Investment Rundown

From my last publication about Eaton Corporation plc (NYSE:ETN), the share price has run up quite far, about 25% in the span of just a few months. Right now the company displays the valuation of a high-growth business with a p/e of over 27. The market has been very bullish on ETN and the expectations are that it will continue to post double-digit EPS growth for the next several years at least.

The last report showcased a record level of EPS being reported at $1.86 per share and 13% of organic sales growth. The mega projects that are continuously being announced are creating long-lasting demand for ETN. With the broad array of offerings the company has, they are further well positioned to capitalize on this. But with the share price running up nearly 60% in the last 12 months I think we are in for a correction quite soon. I don’t want this piece to sound pessimistic by any means on the company. For the long term, I think ETN is one of the best options right now. The issue I have is that the share price might very well decrease to an earnings multiple of around 23-24 instead, and leave a better buying window for investors. I am willing to take the risk of holding off investing more and will be rating ETN a hold for now.

Company Segments

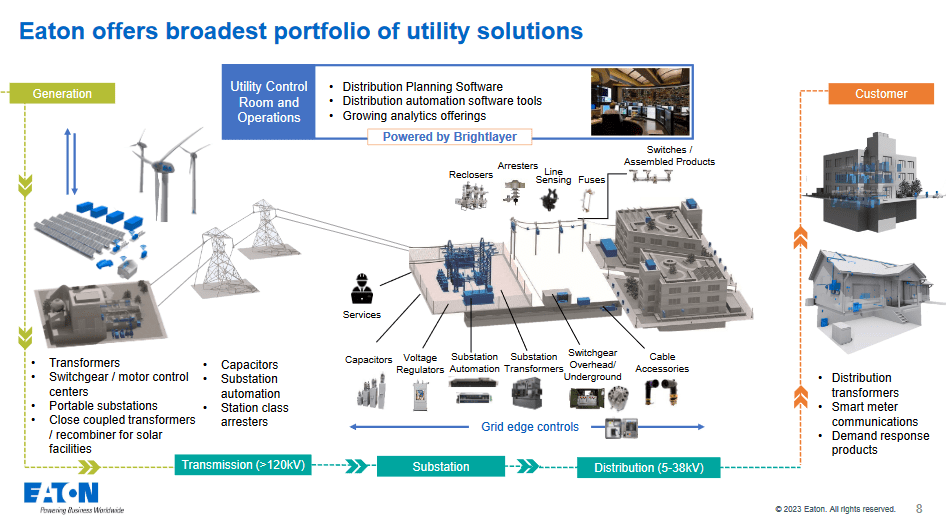

In ETN, there are five distinct segments, with the Electrical Americas Segment and the Electrical Global Segment standing out as the most significant contributors, accounting for approximately 75% of the company’s total revenue. According to ETN’s assessments, they anticipate that the frequent announcements of global mega projects will play a pivotal role in propelling the growth of their electrical business. These mega projects represent a substantial opportunity for the company to expand its presence and drive revenue in the global electrical market.

Portfolio (Investor Presentation)

Engaged in the industrial sector ETN is a major beneficiary of large spending in the space as the infrastructure is improved and the electric grid is built out further. ETN is a supplier of a large number of products and components used in these expansions. One good way to see the immediate impact of these megatrends is the growing backlog of orders for the company. In the last quarter alone the backlogs were up 30% organically over June 2022. This type of momentum is why I can see ETN being valued where it is right now. The market is looking for a growth story and ETN offers one right now that is very compelling. The reliability of their revenues and earnings is also a big positive as much of it is from government sources too.

Earnings Highlights

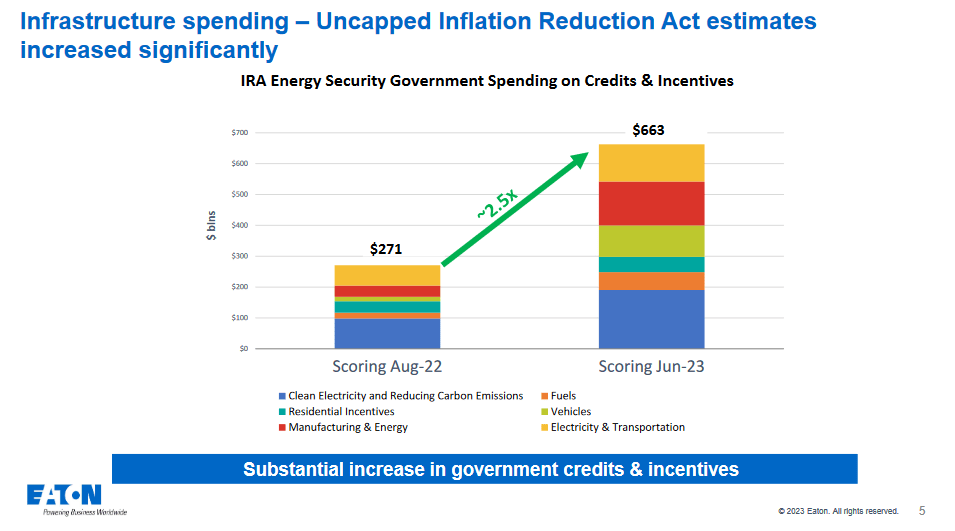

Market Trends (Investor Presentation)

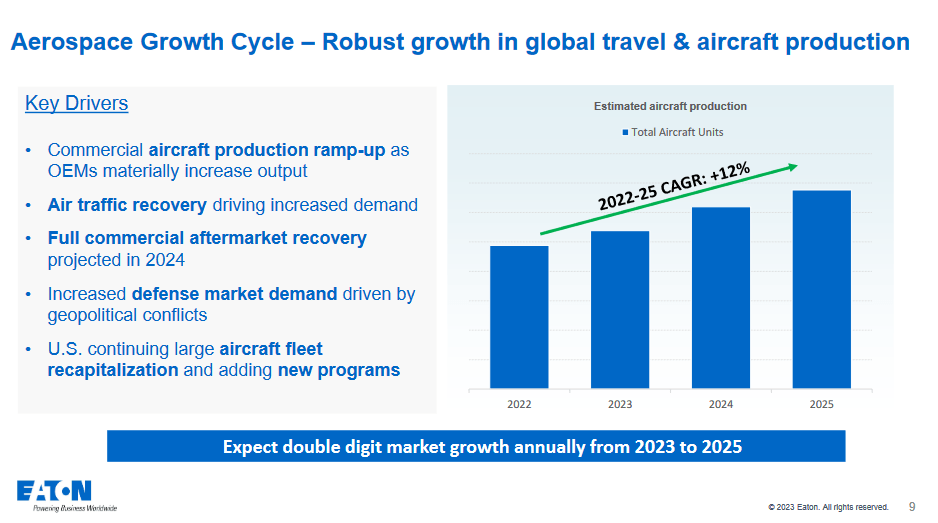

From the last report, there was some good progress in the aerospace part of the business as it has been able to display a strong sense of growth so far. Between 2023 and 2025 the expectations are for double-digit growth at least, which I think is very possible if they manage to maintain strong operation and production levels. With the US adding more aircraft programs the addressable market and earnings opportunity for ETN further grows.

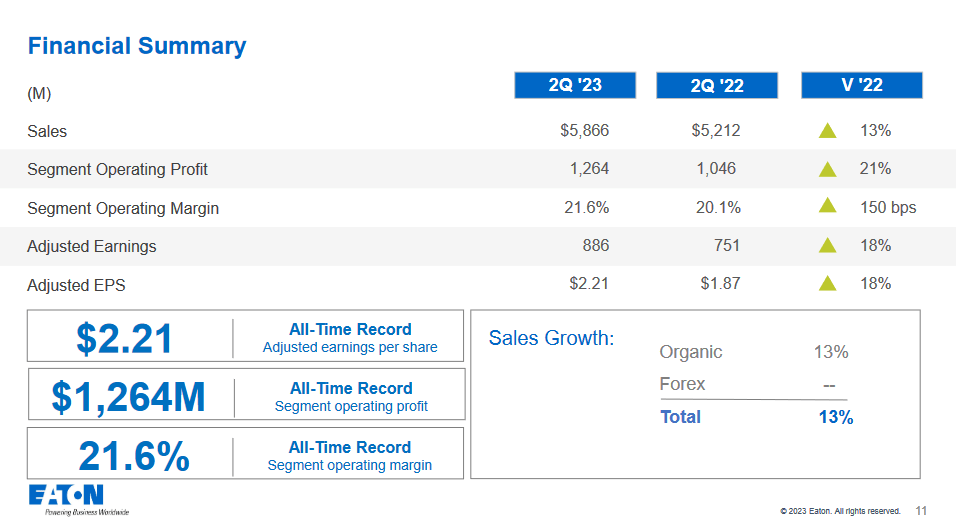

Financial Results (Investor Presentation)

Looking at the financial summary the company managed to achieve record levels on several fronts, both the adjusted EPS, operating profit, and the operating margin. ETN does hold a significant amount of debt at $8.8 billion which has been weighing on the earnings of the business as interest expenses rise. In the last 12 months it has been $166 million in total, nearly double that in 2022 combined. For the full year of 2023, the operating margin is expected to decline very slightly on the higher end and come in at 21.5%, this does, however, represent a raise from the previous guidance the company has had. Besides that, the Electrical Americas segment is expected to grow faster as well, benefiting from megatrends and increased spending and investments. Organic growth is set to be 14 – 16% and a beat on that would most likely send the share price even higher I think.

Risks

ETN, in my view, faces potential risks related to a slowdown in order inflow. Such a scenario would necessitate an adjustment in the company’s valuation to account for the reduced demand. Currently, there are high expectations that ETN will consistently expand its order backlog due to robust demand from various markets. However, any significant disruption in this growth trajectory could impact the company’s financial outlook and investor sentiment. ETN needs to continue managing its order flow effectively to sustain its positive momentum in the market.

Inflation Act (Investor Presentation)

In recent years, we’ve witnessed the announcement of numerous mega projects, which raises the question of how many more such projects can realistically be introduced. The current trend of rising interest rates could potentially act as a headwind against the continued announcement of mega projects. From 2021 up until fairly recently, capital flowed more freely, and optimism was higher. However, as spending begins to slow down, it could lead to a deceleration in the order backlog for ETN. Consequently, investors may become less inclined to pay a premium of 27 times forward earnings for the company’s stock, as the landscape becomes less favorable for growth. But with increased incentives from government sources and growing spending, I think that the market conditions are still in favor of ETN right now.

Final Words

I have covered ETN before and had a very positive view of the company back then. I rated them a buy but will be downgrading it to a hold right now. I think the company has run up far too quickly in the last few months. For the long-term investor that might now be a problem, but for those that seek a better entry point I think there is a real possibility of a correction in the last part of 2023. The share price could potentially go down to a p/e of 21 – 23, which is a point I would consider a decent buy again. Historically ETN has had a p/e of 20, and whilst my targets are above this, I would argue that because of the rapid set of growth the company has exhibited in recent years a slight premium may be in order. With that target, ETN would also trade at a premium to the sector median of about 25% based on earnings. Something that seems reasonable given that ETN has consistently grown the EPS by over 7% yearly for the last decade. ETN has proven to reliably raise earnings and that is something the market often rewards with a higher valuation. What I think could continue sending the stock price higher though is if coming earnings reports manage to surprise and beat expectations significantly, likely caused by improved pricing environments and demand. Further announcements of infrastructure spending are also adding to the bull case and likely fuel the upward momentum further. For the moment though I think the valuation should be viewed more neutral and a hold rating will be issued by me.

Read the full article here