Investment thesis

Our current investment thesis is:

- FRCOY is a highly attractive business, as despite a highly competitive industry and inherent risks associated with changing trends, the company has been able to consistently grow well and generate outsized returns.

- Its business model is underpinned by strong operational capabilities and well-regarded brands. We expect this to allow the business to maintain healthy growth going forward.

- FRCOY is trading at a premium to its historical average and peer group, which is reasonable in our view based on its strong financial performance and commercial development. This said, we struggle to see upside beyond this point.

Company description

Fast Retailing Co., Ltd. (OTCPK:FRCOY) is a Japanese multinational retail holding company headquartered in Tokyo, Japan. Founded in 1963, it is one of the world’s largest and most successful fast-fashion retailers. The company operates several well-known brands, including Uniqlo, GU, Theory, Comptoir des Cotonniers, Princesse tam.tam, J Brand, and more. Uniqlo is its flagship brand and is renowned for its high-quality, affordable clothing with a focus on simplicity and functionality.

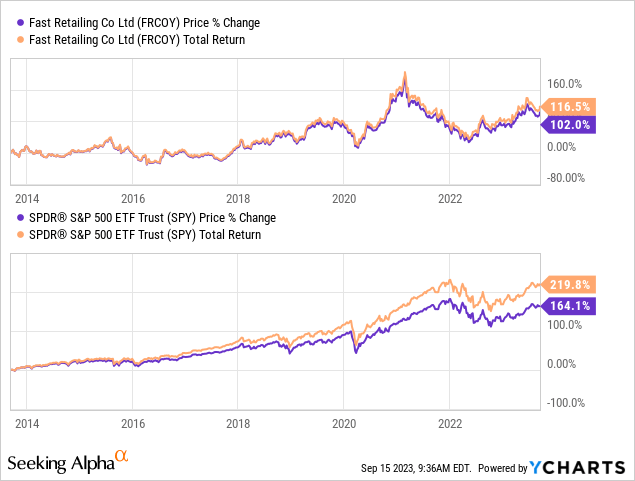

Share price

FRCOY’s share price performance has been strong, returning over 100% to shareholders. The company’s strong performance is a reflection of its positive development during a time of increased competition and changing industry dynamics.

Financial analysis

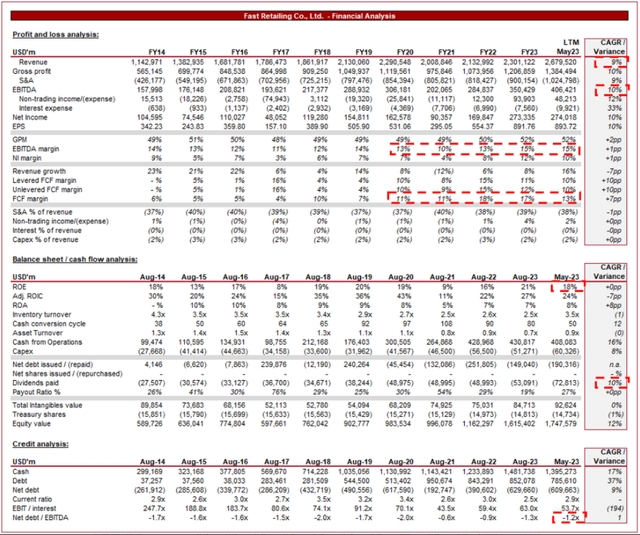

Fast Retailing Financials (Capital IQ)

Presented above are FRCOY’s financial results.

Revenue & Commercial Factors

FRCOY’s revenue has grown at a strong 9% CAGR, with impressive consistency during this period.

Business Model

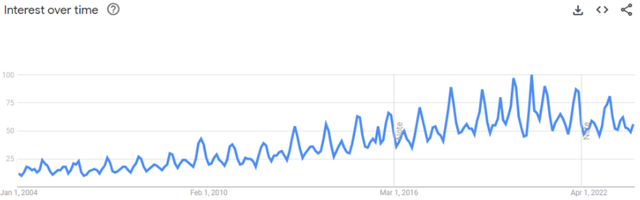

FRCOY operates as a global apparel retailer, with Uniqlo being its flagship brand. Uniqlo offers a wide range of affordable and functional clothing for men, women, and children, emphasizing simplicity and quality (with Japanese influence). This reputation has been incredibly beneficial for the company, as FRCOY is equally respected by die-hard fashion fans and casuals in equal amount. As the following illustrates, interest in the brand has developed well over time, underpinned by both product innovation and marketing.

Uniqlo (Google Trends)

In addition to Uniqlo, FRCOY owns several other brands, including GU, Theory, Helmut Lang, and Comptoir des Cotonniers. This diversification allows the company to target different customer segments and market niches, while also reducing dependency on a single brand as tastes/trends change.

FRCOY embraces the fast fashion concept, emphasizing rapid product turnover and responsive production. It has a strong track record for quickly adapting to changing fashion trends and consumer demands. This trend has taken over the affordable fashion industry, as social media and other factors have contributed to a harmonization of interest around celebrity and influencer trends. We do think FRCOY is differentiated in this space, however, in that the company still has a strong reputation for quality, whereas many of its peers are known purely for affordability.

The company has pursued an aggressive global expansion strategy, opening stores in major cities worldwide. This approach allows it to tap into diverse markets and cater to a broad customer base, increasing its TAM. This major city approach has allowed the business to develop its brand in countries quickly from which it can serve the wider nation through e-commerce.

FRCOY places a strong emphasis on sustainability, striving to reduce its environmental footprint by using eco-friendly materials and sustainable manufacturing practices. This is a trend many fast fashion brands have been forced to embrace, many of which are talking more than they are delivering. According to Good on You, an independent reviewer of brands, Uniqlo scores an “I’s a start” rating (3/5 – 5 being best). This is a good relative to many of its peers, with H&M at 3/5, Zara at 2/5, Shein at 1/5, and Boohoo and Asos at 2/5. With McKinsey research finding consumers are buying sustainable products as a preference, FRCOY is positioned well relative to peers.

FRCOY follows a vertically integrated supply chain model. It controls various stages of the production process, from design and manufacturing to distribution and retailing. This integration helps streamline operations and maintain cost control, while providing the flexibility and reflexivity required to remain agile in a changing industry (particularly with fast fashion trends).

Apparel Industry

We see the following trends impacting the apparel industry, in addition to the factors discussed above.

- Digital Presence – Demand is increasingly transitioning online, which has changed the competitive dynamic of the industry. Consumers have greater choice and there has been a significant increase in new entrants. FRCOY has a strong online presence and e-commerce platform but has still felt the negative impacts of this.

- Market Saturation – In many mature markets, such as Japan and the West, there are signs of saturation, leading to a need to focus more on emerging markets for growth. This is in part due to the increased number of new entrants. As a global brand, FRCOY is well-positioned but does not necessarily have the brand to compete with some of its peers.

- Supply Chain Complexity – Managing a global supply chain is complex at the best of times, with recent pandemic and transportation disruptions compounding this. The concern is that businesses will need to diversify in the coming years following these disruptions, contributing to increased costs or pricing pressure.

- Brand Expansion – Given the competitive pressures during the last decade, we have seen increased consolidation, with larger businesses acquiring brands as part of a wider portfolio. FRCOY has a strong track record of delivering this and we consider it a key opportunity going forward.

Competitive Positioning

We consider the following factors to be key competitive advantages of FRCOY:

- *Affordable Quality – Uniqlo’s core value proposition is affordable prices without compromising on quality. This resonates with all consumers regardless of income, particularly when it comes to basics.

- Global Expansion – FRCOY’s aggressive global expansion has allowed it to access a wide customer base and benefit from the growth of emerging markets, particularly in Asia.

- Strong Branding – Uniqlo has established a strong brand identity, with other brands expected to follow a similar trajectory over time.

- Innovation – FRCOY’s ability to consistently produce goods that successfully meet changing consumer preferences is commendable and a reflection of its operational capabilities.

Economic & External Consideration

Current economic conditions represent the potential for near-term headwinds, with high inflation and elevated rates contributing to a softening of discretionary spending, as consumers protect finances. Retail is usually disproportionately hit by this, as consumers rarely require clothing when times get tough. Over the long term, financial struggles can be beneficial for the company, as it increases the company’s addressable market.

FRCOY’s quarterly performance would imply resilience, with impressive growth despite the conditions. In the company’s last 3 quarters, top-line growth was +14.2%, +26.9%, and +23.8% YoY. In addition to this, margins have remained broadly flat, suggesting inflationary pressures and demand concerns have not impacted pricing or costs materially. This is incredibly impressive given the issues many of its peers have faced.

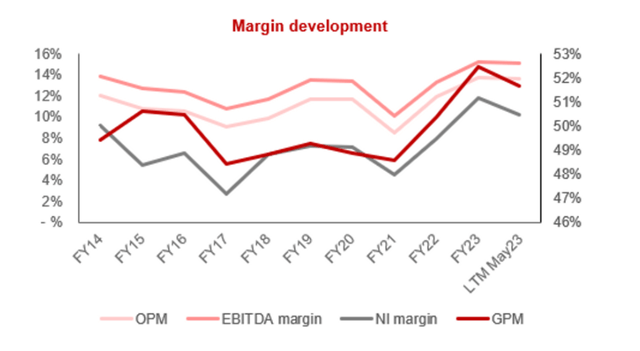

Margins

Margin (Capital IQ)

FRCOY’s margins have gradually improved over the historical period, driven by improved brand value, greater scale, and execution on operational improvement. We do not expect significant improvement from this as potential gains diminish, although the current position appears defensible given its current performance.

Balance sheet & Cash Flows

FRCOY’s inventory turnover has improved to a level not seen since Aug-17, underpinning the fantastic recent performance of the company. This has allowed for a strong FCF margin, which has consistently improved in line with profitability.

In typical Japanese style, Management is careful with its capital allocation strategy, with a negative ND balance, cash balance growth in excess of EBITDA, a hesitant distributions.

The company has the potential for more, although a 10% dividend growth rate is respectable. We suspect improvement is unlikely, as is M&A.

Industry analysis

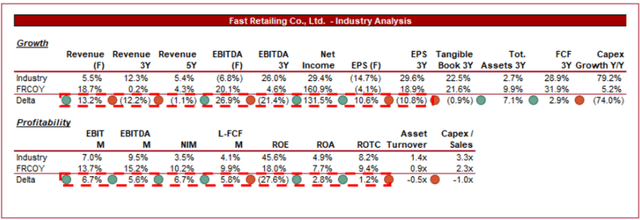

Apparel (Seeking Alpha)

Presented above is a comparison of FRCOY’s growth and profitability to the average of its industry, as defined by Seeking Alpha (31 companies).

FRCOY performs well relative to peers, with a significant margin premium relative to peers. The translation of this to FCF allows the business to reinvest in growth while maintaining strong shareholder returns.

FRCOY’s revenue growth is more comparable to the average, which we consider a good performance given the company’s scale. Further, when considering growth in profitability, FRCOY is consistently an outperformer.

Valuation

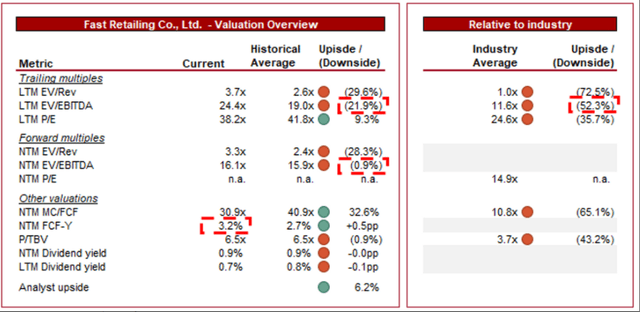

Valuation (Capital IQ)

FRCOY is currently trading at 24x LTM EBITDA and 16x NTM EBITDA. This is a premium to its historical average.

A premium is justifiable in our view, primarily due to the company’s resilient performance, margin improvement, and development of its brands. The LTM premium appears reasonable, although the NTM level suggests upside. Further, FRCOY is trading at a 52% premium to its peers on an LTM EBITDA basis and 65% on a FCF basis. This is a substantial level and likely reflects any financial superiority.

We struggle to see upside at these levels, underpinned by the minimal improvement in FCF yield. Analysts concur with this view, with a target upside of 6%.

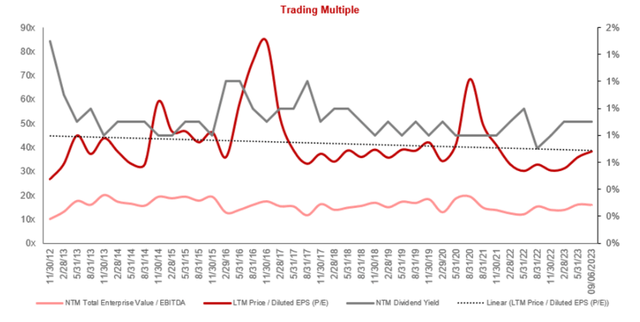

Valuation development (Capital IQ)

Final thoughts

FRCOY is a quality business. Despite the highly competitive nature of the apparel industry, the company has generated impressive and consistent growth. Further, the risk of downside is compounded by current economic conditions, and yet FRCOY has still managed to maintain strong returns. This has naturally garnered a premium valuation for the company, as the outlook remains broadly positive into the medium term. FRCOY is currently trading at a premium to its historical average and peer group, which is justifiable, but does not imply upside beyond this.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here