On 14 September, Taseko Mines (NYSE:TGB) finally received the long-awaited UIC permit from the US EPA for the Florence project. The market reaction was quite positive as shares rallied 12.3% during the day.

Market reaction (Seeking Alpha)

For some backstory, I’ve written a number of articles on the company with the most recent one being available here. In short, I’m bullish on the copper and Taseko as it fits my criteria of existing production and considerable exploration/development upside. The final UIC permit was the last roadblock that needed to be cleared before construction begins. With the indicative construction schedule that management provided, first copper from Florence could be expected towards the middle of 2025. While existing sources of liquidity should be sufficient to complete the project, the company is expected to announce additional funding through some sort of royalty agreement soon. In terms of valuation, Taseko’s EV remains well below the combined estimated NPVs of Gibraltar and Florence and I expect that gap to be closing as construction advances.

The path towards construction should be clear

For years, Taseko has been battling red tape in order to begin construction at Florence. On 14 September, the last piece of documentation was granted as the US EPA issued a final UIC permit for the Florence copper project. This happened more than a year after the draft permit was issued in August 2022. It has to be mentioned that while the last decision opens the path to construction, there’s a period of around 30-45 days where the decision of the EPA could be challenged as management admitted during a recent interview. However, an appeal could be filled by only those who raised their concerns during the public comment period last year, where over 98% of the responses were positive. Additionally, the EPA addressed the few negative comments while issuing the permit so the chances of further delay seem small.

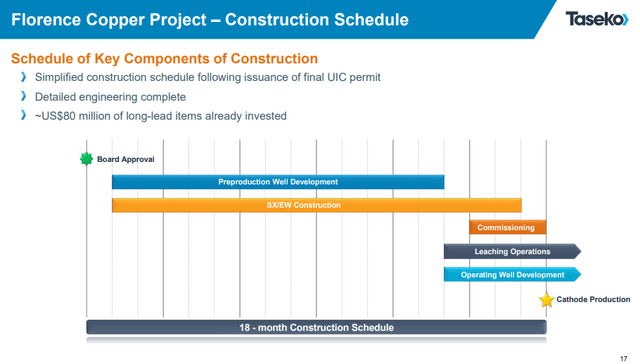

Construction schedule (Taseko mines)

In terms of timing, management has indicated an 18-month timeline to put the project into operation. Keeping that in mind, I would expect first copper from Florence somewhere towards mid-2025. Such timeline should work well for Taseko, given the US$400M of notes due in 2026 will be refinanced much easier and with better terms once the cost-superior Florence is in production.

The project itself is a game-changer for Taseko, which has only one currently operating mine with relatively low-grade copper content, resulting in quite high and volatile cost structure. However, Florence has much better profile with roughly half of the indicated cash costs of Gibraltar.

Liquidity situation

The next important question is the initial capital cost of the project and the way it will be financed. This was highlighted by Taseko’s CEO in the permit announcement:

With procurement well advanced, the next steps will be mobilization of contractors for the wellfield and SX/EW plant construction. We continue to advance discussions with potential lenders and royalty providers for the remainder of the project financing package and expect to have additional commitments in place before construction spending ramps up.

– Stuart McDonald, CEO of Taseko

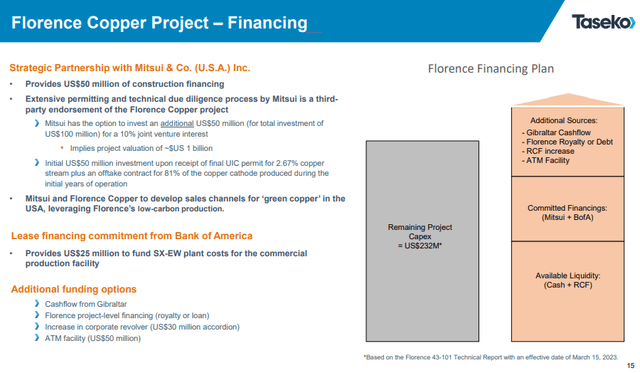

Taseko’s liquidity sources (Taseko mines)

Looking at currently available sources of liquidity, things don’t look bad at all. First, the company has around US$64M of cash and equivalents. In addition to that, there’s US$70M remaining under a credit facility and US$25M of committed financing from BofA. Also, the US$50M under the Mitsui deal, which are to be received in tranches as construction advances. This brings total liquidity to about US$209M, slightly below the US$232M of indicated initial CAPEX. However, Taseko could issue up to US$50M of shares under an ATM equity offering. The latter would be dilutive though, especially as the company is trading at a discount to the indicated value of its projects. So the most logical path for securing the remainder of the funds will be some type of project loan or royalty/streaming agreements, which is actually the path management is pursuing as per a recent interview.

Valuation

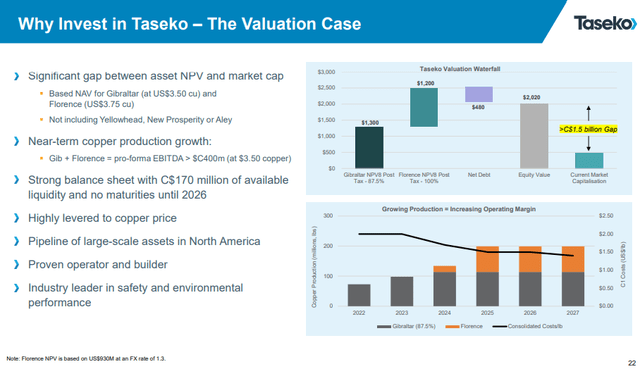

Valuation gap (Taseko mines)

Despite the positive market reaction to the news announcement, Taseko’s EV amounts to just CAD$1,140M, which is well below CAD$2,500M of combined estimated NPV of Gibraltar and Florence, without counting on any of the other exploration/development projects of the company. My guess is that when actual construction begins and advances, the valuation gap should begin to shrink.

Conclusion

The issuance of the final UIC permit for Florence removes the last red-tape roadblock before construction. The project itself should be a game-changer for Taseko, because of its favorable cost profile. If nothing unexpected happens, I expect first copper from Florence to be produced mid-2025. At the same time, the company remains deeply undervalued in comparison to the combined indicated NPVs of Gibraltar and Florence. I expect the valuation gap to shrink as construction advances.

Read the full article here