The JPMorgan Equity Premium Income ETF (NYSEARCA:JEPI) is the gold standard of covered call ETFs for a few key reasons, which we’ll cover in this article.

I’ve also been comparing JEPI to challenger ETFs like DIVO and SPYI, both requests from Dividend Kings members to see if either challenger could unseat the king of ultra-high-monthly yield.

Today I’m presenting a unique article, which is both a comparison article and a warning to retirees who love covered call ETFs.

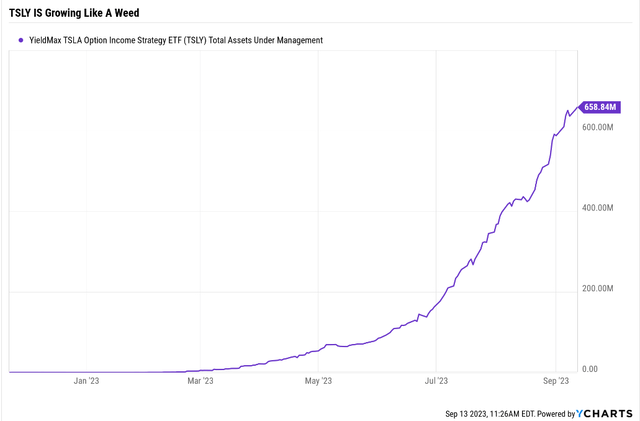

A Dividend King member recently asked me about the YieldMax TSLA Option Income ETF (NYSEARCA:TSLY). At first glance I thought this ETF was so absurd that no one would bother buying it.

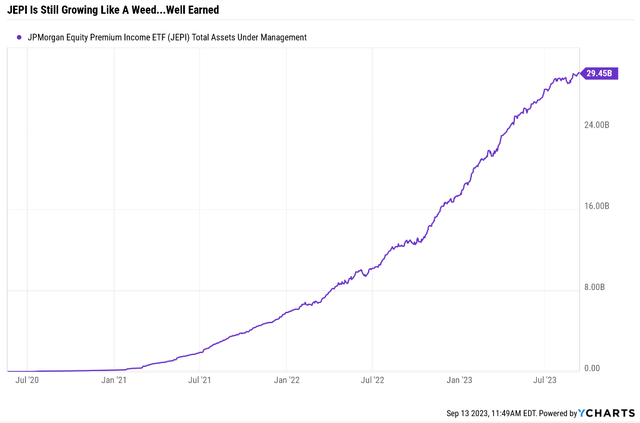

Ycharts

It turns out that a 50% yielding ETF can indeed attract a lot of people.

So to help teach retirees and anyone else attracted to covered call ETFs, how to do it safely, today I present JEPI & TSLY: What A 50% Yielding ETF Can Teach Retirees about covered call investing.

Lesson One: What These ETFs Own

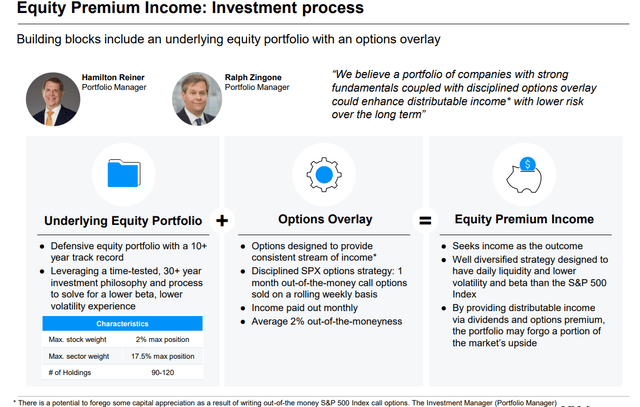

JEPI is run by two option pros with about 60 years of cumulative experience.

JPMorgan Asset Management

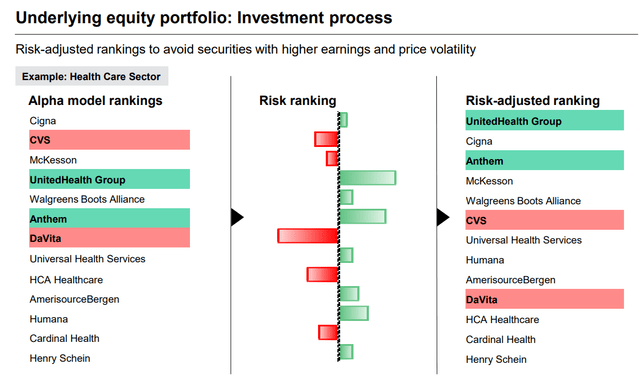

They take a diversified portfolio of about 110 blue-chip stocks, screened for quality and earnings stability, and then use a unique option strategy to generate income off just 15% of the portfolio.

JPMorgan Asset Management

These are exchange-linked notes or ELNs on 15% of a blue-chip portfolio, a more complex strategy than simple covered calls.

But JEPI is designed to be a single ticker retirement solution, combining quality companies with strong long-term option income to try to earn 6% to 10% returns, or about 80% of the S&P’s underlying return.

JPMorgan Asset Management

JEPI is also designed to achieve about 35% lower volatility than the S&P, which it managed to do in 2022. Which is why it was such a Wall Street darling and attracted such monster inflows last year. In 2022 JEPI soared from $7 billion in AUM to $17 billion, one of the top 10 ETFs of the year.

Ycharts

Coveraged calls are basically when you act as an insurance company for someone who is worried that a stock’s price might fall.

Anyone can write covered calls and they are flexible and usually not held until maturity.

ELNs are the realm of the institution, special contracts linked to the price of stocks, indexes, or baskets of stocks.

These are usually held until maturity and can create stronger leverage, which is why JEPI is able to generate such strong income from a 1% to 2% yielding basket of stocks, while only writing ELNs against 15% of the portfolio.

Basically, JEPI uses an advanced form of option leverage in exchange for counterparty risk.

In the very unlikely event of another financial crisis, when JEPI’s goal of 35% less volatility than the S&P would be most useful, JEPI’s income could theoretically tank.

Note that the counter parties JPMorgan is working with are companies like Citigroup, Bank of America, and Goldman Sachs. They are not going to fail, and if they ever do, we’ll all have bigger problems than our portfolios.

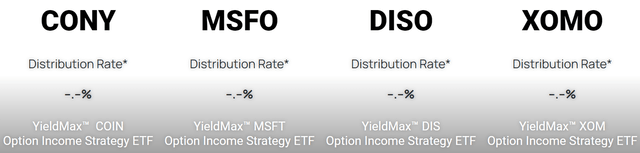

So what about TSLY? It’s part of the yieldmax family of ETFs, that use options to try to generate max income with maybe a bit of gains in the underlying stocks as well.

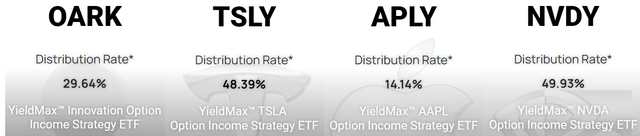

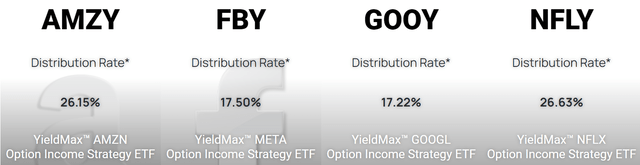

YieldMax YieldMax YieldMax YieldMax

Some of these are so new they haven’t started paying distributions yet. But you can see how 14% to 48% yields on high volatility stocks like big tech can be very enticing to an income focused investor.

Each of these YieldMax ETFs is designed to own just one stock and write calls against it.

Lesson Two: How These ETFs Make Money

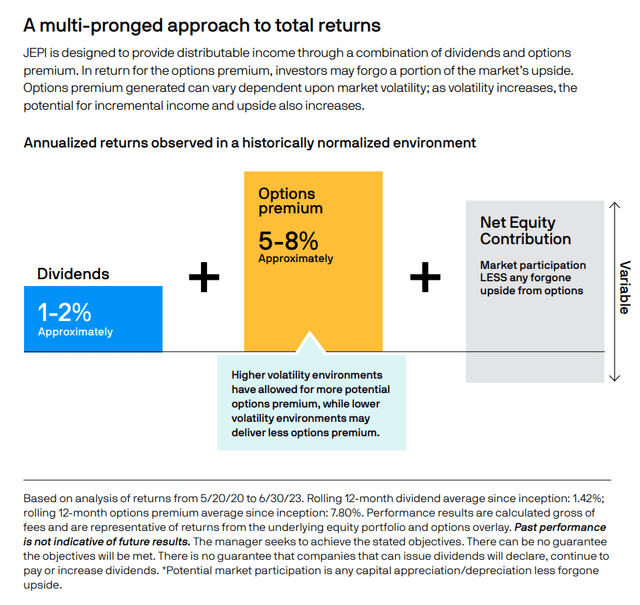

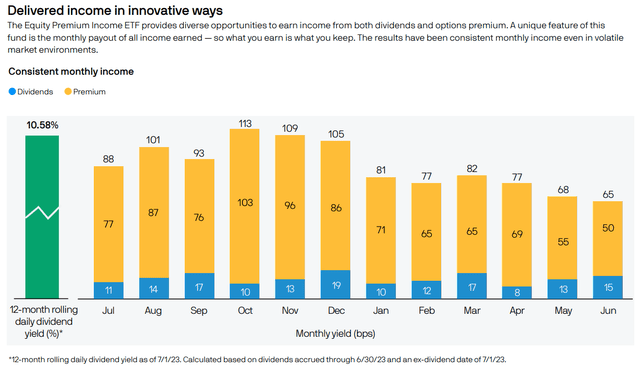

JEPI is designed to be sustainable and try to generate as much sustainable income as possible over years. Management is writing ELNs targeting a 5% to 8% yield.

JPMorgan Asset Management

You can see how the rolling monthly income is pretty stable around 12 basis points or 0.12% per month for the last three months.

You can also see how the vast majority of the income JEPI is paying out is coming from the ELN income. That has been steadily falling since volatility peaked in October, so far the bear market bottom.

A steady fall in volatility has resulted in insurance premiums for stocks declining though JEPI’s annualized June income still works out to 8.2%.

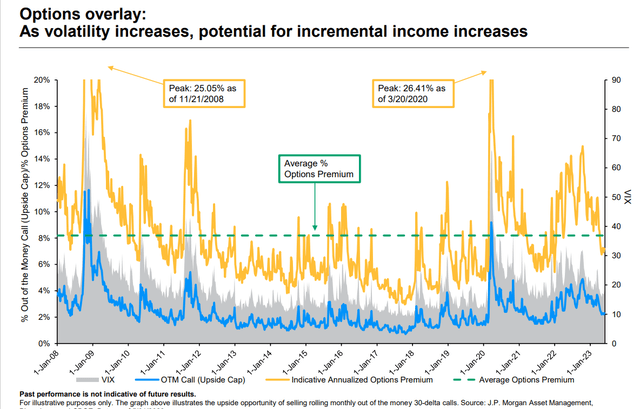

JPMorgan Asset Management

That’s what the average option premium has been since 2008. If this last 15 years of volatility data is representative of the future (it’s 91% likely to be) then JEPI could generate long-term returns:

- 1% to 2% dividend income

- 8% option income

- 9% to 10% long-term returns

- theoretically modest gains from the portfolio themselves

On income along JEPI could potentially deliver 8% to 10% returns, the upper range of management’s 6% to 10% range.

9% to 10% long-term returns would be 90% to 100% of the S&P’s future expected return but with 35% less volatility, and a nice juice 8% yield paid monthly.

Can you see why so many high-yield investors love JEPI?

Lesson 3: Watch The Dependability Not The Yield

OK so we can see how JEPI thinks it can achieve 8% long-term income from its ELNs.

But how on earth is TSLY paying out a 50% yield? What black magic is it conjuring to achieve this?

Ycharts

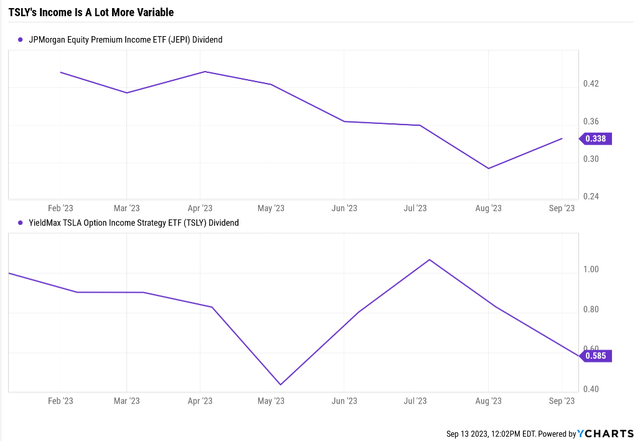

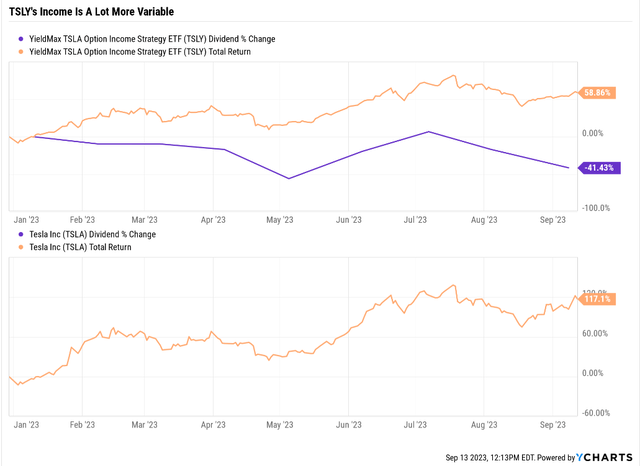

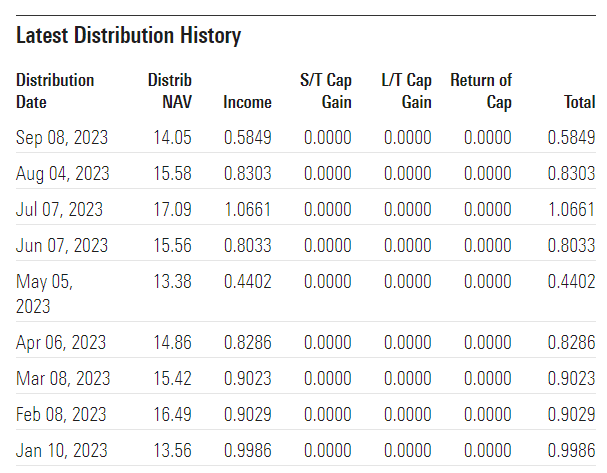

Well for one thing it’s not a stable 50% yield, not even close.

These distribution rates caused by unusually favorable market conditions may not be sustainable. Such conditions may not continue to exist and there should be no expectation that this performance may be repeated in the future.” – YieldMax

For TSLY the premiums can soar the highest when the stock is raging higher.

Ycharts

When the price of Tesla nearly doubles in a few weeks, TSLY’s dividend explodes higher. When Tesla starts trading flat the TSLY distribution is almost cut in half.

The distribution may include a combination of ordinary dividends, capital gain, and return of investor capital, which may decrease a fund’s NAV and trading price over time. As a result, an investor may suffer significant losses to their investment.” – YieldMax

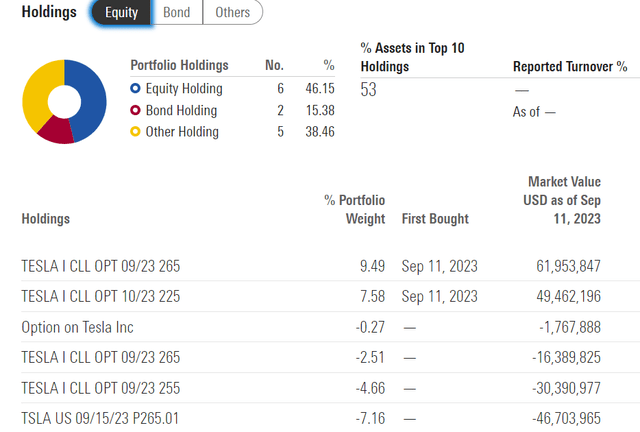

TSLY appears to be using hedged bull call spreads.

Morningstar

The max profit for this is the difference between the two strike prices minus the net premium paid. In this case example, the difference between the strike prices is $265 – $225 = $40.

If TSLY earned $20 for the $225 call and received $10 for selling the $265 call, the net premium paid would be $20 – $10 = $10. Therefore, the maximum profit would be $40 – $10 = $30 per share, or $3,000 per contract (since each contract typically represents 100 shares).

The max profit occurs above $265, and TSLA is currently at $270.

So basically, this means that TSLY is using hedged bull call spreads on a hot stock to generate max income, and when Tesla is ripping higher, the annualized yield is a blistering 50%.

Thus why this is so popular right now.

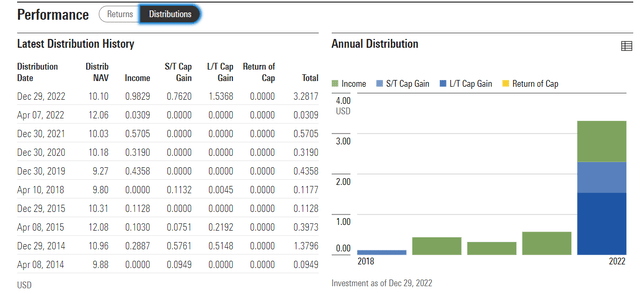

TSLY Distributions

Morningstar

Notice how the income started out very high and then collapsed and then soared again, and has now collapsed again.

That’s the volatility in Tesla’s share price. The stock took off like a rocket at the start of the year. Then went flat, then took off again, and is now flat again.

Lesson 4: Don’t Forget About Taxes

There is a very specific reason why I recommend JEPI for just two kinds of investor.

- JEPI: This 12% Yielding ETF Is Perfect For 2 Kinds Of Investors

If you are a Roth IRA investor who doesn’t want to think about anything ever, then JEPI is a potentially superior single ticker alternative to a 60/40 fund.

It’s also a great choice for tax-free accounts like IRAs, 401Ks, and Roth IRAs.

But once you start paying taxes? Those 8% to 10% management guidance returns on JEPI disappear in a hurry.

| ETF | Tax Expense Ratio Since Inception | Annual Total Returns Since Inception | % Of Gains Given Up to Taxes |

| COWZ | 0.73% | 13.44% | 5.4% |

| SCHD | 0.94% | 13% | 7.2% |

| VIG | 0.57% | 9.22% | 6.2% |

| SCHG | 0.31% | 15.12% | 2.1% |

| QQQ | 0.22% | 9.20% | 2.4% |

| MOAT | 0.51% | 14.23% | 3.6% |

| SYLD | 1.08% | 12.44% | 8.7% |

| SPY | 0.59% | 9.91% | 6.0% |

| JEPI | 3.86% | 8.29% | 46.6% |

(Source: Morningstar)

JEPI was built for 8% long-term returns. It’s delivered 8% long-term returns.

It was built for 35% lower volatility than the S&P and that’s what it’s delivered.

But if you own JEPI in a taxable account? Or any covered call ETF? Up to 50% of your gains can be eaten up by the IRS.

And that’s just the average taxpayer.

If you’re top tax bracket and living in NYC you can lose up to 60% of your returns in the form of taxes.

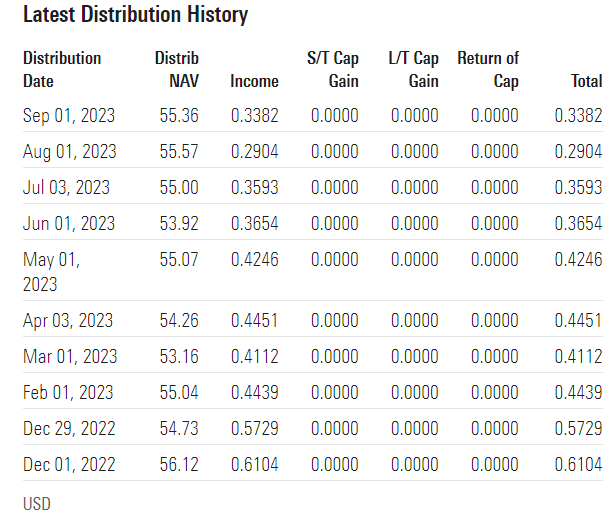

In this case neither JEPI or TSLY is going to escape the tax man’s furry. ELN income is taxed as ordinary income just like regular covered call option income.

Now some option managers are able to get some of the income taxed as return on capital or long-term capital gains.

JEPI Distributions

Morningstar

No such luck with JEPI or TSLY or most covered call ETFs.

AMFAX Distributions

Morningstar

Managed futures are generally able to be taxed 2/3 as long-term cap gains and 1/3 as short-term (ordinary income rates).

Lesson 5: Don’t Forget About The Downside Of Covered Call ETFs

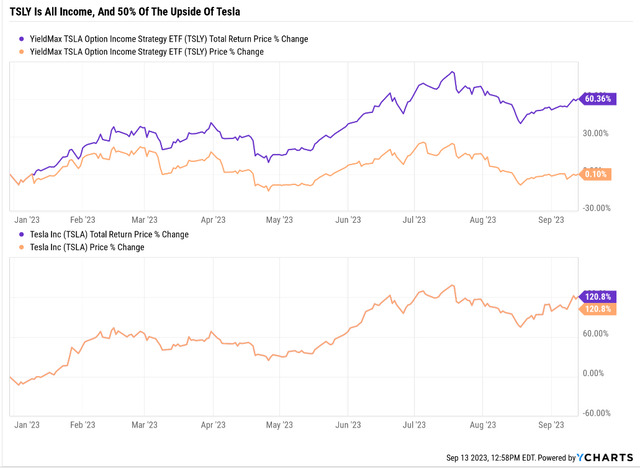

Tesla is up 120% YTD, one of the hottest stocks of the year. TSLY is primarily focused on income and willing to give up a lot of gains to do it.

How much?

Ycharts

If you had reinvested your distribution into more shares of TSLY you’d be up 60% or half as much as Tesla.

If you took the income out to spend you’d be dead flat for the year. And don’t’ forget that most people will have to give up 40% to 60% of the income as taxes.

So a high income earner in TSLY who was spending that income would be up about 30% after taxes or 1/4th what Tesla longs made this year.

Now you might be thinking “who cares that I’m ONLY up 30%! That’s pure income!”.

And yes, if TSLY could deliver about 30% annual income after taxes, or even half that it would be a rich retirement dream stock.

But remember how TSLY works. It uses bull call spreads on a hyper volatile stock and this is pretty much the perfect year for Tesla longs.

I suppose it would have been doing even better (likely over 100% yield) in 2020 after the Pandemic stimulus caused Tesla so soar almost 10X in a year.

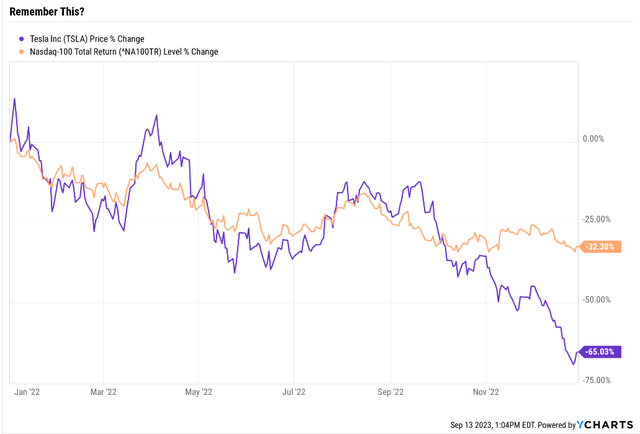

But what about 2022? Well, that was a terrible year for Tesla.

Ycharts

In a falling market covered call premiums aren’t doing too hot so you shouldn’t expect much downside protection.

Since TSLY started in January 2023 we don’t know what it would have done in 2022.

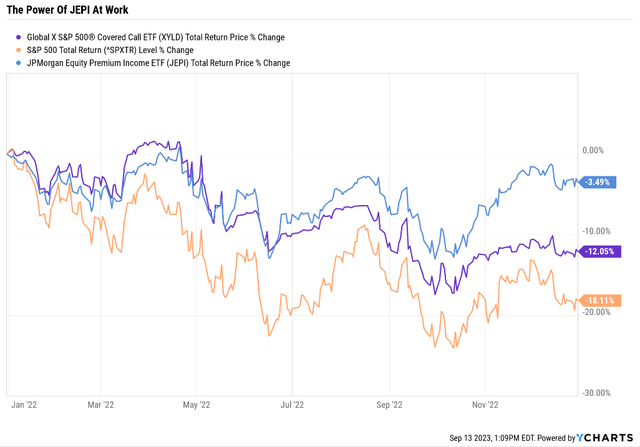

Ycharts

The S&P 500 covered call ETF fell 35% less than the S&P. JEPI fell 1/6th as much as the market thanks to really good stock picking and option management.

My best guess is TSLY would have been down about 40% in 2022, not exactly a banner year for anyone looking to sleep well at night in retirement.

JEPI in 2023? +5% or roughly 50% that of the S&P though that’s not exactly a fair comparison since its portfolio looks nothing like the S&P.

Bottom Line: Covered Call ETFs Are A Useful Tool If You Know How They Work

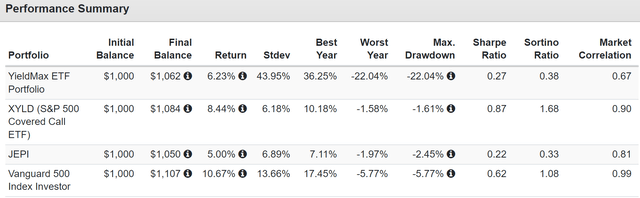

What if you took all those YieldMax ETFs, and combined them into a hyper-volatile hyper-yield portfolio? Might that be a better option than JEPI?

2023 Total Returns

Portfolio Visualizer Portfolio

The YieldMax ETFs have a 1% expense ratio about 3X that of JEPI.

And this year they would have basically matched JEPI’s returns but with 7X the volatility and a peak decline 9X as bad.

In a year when the S&P never fell more than 6%, YieldMax’s hyper-volatile covered call ETFs were hypervolaile and fell almost 4X as much.

Can I recommend YieldMax ETFs? Not really. If you cherry pick an individual one and get lucky, you can do great. Just see TSLYA’s 30% after tax gain this year which is about 3X that of the S&P and pure after-tax spendable income.

But how many years do you expect Tesla to soar 120%?

How often will a perfect storm break in your favor?

And how are you going to feel earning basically JEPI like returns but with 7X the volatile and 9X the peak declines of JEPI?

To me it looks like YieldMax got lucky this year, when high volatility big tech was on fire.

They were able to sell “50% yielding ETFs!” which is super easy when nothing is going wrong.

In 2022 YieldMax and TSLY would have gotten slaughtered.

In the 2024 recession? I imagine they are going to be tested and not do anywhere near as well as JEPI did in 2022’s bear market.

If you like covered call ETFs then JEPI remains the gold standard.

Just remember when considering JEPI that there are 2 kinds of investors that should use it.

- Roth IRA is ideal

- 401K or IRA or other tax-sheltered is also good

- best for those looking for a single ticker alternative to a 60/40 portfolio

Read the full article here