 per share. There may be an uplift in 2023 as the Texas Senate will vote on lower real estate taxes in the fourth quarter of this year. Should the proposal make it, BSR REIT should see an uplift of C$0.02-0.03 in AFFO per share which will easily push the 2024 AFFO to in excess of 90 cents per share.

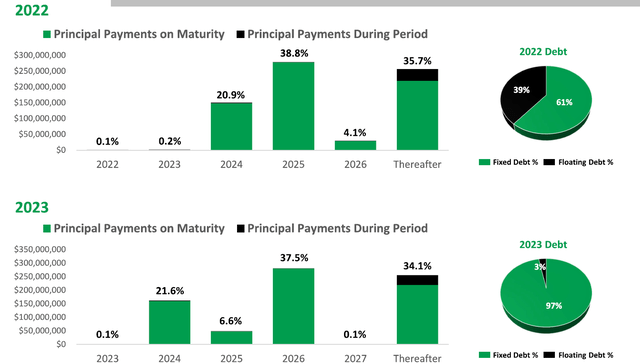

The vast majority of the REIT’s debt is now fixed: 97% of the interest expense has been fixed but keep in mind the REIT will have to refinance a substantial portion of its total debt in 2024.

BSR REIT Investor Relations

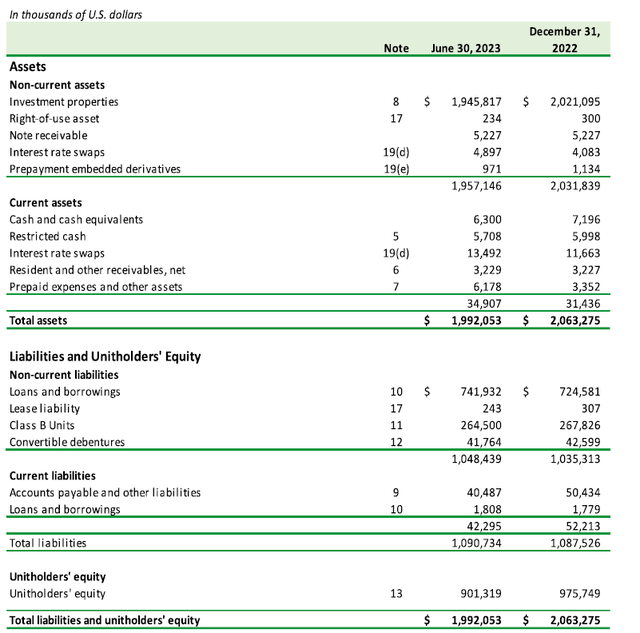

While we can expect the interest expenses to increase, I think those increases will be manageable thanks to the relatively low debt ratio of the REIT. As of the end of June, the balance sheet contained $775M in net debt (cash and restricted cash minus debt but excluding lease liabilities). Considering the book value of the properties was $1.95B, the LTV ratio as of the end of the second quarter was approximately 40%.

BSR REIT Investor Relations

And while I usually take the book value with a grain of salt, in BSR’s case I think the $1.95B value appears to be fair. We know the annualized NOI is $92M which means the assets are valued at close to a 5% NOI yield, adjusted for vacancy. That’s fine with me, and the NAV/share was approximately $20.60 per share.

Even if I would apply a 6% capitalization rate based on the NOI (and again adjusted for vacancy), the NAV/share would still be approximately US$15/share while the LTV ratio would remain limited to 48%.

The distribution appears to be safe

BSR is currently paying a distribution of $0.433 per share on a monthly basis. This results in an annualized distribution of $0.52 per share. Assuming a full-year AFFO of $0.87, the payout ratio is just around 60%. And this will further decrease if the AFFO per share continues to increase in 2024 thanks to the Texas tax cut.

This paves the way for a distribution increase, and although BSR hasn’t really been a big distribution hiker, the sub-60% payout ratio could hopefully result in a more substantial dividend boost towards $0.54 or $0.55 per share.

But for now, I will continue to use $0.52 per share in my models. And this means that based on the current share price of $12.13 the yield is approximately 4.3% which is pretty good given the payout ratio of just around 60% (and decreasing from this level).

At the current payout ratio, the REIT is retaining about $20M per year in cash which could be used for debt reduction (at a pace of just over 100 bp per year) or additional acquisitions. And with an LTV ratio of just under 40%, the balance sheet could certainly handle additional M&A.

Investment thesis

Residential REITs have always been relatively expensive (relative to other REIT categories), but BSR REIT is now entering a territory where I would feel comfortable buying the stock. The stock is currently trading at approximately 14 times this year’s AFFO (I am assuming US$0.87 in AFFO per share) and if the property tax cut in Texas indeed passes in November, I’m anticipating an AFFO per share of US$0.91-0.92 in 2024 resulting in a multiple of just 13.3 times the AFFO.

I currently have no position in BSR REIT but I’m ready to pull the trigger. I like the REIT at the current valuation and although the 4.3% yield is already very respectable, it still represents a payout ratio of just 60%.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here