“The surprise is that you continue to be surprised.” … Jill A. Davis

The early bounce in the markets to start the year got a boost in May. The ‘Sell in May and Go Away’ myth proved to be just that—a myth. Stronger-than-expected economic data, AI Mania, slowing inflation, and hopes that the Fed is nearing the end of its tightening cycle put the S&P 500 on track for a ~7% gain this summer. This is the seventh time in the last eight years that the S&P 500 was higher during the summer (Memorial Day to Labor Day).

With the Big 7 garnering all of the headlines, it created somewhat of a false narrative. The mega caps weren’t the only names driving the market higher as there was a broadening of performance. 10 of 11 sectors were in positive territory with select cyclicals, such as Energy, Consumer Discretionary and Industrials leading the way. The bar was set low, so Q2 earnings were better than feared although the S&P 500 posted its third consecutive quarter of negative earnings growth.

One bright spot: positive corporate guidance saw earnings for 2023 and 2024 inflect higher which fundamentally supports recent gains. Despite the oversized rally this year, the pullback in August was very tame. The S&P 500 narrowly avoided a 5% pullback with a 4.8% peak-to-trough decline this summer. That is just over half the typical summertime pullback (- 8.5%). Analysts are getting more optimistic as we are now seeing many Wall Street strategists lifting their S&P 500 targets.

Many have concluded that “Soft landing” and “Goldilocks” disinflationary growth scenarios are all but certain, and with that mindset in place equity investors bid up stocks and expanded valuation multiples. August brought a quick pause that bears watching because it was initiated by the factors that we will discuss in a minute.

As we enter September, we’ve seen a resilient consumer keep the economy afloat. While consumers have gotten more discerning with their spending (as highlighted by several companies in their 2Q earnings calls), their post-COVID demand for travel remains strong. Here we are. Another replay of last year’s “Summer of Revenge Travel”. TSA screenings are at record levels, hotel occupancy is back to pre-COVID levels, and the cruise industry experiencing a summertime boom.

It wasn’t just traveling either as other events such as movies, concerts, and sporting events provided a strong boost to economic activity. This resilient consumer spending has led the consensus to pull back its recession calls, with fewer than 50% expecting a recession in the next 12 months.

I continue to follow the indicators and other evidence that takes the other side of that argument. The summertime boost to growth is winding down. Excess savings are melting away, student loan payments (if they are paid) restarting, cracks in the jobs growth picture, and higher borrowing costs (i.e., credit card, mortgage, auto loans) are all new weights on the consumer. At the very least, indiscriminate spending is going to be challenged.

Add that to what was mentioned last week

Higher Treasury yields, higher oil prices, and a higher dollar, are all things that equity bulls do not want to see, but that’s what we have as we enter September.

Investors don’t want to see these near-term trends continue because they are aligned with adding pressure on equities prices. All of that helps confirm my there is a “recession on the horizon” view.

Labor-market indicators are weakening. Let’s face it companies were coming out of a period where they couldn’t find people. I didn’t expect their frenzied trend to add anyone breathing to reverse overnight. Now that they have had time to restructure and streamline operations due to other factors (high borrowing costs, etc.) the hiring frenzy may have seen a peak.

INTERNATIONAL SCENE

Another issue has been the ongoing disappointing economic results from China. Bungled policy priorities are undermining private sector confidence, rendering monetary policy ineffective at generating stimulus. Lower global growth and trade volumes and weaker emerging market currencies further challenge US multinational profits.

While the market “technicals” are still in excellent shape these fundamental developments bear watching. The stock market itself may start to tell us if/when these near-term fundamental headwinds will bleed over to asset prices. While the S&P 500 delivered solid performance this summer, I remain cautiously optimistic or maybe just downright “extra careful”.

The Week On Wall Street

Entering the trading week, every major benchmark index was trading between a key support and resistance level, which signaled a “neutral” setting. Energy (XLE) is the only sector decidedly above all of its key trend lines. The Energy ETFs that I track (XLE), (XOP), and (IEZ), are the only areas of the market that have posted a gain in September.

All of the indices remained locked in a narrow trading range and investors were starting to wonder what might bring a change to the scene. BULLS pushed the indices to resistance levels, then the BEARS stepped up to move prices down to support levels. The CPI report came and went and when the closing bell rang on Wednesday nothing had really changed.

Another day, another inflation report in the form of PPI on Thursday. A report that mimicked the CPI report. However, the bipolar market decided this was good news, and while Treasury yields rose across the board, the BULLS took control. Every index and every sector rallied on the day.

Twenty-four hours later interest rates did matter. The 10-year Treasury rallied right to its recent high at 4.33% and sentiment shifted from risk on to risk off. That left all of the indices and every sector in the red as the frenzied trading week came to a close.

Only the DJIA was able to eke out a small gain for the week. The S&P 500, DJIA, NASDAQ Composite, and Russell 2000 have made it back-to-back losing weeks.

GLOBAL MARKETS

When I look at the fundamentals – European economies are increasingly in “stagflation”, especially across the northern half of Europe, Japan’s economy is reflating into an economic boom, while China’s economy seems to be slowing into potential deflation. A mixed global economy indeed.

Below we see the charts for a wide range of global equity market indices in local currency. Similar to what is occurring in the US indices, it is noteworthy how many indices are currently moving sideways in a range, consolidating after rapid gains off the October lows.

Global Markets (www.bespokepremium.com)

There are counter-examples (Japan, India, Taiwan, China) both bull and bear. Consolidation in and of itself is not bullish or bearish, but it is remarkable how broad the pattern is.

THE ECONOMY

Entering the week, the economist consensus was for 0.6% Month-over-month headline CPI and 0.2% Month-over-month CORE CPI. The CPI report showed an increase of 0.6% in August and the core rose 0.3%. The latter is a little hotter than forecast while the former met expectations. These follow gains of 0.2% for both in July and June. The headline is the highest since June 2022 and the 12-month pace accelerated to 3.7% y/y from 3.2% y/y for the headline, while the core decelerated to 4.3%y/y from 4.7% y/y for the core.

Gains were rather broad-based. As expected, energy prices were a major culprit behind the headline strength. Gas prices jumped 10.6% on the month from 0.2%.

Small Business Sentiment

The NFIB published its latest read on small business sentiment. The headline index fell to 91.3, 0.2 points lower than expectations. Sentiment continues to sit near some of the lowest levels of the past decade, albeit off of the worst post-pandemic period when it had reached a low of 89.0 this past spring.

NFIB (www.Bespokepremium.com)

There are numerous issues facing small businesses and Brad Close, NFIB President spoke to one of the more pressing concerns;

“Passing the Main Street Tax Certainty Act would stop an enormous tax increase currently scheduled to strike small businesses at the end of 2025. The 20% Small Business Deduction is set to expire in 2025, and without it, small businesses will have to limit their plans to grow, invest, and hire. By making the deduction permanent, small business owners will have the tax certainty they need to make business decisions about their future. We are encouraged that this important legislation has been introduced in both the House and the Senate and urge Congress to consider it.”

Higher taxes are a ball and chain around business. IF allowed to expire, businesses will cut back investments, hire fewer employees, and slow down on wages and benefits for their employees. “Small” business employs ~50% of the U.S. workforce so this is a BIG deal.

CONSUMER SENTIMENT

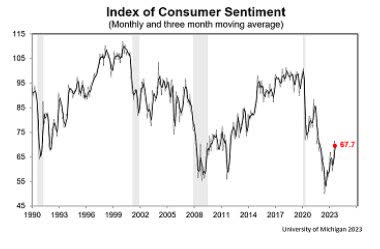

The preliminary Michigan sentiment report revealed a larger-than-expected headline drop to 67.7 from 69.5 in August. Analysts have seen an erratic updraft in the confidence indicators since mid-2022, though the indexes have deteriorated sharply from mid-2021 peaks. The Conference Board measure has remained elevated, but Michigan sentiment and the IBD/TIPP are fluctuating around historically weak levels. All the surveys face headwinds from elevated mortgage rates, tightening credit conditions, and ongoing recession fears.

Consumer Sentiment (www.sca.isr.umich.edu/)

The message has not changed – Sentiment levels that we are experiencing today are well below pre-pandemic levels and indicate the issues that consumers are dealing with.

AUTO COMPANY LABOR ISSUES

Earlier in the week Bloomberg reported that the United Auto Workers and the Big Three North American automakers (F, GM, STLA) were “far apart” on contract negotiations. When the contracts officially expired at midnight on Thursday, September 14th, the unions were officially on strike. The automakers are refusing to move their concessions anywhere close to what the UAW is asking for. The UAW has signaled it would accept modestly lower pay hikes than it’s asking for (for instance, coming down from 40% to 36%, versus mid-teens proposals from the OEMs). Pension coverage, workweek length, and other sticking points are seeing both sides dig in.

Many workers in other manufacturing jobs are dependent on the auto industry. The length of any strike will determine how much of an economic impact this will have.

POLITICAL SCENE

Another mad dash to fund the Federal government is in motion with the September 30th deadline fast approaching.

A review of government shutdowns since 1995 shows that the S&P 500 is up on average 3.2% during these funding gaps and some slight fear trade trends into 10-year Treasuries. This is important as the U.S. Government is facing an October 1 deadline to strike a funding deal, but the probability of a shutdown is on the rise.

While these negotiations and potential shutdown are likely to capture significant attention, it is better not to overreact to the ‘spin” and rhetoric from the media. Markets are largely unaffected in the lead-up to a shutdown, and on average continue to rise in the 30 days following the resolution of a shutdown.

Interestingly “Energy” is the best-performing sector during these events.

The Global Scene

The ECB (European Central Bank);

Inflation continues to decline but is still expected to remain too high for too long. The Governing Council is determined to ensure that inflation returns to its 2% medium-term target in a timely manner. In order to reinforce progress towards its target, the Governing Council today decided to raise the three key ECB interest rates by 25 basis points. The rate increase today reflects the Governing Council’s assessment of the inflation outlook in light of the incoming economic and financial data, the dynamics of underlying inflation, and the strength of monetary policy transmission.”

FOOD FOR THOUGHT

The pushback on investing in China has grown stronger because it seems an investor never knows where the next government intervention in business will be. Hard to argue with that, but let’s also not lose sight of how the anti-business campaign here in the US, is and will affect individual stocks and the equity market. But I digress. The bottom line; there are government intervention risks everywhere.

It seems China can not only deal a blow to some of their private business enterprises, but they can also have a large impact on US-based corporations. We have witnessed that firsthand in the price action of Apple (AAPL) over the past 3 days. In a first step that could morph into a larger initiative, China bans government officials from using iPhones for work.

That’s not exactly a positive development for Apple, and its stock price is reflecting this development. If anyone hasn’t realized that China is always looking out for THEIR interests first, they better start getting the message.

Secretary of Commerce Gina Raimondo was the latest emissary sent to China to ease tensions and smooth relationships. Despite the words that “everything went well”, China’s new announcement regarding iPhones seems to be a stern rebuke to her visit, where she insisted on a “predictable environment” in which to conduct business.

In an ironic twist, the Chinese government seized on the opportunity to make an advertising splash by branding Ms. Rainomonda as an ambassador for the latest Huawei smartphone.

“China needs the US and the US needs China”, but that may be drastically shifting. The pendulum has swung and we saw that play out during the pandemic, where many basic items were in short supply in the US. Dependency on China became very obvious and that has only increased with the “electrification” transition. Now we get a taste of what their decisions can mean for US corporations doing a lot of business over there.

For sure the US can wean itself off of many items produced in China, but this transition is going to be one bumpy road filled with landmines. The role China plays in the US green energy initiatives is also going to be a difficult problem to solve now that the US is completely dependent on China’s materials.

The MACRO economic consequences for individual corporations and the US economy are going to be felt, and it’s just a matter of WHEN, not IF.

The Daily chart of the S&P 500 (SPY)

Both the BULLS and BEARS were frustrated this week. The S&P 500 remained in a narrow trading range all week and each day gave the impression of an impending breakout or breakdown.

S&P 500 (WWW.tc2000/com)

Not much has changed from last week’s analysis. This market can go either way as each side has an excellent case to work with.

INVESTMENT BACKDROP

This Section reviewing the other indices, Growth/Value analysis, and various sectors will now be covered in a NEW BASIC Service that I will be rolling out soon.

FINAL THOUGHTS

And just like that, summer is gone. The Labor Day holiday has come and gone, and for most that marks a return back to a life with less leisure. Wall Street will slowly meander its way back in from their favorite vacation spots. Volumes and volatility do often pick up as we enter the “fall,” even if it’s not immediately noticeable. It is now, officially or not, the home stretch to the end of the year for performance purposes.

All in all, it was a pretty constructive time for the stock market, even if those gains peaked in the middle of July for the most part. The summer months are notoriously slow and choppy, so any progress was welcome. Now, stocks will attempt to hold onto and build upon the year’s momentum. As we enter this next trading period, it should be a relatively quiet time in terms of “new news” for at least a few weeks (barring something unexpected, of course).

This week’s hotter-than-expected inflation data was taken in stride by both the Bond and Stock markets. The 10-year treasury traded at 4.29% on Thursday. It was trading around 4.27-4.28% before the reports.

Meanwhile, the S&P closed at 4487 on Monday, and on Thursday the closing print was 4505. It’s clear the markets are aligned with inflation remaining at these levels and unless there is an “off the charts” report in our future, this will become less and less of a market mover.

Any short-term market forecast now is like a plate of Jello. It can swing from side to side or eventually fall off the plate. When I see these general market setups – I don’t want to “step out” too far on the limb.

In the interim, the focus is on those companies that are raising guidance and that is where the “setups” that put the probabilities in my favor are found.

THANKS to all of the readers that contribute to this forum to make these articles a better experience for everyone.

Best of Luck to Everyone!

Read the full article here