Retirement is not meant to be stressful, especially about money. In retirement, you should not be waking up thinking about how to meet your monthly budget. You worked hard, and the last thing you want is to worry about your basic financial needs.

However, to achieve the above goals and ambitions, you need to plan about it now, when you are in your 40s or early 50s. Sure, you can save at any age, but those savings can grow to a significant sum only if there is sufficient time for them to compound. When you are young, it is easy to keep postponing the idea of putting 15% or even 10% of your income towards that goal. After all, there are so many other priorities that take over.

But now you are in your late 40s and going to be 50 soon. There is no time left to dither retirement planning. If you have not saved until you are 50, the path forward is not going to be easy, but it is still achievable to save a significant sum in the next 10-15 years. The first and foremost question that comes to your mind is about how much you would need in retirement. The answer to that question is highly subjective. It can be as low as $500,000 or as high as $5 million. The answer depends on many factors like your current income and lifestyle, your place of living in retirement, the kind of hobbies you may like to pursue in retirement, etc. But for most working folks, especially if you have not saved much until now, saving $1 million is a modest target. Sure, $1 million is a reasonable and realistic target, assuming that the other two legs of the 3-legged stool, namely, Social Security and Medicare benefits, will be available to you when the time comes. However, since most folks have no pension any longer, we are not considering it in our calculations.

Social Security and Medicare play an important role for most Americans in their retirement planning. There is no doubt that these programs are under stress and run the risk of running short by as much as 25% in 10 to 15 years, meaning they will collect less than their outflow. However, for today’s 50-year-olds, they should be available for the most part. There is a small possibility of some benefit cuts or the full retirement age being pushed further beyond 67 years. However, we can reasonably assume that at least 85-90% of today’s benefits will be available if you are already 50 or older. Sure, if you are in your 30s, you should plan for much less of benefits.

So, when or at what age should you retire? There is no one answer to this either. It depends on so many factors. If you like your job, and it does not cause you too much of stress, and you are healthy enough, you could work well into your late 60s. But if you are doing your job only for the paycheck and it causes you a great deal of stress, then your answer would be different. Many times, you may have to retire involuntarily due to retrenchment at your company. So, for planning purposes, it is good to assume that you should have the ability to retire at 62 if you want or if the situation warrants.

For the purpose of our article, we will consider a couple who may be in their early 50s and want to be prepared to retire by age 62. So, basically, our investor has only 10-12 year to prepare, save, and grow their capital to a reasonable sum that could provide them a comfortable retirement.

Note: This article is part of our Retirement Series, where we periodically write on these retirement themes for different age groups and circumstances. At times, you may notice some repetition of some core principles and strategies, but we feel that is necessary for the benefit of new readers.

All of the tables and charts in this article have been prepared by the author unless explicitly specified otherwise.

Part I: Retirement Planning

Let’s assume a hypothetical couple to demonstrate the planning process. We would name them- John and Lisa. Let’s make certain assumptions:

- Both John and Lisa are 50 years old.

- They want to be prepared for retirement by the age of 60 to 62.

- They jointly make a gross income of $150,000 a year.

- They currently have savings in retirement accounts worth about $250,000. Most of it is in tax-deferred IRA or 401K accounts.

- Their goal is to save well over a million dollars by the age of 62.

While trying to plan for their retirement:

- To save and reach a target of one million dollars (from the current level of savings of $250,000), they would need to test a few scenarios. There are two factors: how much they can save every year and how much growth they can reasonably expect.

- We also have to see how much income they can generate with $1 million in retirement and, along with Social Security, whether it will be sufficient to maintain their current lifestyle. If not, they should work longer or at least work part-time to fill any gaps. To answer some of these questions, they need to figure out their expenses in retirement.

Let’s estimate their expenses in retirement:

The best method to figure out your expenses in retirement is to look at your current net income (gross income minus taxes, social security taxes, and contributions like 401K or IRAs.

Table-1:

|

Item Desc. |

$ Amount (per year) |

Comments |

|

Gross Income |

150,000 |

|

|

(minus) Taxes |

(-) 20,000 |

Rough estimates (highly subjective) |

|

(minus) SS withholding |

(-) 11,500 |

7.65% of the gross |

|

(minus) 401K Contributions |

(-) 22,500 |

15% of gross income (proposed between now and age 62) |

|

(minus) IRA contribution |

(-) 6,000 |

|

|

(minus) 529 Edu contribution |

(-) 5,000 |

|

|

(minus) other deduction & Misc |

(-) 6,000 |

|

|

NET Expenses |

$96,000 |

|

|

Net monthly expenses |

~ $8,000 |

|

|

(minus) House mortgage (monthly) |

(-) $1,500 |

Assuming the mortgage is paid off prior to retirement. |

|

Net Expenses (monthly) in retirement (without accounting for inflation) |

$6,700 |

The above is just one method. The actual expenses can be more or less depending on several other factors.

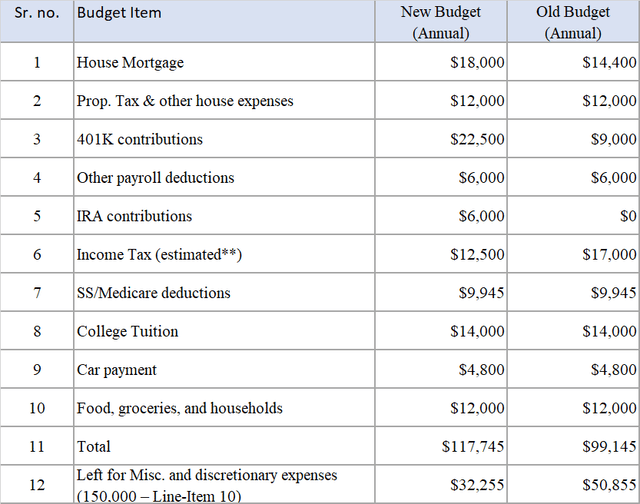

From the table above, we can also see that with the new savings targets of 15% into 401K funds, $6,000 into an IRA account, and $5,000 into a college tuition fund, John and Lisa will have about $8,000 per month left for their day-to-day expenses. We will see below the planning for their new budget vs. the old.

Table 2: John & Lisa’s Budget Planning:

Author

**The author is not a tax expert/consultant. This tax estimate provided in the above table is just a broad estimate by the author. Tax situations can be highly subjective, and they can vary widely.

Savings Targets for Retirement:

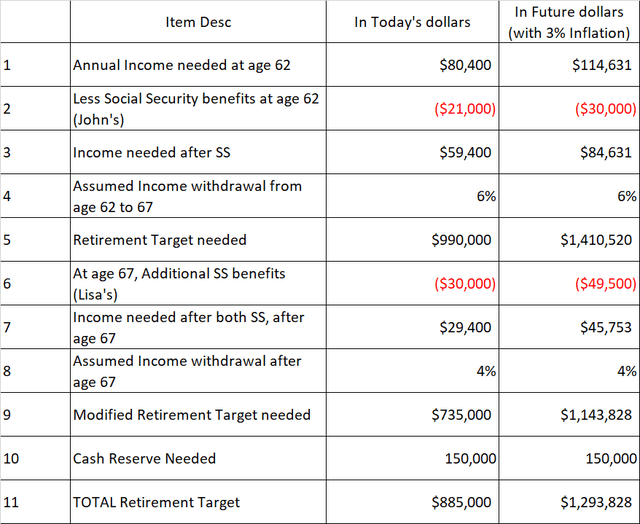

We calculated above that our investor couple would require roughly $6,700 (in today’s dollars) per month in retirement. However, due to inflation in the next 12 years (assuming an average of 3% a year), the same would be equal to $115,000 a year (in future dollars). In addition, we want to keep $50,000 for medical premiums between the ages of 62 and 65 (Medicare eligibility starts at 65). Further, they should keep a cash reserve of $100,000, roughly equivalent to one year’s worth of living expenses.

In Summary, they would need to provide for a total cash reserve of $150,000. Also, they will need roughly $115,000 a year for their annual expenses to maintain their current living standards.

Once they have figured out yearly expenses in retirement (spending budget), it is rather straightforward to calculate how much capital they would need at the onset of retirement.

By doing some reverse calculations, here is what they would need:

Table 3: Needed savings calculations in today’s and future dollars

Author

From the above table, we can see that they would require roughly $900,000 in today’s dollars or $1.3 million in future dollars. It definitely seems a bit of a tall target for a couple who has only $250,000 and has 12 years left for retirement. But there is no reason to be disheartened. There are always solutions and modifications that they can apply in their planning process. Here are some examples:

- They could reduce their expenses in retirement by moving to a cheaper place to save 10% to 15% in their expenses.

- If they do it right and get a bit lucky, they could have an annual average return on their investments of 12%. That would be sufficient to make their savings grow to $1.6 million.

- Or they could save 20% of their gross income today instead of 15%.

- Or at least one of them works longer, full-time or part-time.

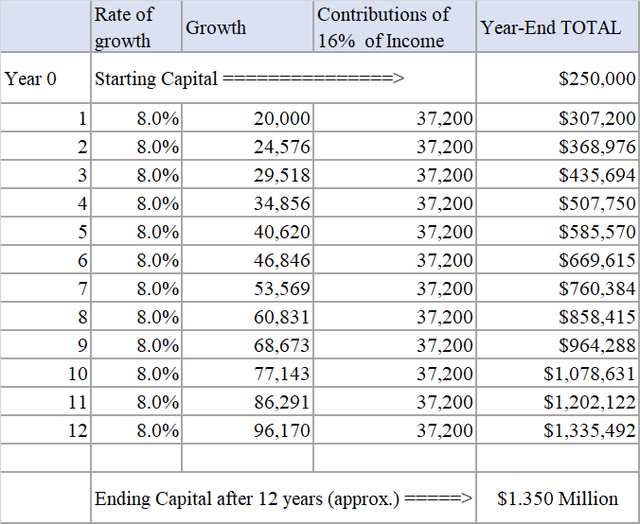

We will now see what they need to do to accumulate $1.5 million or more by age 62.

Investment Returns Calculations (Age 50-62)

From a historical perspective, we know that the stock market returns roughly 9% to 10% over a very long period of time. But that is true if the time is counted in decades but not necessarily so much when you have only 12 years. In the later section, we will try to address this problem and adopt a method to ensure that we can at least get 9 to 10% growth. However, there are no guarantees.

Table 4: Investment portfolio growth from Age 50-62

Author

In the above table, the savings contributions have been assumed to be 16% of gross income, while the average annual return is assumed to be 8%. These two assumptions hit the target almost exactly. If, somehow, the growth rate of 8% cannot be achieved, the savings rate has to go up to 18% or 20%.

Table 5:

|

Savings Rate |

Average Annual Growth Rate |

Target Retirement Savings Achieved |

|

16% |

8.0% |

$1.35 Million |

|

18% |

7.5% |

$1.35 Million |

|

20% |

7.0% |

$1.35 Million |

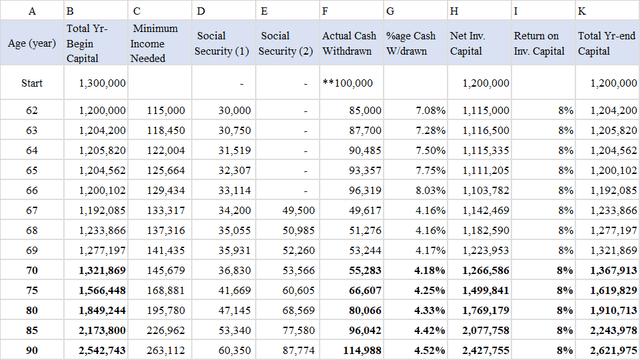

Retirement Years Age 62-90 – Calculations of Capital Growth and Drawdowns

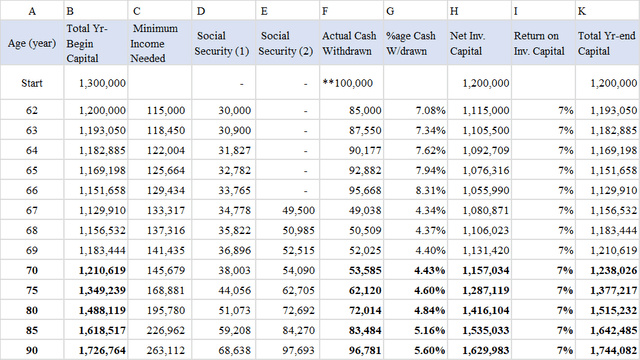

We present below the strategy for John and Lisa during the actual retirement. If things pan out as per the plan, they should never run out of money. In fact, their portfolio would grow nicely but slowly. In fact, we will see in the tables below that by the time they are 80, their capital will almost double from where they started. This tells us that, in all likelihood, they should never run out of money.

We will now present the table that simulates the yearly income from various sources and withdrawals during the period from 62-90 years. It also demonstrates that with an annual growth rate of 8%, their balance would grow nicely over the years, providing them a decent margin for error or overspending. However, we’re going to present another table with a 7% annual growth rate.

Table 6A: Calculation of Capital Growth and Drawdown with an 8% rate

Author

**Cash amount reserve

Note: To keep the table size presentable, some rows have been kept hidden.

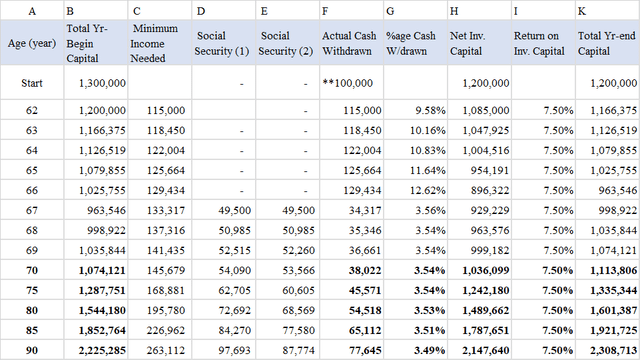

Table 6B: With 7% growth rate

Author

With a 7% annual growth rate, the margin of safety will become a bit thin, but the capital will still keep growing at a slow pace. John and Lisa will not run out of money and will still leave a significant amount to their heirs. Can they get an average annual growth rate of 7%? Now, most people would agree that this target is quite reasonable over a 30-year period, especially when you consider the fact the stock market has returned an average of 9% long-term returns in the past.

Now, the next table shows the growth of the capital with the assumption that both Jon and Lisa decide to withdraw from Social Security at the full retirement age of 67 years. Also, the growth rate is assumed to be 7.5%. Overall results are comparable; however, you would notice that the drawdown in the first five years of retirement is significantly higher at 10-12% each year, but it falls to 3.5% after social security kicks in. Even then, it may cause some problems if the stock market performs poorly in the first five years (due to sequential return risk).

Note: Sequence risk, or sequence of returns risk, is defined as the risk emanating from a stock market crash early in your retirement or just prior to retirement.

Table 6C: Growth and drawdown with a 7.5% growth rate; SS withdrawals at age 67

Author

Part II: Portfolio Strategies to Get 9-10% (or even more) Returns Consistently

It is well acknowledged that index investing in the broader market can give you reasonable returns over a long period of time but with lots of ups and downs. Most retirees may find it difficult to stay the course and often tend to get in and get out at just the wrong time. The recent experience of the past three years has shown that even 60:40 portfolios (60% stocks, 40% bonds) can perform poorly when both the bonds and stocks go down at the same time. Also, recent retirees (or near-term retirees) cannot afford deep drawdowns in the first few years of retirement as it would do irreparable harm to their portfolio (please see risk of sequential returns, explained earlier).

So, what is the solution? We present one alternative strategy below, with three buckets:

- DGI (Dividend Growth Investing) Bucket: 45%

- Risk-Adjusted Rotational Bucket: 45%

- A 10% Growth Bucket: 10% (this is optional depending upon the stage in life).

DGI Bucket: (45% of assets)

This bucket could invest in individual dividend-paying stocks, dividend ETFs, or a mix of both. The choice is rather personal. We prefer individual stocks if they are chosen carefully and monitored at least a couple of times a year. Either way, this portfolio can provide you with roughly 3% income.

A portfolio of 20 large-cap blue-chip stocks is presented below. These stocks have been selected from the popular dividend ETFs. The selection is targeted at relatively young folks, and many of the growth stocks have been selected even if they are yielding very low.

List of 20 Stocks:

(ABBV), (AMGN), (AAPL), (AVGO), (CVX), (CLX), (KO), (XOM), (JNJ), (JPM),(MA), (MRK), MSFT (MSFT), (PEP), (PFE), (PG), (HD), (UNH), (VZ), (V).

Table 7: A DGI portfolio of 20 Stocks

Author

Rotational Risk-Adjusted portfolio: (45% of assets)

We often write and include Rotational strategies as part of our portfolios.

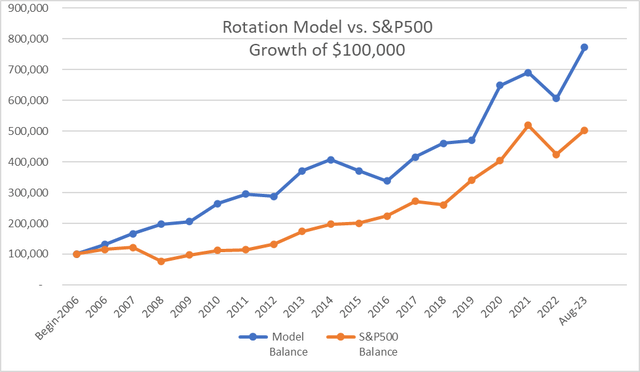

One of the strategies that we can recommend is our QQQ-Prime strategy. We will invest in three securities, namely, Invesco QQQ Trust (QQQ), iShares 20+ Year Treasury ETF (TLT), and SPDR Gold Shares ETF (GLD). We added the third asset class of GOLD as it can often provide some hedge when both the stock market and Treasuries are performing poorly. Every month, we will compare the performance of these three securities during the past three months and select just one for investment. We will repeat this process on a monthly basis. Based on the back-testing results, below are the performance results, annualized returns, and growth of $100,000 since the beginning of year 2006.

Table 8:

|

(from Jan. 2006 to Aug. 31, 2023) |

Rotation Model |

S&P 500 |

|

Annualized Return (OTC:CAGR) |

12.27% |

9.58% |

|

Best Year Perf. |

38.14% |

32.18% |

|

Worst Year Perf. |

-12.19% |

-37.02% |

|

Maximum Drawdown |

-25.44% |

-50.97% |

|

Sortino Ratio |

1.17 |

0.86 |

|

Stock Market Correlation |

0.30 |

1.00 |

Chart 1:

Author

Note: The performance results presented above are based on back-testing and do not guarantee future results.

If you have an interest and have significant exposure to Rotation strategy, it may be preferable to deploy multiple rotational strategies.

Growth Bucket: (10% of assets)

As we stated earlier, this bucket is optional, depending on the life stage. We would recommend a higher percentage, like 20% allocation, if you are relatively younger. Even retirees could allocate about 10% to the growth bucket, as retirements can last 30 years or more. If you do decide to invest in a growth bucket, you should choose these stocks carefully. We should be able to make a distinction between growth stocks and speculative ones.

For example, Microsoft (MSFT), Apple (AAPL), Mastercard (MA), and UnitedHealth (UNH) are some of the examples of growth stocks that could be considered reasonably safe. However, such stocks mostly trade at expensive or fair valuations, so they should be accumulated over time. Now, we should not expect much income from this bucket, but the goal is to grow with capital at a faster pace.

Concluding Thoughts

Saving regularly at an early age and investing (wisely) to let the capital compound are the two most important factors that can offer you a wonderful and financially independent retirement later. But not everyone gets that wisdom when they are just starting their careers. However, there is no point in regretting the past as that is not going to change the future. The future depends on what actions you can take today, and it is never too late to start saving and investing.

In the above article, we demonstrated a strategy with our hypothetical couple who start the retirement planning process in their early 50s and will still be able to afford a decent retirement. We also presented a three-bucket portfolio strategy that would lower the volatility and drawdowns to a large extent while providing a decent level of income and growth. We expect the strategy to provide growth during the boom years and preserve capital during recessionary times or big corrections.

Read the full article here